Global Economics – October 15, 2021

Introduction

Elevated price pressure at the consumer level has yet to abate much in the US, in what appears to guarantee the start of tapering at the next month’s FOMC. Out of the committee’s 18 members, 11 by Econoday’s count have made it clear they’re in favor of immediate tapering and none have voiced opposition. The only detail of the tapering that has been firmly stated is its end date sometime in the middle of next year, a limited time frame that points to sharp cuts in the Fed’s $120 billion per month buying program. How much incoming inflation data will play in the pace and degree of tapering is uncertain, but the latest news isn’t pointing to the luxury of time.

The Global Economy

Inflation

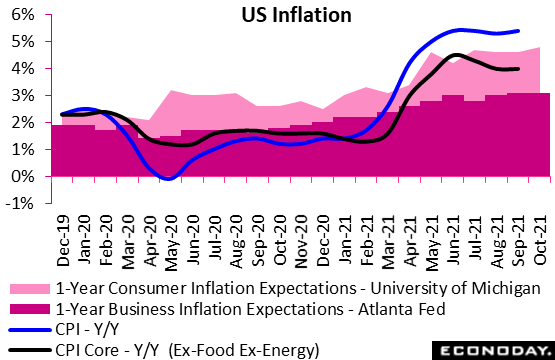

The first definitive data on US inflation in the month of September were headlined by a 0.4 percent monthly rise in consumer prices, up 1 tenth from August’s 0.3 percent rise for an annual rate of 5.4 percent, which was also up 1 tenth. Rising energy prices are behind much of the increase as the CPI excluding energy and also food rose only 0.2 percent for an annual rate of 4.0 percent, both readings unchanged from August.

Also unchanged from August are year-ahead inflation expectations at the business level, at 3.1 percent this month which sounds tame but is a record high for this reading. And showing outright acceleration are year-ahead inflation expectations at the consumer level, up 2 tenths to a 4.8 percent level that is no less elevated. How much of this pressure will make a lasting psychological impression on everybody is still in play, evident in a 2 tenths decline in 5-year consumer expectations to 2.8 percent.

—

To read the remainder of Global Economics, please subscribe via Amazon Kindle or email info@econoday.com to get set-up today!

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.