A steady policy stance is the strong market consensus for Thursday’s ECB announcement. At the September meeting the central bank indicated that it would be trimming asset purchases made under the pandemic emergency purchase programme (PEPP) and President Lagarde indicated that any other changes would be unlikely before December when the next set of updated economic outlooks is due. However, since last month’s gathering, inflation has risen further above target to the angst of the Governing Council’s hawks and sharply higher bond yields have negatively impacted financing conditions. As such, even if the main policy levers remain on hold, it will be interesting to hear how the monetary authority interprets recent developments in general and what it now thinks about the inflation outlook in particular.

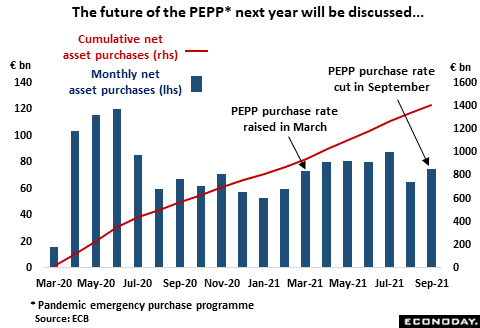

In September the ECB announced that upcoming monthly PEPP purchases would be conducted at a “moderately lower pace than in the previous two quarters (then about €80 billion/month).” No specific levels were mentioned but the language suggested that the reduction would be limited and quite possibly unwind only a portion of the “significantly higher pace” (by about €20 billion) introduced at the March meeting to combat rising bond yields. While volatile, the ECB’s weekly financial reports since then have been consistent with only a mild tapering. However, 10-year bund yields are now the highest since May 2019 and some 25 basis points above their level at the time of March’s discussions. Despite a weaker euro and still historically tight spreads, this implies a deterioration in financing conditions that will not sit well with many Governing Council members and may be why PEPP purchases do not appear to have been trimmed much.

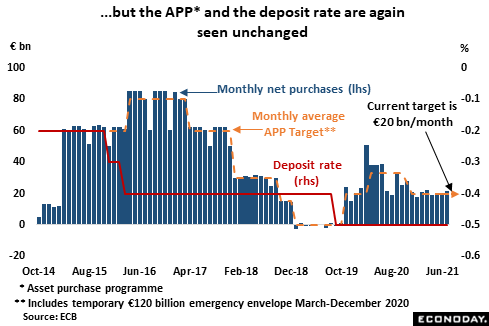

There is minimal likelihood of any adjustment to the longstanding asset purchase programme (APP) where net buying has been targeted at €20 billion/month since November 2019. However, with the PEPP due to expire in March next year, the ECB will be considering how to adjust policy to offset what will otherwise be a hefty reduction in overall QE. To this end, the APP is likely to pick up much of the slack and it might also be made more flexible, along the lines of the PEPP itself. Discussions about how to proceed are ongoing and Thursday’s press conference might provide a few clues. For now though, expect the official statement to reiterate that the APP will only end shortly before the ECB starts raising key interest rates. On that front, there remains a near-zero chance of any move over the foreseeable future. Accordingly, the refi rate should stay at 0.00 percent with the rates on the deposit and marginal lending facilities remaining fixed at minus 0.50 percent and 0.25 percent respectively. The recently amended forward guidance should also be untouched, leaving the central bank expecting rates “to remain at their present or lower levels until it sees inflation reaching two percent well ahead of the end of its projection horizon and durably for the rest of the projection horizon, and it judges that realised progress in underlying inflation is sufficiently advanced to be consistent with inflation stabilising at two percent over the medium term.”

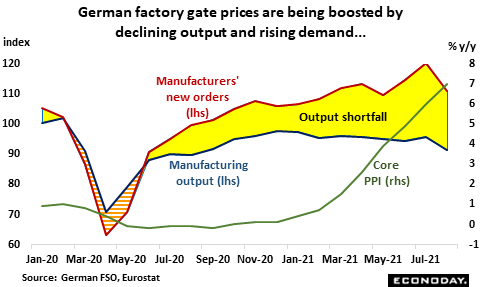

Meantime, having struggled for years trying to get inflation back up to target, the ECB is now faced with an overshoot that is showing ominous signs of being anything but transitory. A mix of Covid, supply chain disruptions and spiking energy costs saw HICP inflation climb to 3.4 percent in September, its highest reading in 13 years. The narrow core rate (excluding energy, food, alcohol and tobacco) was a more modest 1.9 percent and so still below the 2 percent objective, but it too has risen by a full percentage point since June. A rebound in demand is part of the problem but the pick-up here would not be an issue but for the sluggish, supply chain-constrained recovery in output. The net impact is particularly apparent in the German manufacturing sector where the widening gap between the two has helped underlying producer price inflation to surge exponentially in recent months.

