Investopedia is partnering with CMT Association on this newsletter. The contents of this newsletter are for informational and educational purposes only, however, and do not constitute investing advice. The guest authors, which may sell research to investors, and may trade or hold positions in securities mentioned herein do not represent the views of CMT Association or Investopedia. Please consult a financial advisor for investment recommendations and services.

1/ Energies Reach New Highs

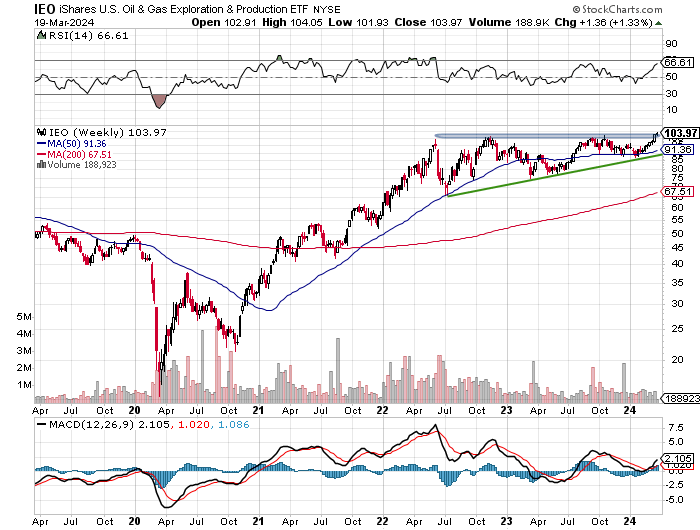

IEO ETF tracks a market cap weighted index of companies in the U.S. oil and gas exploration and production space according to Dow Jones. Also, it is a solid choice for representative exposure to the oil & gas exploration & production segment in the U.S.

The price is reaching a new all-time high as it breaks above the resistance of the ascending triangle.

This upward movement in price is primarily driven by the oil refiners, who have also reached a new all-time high.

2/ Japan Raises Rates

The Bank of Japan just raised interest rates for the first time in 17 years.

The short-term policy range in Japan is now +0.00% to +0.10% and more hikes may be on the horizon.

The 10-Year Japan Treasury Yield Index continues to climb, seeking higher levels. With domestic yields in Japan possibly increasing, will investors cease investing in foreign bonds? This could indeed mark a turning point, as Japan’s monetary policy from the crisis era may finally be nearing its end.

As Japanese investors’ interest in foreign assets diminishes and domestic opportunities improve, global bond yields may rise.

3/ Gasoline Keeps Rising

Gasoline futures prices continue to approach the mid-2022 resistance level.

If prices finally break above this level, inflationary pressure could increase further, after February’s CPI reading was also led by higher gasoline spending.

Gasoline prices tend to rise heading into spring as Americans get back on the road and summer driving season approaches.

4/ The Spread Widens

Treasury bond prices are influenced by inflation expectations, and commodity prices are considered an important indicator of inflation trends. As a result, commodities tend to move in the opposite direction to bond prices.

Therefore, commodities tend to trend in the same direction as interest rates.

If we look at the chart above, we see how commodities have been on the rise since the end of 2023, marking a turning point for bond prices, which saw a halt in the bull rally. The spread reopens between the two.

Inflationary pressures return.

—

Originally posted on March 20th 2024

Disclosure: Investopedia

Investopedia.com: The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. While we believe the information provided herein is reliable, we do not warrant its accuracy or completeness. The views and strategies described on our content may not be suitable for all investors. Because market and economic conditions are subject to rapid change, all comments, opinions and analyses contained within our content are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy. This information is intended for US residents only.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Investopedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Investopedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.