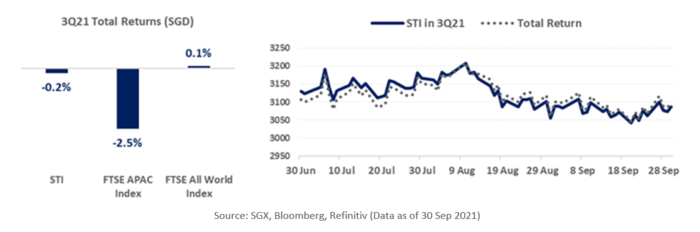

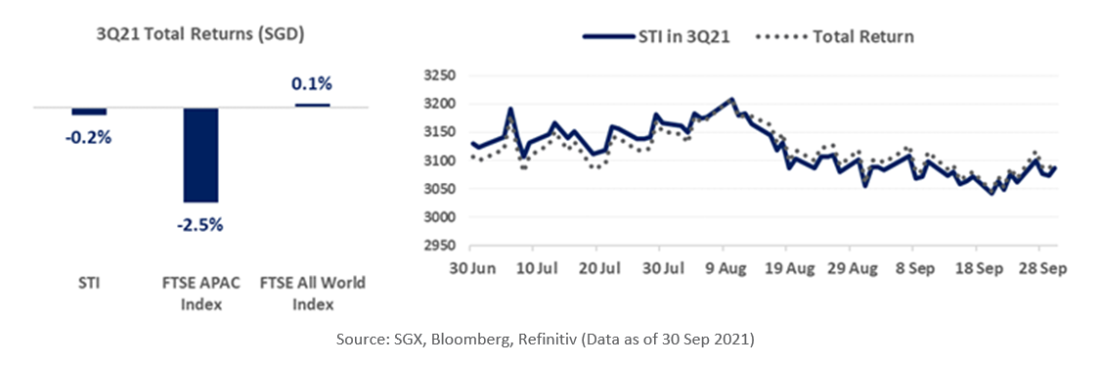

- In 3Q21, the STI saw its narrowest quarterly trading range since 3Q17, generating a 0.2% decline in total return, while the FTSE APAC Index declined 2.5% and the FTSE All-World Index gained 0.1%. The 100 most actively traded Singapore stocks in 2021 also averaged a 3.5% decline in 3Q21, bringing their average nine month total return to 24.9%.

- Singapore Telecommunications saw the most net institutional inflow of the 100 stocks in 3Q21, with S$200 million in net buying, and a 9% total return, while global peers declined 2%. Last week the company announced that Pension Fund Australian Super will buy a 70% stake in Singtel’s Australia tower network for A$1.9 billion.

- RH Petrogas led the price performances of the 100 most actives in September with a 19% gain, while Rex Int added 9%. The Energy Sector was the strongest performing Sector across the globe and the Singapore most actives in 3Q21. Leading global stocks last week, the Energy sector remains in focus with the scheduled OPEC+ virtual meeting tonight.

- For 4Q21, key drivers of the stock market will continue to include how well stocks and sectors can contend with ongoing COVID-19 constrained growth, interest rate expectations, global trade, demand for commodities as well as corporate strategic efforts to maximise operational efficiency key drivers, with the latter showing no signs of abating.

The Straits Times Index (“STI”) saw its narrowest trading range in 3Q21 in four years, since 3Q17, with a 6% differential between the 10 August high (3,207.99) and the 22 Sep low (3,037.79). This was on the back of global banking stocks also seeing their narrowest trading range since 3Q18, and banks making up more than 40% of the STI.

The 2/10 year UST yield curve, saw a comparatively steady quarter, ending at 120bps, similar to its end of June level. From 30 June to 4 August, the yield curve flattened from 120 bps to 100 bps, then from 4 August to 30 Sep, the yield curve steepened from 100 bps back to 120 bps. This saw measured moves in two global stock sectors that are important to the STI, and REITs:

- From 30 June to 4 August, global Banks declined 2%, then from 4 August to 30 Sep, global Banks gained 4%. Steeper yield curves suit banks that borrow short and lend long. While the trio of SGX-listed banks were less correlated to their global peers over the quarter, DBS Group Holdings and United Overseas Bank finished the quarter averaging a 2.6% gain, in-line with the 2.8% gain of the Bloomberg World Banks Index, while Oversea-Chinese Banking Corp declined 1.8%.

