Despite some positive economic indicators, concerns persist about the possibility of a hard landing.

As the U.S. economy continues to navigate a complex landscape with persistent inflation and a stock market setting new highs, the Federal Reserve seems committed to its patient approach regarding interest rate adjustments. Despite some encouraging signs of easing inflation, Fed officials have emphasized the need for more consistent data before considering any rate cuts.

Some financial leaders have been speculating lately on the Federal Reserve’s future actions. JPMorgan Chase (NYSE: JPM) CEO Jamie Dimon speculates that the central bank might actually hike key interest rates this year, going against the market expectations of two rate cuts this year.

Federal Reserve Officials Reiterate the Need to be Patient

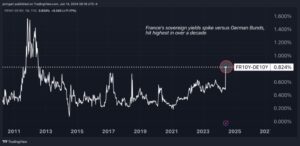

Federal Reserve Governor Christopher Waller, along with Cleveland Fed President Loretta Mester and Boston Fed President Susan Collins, have all expressed the importance of maintaining the current benchmark policy rate at 5.25%-5.50% until there is more definitive evidence of a sustained decline in inflation.

While there is cautious optimism due to recent improvements, concerns persist about the potential for inflation to reaccelerate if rates are reduced prematurely.

Market participants anticipate potential rate cuts starting in September 2024, contingent on favorable inflation data. Traders are firming up expectations for a rate reduction in September, followed by another in December.

However, some prominent figures, such as JPMorgan Chase CEO Jamie Dimon and Goldman Sachs CEO David Solomon, have suggested that the Fed might still hike rates further or refrain from cutting rates in 2024, citing the economy’s resilience driven by government spending and investments in AI infrastructure.

US Inflation Still Above the Fed’s 2% Target Rate, Labour Market Showing Signs of Cooling

The Federal Reserve closely monitors various economic indicators to inform its decision-making process. Recent inflation data, including the Consumer Price Index (CPI), has shown some positive signs, with a 12-month increase of 3.4% ending in April. However, Fed officials require more months of data demonstrating a consistent decline toward the 2% target before considering policy changes.

The labor market has also been a key focus, with U.S. employers adding 175,000 jobs in April, a lower figure compared to previous months. This potentially signals a cooling labor market that could support the case for rate cuts.

Additionally, the economy’s resilience is attributed to the lingering effects of fiscal and monetary stimulus, which drive liquidity and market activity. Improved business activity has raised doubts about the immediate necessity for rate cuts, suggesting that the economy might be able to handle current rates for an extended period.

Hard Landing and Stagflation Risks

Despite some positive economic indicators, financial leaders are concerned about the possibility of a “hard landing” for the U.S. economy.

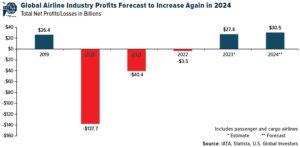

Jamie Dimon warned that stubborn inflation could lead to stagflation, characterized by high rates, recession, and declining corporate profits. Historical trends suggest that the second phase of controlling inflation could be more challenging and increase the risk of a hard landing.

Citigroup CEO Jane Fraser also highlighted the potential difficulties in managing the second phase of inflation, hinting at the challenges ahead. The cautious outlook among financial leaders reflects the uncertainty surrounding the sustainability of the current economic trajectory without facing significant downturns.

—

Originally Posted May 23, 2024 – Financial Leaders Warn of a Potential Hard Landing as Fed Weighs Options

Disclaimer: The author does not hold or have a position in any securities discussed in the article.

Disclosure: The Tokenist

Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult a licensed financial advisor prior to making financial decisions.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from The Tokenist and is being posted with its permission. The views expressed in this material are solely those of the author and/or The Tokenist and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.