Stocks strived to reclaim all-time highs this morning before the University of Michigan released an unpleasant Consumer Sentiment report. It reflects households becoming increasingly concerned about both their job prospects and elevated interest rates, but price pressures were the major dampener within the print. Perhaps even more considerable is a sharp increase in inflation expectations, which sent yields soaring toward aircraft altitudes. Against the backdrop of an upcoming synchronized easing cycle by global central bankers, Canada and UK data released this morning also depict mounting inflationary pressures, as jobs and GDP defeated projections by a mile and then some.

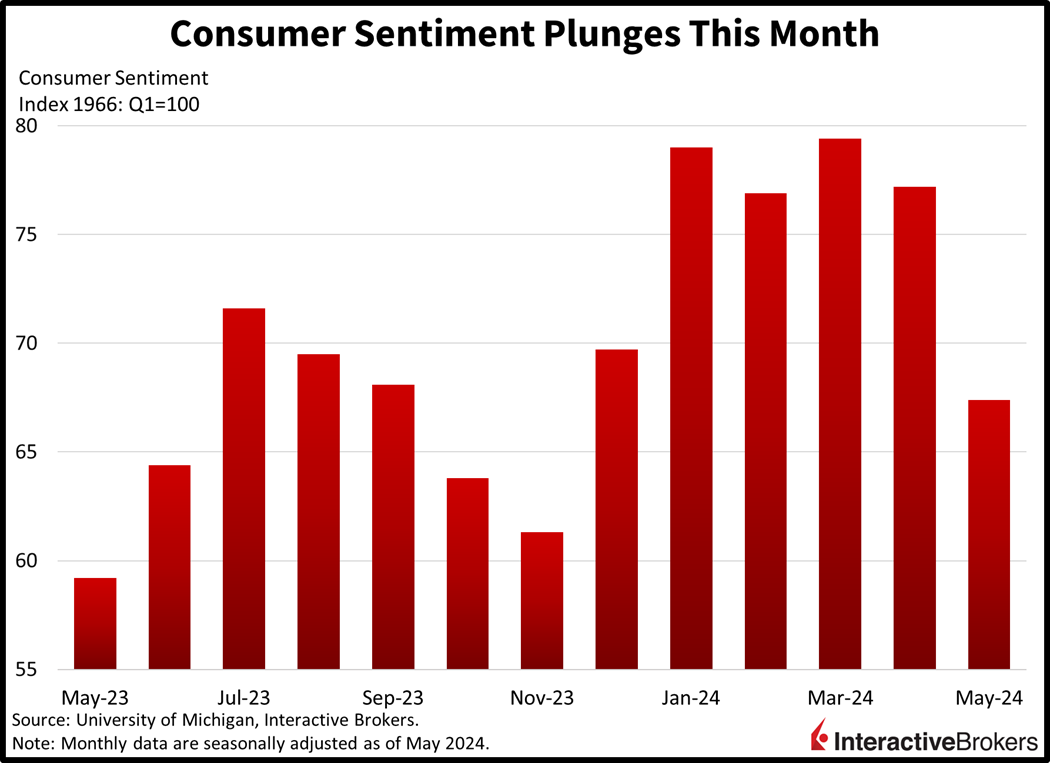

Consumers Deboard Plane of Optimism

Consumer Sentiment plunged to its lowest level since November this month, as folks felt considerable pressure from macroeconomic headwinds. The headline figure of 67.4, substantially missed expectations of 76 and declined significantly from April’s 77.2. Similarly, inflation expectations hit their loftiest heights since November, with 1- and 5-year figures jumping to 3.5% and 3.1% from 3.2% and 3%. Additionally, the current conditions and consumer expectations sub-indices both fell sharply, cratering to 68.8 and 66.5 from 79 and 76.