- From 30 June to 4 August, global REITs gained 4%, then from 4 August to 30 Sep, global REITs declined 4%. With the steepening of the yield curve driven by gains on the long end of the curve, the higher yields decreased the yield premium of 10 year USTs over REITs. Like the global REITs, the iEdge S-REIT Index also gained 4% from 30 June to 4 August, then declined 4% between 4 August and 30 Sep.

For the quarter ahead, interest rate expectations will continue to be a key driver,in addition to how well listed companies and respective setors can contend with the ongoing COVID-19 constrained growth, global trade, demand for commodities as well as corporate strategic efforts to maximise operational efficiency.

The Energy Sector was also the strongest performing Sector across the globe in 3Q21 as well as the past week. Over 3Q21, the two stocks that represent the Energy Sector that are among Singapore’s 100 most traded stocks this year, Catalist-listed Rex International, and Mainboard-listed RH Petrogas, saw the highest combined net institutional inflows proportionate to sector market cap for the three months. While Brent Crude Oil gained 4.5% over the quarter, from US$75.13/bbl to US$78.52/bbl, the gains in September were greater, from US$72.99/bbl to US$78.52/bbl. The 7.6% monthly gain for Brent Crude Oil coinciding with RH Petrogas ranking as the strongest performer of the 100 stocks in September, with a 19% return, while Rex International ranked just outside the top 10 performers with a 9% gain. OPEC+ meets tonight via video conferencing to set production targets for November, with consensus expectations that ministers will continue to gradually raise supply, and possibly boost more than the already planned 400,000 b/d. In the September Monthly Oil Market Report, OPEC estimated that world oil demand will grow by 4.2 mb/d to 100.8 mb/d in 2022, exceeding pre-pandemic levels.

3Q21 Net Institutional Flows & Sector Moves

Together the 100 most traded stocks over the past seven months booked S$754 million of net institutional outflow in 3Q21, bringing the total net institutional outflow for the 100 stocks for the past nine months to S$988 million. While the STI stocks typically dominate the inflows and outflows based on their comparative size in terms of market capitalisation, the 100 stocks do represent 12 sectors. Hence, another lens relevant to the flows is stock inflow/outflow in proportion to stock market capitalisation. When proportioning the combined net institutional flows of the 12 Sectors to the combined sector market capitalisation, the Energy Sector was observed to see the highest net institutional inflows in 3Q21, followed by Materials & Resources Sector and the Telecommunications Sector. In terms of average performances over 3Q21, the Energy Sector generated the highest gains over 3Q21, while The Technology (Hardware/Software) Sector saw the second highest average total returns, followed by REITs.

The average sector performances of the most 100 traded stocks in 3Q21, with sector flows proportionate to sector market capitalisation are tabled below.

Note the average performance can be skewed significantly by one stock’s performance. For instance, in 3Q21, Yinda Infocomm declined 15%, while Singapore Telecommunications, NetLink NBN Trust and StarHub averaged 5% total returns.

Singapore Telecommunications saw the most net institutional inflow of the 100 stocks in 3Q21, with S$199.8 million in net buying, and a 9% total return, while global peers declined 2%. The gains in the Singtel share price since the company announced the issuance of S$1.0 billion 3.3% Subordinated Perpetual Securities under its S$10 billion Guaranteed Euro Medium Term Note Programme, has now seen the company marginally outpace global telecommunication indices over the past nine months. The company has also been a part of the recent wave of Singapore companies conducting strategic reviews, after announcing in May, it was weighing options for its digital marketing and cyber security businesses. Fitch Ratings noted the review signaled suggests a sharper focus on profitable growth and prudent capital preservation, and on 12 Aug reported a turnaround net profit of S$445 million for its 1Q22 (ended 30 June). Last week the company announced that Pension Fund Australian Super will buy a 70% stake in Singtel’s Australia tower network for A$1.9 billion. StarHub also saw a 2% total return in 3Q21, with S$4.5 million of net institutional inflow, and the company proposing an investment in shares of MyRepublic Broadband on 22 Sep. The clear operational highlight of the proposal is to harness synergies across both broadband operation. The Telcocommunications Sector has changed significantly in Singapore in the past few years with the introduction of new mobile virtual network operators, providing broadband services, reducing the cost of mobile data, phone plans for users. At the same time, cost savings have been an important aspect of StarHub’s three year DARE for transformation program which began in October 2018. The program is expected to achieve costs savings of S$273 million by the end of next month.

