Market participants in the week ahead are set to receive fresh reports on the health of the eurozone’s economy, while the United Kingdom enters the new year with a formal departure from the EU.

The eurozone has certainly faced its share of setbacks in 2020, not the least of which has been fueled by strict government mandates to prevent the spread of the deadly Covid-19 virus.

However, fiscal and monetary policy measures to help buoy the eurozone’s economy appear to have brightened some analysts’ outlooks heading into 2021, and, as a result, investors generally appear to have increased their risk-taking in the region.

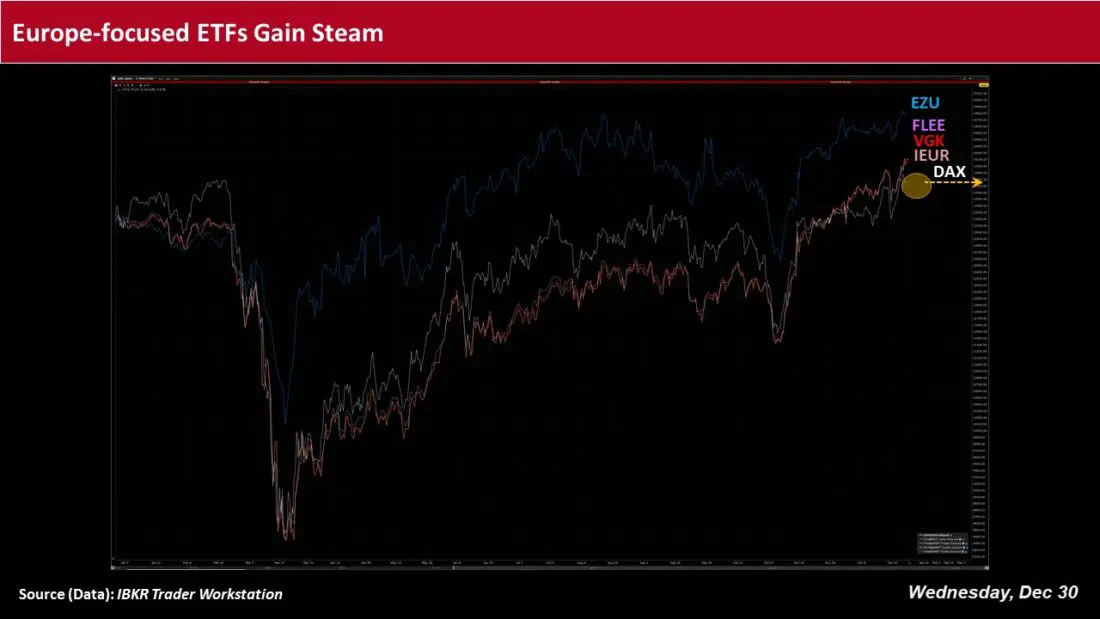

Indeed, certain riskier assets across Europe have yielded positive returns year-to-date in 2020, as the introduction of vaccines to combat the novel coronavirus seem to have provided further impetus to take on risk.

For example, the iShares MSCI EMU (BATS: EZU) and core MSCI Europe (NYSEARCA: IEUR) exchange-traded funds (ETF), as well as the Vanguard FTSE Europe (NYSEARCA: VGK) and Franklin FTSE Europe (NYSEARCA: FLEE) ETFs, have seen positive returns of around 8.8%, 7.2%, 7.3%, and 6.3% year-to-date in 2020, respectively.

