We theorized in last month’s dividend update that bloated cash balances and strong earnings could bolster dividend and share buyback increases and support gains for U.S. equities.

While a choppy month for price returns, September didn’t disappoint, with a flurry of dividend growth from some of the largest payers.

Microsoft and JPMorgan—both top five U.S. dividend payers—each increased 11%.

Microsoft also announced a whopping $60 billion stock buyback plan. That’s double the $30 billion plan that JPMorgan announced last December.

Verizon and Philip Morris increased their dividends 2% and 4%, respectively.

Of the group of the 20 largest dividend payers, there have been 16 dividend increases and four unchanged, combining for an average increase of 4.8% this year.

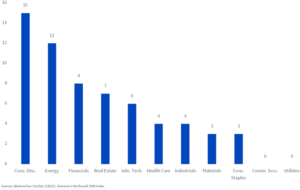

Top 20 U.S. Dividend Payers

Dividend Initiations/Resumptions

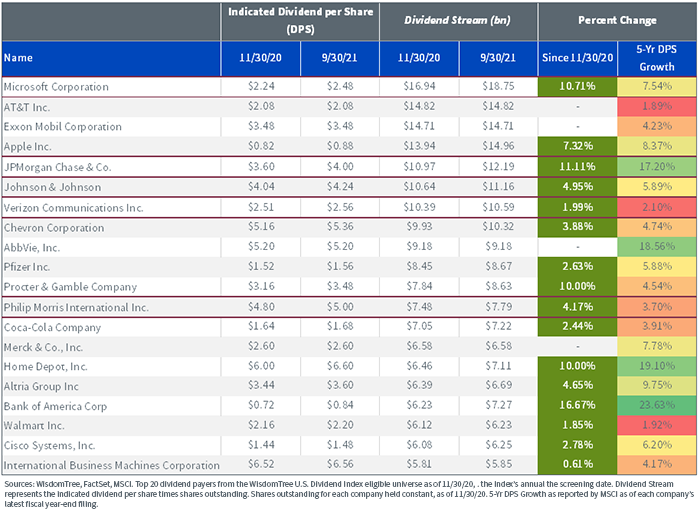

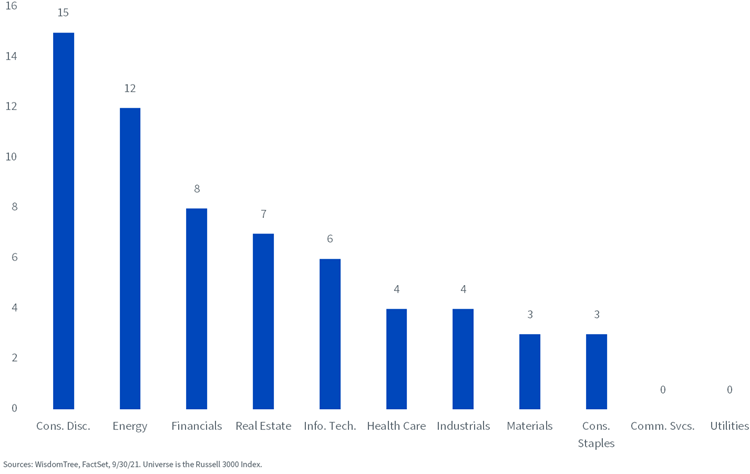

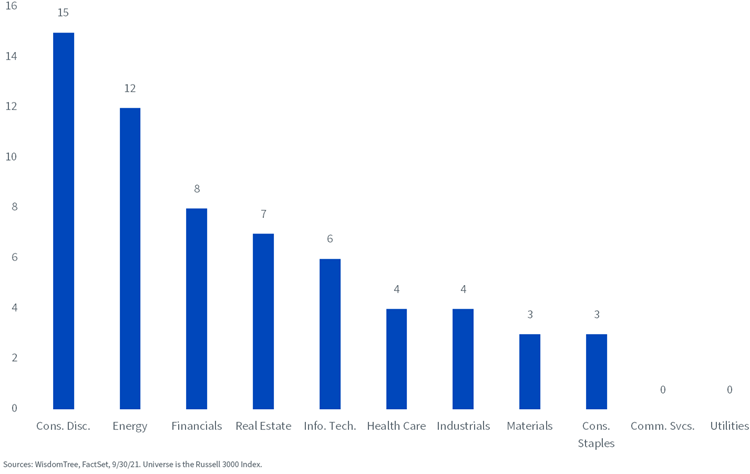

One of the main stories about dividends this year is the number of companies initiating or resuming payouts.