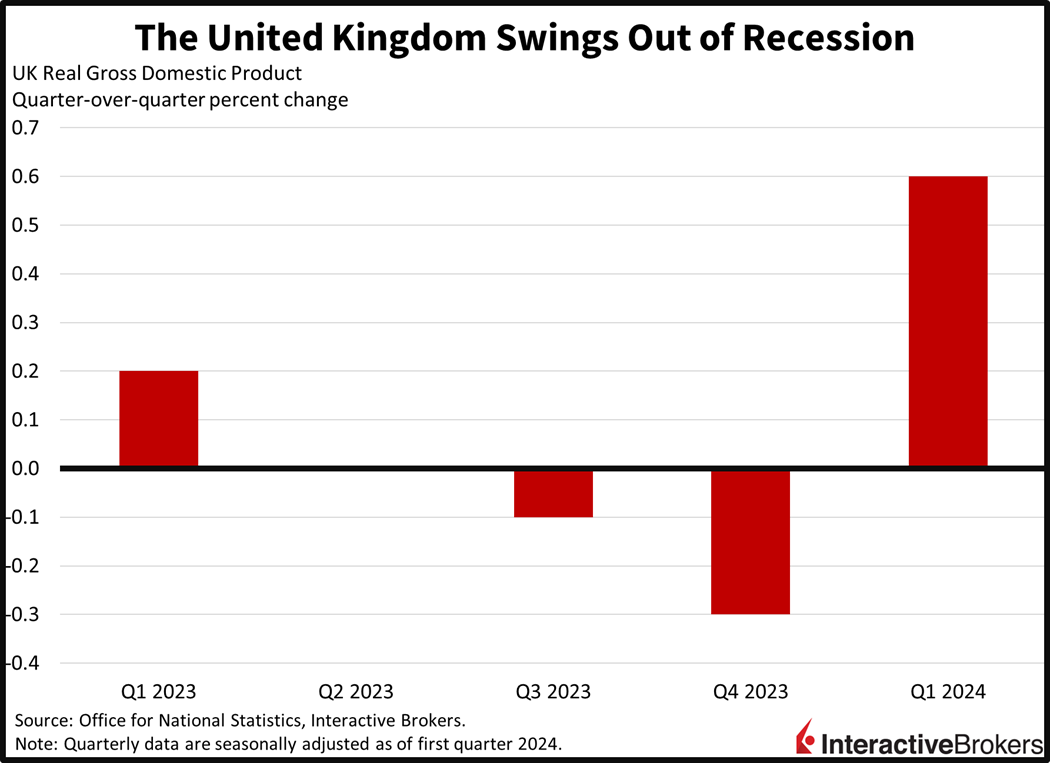

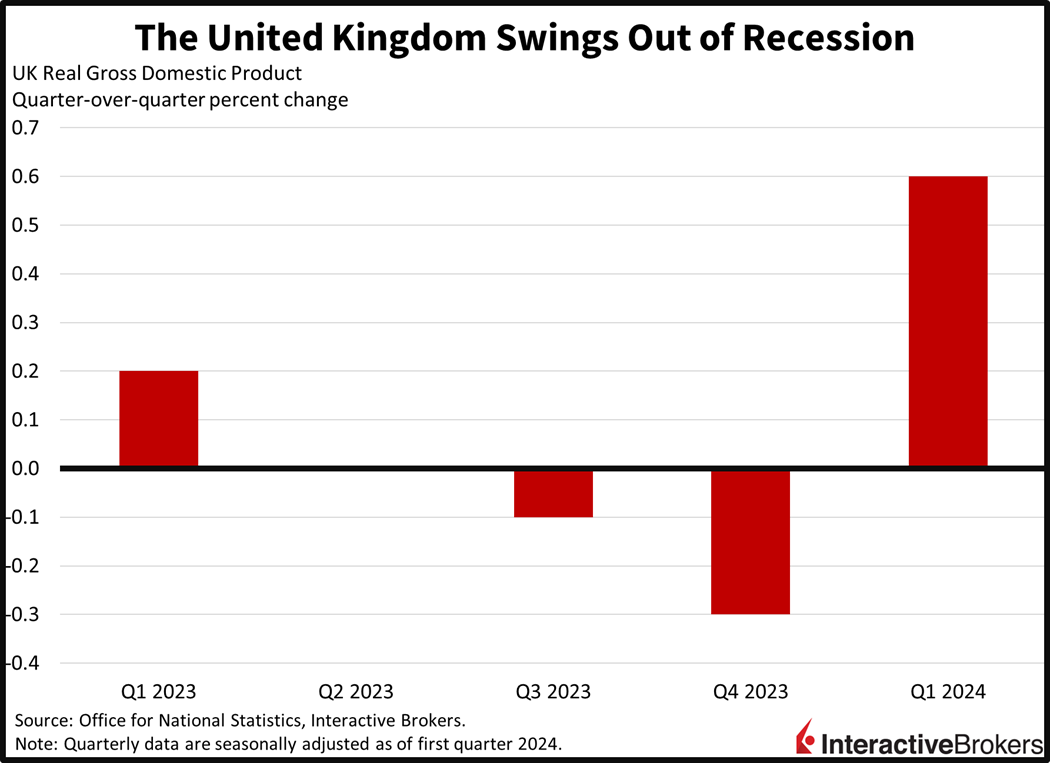

UK Cheers Recession Departure

The United Kingdom swung out of a technical recession in the first quarter, reaching positive economic growth for the first time since the same period one year ago. Real gross domestic product (GDP) grew 0.6% on a quarterly, annualized basis, surpassing the 0.4% median forecast and the previous period’s 0.3% decline. Driving the upside beat were the production and services categories, which increased 0.8% and 0.7%. The construction segment, however, offset some of the progress, declining 0.9%.