While Real Estate was the least performing sector across the globe in 3Q21, CapitaLand Invest (“CLI”) generated a 15% return from its debut through to the end of the quarter, PropNex gained 15% over the quarter, while Hongkong Land edged 3% higher. The remaining seven developers and operators among the 100 most traded Singapore stocks averaged 6.5% declines. Since its debut on 20 Sep, CLI has averaged S$85 million in daily trading turnover, which is markedly higher than the previous entity, CapitaLand, which averaged daily trading turnover of S$37 million a day in the 2021 year through to 9 Sep, and S$33 million in 2020.

2021 YTD Top Traded 100 Stocks by Turnover

The recent performances of the 100 most traded stocks over the past nine months are tabled below. Together the 100 stocks represent S$622 billion or 70% of the total S$888 billion market value of all stocks listed in Singapore. The table is sorted by highest total returns in 3Q21.

| 100 Most Traded Stocks in 2021 | Code | Mkt Cap S$M | Sep Total Return | Sep Net Insti Flow S$M | 3Q21 Total Return | 3Q21 Net Insti Flow S$M | 9M21 Total Return | 9M21 Net Insti Flow S$M | Sector |

| Frencken | E28 | 991 | -1% | -2.7 | 24% | 14.4 | 79% | 38.4 | Technology (Hardware/ Software) |

| Raffles Medical | BSL | 2,729 | 4% | 4.5 | 24% | 46.2 | 49% | 64.1 | Healthcare |

| First Resources | EB5 | 2,572 | 12% | 7.6 | 23% | 15.6 | 30% | 6.4 | Consumer Non-Cyclicals |

| OUE Com Reit | TS0U | 2,474 | 11% | 26.3 | 16% | 33.4 | 26% | 38.1 | REITs |

| IFAST | AIY | 2,606 | 12% | 37.2 | 16% | 10.5 | 215% | 60.4 | Technology (Hardware/ Software) |

| StarhillGbl Reit | P40U | 1,391 | 4% | 26.7 | 15% | 31.3 | 33% | 38.6 | REITs |

| Rex Intl | 5WH | 273 | 9% | 4.2 | 15% | 9.3 | 44% | 10.1 | Energy/ Oil & Gas |

| CapitaLand Invest* | 9CI | 17,691 | 15% | 25.7 | 15% | 25.7 | 15% | 25.7 | Real Estate (excl. REITs) |

| PropNex | OYY | 633 | -7% | -0.1 | 15% | -3.4 | 134% | -3.1 | Real Estate (excl. REITs) |

| ESR-REIT | J91U | 1,863 | 0% | 29.5 | 15% | 53.0 | 25% | 34.8 | REITs |

| SPH | T39 | 3,119 | 1% | 40.2 | 15% | 81.6 | 76% | 201.1 | Consumer Cyclicals |

| Olam Intl | O32 | 6,495 | 10% | 14.2 | 13% | 12.1 | 25% | 13.8 | Consumer Non-Cyclicals |

| UMS | 558 | 907 | -2% | -1.2 | 13% | 8.0 | 60% | 53.2 | Technology (Hardware/ Software) |

| HPH Trust USD | NS8U | 2,839 | 18% | 7.3 | 12% | 2.2 | 35% | -4.7 | Industrials |

| ARA LOGOS Log Tr | K2LU | 1,334 | 5% | 38.7 | 11% | 58.3 | 60% | 81.2 | REITs |

| SPHREIT | SK6U | 2,618 | 4% | 24.2 | 10% | 25.5 | 16% | 16.7 | REITs |

| Lendlease Reit | JYEU | 1,027 | -2% | 15.2 | 9% | 27.2 | 26% | 28.9 | REITs |

| Far East HTrust | Q5T | 1,223 | 6% | 18.5 | 9% | 15.7 | 4% | 8.2 | REITs |

| Singtel | Z74 | 40,619 | 6% | 232.1 | 9% | 199.8 | 8% | -191.1 | Telecommunications |

