Risk assets are rallying after Fed Chair Jerome Powell yesterday expressed his commitment to maintaining the central bank’s outlook for rate cuts this year despite the organization raising its estimates for economic growth and inflation. Powell appeared to care little about the recent acceleration in price pressures, the significant loosening in financial conditions and the stubborn upward climb in shelter costs. Meanwhile, data this morning is yet another example of stronger economic performance on the back of a Fed that has essentially accepted that the journey to 2% inflation is too challenging, and frankly, not worth it. Indeed, today’s unemployment claims, Purchasing Managers’ Indices, and existing home sales point to strengthening economic activity while hinting at firmer inflation in coming months.

Fed Commits to Cuts

The Fed is increasingly tolerant of above target inflation, with 2026 marking the anticipated year for when the central bank hits its 2% goal. It believes price pressures will be more persistent this year and next relative to what it previously anticipated. In discussing the Fed’s updated Statement of Economic Projections (SEP) yesterday, Powell appeared unphased by recent stronger-than-expected economic data, the rise in shelter costs and the loosening of financial conditions. Indeed, the Fed left its outlook for three rate cuts this year unchanged from the December SEP, despite increasing its forecast for the Core Personal Consumption Expenditures Index to climb 2.6% this year, up 20 basis points (bps) from the median policymaker forecast in December. Additionally, policymakers now anticipate three rate cuts next year rather than the December forecast of four. One significant and somewhat expected change is Powell’s anticipation that the Fed will slow its quantitative tightening (QT) program, or the process of contracting its balance sheet to reduce the amount of cash in the economy. The Fed’s recent policy of trimming $95 billion a month from its balance sheet has created concerns that the rate of QT, if left unchanged, could spark funding problems and weigh on bank reserves.

