Robust PMI data from the US and Europe are dampening investor sentiment and offsetting the impact of blockbuster earnings results from AI juggernaut Nvidia. This morning’s figures are sending yields north at a time when global central bankers are eager to cut rates. Rates are also taking their cue from yesterday’s release of minutes from the last Fed meeting depicting certain officials leaving the door open to further rate hikes amidst a lack of inflation progress. Those same policymakers were skeptical of the restrictiveness of current policy. It’s indeed hard to argue that policy is tight, considering that home prices and stock values have reached fresh all-time highs countless times this year. Central bankers are contending with the risks of declaring victory too early.

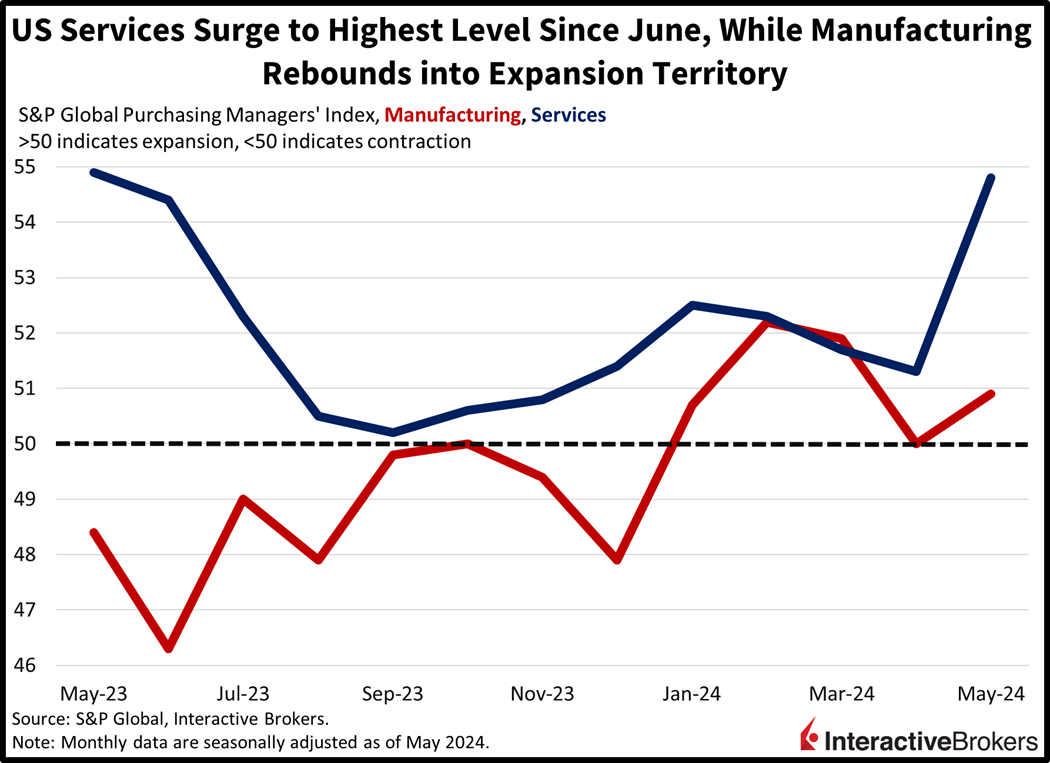

PMIs Strengthen Inflation Fears

US economic performance in May accelerated to its fastest pace in 25 months, according to this morning’s flash Purchasing Managers’ Indices (PMI) from S&P Global. May’s composite PMI score of 54.4 trounced expectations of 51.1 and improved sharply from April’s 51.3. The progress wasn’t free—price pressures continued to build on the back of deep order books, elevated materials costs and labor shortages. The lack of worker availability did lead to a decline in employment at servicers, which was partially buffered by an increase in manufacturing headcounts.

