- REITs historically have generated real income and outperformed other assets in a high inflationary environment.

- Strong demand for chips may persist in the coming years due to the increasing penetration of 5G smartphones, Internet of Things (IoT), and post-pandemic digital transformation that spurs demand for new generation data centers and cloud services.

- Biotech’s significant drawdown and underperformance this year have created a long-term growth opportunity at a reasonable price.

While the broad US equity market posted its sixth straight month of gains in Q3, the tug of war between value and growth has intensified, evidenced by record high volatility of return differences between value and growth indices.1 Meanwhile, our economists believe that although inflation driven by supply chain disruptions and pent-up demand during the pandemic recovery might be peaking, rising rent and housing costs may keep inflation elevated next year.2 While the market historically has tended to be bumpier in Q4, inflationary pressure and some secular industry trends may persist regardless of short-term market sentiment. Therefore, we see three industry opportunities for the final quarter of 2021.

REITs: Pursue Income and Total Return in an Inflationary Environment

With interest rates near pre-pandemic lows and actual inflation as well as inflation expectations elevated, US REIT funds’ ability to provide dividend income exceeding inflation has attracted investors this year. Because most leases are tied to inflation, income from leases and property values tend to increase when overall price levels rise. This supports REITs’ dividend growth and helps investors to pursue real income during inflationary periods. In all but three of the past 20 years, REITs’ dividend increases have outpaced inflation as measured by the Consumer Price Index.3 Although the dividend yield of the US REITs industry has declined to around 3% as some REIT share prices increase, this income level is still much higher than inflation expectations and yields of investment-grade bonds.4 As the REITs sector continues to recover from the economic downturn, increases in lease payments likely will boost dividend distributions.

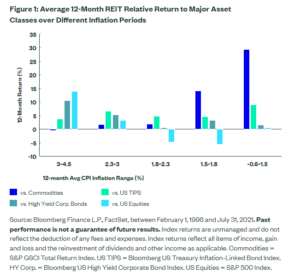

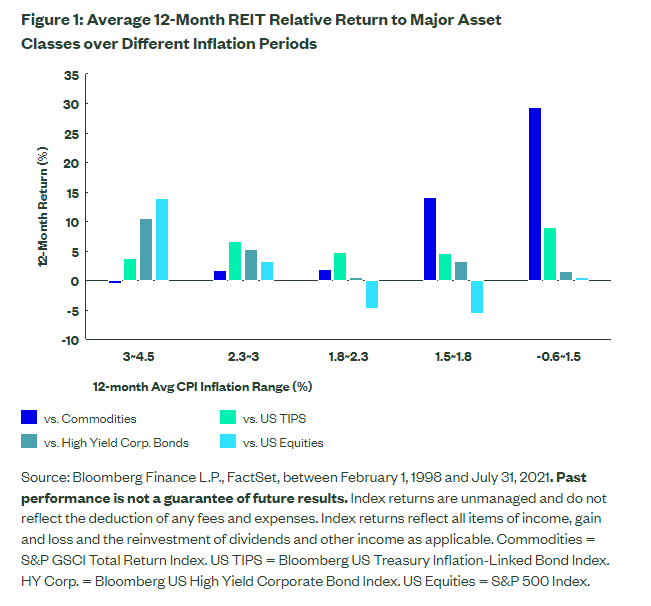

From a total return perspective, REITs also provide investors a powerful tool for inflation hedging. Rolling 12-month average of CPI inflation rate has increased for six straight months in August and now sits at 3%, well above the historical median. While inflation has shown signs of peaking recently, it’s likely to remain elevated in the coming months as the economic recovery continues. And when 12-month average CPI inflation has been in the top two quintiles, REITs have outperformed broad equities, US Treasury Inflation-Protected Securities (TIPS) and high yield bonds and been on par or slightly exceeded broad commodities, as shown in the chart below. This underscores REITs’ total return advantage over other assets in a high inflationary environment.

Click here to read the full article

Footnotes

1FactSet, as of 10/1/2021. Value and Growth are represented by the S&P 500 Value and S&P 500 Growth indices.

2Weekly Economic Perspectives Quarterly Edition, September 27, 2021.

3Nareit, S&P Global Market Intelligence, as of December 2020.

4Bloomberg Finance L.P., as of 9/24/2021.