| Oceanus | 579 | 996 | 17% | -1.9 | 8% | -3.7 | 52% | -18.3 | Consumer Non-Cyclicals |

| AEM | AWX | 1,249 | -2% | 22.6 | 6% | 85.1 | 19% | -29.2 | Technology (Hardware/ Software) |

| KepPacOakReitUSD | CMOU | 1,106 | 6% | 19.4 | 6% | 18.0 | 28% | 5.5 | REITs |

| Ascendas-iTrust | CY6U | 1,649 | -1% | -0.4 | 6% | -0.4 | 10% | -8.7 | REITs |

| SATS | S58 | 4,668 | 2% | 14.2 | 6% | 23.8 | 5% | 18.1 | Industrials |

| Cromwell Reit EUR | CWBU | 2,303 | 5% | 25.7 | 6% | 29.5 | 14% | 30.4 | REITs |

| Frasers L&C Tr | BUOU | 5,588 | 1% | 17.9 | 6% | 51.5 | 12% | 16.4 | REITs |

| NetLink NBN Tr | CJLU | 3,877 | 3% | 6.6 | 5% | 6.9 | 6% | -50.4 | Telecommunications |

| Prime US ReitUSD | OXMU | 1,354 | 5% | 20.1 | 4% | 12.7 | 21% | 0.5 | REITs |

| SIA | C6L | 14,926 | -1% | -38.6 | 4% | -98.2 | 18% | -300.9 | Industrials |

| HongkongLand USD | H78 | 15,211 | 16% | 31.3 | 3% | -7.2 | 25% | -41.3 | Real Estate (excl. REITs) |

| DBS | D05 | 77,871 | 1% | -41.1 | 3% | -56.4 | 24% | 885.8 | Financial Services |

| UOB | U11 | 43,297 | 1% | 43.1 | 2% | -41.6 | 19% | 232.9 | Financial Services |

| Ascendas Reit | A17U | 12,585 | -1% | 26.6 | 2% | 99.1 | 4% | -157.2 | REITs |

| Golden Agri-Res | E5H | 2,983 | 2% | 1.5 | 2% | 14.4 | 51% | 39.3 | Consumer Non-Cyclicals |

| Keppel DC Reit | AJBU | 4,253 | -1% | -5.9 | 2% | -10.0 | -8% | -184.9 | REITs |

| ParkwayLife Reit | C2PU | 2,813 | -4% | -6.4 | 2% | -4.2 | 23% | -2.4 | REITs |

| StarHub | CC3 | 2,112 | 0% | 0.0 | 2% | 4.5 | -3% | -20.9 | Telecommunications |

| Kep Infra Tr | A7RU | 2,720 | 1% | 1.0 | 2% | -23.8 | 7% | -57.2 | Utilities |

| Mapletree Log Tr | M44U | 8,765 | 0% | 10.5 | 1% | 13.4 | 4% | -17.6 | REITs |

| GKE | 595 | 103 | 2% | -0.5 | 0% | 1.6 | 11% | -3.7 | Industrials |

| ST Engineering | S63 | 11,874 | 1% | -12.8 | 0% | -20.9 | 4% | -75.8 | Industrials |

| CapLand Int Com T | C38U | 13,151 | -1% | 9.1 | -1% | 22.2 | -3% | -22.3 | REITs |

| AIMS APAC Reit | O5RU | 1,019 | -7% | 6.0 | -1% | 15.8 | 21% | 17.2 | REITs |

| Suntec Reit | T82U | 4,044 | -4% | -19.1 | -1% | -13.2 | -1% | -75.0 | REITs |

| Mapletree Ind Tr | ME8U | 7,394 | -5% | -32.0 | -1% | 6.6 | 0% | -94.2 | REITs |

| OCBC Bank | O39 | 51,749 | 1% | -12.6 | -2% | -299.6 | 18% | 187.1 | Financial Services |