Economic Expansion Continues

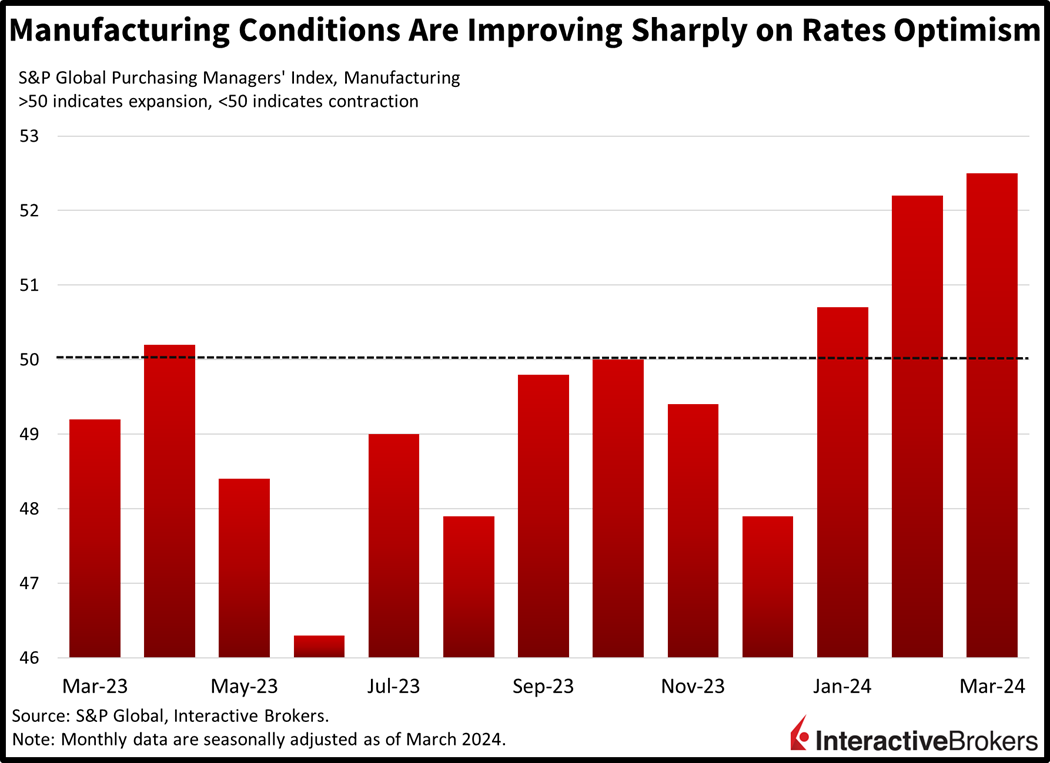

US economic activity expanded at a strong pace this month, according to the preliminary S&P Global Purchasing Managers’ indices (PMI). Both the manufacturing and services segments substantially exceeded the contraction-expansion threshold of 50, with the former at 52.5 while the latter hit 51.7, nearly matching expectations of 51.7 and 52 and last month’s 52.2 and 52.3. Overall, hiring was robust with job growth hitting an eight-month high, according to the PMIs. March demand and production were both strong but not without inflationary pressures. Prices accelerated as input costs rose at the briskest rate in six months while selling prices climbed at the fastest pace since last April. Business confidence also surged, hitting a two-year high as top-level executives chanted in unison, “rate cuts, rate cuts, rate cuts”.

US Manufacturing Rebounds

Ordering activity was stronger in manufacturing than services, as higher prices served to blunt consumer demand in the latter category. Servicers cited labor shortages and wages as the main sources of price pressures, while manufacturers pointed to rising materials and oil costs. Manufacturing is in a recovery mode, however, with orders growing strongly after many consumers loaded up on goods during the pandemic and then proceeded to shift their spending to services. This is the first time that manufacturing outperformed services since 2022.

Euro Manufacturing Weakens Further

PMIs from Europe weren’t as strong, however, with the manufacturing sector remaining deep in contraction territory, although services picked up. The Manufacturing PMI, at 45.7, missed forecasts of 47 and weakened from February’s 46.5. Services activity rose from 50.2 to 51.1 while exceeding projections of 50.5. Employment contracted at manufacturers but grew at service providers. More broadly, overall, business confidence increased for the sixth consecutive month on the back of slower price pressures and expectations of summer rate cuts from the European Central Bank. Supply chains improved, similar to the US, as Red Sea disruptions from Houthi rebels calmed. Order weakness in France and Germany, the region’s two largest economies, offset the impact of improving performances from other countries in the continent.