Since the end of the first quarter, 62 initiations/resumptions have been made by Russell 3000 Index constituents. Among these companies, many are in sectors that were most impacted by 2020 shutdowns—Consumer Discretionary, Energy, Financials and Real Estate.

At WisdomTree’s annual domestic Index rebalance in December, all active dividend payers are eligible for our starting universe. We anticipate more names from these sectors being added to our dividend Indexes.

Dividend Initiations/Resumptions since 1Q21

Real Estate Sector

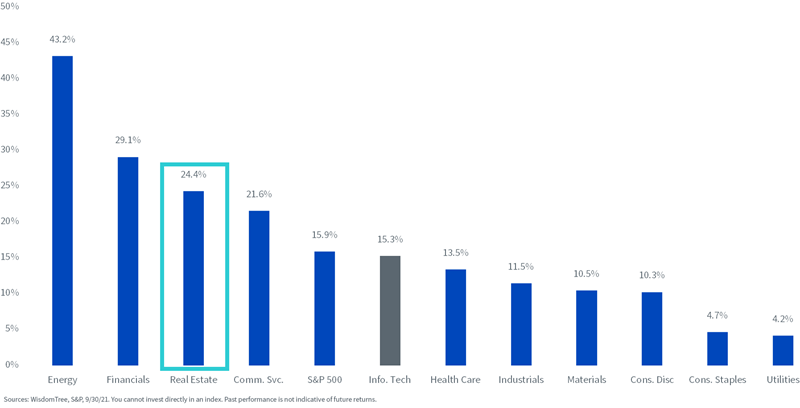

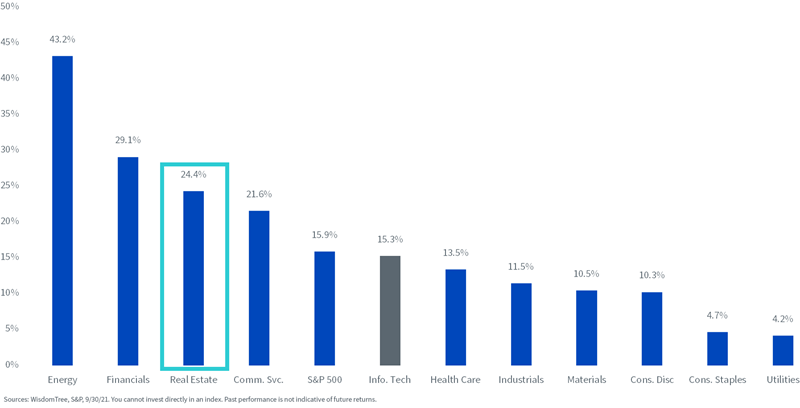

With interest rates historically low and property markets recovering from the COVID-19 pandemic, the Real Estate sector has been one of the top performers year-to-date.

S&P 500 Sector Performance

The sector’s market cap weight in the S&P 1500 is just under 3%. Given its high payouts, the sector’s dividend weight is twice that at around 6%.

