The Federal Reserve’s war against inflation continues to weaken an important segment of the economy: the residential real estate market. September’s building permit data released today reflects a continued shift in home-building activity. Rental property construction has increased substantially while construction of single-family homes has continued to plummet.

The overall number of building permits rose 1.4% from August, stronger than the expected 0.8% decline. Gains were driven by rental apartments, as permits for structures with five or more units rose 8.2% on the month and 25.5% from the same period a year ago. Single-family homes, on the other hand, weakened significantly, declining 3.1% on the month and 17.3% year-over-year. Overall, rising interest rates and deteriorating housing affordability are incentivizing builders to build apartment buildings ideal for renting, not single-family homes.

On balance, this report is positive for the Federal Reserve’s (the Fed) inflation battle. Declining numbers of building permits for single-family homes reflects weakening mortgage volumes as a result of fewer homebuyers and points to reduced demand and slower economic growth. An increasing supply of rental apartment buildings is also positive because more rental units offer consumers more options and landlords less pricing power, a deflationary development. Shelter expenses are a huge component of the American budget so softer rents due to an increasing supply of rental units will likely serve as a budgetary tailwind.

From a regional perspective, today’s data shows that overall building permit gains were driven by the Midwest and the South with increases of 4% and 3.1% during the period. The West contributed to the increase more modestly with a gain of 0.3%. The Northeast was the laggard in this report, offsetting some of the broad progress with a decline of 9.4%. Meanwhile, housing starts weakened considerably with an 8.1% decline on the month while housing completions were strong, gaining 6.1% on the month.

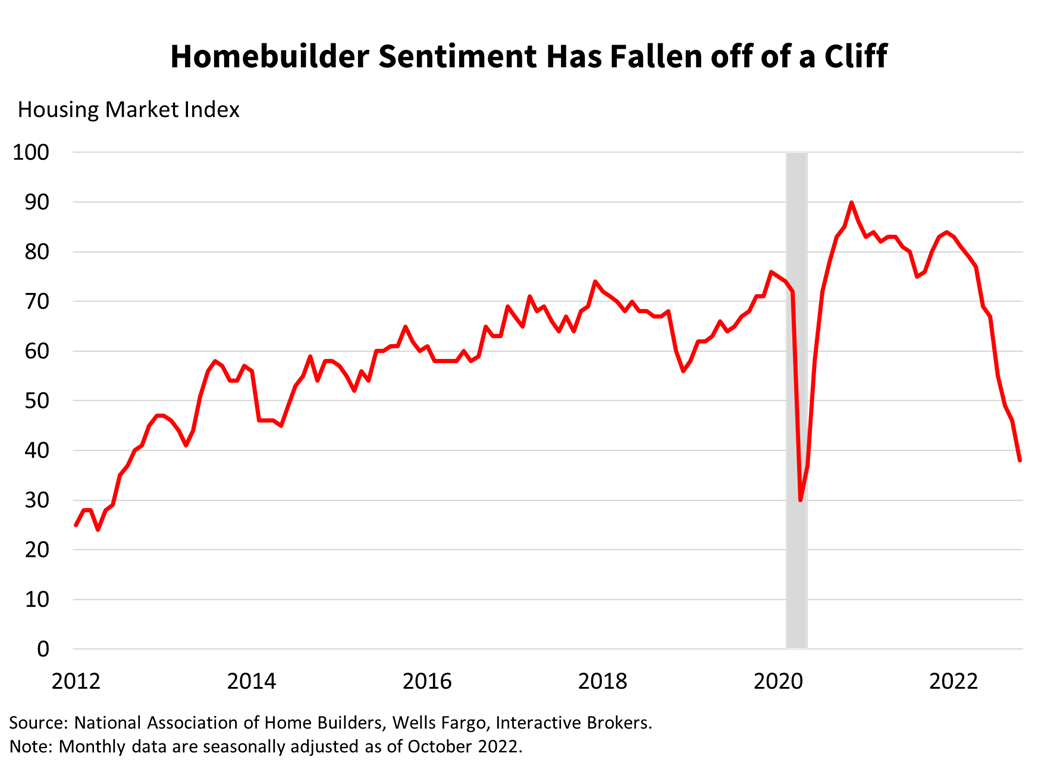

Yesterday’s NAHB/Wells Fargo Housing Market Index release, which measures the perceived strength of the single-family housing market, dropped for the tenth consecutive month and reflected the worst homebuilder sentiment since 2012 excluding low pandemic readings in April and May 2020. Higher monthly mortgage payments driven by high prices and rising rates have led to a lack of homebuyers. Construction costs have also climbed substantially due to higher prices for materials and rising worker wages, resulting in compressed profit margins for builders. The macroeconomic backdrop for homebuilders continues to deteriorate and is likely to worsen as the Fed continues to raise rates and reduce its balance sheet, leading to higher borrowing costs, reduced credit availability and declining liquidity levels.

Mortgage rates are now back up above 7% and at their highest level since the Great Financial Crisis of 2008. Strict lending standards and a shortage of homebuilding following the Great Financial Crisis are likely to support home prices somewhat; however, lofty valuations born in a low-rate, high-liquidity environment cannot sustain themselves in a high-interest-rate, low-liquidity one. Home prices are falling fastest in pandemic boomtowns like Austin, Phoenix, Charlestown, Denver and Las Vegas. The extent of continued and broader declines depends on how the Fed’s inflation battle evolves. Tighter monetary policies moving forward will lead to softer pricing conditions while lighter ones will support prices.

Watch the Building Permits Educational Video at Traders’ Academy – Click Here

—

Originally Posted October 19, 2022

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.