Stocks are cautiously optimistic this morning as the three major averages reach new all-time highs. Yields are ticking north though, as bond traders realize that yesterday’s swift move south may have been an overreaction, particularly as price pressures are running well above the Fed’s 2% target. On the economic data front, last week’s spike in initial unemployment claims was pared back in this morning’s report, curbing concerns that the labor market is softening while serving to send rates up. Real estate data, however, pointed to dwindling confidence among homebuilders which is leading them to moderate their pace of construction.

Patience Is a Virtue

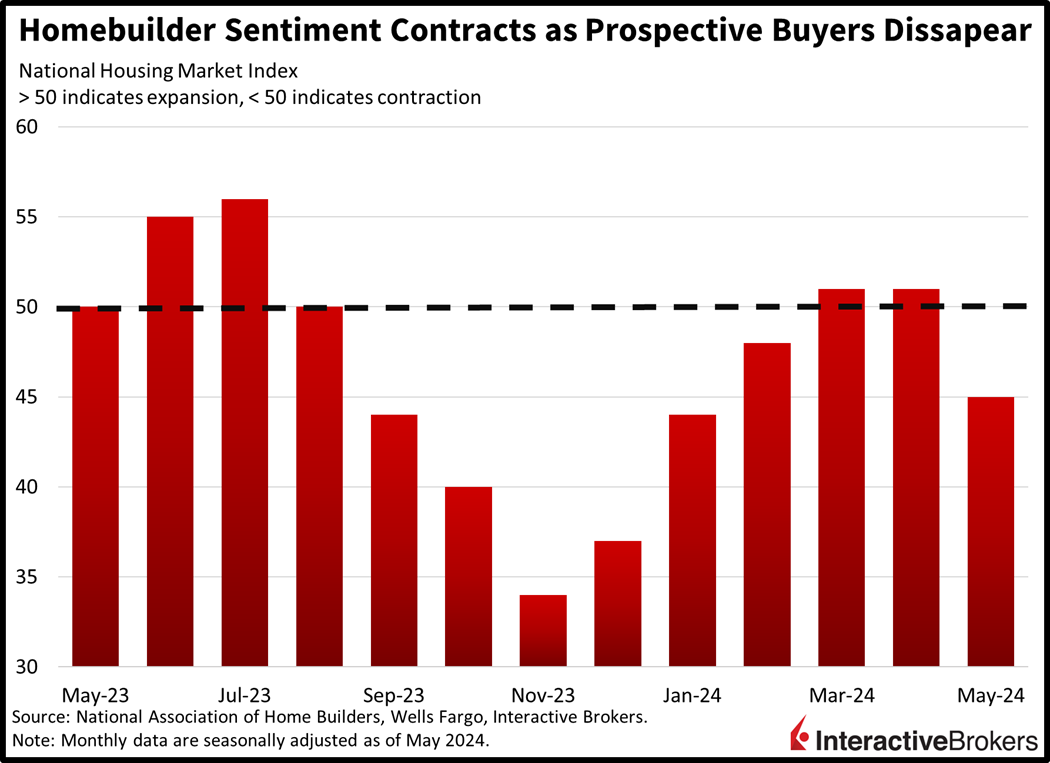

Homebuilders were increasingly upbeat in March and April as they awaited lighter mortgage rates that would support housing affordability. The lack of progress on borrowing costs, however, led to a sharp plunge in homebuilder sentiment this month. May’s reading of 45 missed projections calling for an unchanged 51 from April while tanking to well below the contraction-expansion threshold of 50. Additionally, it was the lowest figure since January’s 44. The index’s components all declined with the traffic of prospective buyers and the outlook for sales in the present and in the next six months coming in at 30, 51 and 51 from April’s 34, 57 and 60. All regions also saw figures move lower, with the Northeast, Midwest, South and West falling to 58, 49, 45 and 36 from 65, 50, 50 and 48.