While manufacturing climbed firmly into growth territory, activity was led by servicers. The services PMI of 54.8 is well above both the expansion-contraction threshold of 50 and the median analyst forecast of 51.2, which would have been near last month’s 51.3. The manufacturing PMI arrived at 50.9, up from April’s 50, which was also the consensus projection for this month. Goods orders were propelled by exports, which counteracted sluggishness in domestic purchases. Improved confidence across both firms and customers also buoyed results. However, optimism remains below longer-term trends as corporations and households alike are concerned about rates, elections and geopolitical instability.

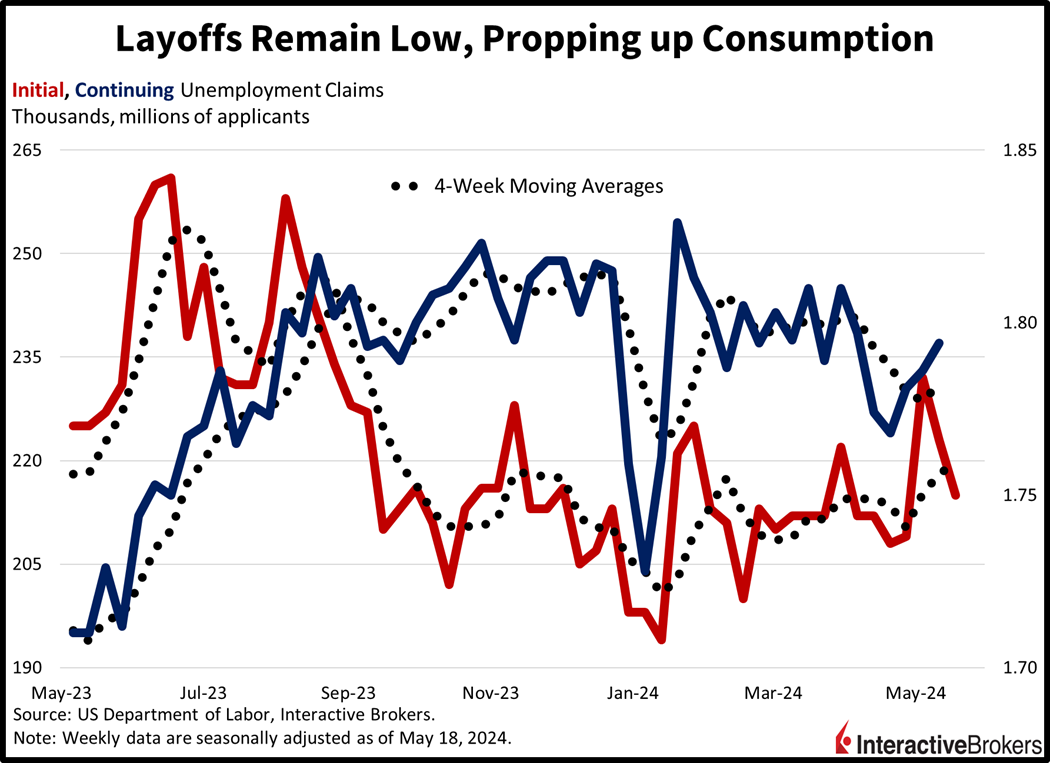

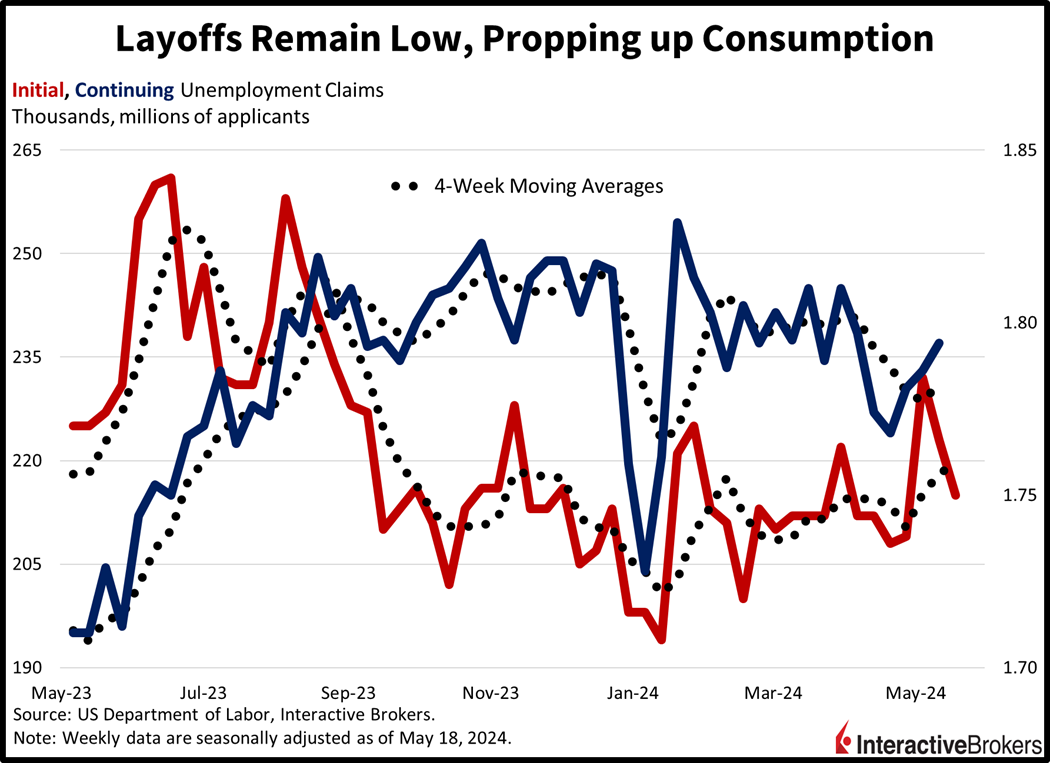

Hiring is Slow, but So Are Layoffs

Labor market conditions remain benign with unemployment claims arriving near their recent ranges. Initial unemployment claims of 215,000 for the week ended May 18 were slightly less than the 220,000 expected and the prior week’s 223,000. Continuing claims, meanwhile, came in at 1.794 million for the week ended May 11, near estimates of 1.793 million and the previous period’s 1.786 million. Four-week trends did move slightly higher, with moving averages rising from 218,000 and 1.777 million to 219,750 and 1.782 million.

Discounts Fail to Support New Home Sales

Similar to yesterday’s existing home sales report, April new home sales missed expectations despite improving supply conditions. The pace of new home sales declined 4.7% month over month (m/m) to 634,000 seasonally adjusted annualized units, despite the Street awaiting a number closer to 