| SIA Engineering | S59 | 2,369 | -1% | -0.3 | -2% | -2.9 | 7% | -2.5 | Industrials |

| Tuan Sing | T24 | 589 | -2% | 1.5 | -2% | 6.9 | 58% | 6.0 | Real Estate (excl. REITs) |

| YZJ Shipbldg SGD | BS6 | 5,449 | -16% | -79.4 | -2% | 14.7 | 49% | 243.5 | Industrials |

| Thomson Medical | A50 | 2,221 | -2% | -0.6 | -2% | -1.2 | 68% | 20.7 | Healthcare |

| Keppel Corp | BN4 | 9,498 | 0% | 13.6 | -2% | -54.9 | 0% | -114.5 | Consumer Non-Cyclicals |

| ThaiBev | Y92 | 16,453 | -4% | -24.2 | -3% | -27.6 | -8% | -352.4 | Consumer Non-Cyclicals |

| Jiutian Chemical | C8R | 161 | 0% | 1.1 | -4% | 1.2 | 2% | -2.9 | Materials & Resources |

| Mapletree Com Tr | N2IU | 6,875 | 2% | 25.4 | -4% | -1.1 | 0% | -26.1 | REITs |

| Sheng Siong | OV8 | 2,225 | -2% | -10.9 | -4% | -32.9 | -1% | -117.1 | Consumer Non-Cyclicals |

| CityDev | C09 | 6,267 | 1% | 1.4 | -5% | -117.6 | -12% | -264.9 | Real Estate (excl. REITs) |

| COSCO SHP SG | F83 | 627 | -2% | 1.0 | -5% | 1.5 | 0% | 6.5 | Industrials |

| Ascott Trust | HMN | 3,028 | -8% | -18.8 | -5% | -19.7 | -10% | -40.6 | REITs |

| Venture | V03 | 5,221 | -5% | -28.1 | -5% | -10.1 | -4% | -164.7 | Technology (Hardware/ Software) |

| Wilmar Intl | F34 | 26,556 | 2% | -13.5 | -5% | -137.6 | -6% | -229.0 | Consumer Non-Cyclicals |

| RH PetroGas | T13 | 116 | 19% | 0.0 | -5% | 0.1 | 524% | -1.1 | Energy/ Oil & Gas |

| Yoma Strategic | Z59 | 282 | -3% | 1.5 | -6% | 5.3 | -57% | -33.1 | Real Estate (excl. REITs) |

| Hong Fok | H30 | 659 | -2% | 0.4 | -6% | 1.0 | 7% | -6.0 | Real Estate (excl. REITs) |

| UOL | U14 | 5,792 | -2% | -7.0 | -6% | -16.3 | -9% | -40.3 | Real Estate (excl. REITs) |

| Frasers Cpt Tr | J69U | 3,857 | -2% | -19.7 | -7% | -41.0 | -5% | -77.6 | REITs |

| CapLand China T | AU8U | 1,898 | -5% | -11.0 | -7% | -37.2 | -8% | -24.3 | REITs |

| ComfortDelGro | C52 | 3,273 | -7% | -29.7 | -7% | -79.9 | -8% | -140.7 | Industrials |

| Avarga | U09 | 255 | -3% | -0.3 | -7% | 0.6 | 5% | 8.7 | Consumer Cyclicals |

| Mapletree NAC Tr | RW0U | 3,367 | -3% | -13.7 | -7% | -40.0 | 2% | -39.9 | REITs |

| ManulifeReit USD | BTOU | 1,521 | -3% | -4.7 | -7% | -5.6 | 4% | -33.1 | REITs |

| Sasseur Reit | CRPU | 1,038 | -5% | -1.3 | -8% | -4.0 | 11% | -8.1 | REITs |

| Jardine C&C | C07 | 7,660 | 0% | -4.3 | -8% | -36.9 | 2% | 0.0 | Consumer Cyclicals |

| Keppel Reit | K71U | 3,906 | 1% | -18.3 | -9% | -51.2 | 0% | -30.0 | REITs |

| Yanlord Land | Z25 | 2,144 | -7% | 0.4 | -9% | -3.3 | 4% | -18.1 | Real Estate (excl. REITs) |

