Stocks are muted so far today as Wall Street patiently awaits this evening’s earnings report from artificial intelligence juggernaut Nvidia. Investors are expecting a sharp swing in the shares following the announcement, which is likely to either support further equity gains at the index level or generate selling pressure. Yields and the greenback are rising, though, as hotter-than-expected inflation data from London and hawkish remarks from Fed speakers offset the impact of weaker-than-projected existing home sales in the US alongside ECB President Lagarde’s dovish comments this morning. While the ECB appears ready to cut as soon as next month, the Fed is embracing an increasingly patient approach.

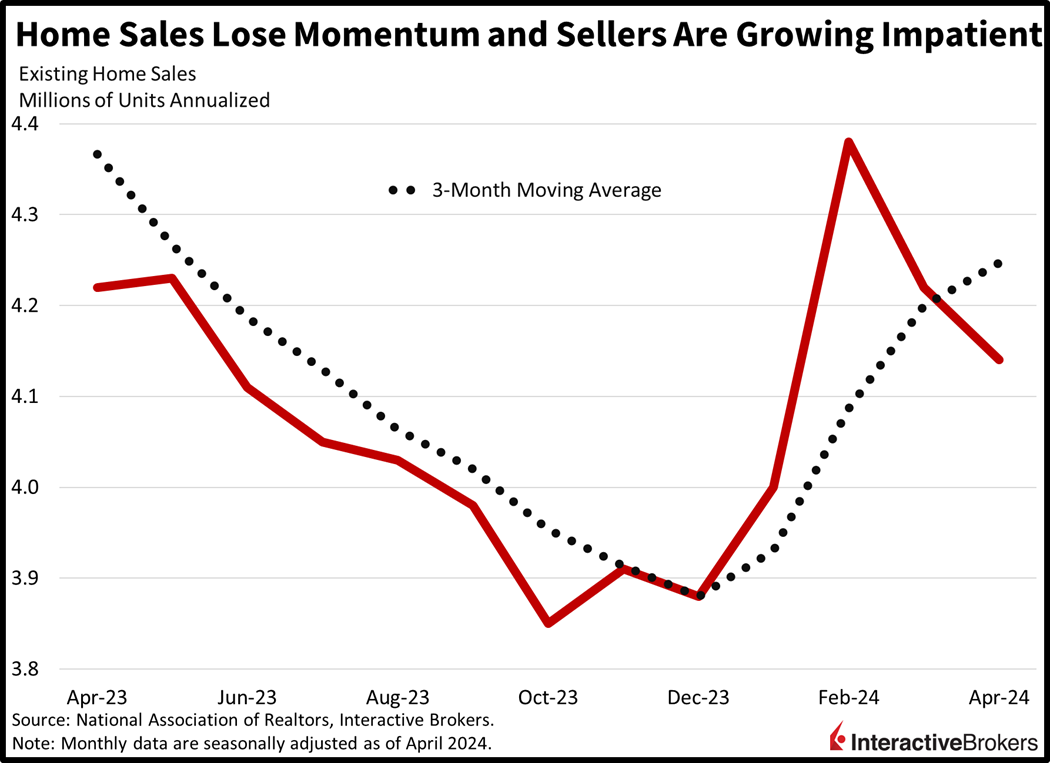

Home Sales Contract as Borrowing Costs Climb

While luxury new home demand as reported by Toll Brothers is strong, lofty mortgage rates sporting a 7-handle alongside all-time high prices served to dishearten less affluent homebuyers last month as sales dropped for the second-consecutive month. Existing home sales sunk to their lowest level since January, when mortgage rates were closer to 6.5%. The rate increase since then coincides strongly with inflation’s resurgence following disinflationary progress in the fourth quarter of last year and expectations for seven Fed rate cuts this year dropping to only one.

The pace of transactions for existing homes fell 1.9% month over month (m/m) to 4.14 million seasonally adjusted annualized units. The figure missed the consensus estimate for a nearly in-line level from March’s 4.22 million. The single-family segment drove the decline, with sales dropping 2.1% m/m while transactions for condominiums and cooperatives were unchanged. All regions suffered contractions, as the Northeast, West, South and Midwest saw m/m reductions of 4%, 2.6%, 1.6% and 1%. While inventory grew 9% m/m to the loftiest level since November 2022 of 1.21 million units, it didn’t lead to discounting, as the median closing price rose 5.7% year over year (y/y) to $407,600, the highest in history. Rising listings weren’t caused by pressured sellers on balance, as distressed transactions remained well anchored at 2% of total volumes, in-line with the previous month and the same period a year ago. Still, the ratio of months’ supply at the current monthly sales pace increased sharply from 3.2 to 3.5, the highest since October.

UK Price Gains Slow Less than Expected

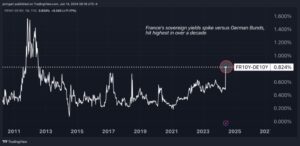

Across the Atlantic, United Kingdom central bankers may be compelled to hold their horses as price pressures flew past expectations even though they slowed from March. UK inflation rose 0.3% m/m and 2.3% y/y in April despite analysts anticipating figures that were 10 and 20 basis points (bps) lighter. Similarly, core inflation, which excludes food and energy, increased 0.9% m/m and 3.9% y/y, 20 and 30 bps heavier than projections. Services drove the upside surprise by rising 1% m/m while goods offset some of the pain, featuring a decline of 0.8%. Indeed, price pressures were broad-based, with the communication, transportation, restaurants/hotels, and health care categories rising at sharp m/m rates of 4.5%, 1.7%, 0.9% and 0.9%. Furniture and household goods weighed on price pressures the most, dropping 0.8% during the period.