680,000. March’s figure came in at 665,000. Most regions delivered m/m contractions in the rate of transactions with the Northeast, West and South declining 20.9%, 7.3% and 4.8%. The Midwest offset some of the softness, rising 10%. The weakness occurs as opportunities to scoop up new builds are on the rise, with the ratio of the months’ supply at the current monthly sales pace bumping sharply from 8.5 to 9.1 m/m, the highest since November. Builders also offered discounts and rate concessions to try and lure in prospective buyers, with the median sales price declining m/m from $439,500 to $433,500. There’s indeed a stark bifurcation between the new and existing markets, with the former down 6% from all-time highs while the latter reaches new heights.

Europe Economic Growth Accelerates

Sailing east, the euro area PMI also battered economists’ expectations, with economic activity expanding at the quickest rate in 12 months. Similar to the states, growth was dominated by services while manufacturing showed modest improvement. An important consideration, however, is that manufacturing remains well below expansion territory, but the rate of decline has moderated, with May’s figure reaching a 14-month high. Services and manufacturing PMIs came in at 53.3 and 47.4, a slight miss on the former but a sizable beat for the latter; analysts were expecting 53.5 and 46.2. Services were unchanged from the prior period while the goods sector climbed from 45.7. Overall, results were supported by business confidence that reached the loftiest level in 27 months amidst strong ordering and steady hiring. Price pressures eased slightly but remained well above trend and target.

