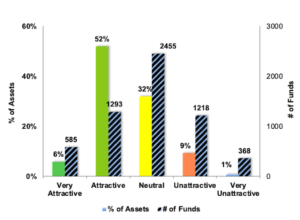

At the beginning of the fourth quarter of 2021, the All Cap Value, Large Cap Blend, and All Cap Blend styles earn Attractive-or-better rating. Our style ratings are based on the normalized aggregation of our fund ratings for every ETF and mutual fund in each style. Our fund ratings are based on aggregations of the ratings of the stocks they hold. See last quarter’s Style Ratings here.

Investors looking for style funds that hold quality stocks should look no further than the All Cap Value, Large Cap Blend, and All Cap Blend styles. These styles house a large portion of the highest rated funds. Figures 4 through 7 provide more details. The primary driver behind an Attractive fund rating is good portfolio management, or good stock picking, with low total annual costs.

Attractive-or-better ratings do not always correlate with Attractive-or-better total annual costs. This fact underscores that (1) cheap funds can dupe investors and (2) investors should focus on funds with good stocks and low fees.

More reliable & proprietary fundamental data, proven in The Journal of Financial Economics, drives our research. Our Robo-Analyst technology[1] empowers our unique ETF and mutual fund rating methodology, which leverages our rigorous analysis of each fund’s holdings.[2] Our Core Earnings[3] and Earnings Distortion factor general novel alpha.

See Figures 4 through 13 for a detailed breakdown of ratings distributions by investment style. See our ETF & mutual fund screener for rankings, ratings, and reports on ~6,000 mutual funds and 800+ ETFs. Our fund rating methodology is detailed here.

All of our reports on the best & worst ETFs and mutual funds in every investment style are available here.

Figure 1: Ratings for All Investment Styles

Source: New Constructs, LLC and company filings

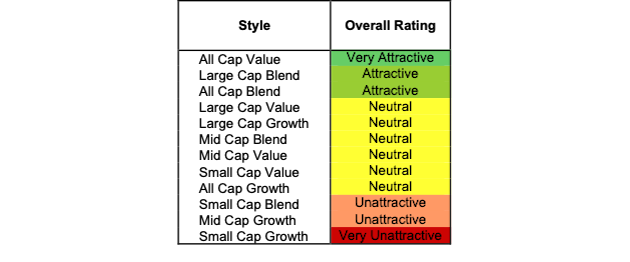

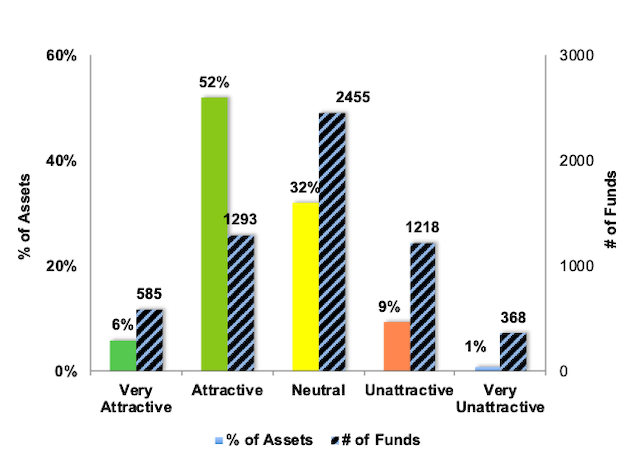

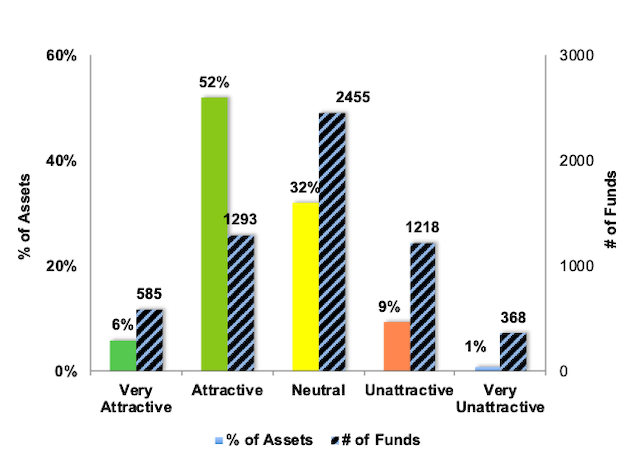

To earn an Attractive-or-better Rating, an ETF or mutual fund must have high-quality holdings and low costs. Only the top 30% of all ETFs and mutual funds earn our Attractive-or-better rating.