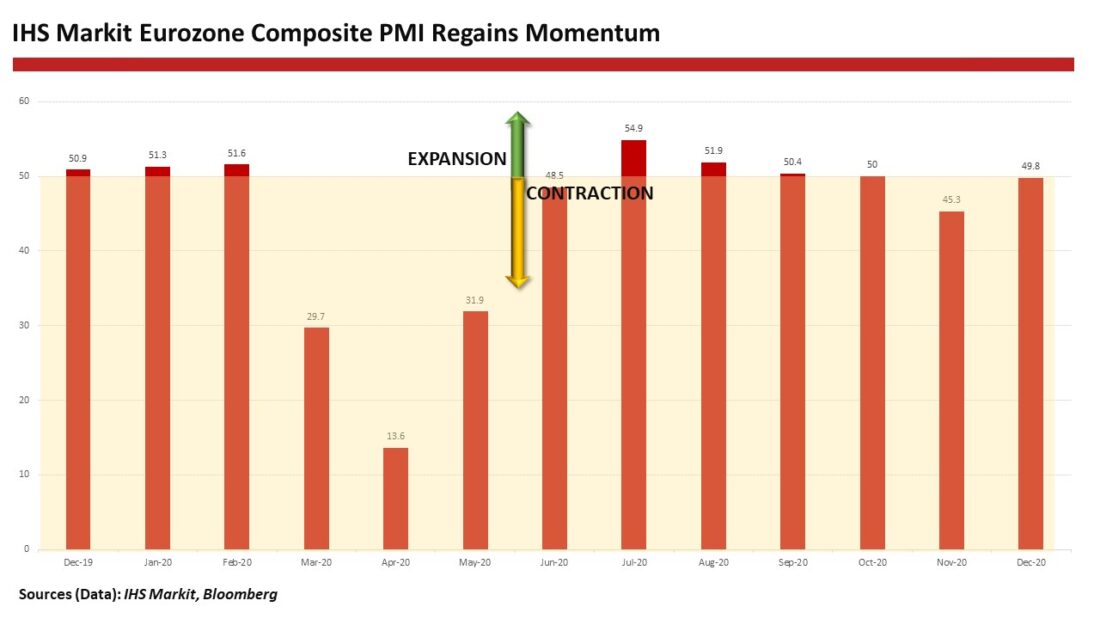

Chris Williamson, chief business economist at IHS Markit recently said that the eurozone’s economy is “faring better than expected in December,” with the flash composite Purchasing Managers’ Index (PMI) coming in at 49.8, ahead of consensus expectations of 45.8. He observed that the latest PMI data “hint at the economy close to stabilizing after having plunged back into a severe decline in November,” amid renewed Covid-19 lockdown measures.

Williamson added that companies have “also become increasingly optimistic about the year ahead, with vaccine rollouts expected to help restore businesses to more normal trading conditions as 2021 progresses.”