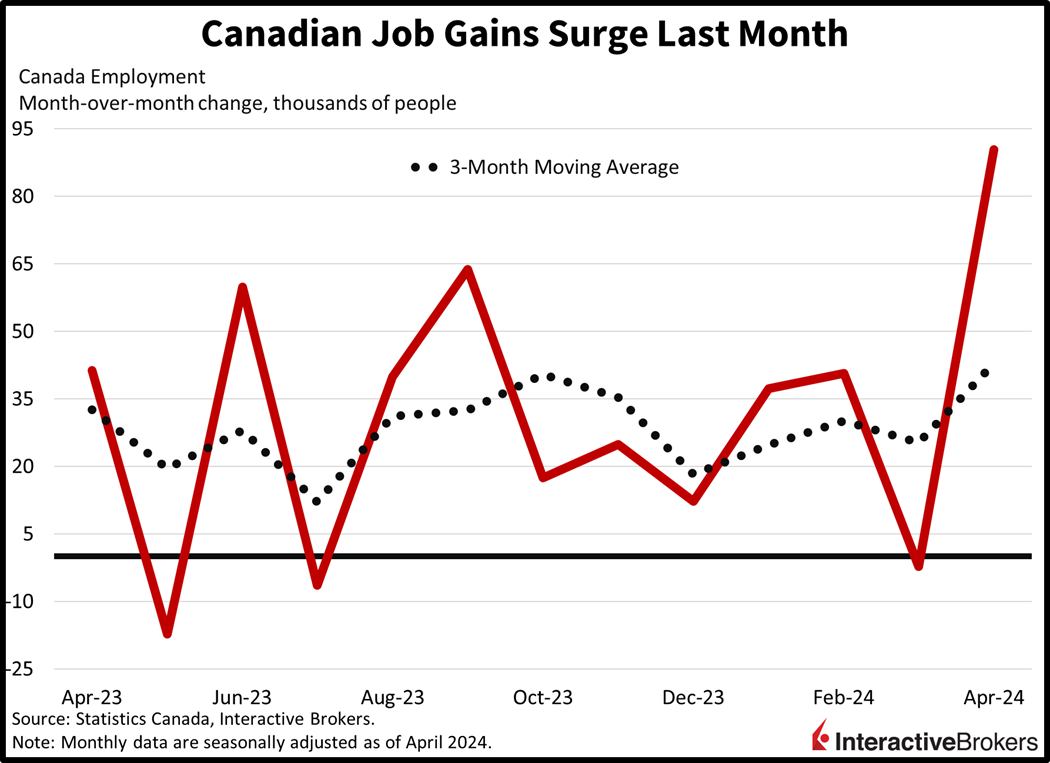

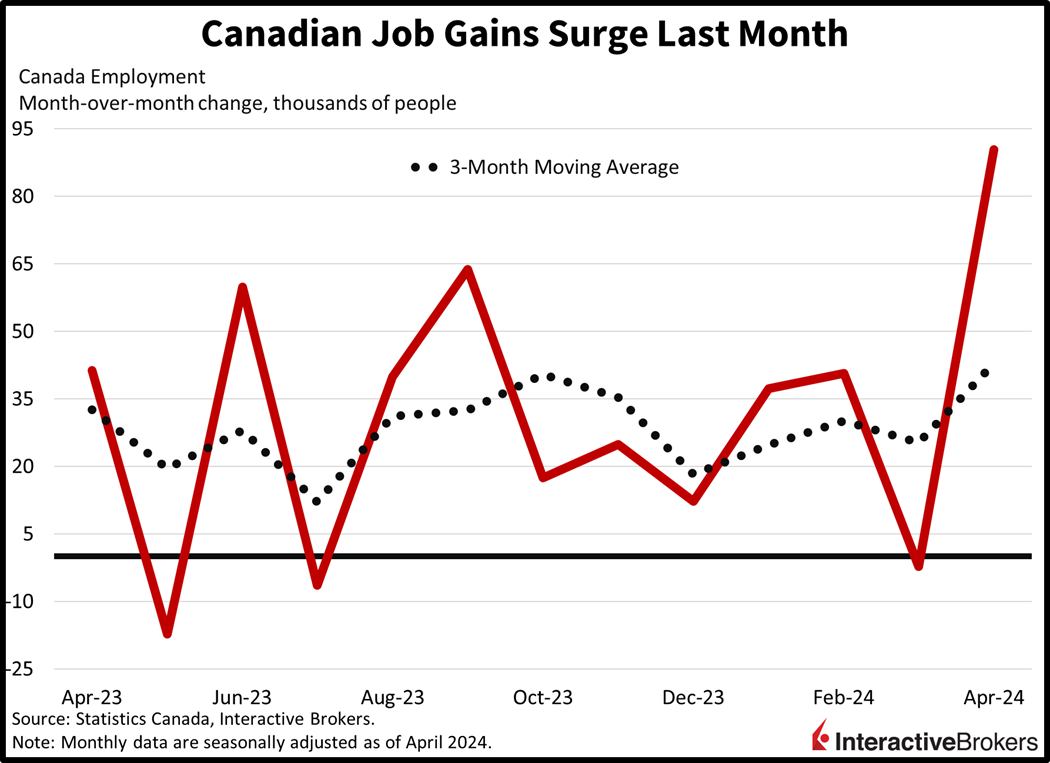

Canadian Job Market Flies to Growth Territory

Another significant reversal occurred north of the US border with Canadian employment moving from contraction to expansion. Canada added 90,400 jobs last month, much higher than the anticipated 18,000 and March’s loss of 2,200. The unemployment rate remained steady at 6.1% despite forecasters awaiting an uptick to 6.2%. The strong hiring, however, was comprised by a sizable gain in part-time employment of 50,000, more than half of the monthly additions.

Investors Scrutinize Central Bankers as Elections Approach

Investors are sifting through recent comments from Fed, Bank of England (BOE) and European Central Bank (ECB) members to assess if upcoming elections are creating reluctance for central banks to turn dovish to avoid appearing partisan. The UK will hold its general election in January, just two months after the US presidential election. This morning, Fed Governor Michelle Bowman said she believes interest rates should be maintained “for a bit longer” because elevated inflation is likely to persist. Minneapolis Fed President Neel Kashkari was also scheduled to speak today. He recently produced an essay arguing that monetary policy isn’t sufficiently restrictive based on housing inflation observations, and he was expected to reiterate those concerns today.

Also today, two BoE speakers provided dovish comments, just one day after the central bank decided to maintain its 5.25% key interest rate. This morning, Governor Andrew Bailey said a rate cut at the organization’s June meeting was not a “fait accompli,” but he said he is increasingly confident that the central bank will soon lower its key interest rate, and policymaker Swati Dhingra said there is greater risk in raising rates than keeping rates steady as households are struggling with high energy and housing costs.

The ECB also appears to be moving toward a dovish shift. At its April meeting, a majority of ECB members agreed to maintain the current key interest rates but were open to considering a cut at the bank’s June meeting, according to an account of the central bank’s gathering released this morning. A minority of policymakers supported cutting rates. This morning, Executive Board member Frank Elderson said a rate cut in June is likely if the central bank’s economic projections prove to be accurate.

Inflation Fears Spark Market Reversal