S&P 1500 Real Estate Sector

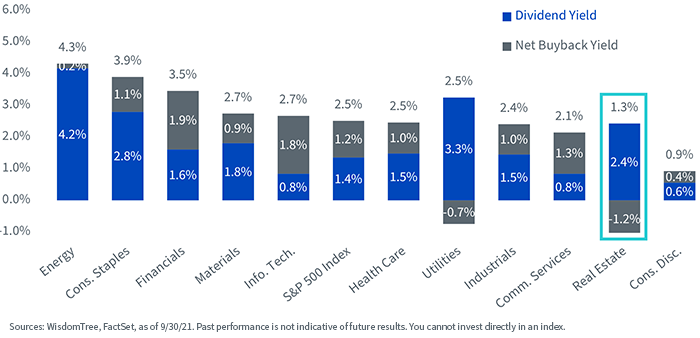

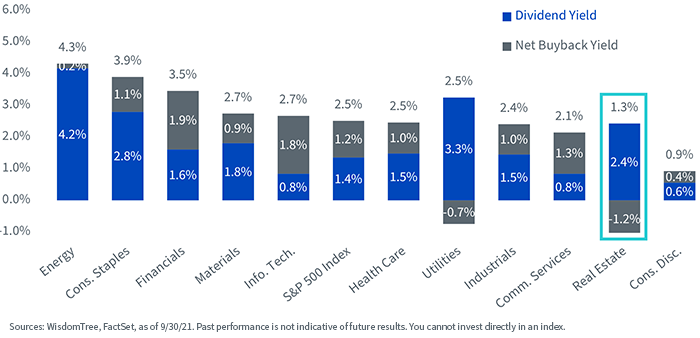

REITs—which make up much of the Real Estate sector—are a unique class of equities. They are required to pay out at least 90% of their taxable income as dividends.

As a result of the payout requirement, the sector has the fourth-highest dividend yield. On the other hand, it is also one of only two sectors that have a negative net buyback yield—meaning companies issue more in shares than they buy back. That’s why some index providers choose to exclude the sector from dividend indexes.

Removing Real Estate means removing exposure to a sector with a premium dividend yield and one that has not only performed well in 2021 but is growing in weight (i.e., importance) in market cap-weighted benchmark indexes.

S&P 500 Index–Total Shareholder Yield by Sector

For WisdomTree’s U.S. dividend Indexes, we have chosen to include Real Estate companies with caps—either at 5% or 10%, depending on the Index.

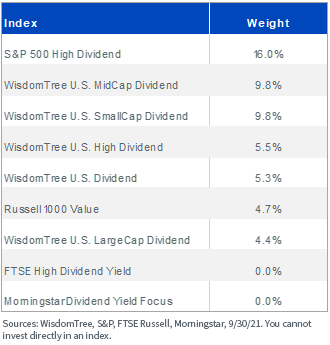

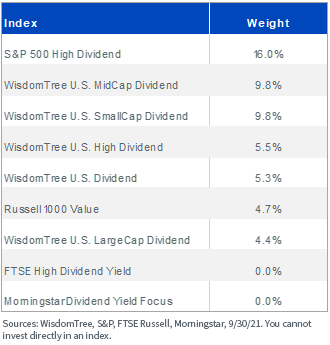

As we show below, some dividend Indexes—like the FTSE High Dividend Yield Index and the Morningstar Dividend Yield Focus Index—have no exposure.

On the other end of the spectrum, the S&P 500 High Dividend Index has a 16% weight to the sector—an over-weight of over 13% relative to the S&P 500.

We believe our approach of including Real Estate within guardrails strikes a good balance of broadness, maximizing yield and mitigating tracking risk relative to comparable value indexes.

In a low-rate environment, the premium income of the sector and its price appreciation potential makes it an attractive component of our dividend Indexes, in our view.

Percent Index Weight: Real Estate

—

Originally Posted on October 8, 2021 – September U.S. Dividend Update

Disclosure: WisdomTree U.S.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this and other important information, please call 866.909.WISE (9473) or click here to view or download a prospectus online. Read the prospectus carefully before you invest. There are risks involved with investing, including the possible loss of principal. Past performance does not guarantee future results.

You cannot invest directly in an index.

Foreign investing involves currency, political and economic risk. Funds focusing on a single country, sector and/or funds that emphasize investments in smaller companies may experience greater price volatility. Investments in emerging markets, real estate, currency, fixed income and alternative investments include additional risks. Due to the investment strategy of certain Funds, they may make higher capital gain distributions than other ETFs. Please see prospectus for discussion of risks.

WisdomTree Funds are distributed by Foreside Fund Services, LLC, in the U.S. only.

Interactive Advisors offers two portfolios powered by WisdomTree: the WisdomTree Aggressive and WisdomTree Moderately Aggressive with Alts portfolios.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree U.S. and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree U.S. and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.