Glossary

Bloomberg Barclays US High Yield Corporate Bond Index

The index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included. The index includes both corporate and non-corporate sectors.

Bloomberg Barclays US Treasury Inflation-Linked Bond Index

The index measures the performance of the US Treasury Inflation Protected Securities (TIPS) market. Federal Reserve holdings of US TIPS are not index eligible and are excluded from the face amount outstanding of each bond in the index.

CPI Inflation Rate

The change in the price index over a period of time

Price-to-Sales (P/S) Ratio

A valuation ratio that compares a company’s stock price to its revenues.

Real Estate Investment Trust (REIT)

Companies that own or finance income-producing real estate across a range of property sectors.

Semiconductor

Materials which have a conductivity between conductors (generally metals) and nonconductors or insulators (such as most ceramics). Semiconductors can be pure elements, such as silicon or germanium, or compounds such as gallium arsenide or cadmium selenide. In a process called doping, small amounts of impurities are added to pure semiconductors causing large changes in the conductivity of the material.

S&P 500 Index

The version of the popular benchmark for US large-cap equities that includes 500 companies from leading industries and captures about 80% coverage of available market capitalization in the US that reflects returns after reinvestment of dividends.

S&P GSCI Total Return Index

The S&P GSCI Total Return Index in USD is widely recognized as the leading measure of general commodity price movements and inflation in the world economy. The index is calculated primarily on a world production-weighted basis comprised of the principal physical commodities futures contracts.

—

Originally Posted on October 4, 2021 – Spotting Trends: Sector Opportunities for Q4 2021

Disclosures

Important Risk Information

This communication is not intended to be an investment recommendation or investment advice and should not be relied upon as such.

All information is from SSGA unless otherwise noted and has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

The views expressed in this material are the views of SPDR ETFs and SSGA Funds Research Team through the period ended September 28, 2021 and are subject to change based on market and other conditions and do not necessarily represent the views of State Street Global Advisors or any of its affiliates. This document contains certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected.

Past performance is not a reliable indicator of future performance.

Investments in small-sized companies may involve greater risks than in those of larger, better known companies.

Targets are estimates based on certain assumptions and analysis made by SSGA. There is no guarantee that the estimates will be achieved.

Frequent trading of ETFs could significantly increase commissions and other costs such that they may offset any savings from low fees or costs.

Concentrated investments in a particular sector or industry tend to be more volatile than the overall market and increases risk that events negatively affecting such sectors or industries could reduce returns, potentially causing the value of the Fund’s shares to decrease.

Passively managed funds invest by sampling the Index, holding a range of securities that, in the aggregate, approximates the full Index in terms of key risk factors and other characteristics. This may cause the fund to experience tracking errors relative to performance of the Index.

Equity securities may fluctuate in value in response to the activities of individual companies and general market and economic conditions. Funds investing in a single sector may be subject to more volatility than funds investing in a diverse group of sectors.

Investing involves risk including the risk of loss of principal.

Real Estate Investment Trusts (REITS) investing may be subject to risks including, but not limited to, declines in the value of real estate, risks related to general economic conditions, changes in the value of the underlying property owned by the trust and defaults by borrowers.

Technology companies, including cyber security companies, can be significantly affected by obsolescence of existing technology, limited product lines, and competition for financial resources, qualified personnel, new market entrants or impairment of patent and intellectual property rights that can adversely affect profit margins.

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

Disclosure: State Street Global Advisors

Do not reproduce or reprint without the written permission of SSGA.

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. There is no representation or warranty as to the current accuracy, reliability or completeness of, nor liability for, decisions based on such information and it should not be relied on as such.

State Street Global Advisors and its affiliates (“SSGA”) have not taken into consideration the circumstances of any particular investor in producing this material and are not making an investment recommendation or acting in fiduciary capacity in connection with the provision of the information contained herein.

ETFs trade like stocks, are subject to investment risk, fluctuate in market value and may trade at prices above or below the ETF’s net asset value. Brokerage commissions and ETF expenses will reduce returns.

Bonds generally present less short-term risk and volatility than stocks, but contain interest rate risk (as interest rates raise, bond prices usually fall); issuer default risk; issuer credit risk; liquidity risk; and inflation risk. These effects are usually pronounced for longer-term securities. Any fixed income security sold or redeemed prior to maturity may be subject to a substantial gain or loss.