Markets pulled a bearish reversal this morning as investors braced for potential make or break inflation data next week. Stocks were flying in the morning before paring almost all of their gains amidst yields bumping higher. While the Dow Jones Industrial and S&P 500 benchmarks are holding on for dear life near the flatline after being up roughly half a percent, the Russell 2000 and Nasdaq Composite indices couldn’t withstand the pressure; they’re down 0.7% and 0.1%. Sector breadth is tilted positive, however, with 7 out of 11 segments in the green. Leading the upside are financials, technology and healthcare, sporting daily progress of 0.4%, 0.3% and 0.3%. Meanwhile, consumer discretionary, real estate and communication services are the greatest laggards, dropping 0.6%, 0.3% and 0.3%. In fixed-income and currency land, yields and the dollar have reversed to higher levels. The 2- and 10-year Treasury maturities are changing hands at 4.85% and 4.5%, 3 and 4 basis points (bps) loftier on the session. The Dollar Index is up 12 bps to 105.33, as traders reevaluate the path of global central banks amidst rising price pressure expectations. The greenback is up versus most of its major contemporaries including the euro, pound sterling, franc, yen, yuan and Aussie dollar. The Canadian dollar is up relative to its US counterpart, however, as blockbuster employment growth softens monetary policy expectations for north of the border. Crude oil is getting cheaper as demand prospects are being revised lower on the back of mounting evidence of inflationary pressures that may keep central bankers at bay. WTI is down 0.7%, or $0.53, to $78.98. Copper and gold are going the other way, however, with prices gaining 0.8% for both commodities.

Core Inflation is Likely to Offset Declining Oil Prices

We will receive US inflation data next week for price pressures at the wholesale and final consumer levels. The timing is crucial because it coincides with policymakers becoming eager to reduce short-term interest rates despite inflation remaining well above targets. The positive news, however, is that May inflation data, which will be released next month, is likely to ease, a result of oil prices declining roughly 7% month over month. Against this backdrop, though, the month isn’t over yet, and while oil is cooperating, shelter and services as a whole are going the other way. Finally, despite the cooling we’re seeing at the headline level this month, the core segments are running at the same pace as April, pointing to central bankers that have frankly given up on 2% inflation.

Visit Traders’ Academy to Learn More About GDP and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.