Markets are slightly bearish today as last month’s pace of consumer spending data flew past projections, which contributed to yesterday’s big beat on GDP. While this morning’s inflation data generally matched estimates, bond traders are demanding more compensation in light of strong consumer spending that has elevated the risks of additional price pressures. This robust consumer spending isn’t the only headwind in the Fed’s quest for 2% inflation—goods prices are rising due to geopolitical conflicts disrupting supply chains. Against this backdrop, oil prices are up approximately 10% year to date, a result of new Chinese stimulus, persistent demand and lighter supply from certain countries buoying the commodity.

Consumers Flock to Retailers for The Holidays

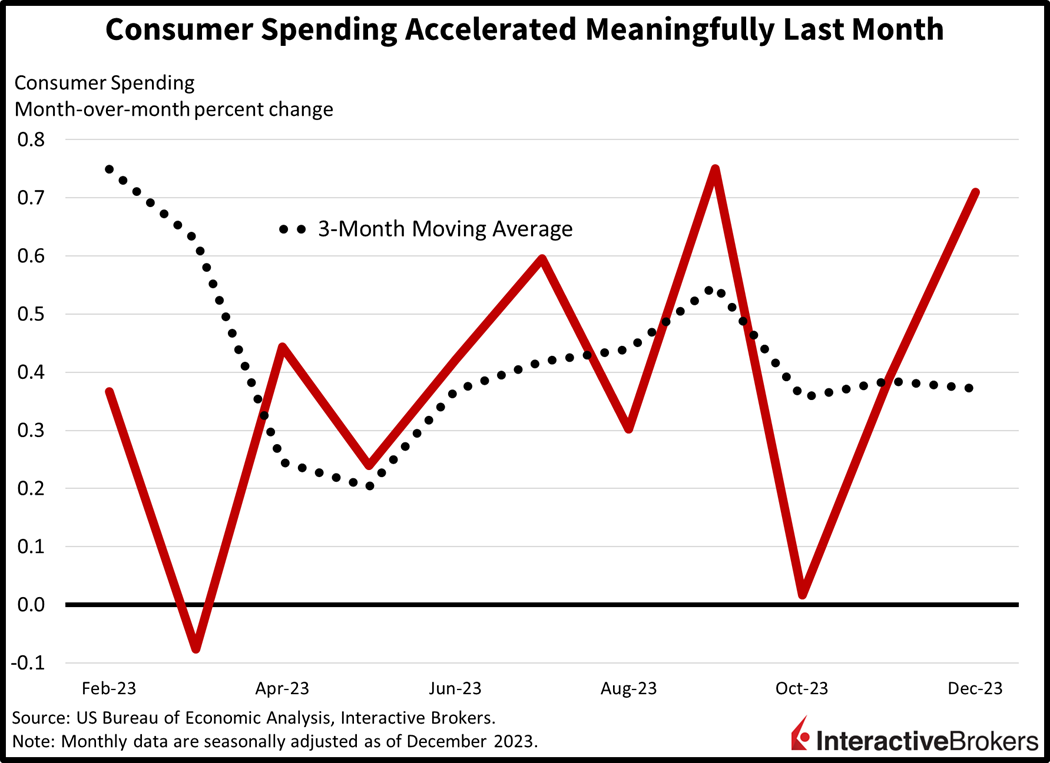

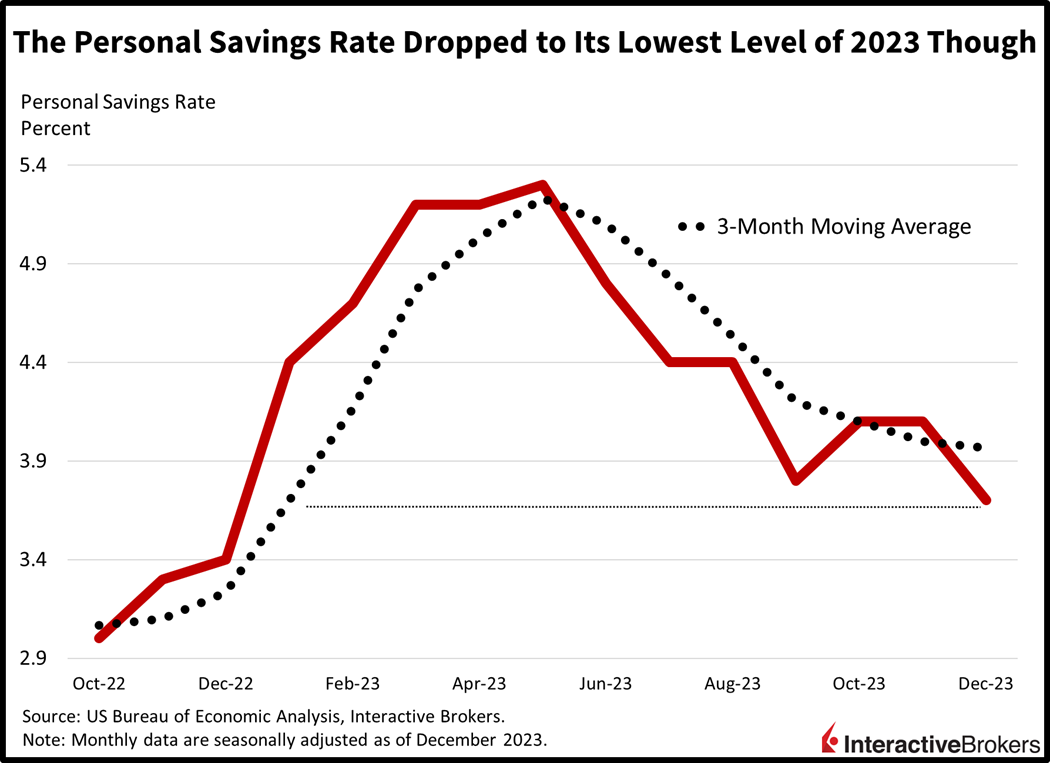

December marked one of 2023’s strongest months for consumer spending, with a notable 0.7% month-over-month (m/m) pace of growth, surpassed only by September and January. The figure exceeded projections for 0.4%, which would have been relatively unchanged from November. Goods spending made a strong comeback, rising 1.1% in real terms during the period, with durables gaining 1.5% while non-durables increased 0.9%, the former rising at its fastest pace since January 2023 while the latter rose at the quickest pace since August 2021. While services spending slowed slightly to 0.3% from the previous period’s 0.4%, households utilized savings, as incomes only rose by 0.3%, matching expectations and decelerating from November’s 0.4%. This dynamic resulted in a decline in the personal savings rate to 3.7%, its lowest level since December 2022.