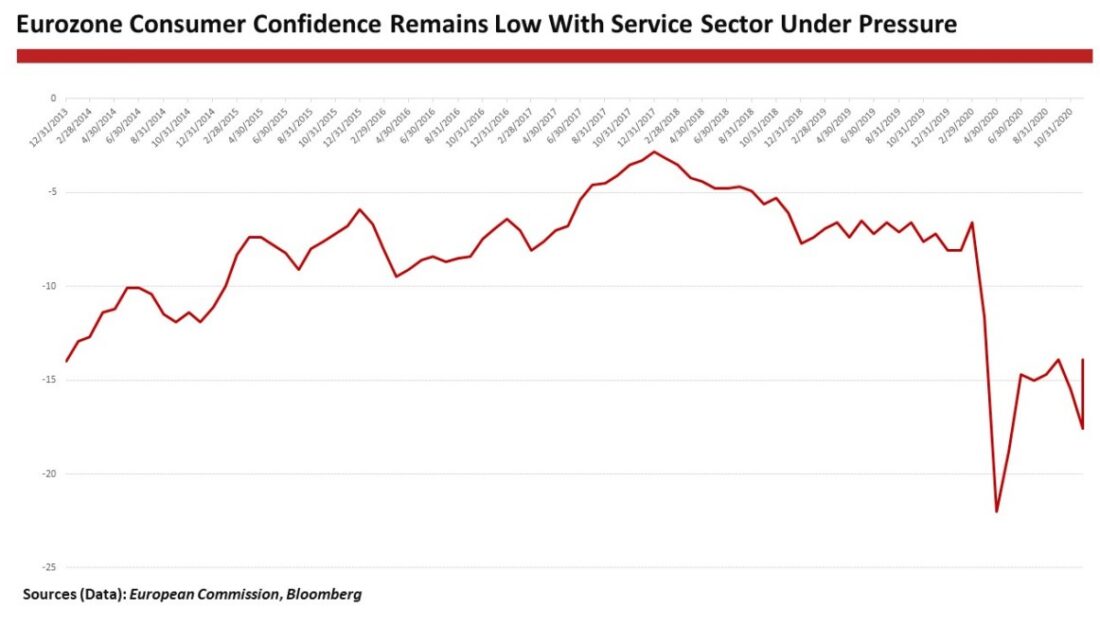

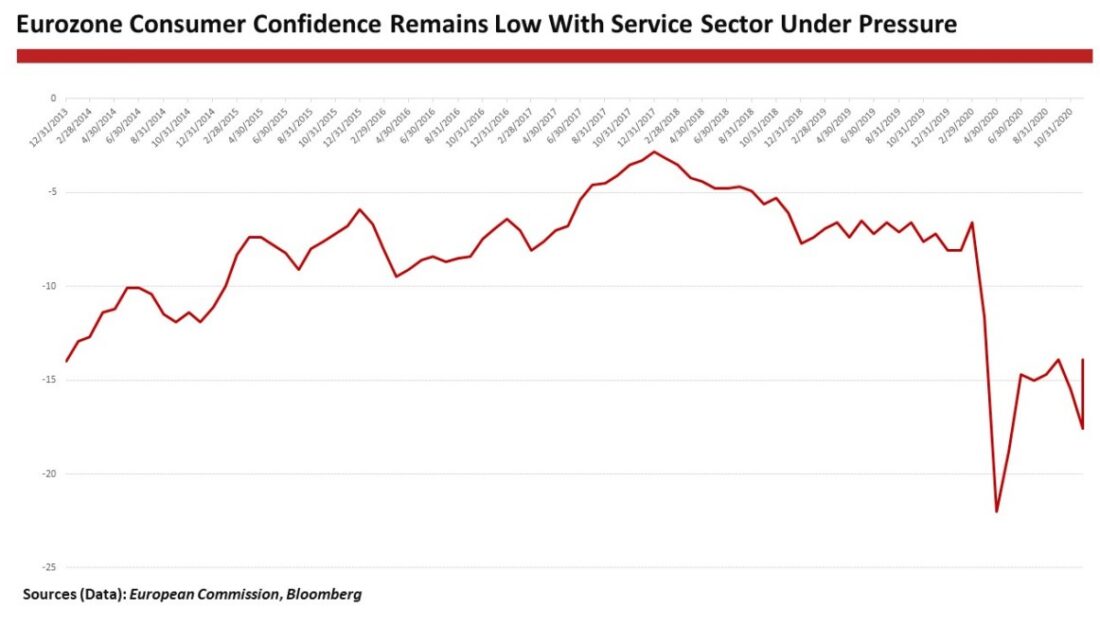

However, while Germany’s manufacturing industry and booming export activity appear to be driving eurozone growth, European service sector companies operating in the ongoing pandemic-stricken environment continue to face daunting near-term hurdles, as social distancing measures remain highly restrictive to revenue generation. These challenges are likely to continue into 2021, despite the vaccine rollouts.