Nvidia Boosts Optimism for Artificial Intelligence

At least one provider of off-premises technology is validating Nvidia’s comments about strong demand for products from cloud-computing companies and data centers. Meanwhile, the trend of discount store operators such as BJ’s capturing market share is continuing while mainstream retailers feel the pinch of inflation hurting consumer spending. Consider the following earnings highlights:

- Nvidia’s quarterly revenue more than tripled year over year (y/y) with the company reporting data center sales growing more than 400%. While its earnings and revenue exceeded analyst consensus expectations, Nvidia’s explanation that customers are generating profits from artificial intelligence eased investors’ concerns that the new technology could be more fluff than stuff. CFO Colette Kress says customers of Nvidia can generate immediate and strong returns on their tech investments. In one example, customers can generate $7 in revenue over four years for every dollar they spend on Nvidia’s HDX H200 server, which is used for accessing Met’s AI.

- Snowflake, a provider of software for cloud-computing, joined Nvidia in reporting strong demand among off-premises providers of information technology. Its first-quarter revenue earnings climbed 33% y/y, resulting in the metric as well as earnings exceeding analyst consensus expectations.

- BJ’s reported fiscal fourth-quarter earnings, revenue and same-store sales that exceeded Wall Street expectations. While its revenue climbed 4.1% y/y and same store sales grew 1.6%, its earnings per share declined slightly. Chief Executive Bob Eddy says the revenue growth resulted from the company capturing market share at its discount warehouse locations and gas stations.

- VF Corp., which owns The North Face brand of outdoor clothing and equipment, joined Target, Lowes, Macy’s and numerous other retailers that have experienced declining sales as consumers struggle with inflation. VF, which also owns Vans, Timberland, Dickies and Supreme, reported a 22% decline in sales in the US, although revenue in Greater China climbed slightly. The company’s overall revenue decline and net loss per share were both worse than analyst consensus expectations. Its stock price tanked almost 16% following the earnings release.

Inflation Fears Tank Bonds and Cyclical Stocks

Markets are mixed with technology rocketing north, but cyclicals and bonds are getting absolutely hammered. The Nasdaq Composite is the sole gainer among major US equity indices; it’s up 0.5% while the Russell 2000 and Dow Jones Industrial benchmarks are both down 0.7%. The S&P 500 Index is unchanged on the session after paring sharp gains of 0.6% from earlier in the morning. Sectoral breadth is terrible with just technology traveling north on the back of chipmaker giant Nvidia’s stellar results; the segment is up 0.3%. Leading the laggards south are utilities, real estate and financials, which are falling 1%, 0.9% and 0.7%. Yields and the dollar are climbing on the back of firm activity data depicting mounting inflation pressures; the 2- and 10-year Treasury maturities are changing hands near critical resistance levels of 4.94% and 4.49%, 7 basis points (bps) loftier on the session for both durations. The dollar is climbing 5 bps and gaining relative to the yen, yuan, pound sterling and Aussie and Canadian dollars. Fears that the ECB may not be able to cut rates at June’s meeting are propping up the euro and franc versus the greenback, however. Among commodities, oil is trading lower against the backdrop of reduced Fed easing expectations, buoyant supply conditions and simmering geopolitical tensions; WTI crude is down 0.2%, or $0.14, to $76.91 per barrel. A lack of geopolitical catalysts is also weighing on gold, which is lower by 1.5%. Rosier manufacturing activity stateside and in Euroland is supporting copper though, which is gaining 0.3% so far today.

Balancing Inflation Fears with AI Optimism

This morning’s accelerating growth data point to the uncertainty plaguing inflation just as global central bankers’ inch closer to the scissors. The risks of waiting too long to reach an inflation target include a greater chance of price gains along the road. For equities, meanwhile, today’s concentrated action characterized by just one in-the-green sector is emblematic of AI’s benefits failing to include the rest of the economy. As a reminder, big tech comprises roughly half of Nvidia’s revenue, as a lack of larger-scale use cases fail to provide inclusive growth at this juncture.

Visit Traders’ Academy to Learn More About New Home Sales and Other Economic Indicators

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.