I seem to be obsessed with open water these days. I’m not sure why; maybe it stems from a recent kayak trip through part of Chesapeake Bay. We’ve recently discussed cross currents, rip currents and rip tides. During a TV appearance yesterday, I invoked Warren Buffett’s idea that you don’t know who’s swimming naked until the tide goes out. Maybe it’s a lack of imagination, but I can’t think of a better way to visualize the changing trends in monetary policy.

Water flows, and so does money – liquidity is a term that can be applied to both. Analogizing them seems straightforward. The enormous liquidity unleashed by the Federal Reserve through its zero interest rate policy (ZIRP) and quantitative easing (QE) indeed felt like a giant wave of money. The periodic deposits of stimulus money into the bank accounts of millions of citizens were like swells amidst the already rising tide. We can debate whether these moves were designed to lift asset prices, but that tide lifted stocks both large and small – like battleships and canoes.

After nearly 18 months of relentless monetary stimulus, the meteorologists at the Fed are now telling us to expect the tide to peak in the coming weeks. We’re talking metaphorically of course, but the most recent statement from the Fed’s Open Market Committee (FOMC) told us that “a moderation in the pace of asset purchases may soon be warranted.” Various Fed-watchers have asserted that “soon” is likely to mean “next meeting” in Fed-speak. Markets seemed encouraged by that concept initially. We noted yesterday that the third quarter’s low yield in 30-year bonds was on September 22nd. It is little coincidence that was the date of the FOMC announcement. With the imminent departure of an institution reliably buying $120 billion of bonds per month – a price insensitive buyer, at that – is it any wonder that 30-year yields have risen about 20 basis points in the weeks since?

One could argue that the Fed could have begun tapering even sooner. Daily reverse repo activity at the New York Federal Reserve has been setting new records for months. It reached a new peak of over $1.6 trillion yesterday. While it is not unusual to see repo and/or reverse repo activity peak at the end of a quarter as banks manage their books for reporting purposes, the quarterly reverse repo peaks have typically been less than 1/3 of yesterday’s figure. Reverse repos are designed to “temporarily reduce the supply of reserve balances in the banking system.” Yet one should question whether that measure is truly temporary if it persists and grows at a daily basis for months.

The Fed pays 5 basis points on its reverse repos. Yesterday’s activity told us that banks and other financial institutions had over $1.6 trillion in cash that they otherwise could not invest for more than 5 basis points. Remember that the pace of QE is $120 billion per month. That means that over a year’s worth of QE showed up at the New York Fed’s window looking for a measly overnight return. This is the monetary equivalent of filling a pool with a hose at one end and pumping it out at the other. That seems like a pointless activity, doesn’t it?

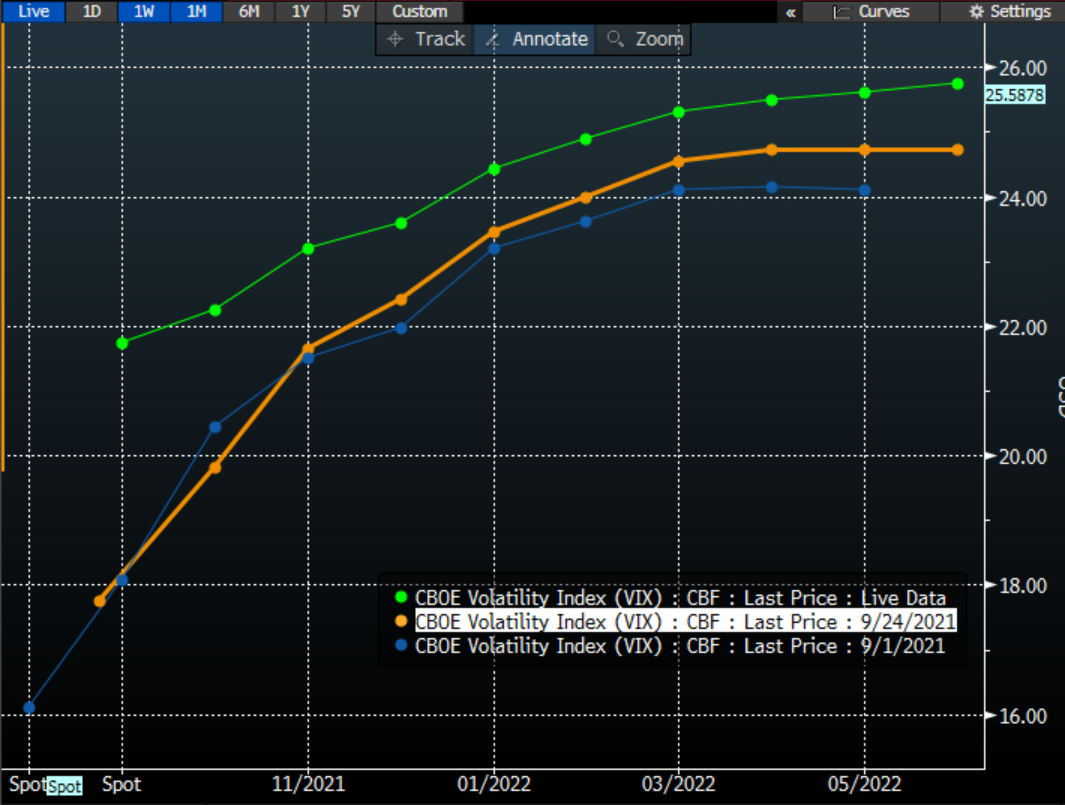

Yet it does not appear that investors are racing to buy flood insurance. Despite the recent declines in major indices like the S&P 500 (SPX), futures on the CBOE Volatility Index (VIX) are elevated but not inverted, as shown by the chart below:

VIX Futures Curves, Today (green), 1 Week Ago (orange), 1 Month Ago (white)

Source: Bloomberg

It is typical to see VIX rise when SPX falls, especially when those moves exceed 1%. Yet the curve remains upward sloping (“in contango”). When futures are in contango, it usually indicates a normal supply/demand balance. Panicky markets are usually accompanied by an inverted VIX futures curve (“backwardation”). That would indicate a shortage, in this case a shortage of available volatility protection. We simply don’t see that sort of panic at the moment, despite some sharp dips in major indices.

Flood insurance can be expensive and difficult to purchase. As of now, insurance against the changing tide of liquidity is pricier than it was recently, but not particularly difficult to obtain. Those investors who are living in the market’s tidal zone might consider whether to insure the properties they have built.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.