Key News

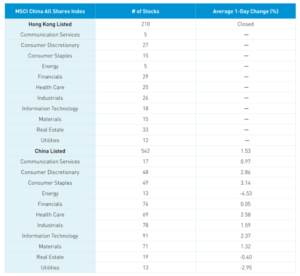

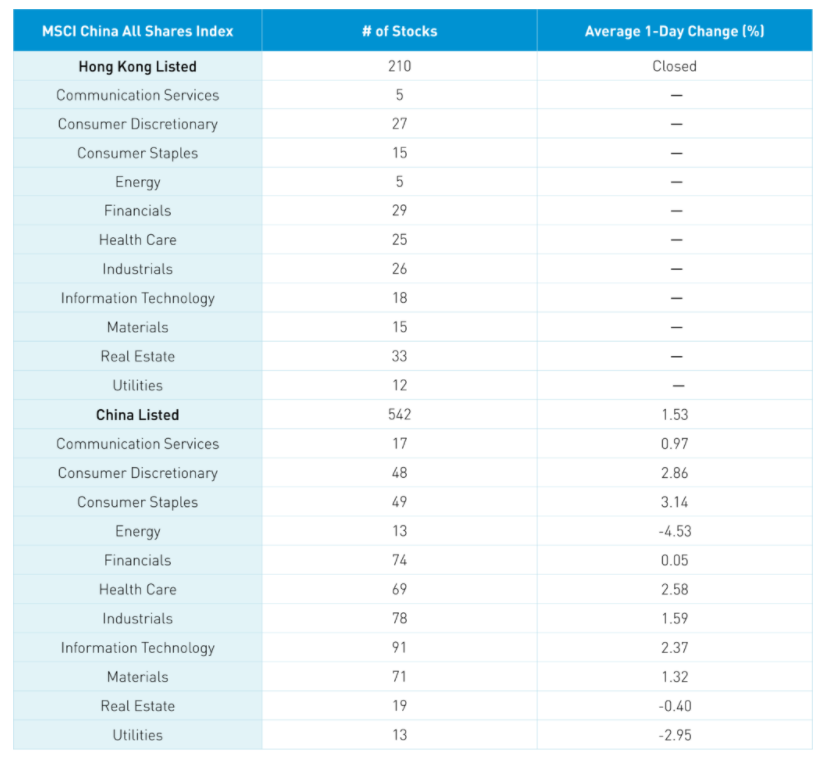

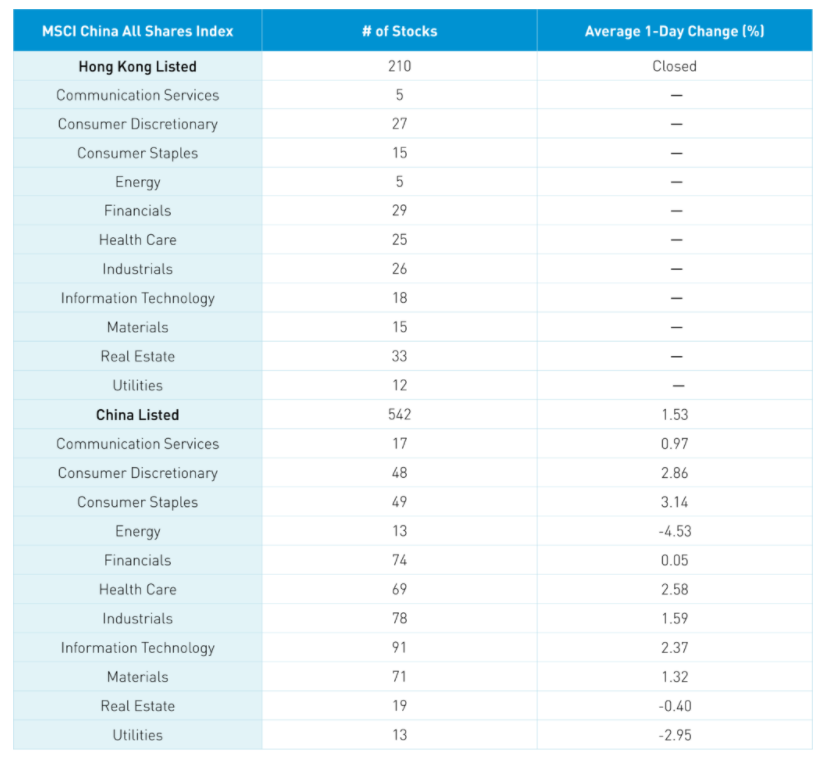

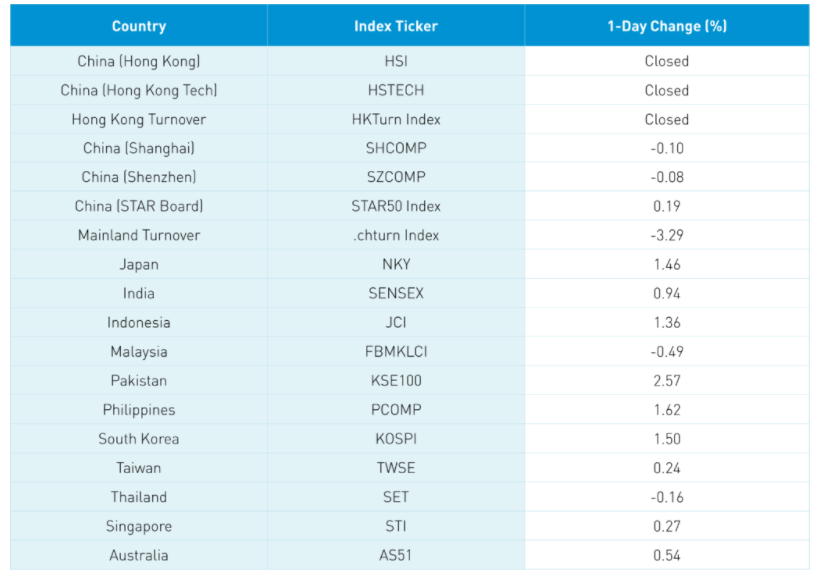

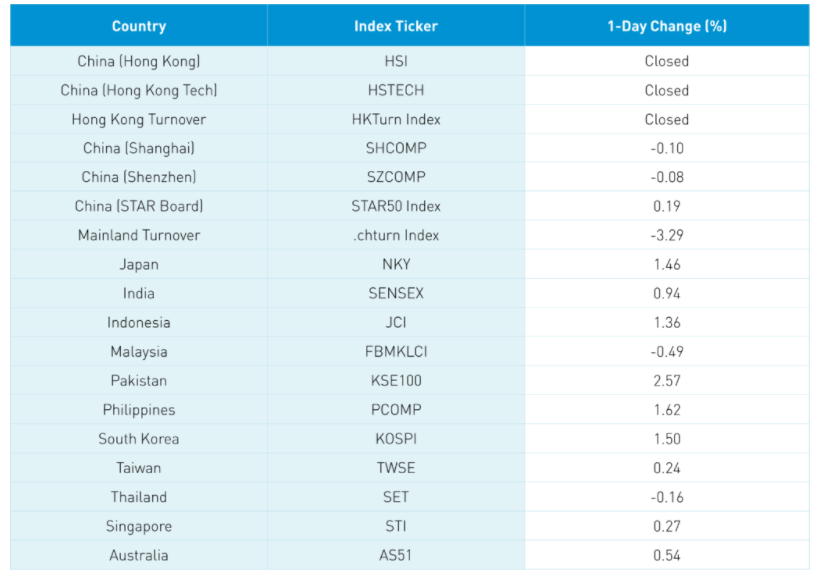

Asian markets were mixed as Mainland China was nearly flat and Hong Kong was closed for its National Day holiday. The STAR Board managed a small gain and volumes were weak as Northbound Stock Connect was closed due to the market holiday in Hong Kong. Inflation data was released in Mainland China overnight along with new loans, which were weaker than expected, potentially giving the People’s Bank of China (PBOC) a reason to increase liquidity and proceed with another reserve requirement ratio RRR cut to support the economy. The quiet trading in Mainland markets overnight suggests that investors are awaiting clarity on the central bank’s stance following the economic data release.

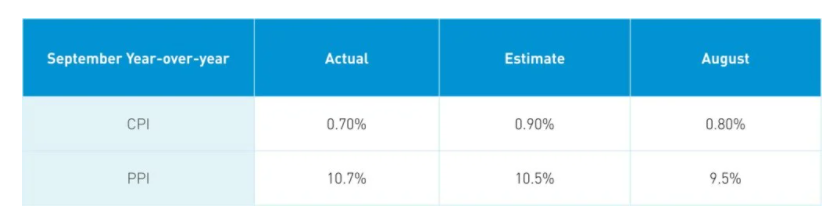

China released both the consumer price index (CPI) and producer price index (PPI) last night before the Mainland market open. On the positive side, inflation was lower than expected in September, though still high, mirroring the record inflation seen in the US in September. The PPI, which measures the prices that producers pay for inputs, rose by a whopping +10.7% year-over-year, which was slightly higher than expected. However, the steep PPI rise was to be expected due to the recent energy crunch and surge in oil and other commodities.