Pacer U.S. Cash Cows 100 ETF (COWZ) is the top rated All Cap Value fund. It gets our Very Attractive rating by allocating over 69% of its value to Attractive-or-better-rated stocks.

Dunham Small Cap Growth Fund (DADGX) is the worst rated Small Cap Growth fund. It gets our Very Unattractive rating by allocating over 42% of its value to Unattractive-or-worse-rated stocks. Making matters worse, it charges investors total annual costs of 5.44%.

Figure 2 shows the distribution of our Ratings for all investment style ETFs and mutual funds.

Figure 2: Distribution of ETFs & Mutual Funds (Assets and Count) by Rating

Source: New Constructs, LLC and company filings

Click here to read the full article

—

This article originally published on October 18, 2021.

Disclosure: David Trainer, Kyle Guske II, and Matt Shuler receive no compensation to write about any specific stock, sector or theme.

Follow us on Twitter, Facebook, LinkedIn, and StockTwits for real-time alerts on all our research.

[1] Harvard Business School features our research automation technology in the case Disrupting Fundamental Analysis with Robo-Analysts.

[2] See how our models overcome flaws in Bloomberg and Capital IQ’s (SPGI) analytics in the detailed appendix of this paper.

[3] The Journal of Financial Economics proves that only Core Earnings enable investors to overcome the flaws in legacy fundamental data.

Click here to download a PDF of this report.

Disclosure: New Constructs

David Trainer, Kyle Guske II, Sam McBride, Matt Shuler, Alex Sword, and Andrew Gallagher receive no compensation to write about any specific stock, style, or theme.

The information and opinions presented in this report are provided to you for information purposes only and are not to be used or considered as an offer or solicitation of an offer to buy or sell securities or other financial instruments. New Constructs has not taken any steps to ensure that the securities referred to in this report are suitable for any particular investor and nothing in this report constitutes investment, legal, accounting or tax advice. This report includes general information that does not take into account your individual circumstance, financial situation or needs, nor does it represent a personal recommendation to you. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about any such investments or investment services.

Information and opinions presented in this report have been obtained or derived from sources believed by New Constructs to be reliable, but New Constructs makes no representation as to their accuracy, authority, usefulness, reliability, timeliness or completeness. New Constructs accepts no liability for loss arising from the use of the information presented in this report, and New Constructs makes no warranty as to results that may be obtained from the information presented in this report. Past performance should not be taken as an indication or guarantee of future performance, and no representation or warranty, express or implied, is made regarding future performance. Information and opinions contained in this report reflect a judgment at its original date of publication by New Constructs and are subject to change without notice. New Constructs may have issued, and may in the future issue, other reports that are inconsistent with, and reach different conclusions from, the information presented in this report. Those reports reflect the different assumptions, views and analytical methods of the analysts who prepared them and New Constructs is under no obligation to insure that such other reports are brought to the attention of any recipient of this report.

New Constructs’ reports are intended for distribution to its professional and institutional investor customers. Recipients who are not professionals or institutional investor customers of New Constructs should seek the advice of their independent financial advisor prior to making any investment decision or for any necessary explanation of its contents.

In-depth risk/reward analysis underpins our stock rating. Our stock rating methodology grades every stock according to what we believe are the 5 most important criteria for assessing the quality of a stock. Each grade reflects the balance of potential risk and reward of buying that stock. Our analysis results in the 5 ratings described below. Very Attractive and Attractive correspond to a “Buy” rating, Very Unattractive and Unattractive correspond to a “Sell” rating, while Neutral corresponds to a “Hold” rating.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from New Constructs and is being posted with its permission. The views expressed in this material are solely those of the author and/or New Constructs and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Mutual Funds

Mutual Funds are investments that pool the funds of investors to purchase a range of securities to meet specified objectives, such as growth, income or both. Investors are reminded to consider the various objectives, fees, and other risks associated with investing in Mutual Funds. Please read the prospectus accordingly. This communication is not to be construed as a recommendation, solicitation or promotion of any specific fund, or family of funds. Interactive Brokers may receive compensation from fund companies in connection with purchases and holdings of mutual fund shares. Such compensation is paid out of the funds' assets. However, IBKR does not solicit you to invest in specific funds and does not recommend specific funds or any other products to you. For additional information please visit https://www.interactivebrokers.com/en/index.php?f=1563&p=mf