1/ Markets in a Robust Uptrend

2/ Staying Invested in the Strength

3/ Quadrant Crossovers Indicate Potential Beginning of Relative Outperformance

4/ Results Potent with Compelling Technical Setup

Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Markets in a Robust Uptrend

Courtesy of StockCharts.com

Six weeks of straight gains and counting; the broad market index S&P 500 has broken out from the key levels; it is seen marching towards the all-time high level of 4818 that were seen in 2022. While the weekly charts seem comfortable, the daily charts remain steeply overbought. Being overbought is a good sign and in strong uptrends, the index or a stock tends to stay overbought for prolonged periods; however, the structure looks a bit overextended. This increases the possibility of the markets marching higher towards their high but not without some consolidation at current or higher levels.

2/ Staying Invested In The Strength

During market all-time highs, staying invested in relatively stronger stocks is crucial for several reasons. First, these stocks often demonstrate resilience and momentum, providing a potential buffer against market downturns. Second, strong stocks tend to outperform during bullish trends, contributing to portfolio growth. Lastly, maintaining exposure to strength helps capitalize on market optimism and positive sentiment, enhancing overall investment returns.

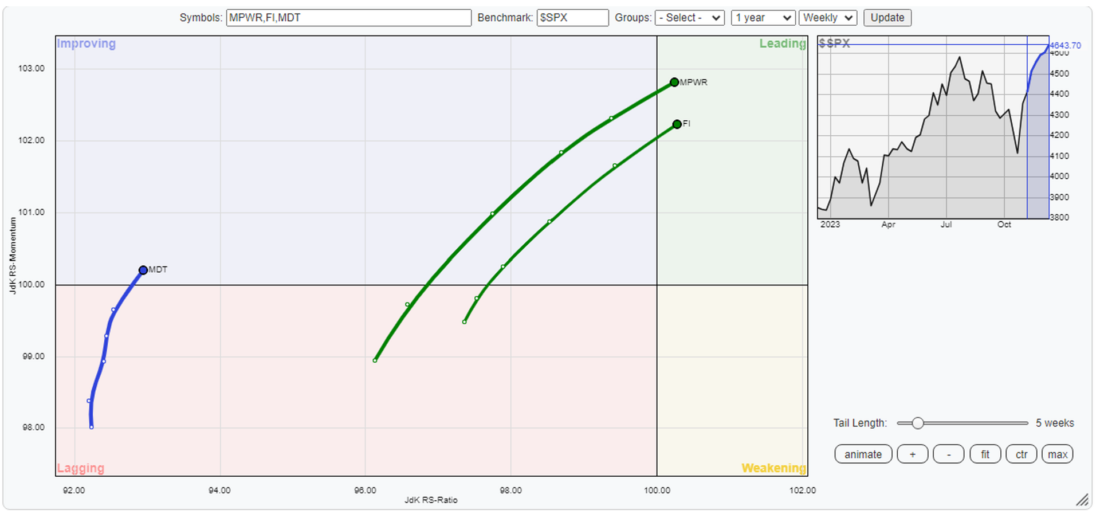

3/ Quadrant Crossovers Indicate Potential Beginning Of Relative Outperformance

Courtesy of StockCharts.com

In Relative Rotation Graphs (RRGs), when a stock’s JdK Momentum crosses above 100, it indicates a transition from the Weakening/Improving quadrant to the Leading quadrant or from Lagging Quadrant to the Improving quadrant. This crossover is significant as it signals a shift in relative strength, suggesting that the stock is gaining momentum and moving into a position of out performance compared to the benchmark.

Investors often interpret this crossover as a bullish signal, implying that the stock is exhibiting positive momentum and may continue to do well in the near term. It can be considered an opportune time for potential entry or reinforcement of existing positions, aligning with the expectation of the stock’s continued relative strength compared to its peers.

4/ Results Potent With Compelling Technical Setup

Courtesy of StockCharts.com

When Quadrant Crossovers take place and if they are backed up with a compelling and a potent technical setup, it makes an excellent combination. Both MPWR and FI have crossed over to the leading quadrant from the Improving quadrant. This means that going ahead from here, they are likely to relatively outperform the broader S&P500 index. Given the breakout and overall strong technical setup, being inside the leading quadrant will ensure that the stocks show a lot of resilience even if the markets consolidate; if they continue moving higher, these stocks can post strong relative out performance.

Courtesy of StockCharts.com

MDT on the other hand has rolled inside the Improving quadrant from the Lagging quadrant. The technical setup shows that the stock is making a strong attempt to put a bottom in place and may confirm a trend reversal. The last phase of the price decline has come with a bullish divergence of the RSI against the price. Importantly, while rolling inside the Improving quadrant, the stock is placed farthest among the three stocks from the center point; it is likely to generate higher alpha as compared to the other two stocks.

—

Originally posted 14th December 2023

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.