Solar power stocks have risen for the past two days. The sector recently experienced a correction due to high commodity prices, especially for silicon, which is used in photovoltaic panels, and increasing demand for dirty energy sources amid the recent energy crunch. CICC analysts posit that the sector may see positive tailwinds soon thanks to supportive policies and the stabilization of raw materials prices. Targets for solar power infrastructure construction in China remain ambitious despite the slowdown in construction due to inclement weather and surging raw material costs.

The director of China’s CDC announced that if vaccination rates rise above 85% in the new year, the country may scrap quarantine requirements for foreign visitors.

Some analysts expect weak Q3 results for Tencent as the material impacts of regulation on gaming and advertising become crystallized. However, Mainland investors have been buying its stock in size given its favorable valuation. Presumably, unlike Western analysts, Mainland investors are expecting positive results.

H-Share Update

Hong Kong markets were closed overnight.

A-Share Update

Shanghai, Shenzhen, and the STAR Board closed -0.10%, -0.08%, and +0.19%, respectively, on volume that was -3% lower than yesterday as Northbound Stock Connect was closed due to the market holiday in Hong Kong, meaning that foreign investors could not trade Mainland stocks.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.44 versus 6.43 yesterday

- CNY/EUR 7.47 versus 7.44 yesterday

- Yield on 1-Day Government Bond 1.70% versus 1.70% yesterday

- Yield on 10-Year Government Bond 2.96% versus 2.96% yesterday

- Yield on 10-Year China Development Bank Bond 3.26% versus 3.26% yesterday

- Copper Price +2.40% today

—

Originally Posted on October 14, 2021 – September Inflation Softer Than Expected, Solar Stocks Rebound

Author Positions as of 10/14/21 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.