Investing involves risk including the risk of loss of principal.

The whole or any part of this work may not be reproduced, copied or transmitted or any of its contents disclosed to third parties without SSGA’s express written consent.

Investing in high yield fixed income securities, otherwise known as “junk bonds”, is considered speculative and involves greater risk of loss of principal and interest than investing in investment grade fixed income securities. These Lower-quality debt securities involve greater risk of default or price changes due to potential changes in the credit quality of the issuer.

COPYRIGHT AND OTHER RIGHTS

Other third party content is the intellectual property of the respective third party and all rights are reserved to them. All rights reserved. No organization or individual is permitted to reproduce, distribute or otherwise use the statistics and information in this report without the written agreement of the copyright owners.

Definition:

Arbitrage: the simultaneous buying and selling of securities, currency, or commodities in different markets or in derivative forms in order to take advantage of differing prices for the same asset.

Fund Objectives:

SPY: The investment seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index. The Trust seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the index (the “Portfolio”), with the weight of each stock in the Portfolio substantially corresponding to the weight of such stock in the index.

VOO: The investment seeks to track the performance of a benchmark index that measures the investment return of large-capitalization stocks. The fund employs an indexing investment approach designed to track the performance of the Standard & Poor’s 500 Index, a widely recognized benchmark of U.S. stock market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target index by investing all, or substantially all, of its assets in the stocks that make up the index, holding each stock in approximately the same proportion as its weighting in the index.

IVV: The investment seeks to track the investment results of the S&P 500 (the “underlying index”), which measures the performance of the large-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index. It may invest the remainder of its assets in certain futures, options and swap contracts, cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index.

The funds presented herein have different investment objectives, costs and expenses. Each fund is managed by a different investment firm, and the performance of each fund will necessarily depend on the ability of their respective managers to select portfolio investments. These differences, among others, may result in significant disparity in the funds’ portfolio assets and performance. For further information on the funds, please review their respective prospectuses.

Entity Disclosures:

The trademarks and service marks referenced herein are the property of their respective owners. Third party data providers make no warranties or representations of any kind relating to the accuracy, completeness or timeliness of the data and have no liability for damages of any kind relating to the use of such data.

SSGA Funds Management, Inc. serves as the investment advisor to the SPDR ETFs that are registered with the United States Securities and Exchange Commission under the Investment Company Act of 1940. SSGA Funds Management, Inc. is an affiliate of State Street Global Advisors Limited.

Intellectual Property Disclosures:

Standard & Poor’s®, S&P® and SPDR® are registered trademarks of Standard & Poor’s® Financial Services LLC (S&P); Dow Jones is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones); and these trademarks have been licensed for use by S&P Dow Jones Indices LLC (SPDJI) and sublicensed for certain purposes by State Street Corporation. State Street Corporation’s financial products are not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates and third party licensors and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability in relation thereto, including for any errors, omissions, or interruptions of any index.

BLOOMBERG®, a trademark and service mark of Bloomberg Finance, L.P. and its affiliates, and BARCLAYS®, a trademark and service mark of Barclays Bank Plc., have each been licensed for use in connection with the listing and trading of the SPDR Bloomberg Barclays ETFs.

Distributor: State Street Global Advisors Funds Distributors, LLC, member FINRA, SIPC, an indirect wholly owned subsidiary of State Street Corporation. References to State Street may include State Street Corporation and its affiliates. Certain State Street affiliates provide services and receive fees from the SPDR ETFs.

ALPS Distributors, Inc., member FINRA, is distributor for SPDR® S&P 500®, SPDR® S&P MidCap 400® and SPDR® Dow Jones Industrial Average, all unit investment trusts. ALPS Distributors, Inc. is not affiliated with State Street Global Advisors Funds Distributors, LLC.

Before investing, consider the funds’ investment objectives, risks, charges, and expenses. For SPDR funds, you may obtain a prospectus or summary prospectus containing this and other information by calling 1‐866‐787‐2257 or visiting www.spdrs.com. Please read the prospectus carefully before investing.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from State Street Global Advisors and is being posted with its permission. The views expressed in this material are solely those of the author and/or State Street Global Advisors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.