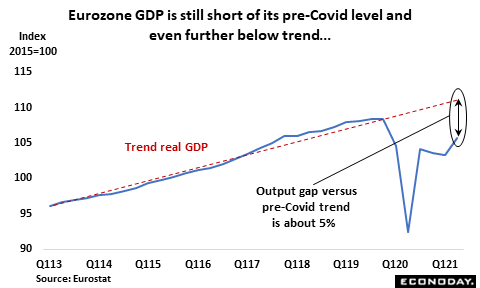

Indeed, despite an upward revision, Eurozone GDP in the second quarter was still 2.5 percent below its level in the final quarter of 2019. Even worse, the shortfall versus where it would have been if trend growth had been sustained was around 5 percent. August looks to have been a poor month for economic activity in general with both retail sales and industrial production falling well short of market expectations. Early data on September have been similarly soft and October’s flash PMI points to a further loss of momentum. In addition, there have been signs that weak output is now hampering sales as production cutbacks in some industries translate into reduced demand in others.

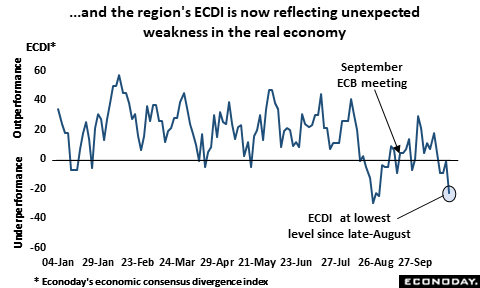

Until recently, Econoday’s economic consensus divergence index (ECDI) had been in mainly positive surprise territory since September’s meeting. However, the apparent outperformance masked unexpectedly soft reports on both sales and output and reflected much more the unanticipated rapid rise in pipeline and final goods and services prices. Indeed, the latest data have pushed the index to its lowest level in almost two months. Consequently, the ECB is unlikely to be any more confident about economic recovery prospects and will probably still see economic risks as finely balanced. As such, unless the ECB is no longer convinced about the transitory nature of higher inflation, there is little reason to change policy.

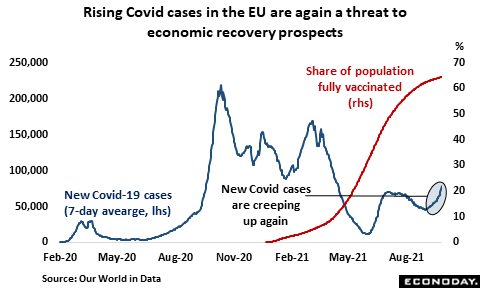

As it is, Covid remains a threat to the Eurozone’s economic recovery, both directly and, increasingly, through its disruptive impact on global supply chains. After a very slow start, the vaccination programme in the EU picked up very sharply from the second quarter and helped to contain a fresh wave of new infections during the summer. Even so, while the EU’s fully vaccinated rate now stands at about 65 percent, around 8 percentage points higher than in the U.S., it leaves a still sizeable portion of the population yet to be immunised. Moreover, with immunity likely to wane over time and new Covid cases on the rise again, the shortfall inevitably poses some extra downside risks to the economy as winter approaches.

In sum, the balancing act that the ECB has to achieve trying to contain rising inflation on the one hand while still supporting a slowing economic recovery on the other is getting harder. The current spike in Eurozone inflation may yet prove transitory and forward guidance anyway specifically accommodates a period of overshooting the 2 percent target. However, unless energy prices start to cool soon, the Bank’s updated outlooks due in December will make maintaining the current policy stance next year increasingly difficult to justify. There is plenty for the doves and hawks to disagree about.

—

Originally Posted on October 25, 2021 – October ECB Meeting Preview: Balancing Policy Is Getting More Complicated

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.