Inflation Accelerates Marginally

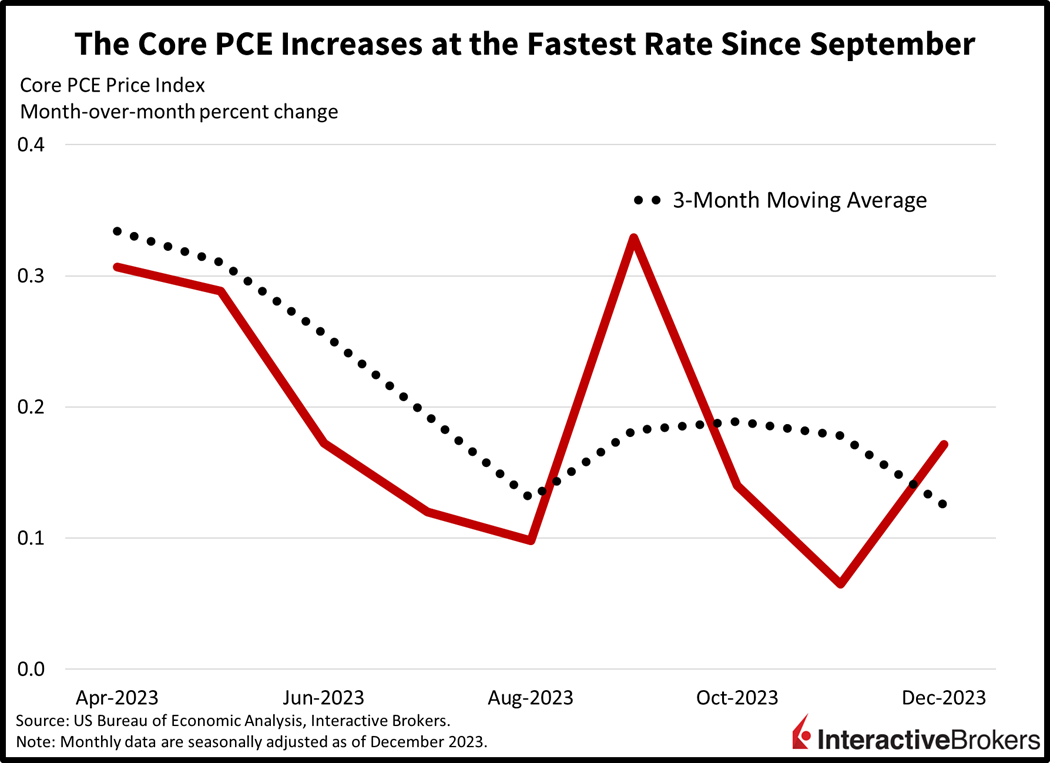

The price indices within the report came in largely as expected, while the core Personal Consumption Expenditures Price (PCE) Index showed its fastest month-over-month (m/m) increase since September. Beyond September, however, it reached its swiftest rate since June. Despite this, the 0.2% m/m rise in prices remained moderate and in-line with the Fed’s 2% target. Both the headline and core PCE price indices increased by 0.2%, meeting expectations and accelerating from November’s -0.1% and 0.1%. On a year-over-year (y/y) basis, headline prices rose by 2.6%, consistent with projections and unchanged from the previous month. Core prices narrowly surpassed estimates on the y/y front, registering 2.9% and cooling from November’s 3.2%. Last month, inflation was primarily driven by the services segment, which saw a 0.3% m/m price increase, while goods charges dropped by 0.2%.

Earnings Reflect Strong Spending Overall

Consumer spending, including international travel, continued at a strong pace in the fourth quarter while the languishing laptop and personal computer market appears to have strengthened. The observations were included in recent earnings reports as described in the following highlights.

- Visa, an important indicator of consumer spending, produced an impressive fiscal first quarter, a result of robust international travel and holiday shopping. Revenue hit $8.63 billion, climbing 9% from the $7.94 billion generated in the year-ago quarter. Revenue surpassed the consensus estimate of $8.5 billion. After adjusting for irregular expenses, Visa’s earnings of $4.94 billion, or $2.41 per share, climbed 8% and exceeded the consensus estimate of $2.34. Payment volume totaled $3.28 trillion, up more than 8% y/y. Cross-border transactions excluding intra-Europe, which is an indicator of travel volumes, climbed 16% y/y. The strongest transaction growth occurred in Central Europe, the Middle East, Africa, Latin America and the Caribbean. Chief Executive Officer Ryan McInerney said consumer spending was resilient during the quarter. Visa said it anticipates “low double-digit” revenue growth for its full fiscal year while its earnings per share (EPS) will grow in the “low-teens.” The company expects current-quarter results to be hampered by extreme cold in various parts of the country curtailing shopping. Shares are down 1.4% on the news of a cold winter impacting results.