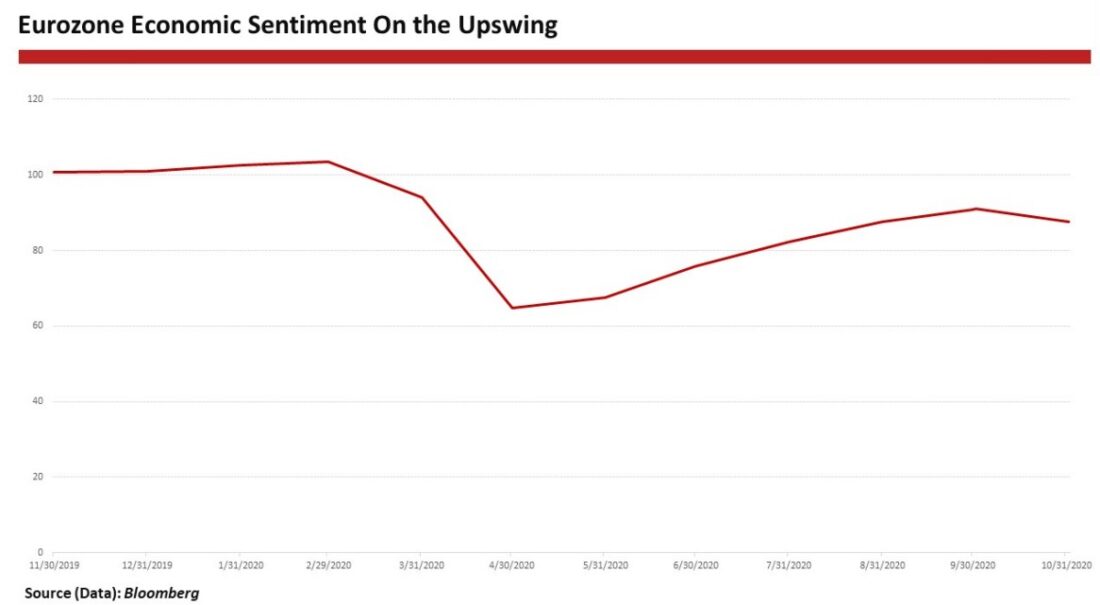

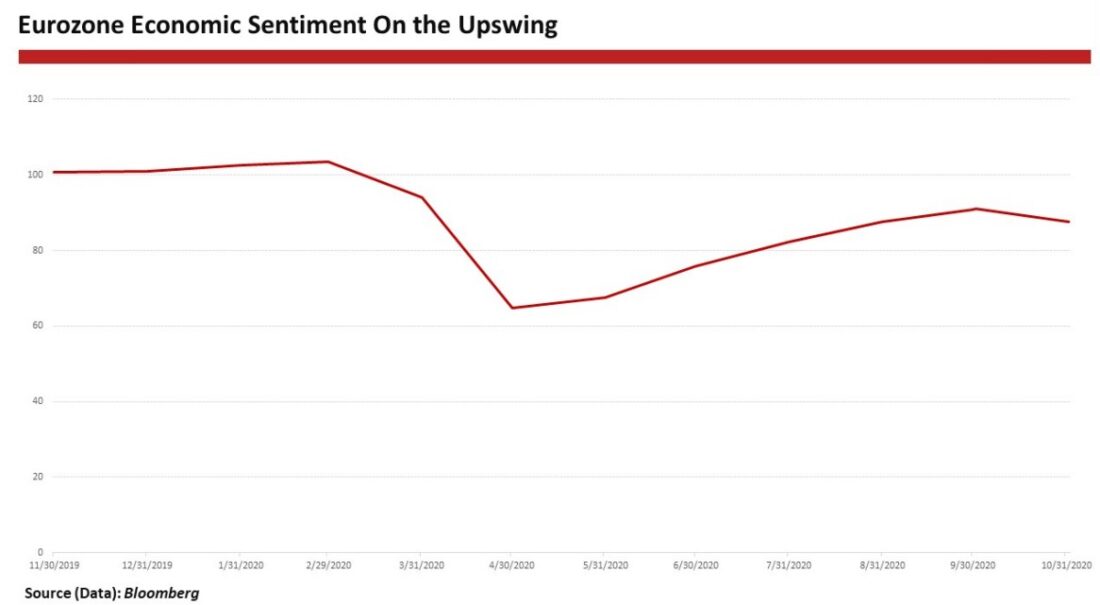

Meanwhile, government-led stimulus measures have generally supported economic sentiment in the region.

In the International Monetary Fund’s World Economic Outlook for October 2020, the institution noted that the “bleak numbers that mark the Covid-19 recession would have constituted far worse signposts had massive policy support not thwarted further slides in activity,” while “the novelty of the policy actions has also supported sentiment.”

The European Union’s €750 billion pandemic recovery package–fund, for example, along with support from the European Central Bank, have largely contributed to the resurgence of riskier asset performance in the second half of 2020.

The IMF noted that equity markets in advanced economies have mostly regained, and in some cases exceeded, their levels from the start of the year, sovereign bond yields are “broadly unchanged” or have declined further since June, “as seen in Italy since the European Union’s pandemic recovery package was established and the European Central Bank’s pandemic emergency purchase program was expanded,” and corporate spreads have dropped further, “particularly for high-yield credit.”

Year-to-date in 2020, credit default swap (CDS) spreads on Italy’s 5-year sovereign bonds have closed-in by more than 24 basis points to just under 100 bps. The country was also among those euro area and EU nations that recorded the sharpest increases in GDP in the third quarter of 2020, with a 15.9% increase – third behind Spain (+16.7%) and France (+18.7).

Cutting Ties

Against this backdrop, the European Commission released details of the EU-UK Trade and Cooperation Agreement, as the UK gets set to exit from the EU Single Market and Customs Union, as well as all EU policies and international agreements on January 1, 2021.

Among the “inevitable” changes from Brexit, the EC highlighted that the UK’s departure will “put an end to the free movement of persons, goods, services and capital with the EU.”

The EC put forth examples of these changes as:

The free movement of persons will end: UK citizens will no longer have the freedom to work, study, start a business or live in the EU. They will need visas for long-term stays in the EU. Border checks will apply, passports will need to be stamped, and EU pet passports will no longer be valid for UK residents.