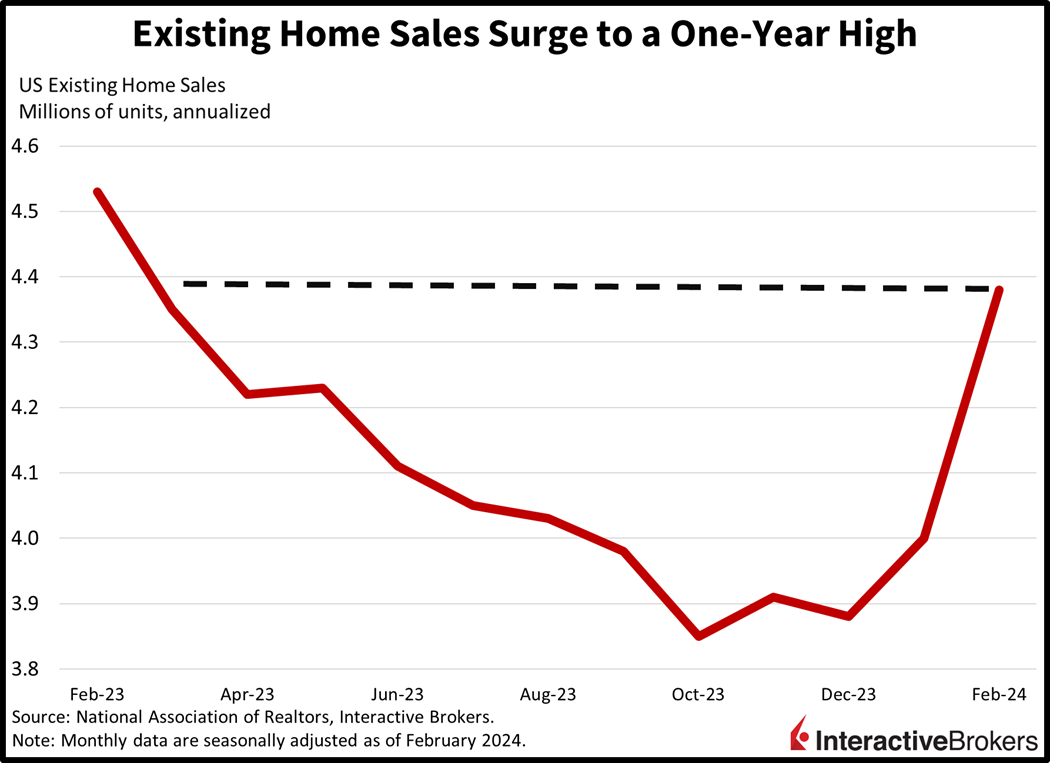

US Home Sales Increase

Existing home sales surged to a one-year high in February, supported by buoyant capital markets and improving inventories. The 9.5% month-over-month (m/m) increase resulted in a seasonally adjusted annualized rate of 4.38 million sales, trouncing expectations for 3.94 million and January’s rate of 4 million. Single-family homes drove the increase, rising 10.3% m/m while condominiums and cooperatives increased a more tempered 2.5% m/m. Gains were robust in three out of four regions with the West, South and Midwest rising 16.4%, 9.8% and 8.4% m/m; the Northeast was unchanged. Inventories rose to 1.07 million, up 5.9% m/m and 10.3% year over year (y/y), while median prices rose 5.7% y/y, the eighth consecutive month of y/y progress.