Discount Retailers and Luxury Brands Thrive

Discount retailers are hitting payday as consumers feel the sting of inflation and shift their shopping to off-price stores. Households that are less susceptible to price pressures, however, are splurging on luxury items. In a somewhat similar trend, high-end real estate thrived during the first quarter. In the tech sector, a glut of inventory in analog chips appears to be easing. Those are a few observations from the following earnings highlights:

- TJX, which operates T.J. Maxx off-price stores, Marshalls department stores and MarMax, a provider of luxury handbags, jewelry and accessories, reported a 3% y/y increase in same-store sales. Sales increased at both the MarMax brand and the company’s off-price retail stores. The company’s earnings and revenue surpassed analyst consensus expectations. TJX anticipates similar growth in the current quarter and its share price jumped approximately 7% this morning.

- Urban Outfitters posted strong results that benefited from its higher-end brands appealing to luxury shoppers. While its namesake store sales posted a y/y decline, the company’s high-end women’s brands Free People and Anthropologie generated comparable same-store sale increases of 17.1% and 10.4%, respectively. For the first quarter, the company’s earnings and revenue exceeded analyst consensus expectations. It anticipates current-quarter sales to increase in the mid-single digits; however, its stock price declined approximately 3% this morning.

- Target reported a first-quarter 3.7% y/y decline in same-store sales as shoppers curtailed spending on discretionary products and other items, such as groceries and paper towels. While the company’s revenue met the analyst consensus expectation, earnings missed estimates. On Monday, Target said it is lowering prices on thousands of groceries and other products, such as diapers and paper towels, to win back customers that are fatigued from high prices. The company expects sales growth will return during the second half of this year. Target’s share price dropped approximately 8% in premarket trading.

- Petco Health and Wellness reported a 1.2% y/y decline in comparable same-store sales and a slightly larger decline in net revenue during the first quarter. Gains in consumables and services were offset by declines in other products for companion animals, which sank 6.8%. However, Petco’s earnings and same-store sales significantly exceeded Wall Street expectations, causing its share price to soar approximately 33% following the earnings release.

- Toll Brothers, which is a luxury homebuilder, posted a 13% y/y increase in revenue and a 60% increase in earnings. For the company’s fiscal second quarter, earnings, revenue and the number of homes delivered exceeded analysts’ expectations. Its average home sales price was $1 million. However, after excluding the sale of a large land parcel, the company’s earnings fell below the analyst consensus. Chief Executive Douglas Yearley Jr. says demand for luxury homes is being driven by a strong economy, favorable demographics, a lack of supply caused by underproduction and low levels of resale inventory. The company also upgraded its full-year guidance, but its share price declined approximately 7% this morning after initially climbing 1% following the earnings release last night.

- Analog Devices, which makes radio frequency, power management and sensor semiconductors for industrial applications, communications, automobiles and consumer products, posted earnings and revenue that beat analyst consensus expectations. On a y/y basis, however, earnings fell 51% and sales declined 34%. Chief Executive Vincent Roche said the company is experiencing improvements with new orders and he believes inventory rationalization across Analog Devices’ customers is stabilizing. Analog Devices provided current-quarter earnings guidance that was at the mid-point of analysts’ expectations and its share price climbed roughly 8% this morning.

Markets Lack Direction as Investors Anticipate Nvidia Results

Markets are mixed and trading in a tight range as we await the final big-tech earnings report of the season from chipmaker giant Nvidia. Tech and communication services are outperforming cyclicals, with the Nasdaq Composite gaining 0.1% while all other major US equity indices are traveling south. The small-cap Russell 2000, Dow Jones Industrial and S&P 500 benchmarks are lower by 0.3%, 0.2% and 0.1%. Sector breadth is negative, as the technology and communication services segments are the only two meaningfully in the green, with the baskets higher by 0.5% and 0.2%. Leading the laggards are the commodity-centric energy and materials components which are suffering losses of 1.8% and 1.1%. The losses occur as commodities give back a heavy dose of their recent gains with copper, silver, gold, and oil trading lower by 4.9%, 2.2%, 1.4% and 0.3%. Generally speaking, the space is paring gains on the back of rosier supply outlooks, as copper shipments appear to gain steam and geopolitical tensions simmer. Yields and the dollar are journeying north on the back of firmer inflation data from London and a collective message of patience from Fed speakers. The 2- and 10-year Treasury maturities are changing hands at 4.86% and 4.42%, 3 and 1 bps higher on the session. The Dollar Index is up 15 bps as the US currency gains relative to most of its major counterparts, including the euro, franc, yen, yuan and Aussie and Canadian dollar. The greenback is losing ground versus the pound sterling, however, as Bank of England easing expectations wane on the back of this morning’s unfriendly inflation report.

A Risky Time for Equity Investors

With equity indices hovering near record highs, the bar is particularly high for this evening when Nvidia reports. Top of mind for market participants will be the extent of AI adoption that is occurring across the entire economy, not just at the chipmaker’s top customers, which are all members of the big-tech cohort. Additionally, there are concerns of excessive ordering by some buyers that may challenge comps and raise the odds of oversupplied conditions in the medium-term. With one name dominating the AI story and responsible for much of the gains in the S&P 500 and Nasdaq Composite in the past 17 months, the concentrated progress is inherently risky.

Visit Traders’ Academy to Learn More About Existing Home Sales and Other Economic Indicators

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

This is very informative blog , Thanks for sharing about low voltage landscape lighting. The attention to detail and passion for outdoor lighting evident in your blog posts is commendable. Well done! ! .low voltage landscape lighting Low voltage landscape lighting is a game-changer, providing subtle illumination that enhances outdoor beauty. Your blog expertly showcases their charm!

Thanks for engaging!