Global Economics – November 19, 2021

Introduction

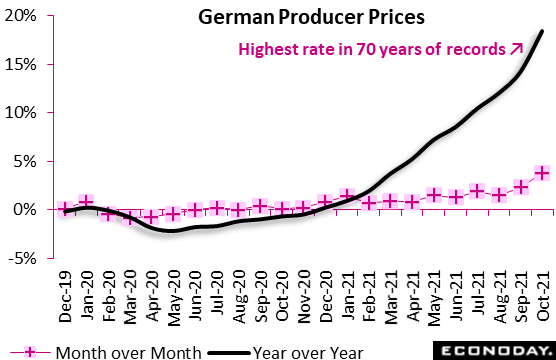

Sky high divergence scores of 57 for China and 47 for the US put into context a week of unexpectedly strong economic data, some of which is wanted but some of which (when it comes to inflation) isn’t wanted at all. No one was prepared for the prior week’s acceleration in US consumer prices, at 0.9 percent on the month and 6.2 percent on the year, including no doubt Jerome Powell who has been assuring everyone all year that supply constraints will ease and that the secular trend of disinflation will reassert itself. Could it be that the inability to restrain consumer prices will cost Jerome Powell his job? That’s up to President Biden who is expected to announce his Fed chair pick any day now. All this heat, whether on Powell or consumer prices, starts at the producer level where costs are literally in vertical flight across the globe, and especially in Germany.

The Global Economy

Producer prices continue to soar and again far exceeded even the grimmest expectations in October. Having already jumped a monthly 2.3 percent in September, Germany’s PPI surged fully 3.8 percent at the start of the quarter. Annual PPI inflation climbed 4.2 percentage points to 18.4 percent, the highest reading in records that began in 1951. In line with the pattern seen over much of the year so far, energy (12.1 percent) dominated the overall monthly change but intermediates (0.9 percent), capital goods (0.5 percent), consumer durables (0.3 percent) and non-durables (0.5 percent) all posted fresh gains too.The annual core rate accelerated again, climbing from 8.6 percent to 9.2 percent, some 8.9 percentage points above its level at the end of last year. The October update shows that pipeline inflation pressures in German manufacturing are still building rapidly and warn that CPI inflation, already at 4.5 percent last month, could have further to go before finally peaking.

—

To read the remainder of Global Economics, please subscribe via Amazon Kindle or email info@econoday.com to get set-up today!

Disclosure: Econoday Inc.

Important Legal Notice: Econoday has attempted to verify the information contained in this calendar. However, any aspect of such info may change without notice. Econoday does not provide investment advice, and does not represent that any of the information or related analysis is accurate or complete at any time.

© 1998-2022 Econoday, Inc. All Rights Reserved

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Econoday Inc. and is being posted with its permission. The views expressed in this material are solely those of the author and/or Econoday Inc. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.