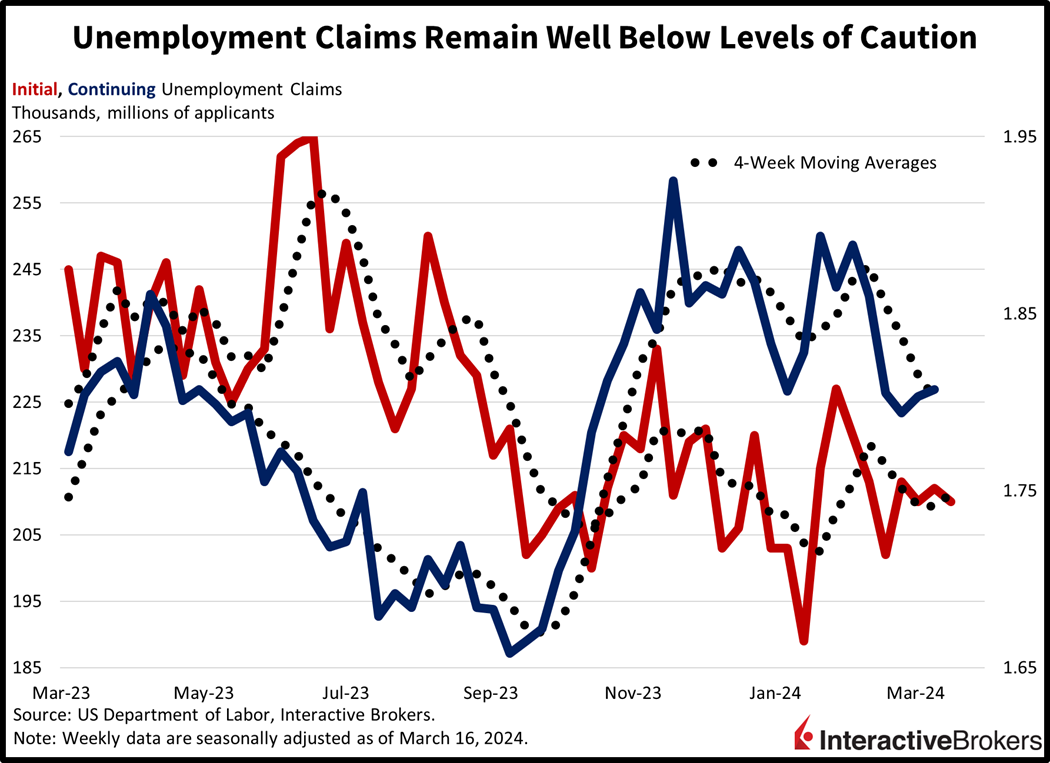

Pink Slips Become Rarer

Unemployment claims were well-behaved in the past two weeks, as companies have become increasingly reluctant to let go of workers amidst strong economic growth. Initial unemployment claims fell to 210,000 for the week ended March 16, below estimates of 215,000 and the prior week’s 212,000. Continuing claims for the week ended March 9, meanwhile, increased slightly to 1.807 million from 1.803 million during the previous period but were below expectations of 1.82 million. The four-week moving average trends for initial claims and continuing claims were mixed, shifting from 209,250 and 1.816 million, respectively, to 211,250 and 1.802 million.

Markets Celebrate Powell’s Comments

Markets are rallying with the S&P 500, Dow Jones Industrial Average and Nasdaq Composite indices all reaching all-time highs in early trading. The small-cap, rate-sensitive Russell 2000 Index is leading with a gain of 0.9%. The Dow Jones Industrial, Nasdaq Composite, and S&P 500 indices are up 0.8%, 0.6% and 0.5%, meanwhile. Sectoral breadth is terrific with all eleven sectors joining the party; industrials, consumer discretionary and financials are leading with gains of 1%, 0.9%, and 0.8%. Bond yields are little changed, with the 2- and 10-year maturities trading at 4.63% and 4.29%, 3 and 1 bps higher on the session. The dollar is stronger too on the back of spectators betting that global central banks will jump on the Fed’s bandwagon and declare victory with inflation well above their targets. Indeed, the Swiss Central Bank just surprised and cut 25 bps while the Brits are hinting at the same. The franc and pound sterling are suffering in response and are down 1.3% and 1%, respectively, relative to the US dollar. Meanwhile, the greenback’s index is up 56 bps to 103.96 as the US currency gains against all its major developed market counterparts, including the euro, yen, yuan and Aussie and Canadian dollars. WTI crude oil is paring some recent gains and is down 1.1%, or $0.86, to $80.50 per barrel as some oil bulls take profits.

Life Goes On

Powell appeared somewhat defensive yesterday when he addressed inflation and by extension critics who believe the anticipated rate reduction pace is too dovish when he opined, “life goes on.” In a nutshell, Powell has basically pulled a U-turn and has dismissed hawkish concerns. In comparison, former Fed Chairman Paul Volcker, who tamed inflation that soared to more than 14% in the 1980s, would, in all likelihood, have shifted to a more hawkish stance rather than downplay the recent surge in prices. As the Fed appears ready to tolerate above target price pressures, the inflation put, or the protection of downside volatility through inflecting earnings growth, has been born. As earnings per share gain an additional 3%-4% each year all else being equal just because of inflation, benchmark indices have found another source of support in addition to the Fed put and dividends. Party on.

Visit Traders’ Academy to Learn More About Existing Home Sales and Other Economic Indicators

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The Fed is there to prop up the regime, and the regime needs a positive macro narrative heading into November. No surprise there.

I think the FED is losing the battle and they know it. Too much cash in the system and the politicians spend like no tomorrow.

3% inflation is awful. That means every ten years, the buying power of the dollar decreases by 30 percent(!!!)

Actually, more than 30 percent, because of the compounding effect.

As far as the stock market, it looks just like 2021 to me. A slow and steady climb, with every little dip being bought.

Not making any predictions, but that is my observation. Look at the options premiums. The calls are much more expensive than the puts, just like last year. I don’t know if this would be happening if it were not an election year, but it’s an election year, and it’s happening.