- Intel produced revenues and earnings that exceeded the analyst consensus expectation, but its weak guidance sparked a selloff of the company’s shares. Intel generated a fourth-quarter EPS of $0.54 after stripping out irregular expenses. The EPS beat the analyst forecast of $0.44 and increased from $0.15 y/y. Intel’s revenue of $15.4 billion surpassed the analyst expectation of $15.2 billion and climbed from $14.0 billion y/y. The laptop and personal computer market, which is Intel’s largest segment, has lingered in the doldrums for the past few years but appears to be improving, with the company’s sales for those applications increasing 33% y/y to $8.8 billion. Intel’s Data Center and AI sales, however, declined 10% and its network and edge segment sales dropped 24%. Intel’s guidance for the current quarter of $0.13 was significantly below the $0.34 expected by analysts and the company’s estimate of $12.2 billion to $13.2 billion for current-quarter revenue fell below the analyst expectation of $14.2 billion. Intel CEO Pat Gelsinger says the company’s core business is strong, but weakness in its computer vision subsidiary Mobileye and its programmable chip segment will hurt revenue. Additionally, the company will no longer generate revenue from various subsidiaries that it has spun off. Shares are down roughly 11% as investors were upset with the company’s lousy 2024 outlook.

Players Await Powell, Big Tech Next Week

Markets are mixed today with most equity indices slightly higher but bond yields notably loftier as players dial down Fed easing expectations while propelling inflation expectations. The Dow Jones Industrial, Russell 2000 and S&P 500 indices are leading with increases of 0.3%, 0.2%, and 0.2%, respectively. Technology is lagging for a change, with the Nasdaq Composite Index down 0.1%. Despite this, sectoral breadth remains positive, with all sectors higher except for technology, energy and real estate, which have declined 0.4%, 0.3% and 0.3%. Leading sectors include consumer discretionary, health care and communication services, each up 0.7%, 0.7% and 0.5%. Bond yields are being led by the short-end, with the 2- and 10-year Treasury maturities trading 5 and 2 basis points (bps) higher to 4.35% and 4.14%. The dollar is near the flatline, strengthening against the yen, yuan, and Aussie dollar but weakening versus the euro, franc, pound sterling, and Canadian dollar.

China’s Red Sea Comments Reverse Oil Gains

Crude oil was on track to extend its bullish streak this week despite news that Beijing is speaking out against Houthi attacks on ships in the Red Sea, a development that could potentially ease supply concerns. China has close ties to Tehran, a country that supports the Houthi rebels, whose attacks in the Red Sea have caused logistics companies to opt for the longer and more expensive route around the southern tip of Africa. The increase in time required resulting from the route also caused logistic costs to increase because it has created a shortage in shipping capacity. Additionally, Houthi attacks have raised fears that a potential escalation of the Israel-Hamas conflict could hinder oil supplies. Even with Beijing’s intervention and actions by the US and UK to safeguard the Red Sea, investors foresee persistent supply disruptions. WTI crude was up almost roughly 1% this morning but has reversed and is now down 1%, or $0.79, to $76.25 per barrel.

Inflation: Services, Goods, Commodities

Chairman Powell opined that as the Fed closes in on its inflation target, it would slow its pace of monetary policy tightening, much like a driver turning off a highway and slowing his or her car’s speed upon approaching a final destination on secondary roads. Much to the Fed’s delight, commodity and goods price gains simultaneously declined as the Fed entered what it thought was its final frontier in the inflation battle—stubborn services inflation. This year, however, it appears that the Fed is fighting a troubling trio of inflation with goods, commodities and services all experiencing price increases in real-time. This trio is likely to cause the Fed to remain restrictive for longer than expected. As the central bank navigates the monetary policy bridge, its pathway foundation that once appeared to be built on stone now appears to be less sturdy, susceptible to swinging in the winds of loosened financial conditions, resilient consumer spending and a stubbornly tight labor market.

Visit Traders’ Academy to Learn More About Personal Income & Outlays and Other Economic Indicators.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.