The free movement of goods will end: Customs checks and controls will apply to all UK exports entering the EU. UK agri-food consignments will have to have health certificates and undergo sanitary and phytosanitary controls at Member States’ border inspection posts. This will cost UK businesses time and money.

The free movement of services will end: UK service providers will no longer benefit from the country-of-origin principle. They will have to comply with the – varying – rules of each Member State, or relocate to the EU if they want to continue operating as they do today. There will be no more mutual recognition of professional qualifications. UK financial services firms will lose their financial services passports.

The UK, not immune to the Covid-19 pandemic, has generally not experienced the same risk-taking fervor that seems to have swept through sectors of the eurozone recently.

For example, while Germany’s blue chip stock index – the DAX – has gained around 13.5% YTD in 2020, the UK’s FTSE 100 index has shed more than 10.76% of its value over the same period.

Overall, analysts’ prospects for a brighter economic picture in the eurozone as 2021 progresses generally appear to prevail, as German manufacturing, fiscal and monetary policy stimulus, and vaccine rollouts help boost sentiment.

Updates on the eurozone’s manufacturing, services, and retail sectors, as well as reports on consumer and economic confidence, are among the long list of releases set for the week ahead.

On the Calendar:

Monday, Jan 4

- IHS Markit – Eurozone Manufacturing PMI (F-Dec)

Wednesday, Jan 6

- IHS Markit – Eurozone Services PMI (F-Dec)

- IHS Markit – Eurozone Composite PMI (F-Dec)

Thursday, Jan 7

- Eurozone Consumer Confidence (F-Dec)

- Eurozone Retail Sales (Nov)

- Eurozone Economic Confidence (Dec)

- Eurozone CPI (Dec)

Friday, Jan 7

- Eurozone Unemployment Rate (Nov)

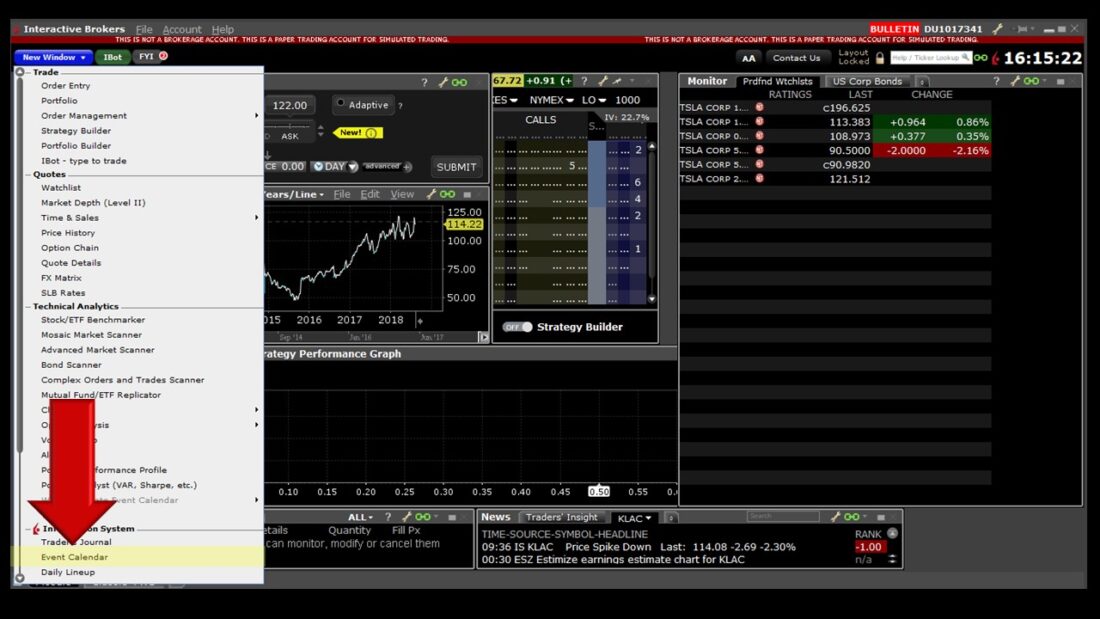

In the meantime, select the Event Calendar option in the IBKR Trader Workstation for a full list of U.S. and global corporate events and earnings, dividend schedules, economic data, IPOs and more.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.