| SingPost | S08 | 1,428 | -3% | -1.6 | -10% | -27.5 | -9% | -46.1 | Industrials |

| SGX | S68 | 10,687 | 1% | -48.8 | -11% | -190.3 | 9% | -64.3 | Financial Services |

| Aspen | 1F3 | 145 | 17% | 0.6 | -12% | 0.8 | -39% | -5.6 | Real Estate (excl. REITs) |

| Sarine Tech | U77 | 230 | -11% | 0.1 | -12% | 2.6 | 62% | -2.5 | Industrials |

| ISDN | I07 | 274 | -2% | -1.4 | -13% | -2.1 | 56% | 1.7 | Industrials |

| Sembcorp Ind | U96 | 3,273 | -5% | -5.3 | -14% | -18.2 | 10% | 59.8 | Utilities |

| Genting Sing | G13 | 8,687 | -6% | -29.1 | -14% | -123.0 | -14% | -121.6 | Consumer Cyclicals |

| CDL HTrust | J85 | 1,278 | -11% | -4.8 | -15% | -7.4 | -15% | -14.8 | REITs |

| Haw Par | H02 | 2,554 | -12% | -6.3 | -15% | -6.8 | 10% | 69.0 | Healthcare |

| Yinda Infocomm | 42F | 266 | 4% | 0.4 | -15% | 2.1 | 166% | 16.0 | Telecommunications |

| Q&M Dental | QC7 | 524 | -9% | -8.3 | -15% | -5.2 | 53% | 13.0 | Healthcare |

| JMH USD | J36 | 51,972 | -1% | -13.8 | -16% | -58.0 | 0% | -73.6 | Consumer Non-Cyclicals |

| Japfa | UD2 | 1,402 | -4% | -1.2 | -17% | -13.8 | -16% | 0.0 | Consumer Non-Cyclicals |

| DairyFarm USD | D01 | 6,264 | -2% | -3.8 | -18% | -26.2 | -13% | -39.2 | Consumer Non-Cyclicals |

| Aztech Gbl** | 8AZ | 805 | -5% | -3.1 | -19% | -20.6 | -18% | -62.6 | Industrials |

| Sunpower | 5GD | 488 | -1% | 1.6 | -19% | 2.9 | 2% | -1.8 | Industrials |

| Sembcorp Marine | S51 | 2,605 | -2% | 15.7 | -21% | 15.4 | -33% | 49.2 | Industrials |

| MM2 Asia | 1B0 | 123 | -5% | 0.3 | -22% | 5.8 | -53% | 7.2 | Consumer Cyclicals |

| Nanofilm | MZH | 2,754 | -3% | 4.6 | -24% | -61.1 | -5% | -24.1 | Technology (Hardware/ Software) |

| Riverstone | AP4 | 1,319 | -27% | -13.1 | -25% | -17.8 | -14% | 6.6 | Healthcare |

| Leader Env | LS9 | 120 | 4% | 0.1 | -28% | 3.1 | 8% | -1.0 | Industrials |

| The Place Hldg | E27 | 529 | -20% | 0.4 | -31% | 1.0 | 173% | 3.2 | Consumer Cyclicals |

| Top Glove | BVA | 7,286 | -29% | -9.3 | -33% | -7.2 | -50% | -61.2 | Healthcare |

| CFM | 5EB | 37 | -25% | -1.7 | -40% | -1.0 | 360% | 0.2 | Industrials |

| UGHealthcare | 8K7 | 213 | -36% | -1.6 | -40% | -3.4 | -41% | -16.4 | Healthcare |

| Medtecs Intl | 546 | 210 | -29% | 1.7 | -55% | -0.8 | -59% | 7.9 | Healthcare |

| Total | 621,849 | 265 | -754 | -988 | |||||

| Average | -1% | -4% | 25% | ||||||

| Median | -1% | -2% | 7% |

*Listed on 20 Sep **Listed on 11 March. Sources: SGX, Bloomberg, Refinitiv (Data as of 30 Sep 2021)

—

Originally Posted on October 4, 2021 – Key Singapore Market Moves and Flows in 3Q21

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.