Plans of Future Construction Decline

Sticky mortgage rates sporting a 7 handle didn’t just ruin moods: lofty costs of capital also slowed construction activity as well as plans for future builds. April’s pace of building permits fell 3% month over month (m/m) to a fresh yearly trough of 1.44 million seasonally adjusted annualized units (SAAU) from 1.47 million in May. Last month’s figure also missed estimates of 1.48 million, while reaching the lowest level since 2022. The weakness was led by multi-family which dropped 9.1% m/m while single-family slipped just 0.9%. Regionally, contractions in the Midwest and West of -18.1% and -14.4% m/m overwhelmed slower growth rates of 5.5% and 4.2% in the Northeast and South.

Construction Activity Remains Weak

Shovels in the ground did recover slightly but remain well below trend. April’s rate of housing starts rose 5.7% m/m to 1.36 million SAAU from March’s 1.29 million but arrived beneath the anticipated 1.42 million. In contrast to permits, multi-family posted a sharp recovery of 31.4% m/m while single-family declined a modest 0.4%. Strength in the Midwest and South characterized by m/m growth rates of 19.1% and 10.1% offset the sluggishness from the Northeast and West, which saw activity drop 22.6% and 2.5%, respectively.

Layoffs are Tempered

The labor market remains well-behaved despite last week’s report featuring a frightening spike in layoffs. This morning’s print brought us back to trend levels, with initial unemployment claims dropping to 222,000 for the week ended May 11 from 232,000 the week before. The figure arrived near estimates of 220,000. Continuing unemployment claims for the week ended May 4, meanwhile, rose to 1.794 million from 1.781 million the week before, landing above the forecasted 1.780 million. Four-week trends remained anchored, with the moving average for initial claims shifting from 215,250 in last week’s report to 217,750 as of this morning. Continuing claims modestly went the other way, with the week to week four-week moving averages moving south from 1.780 million to 1.779 million.

Stocks Smile, Bonds Frown

While the three major moving averages reached fresh all-time highs earlier this morning, anecdotal evidence suggests that small-cap investors and bond traders are sporting frowns right outside of the trading floor. Indeed, the Nasdaq Composite, S&P 500 and Dow Jones Industrial indices are trading higher by 0.3%, 0.2% and 0.2%. The rate-sensitive Russell 2000 is lower by 0.3%, however, as yield watchers acknowledge that yesterday’s inflation print was nowhere near the Fed’s 2% target, despite it arriving below projections. Sectoral breadth is split and defensively tilted as equity investors are unsure about more all-time highs. Six out of eleven sectors are up with consumer staples, financials and utilities leading; they’re up 1.5%, 0.5% and 0.4%. Materials, industrials and consumer discretionary are piloting the laggards with the segments moving lower by 0.4%, 0.2% and 0.1%. In fixed-income and currency land, yields and the dollar are paring yesterday’s move, with rates on the 2- and 10-year Treasury maturities moving north by 5 and 2 basis points (bps) to 4.78% and 4.37%. The greenback’s index is loftier by 17 bps as the US currency gains relative to all of its major counterparts except for the yuan. It’s higher relative to the euro, pound sterling, franc, yen and Aussie and Canadian dollars. Over in the commodity space, WTI crude oil is up 0.3%, or $0.21, to $79.01 per barrel as a decline in stateside inventories motivates buying activity. Copper and gold are down 1.1% and 0.2%, however, as higher rates dampen manufacturing prospects while investors take a break from scooping up the safe-haven asset.

Is More of Walmart Econ Positive?

While market players wonder if yesterday’s bullish move was an overreaction, economists are sharpening their pencils to gauge the health of the consumer on the back of yesterday’s retail sales disappointment. This morning’s big earnings beat from Walmart provides further evidence of households flocking to lower-cost providers of consumer staples, as the company is gaining market share in physical stores. The supercenters are also testing Amazon’s domination, with the firm growing its e-commerce business impressively. While the story of Walmart’s stock reaching a fresh all-time high today is an excellent one for the company’s shareholders, important questions to ponder are whether this development will weigh on overall corporate revenues, and if Walmart’s market share gains point to consumers being on their last leg.

Visit Traders’ Academy to Learn More About Building Permits and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.