Labor conditions remained very tight in September, as strong demand for workers persisted and continued to strike fears among investors that the Fed will continue its aggressive monetary tightening to combat inflation. The economy added 263,000 jobs for the month, exceeding the 250,000 that was expected but trailing the 315,000 notched in August, according to today’s Labor Department job data release. The news, combined with an increase in oil prices, drove an early morning selloff of bonds and equities.

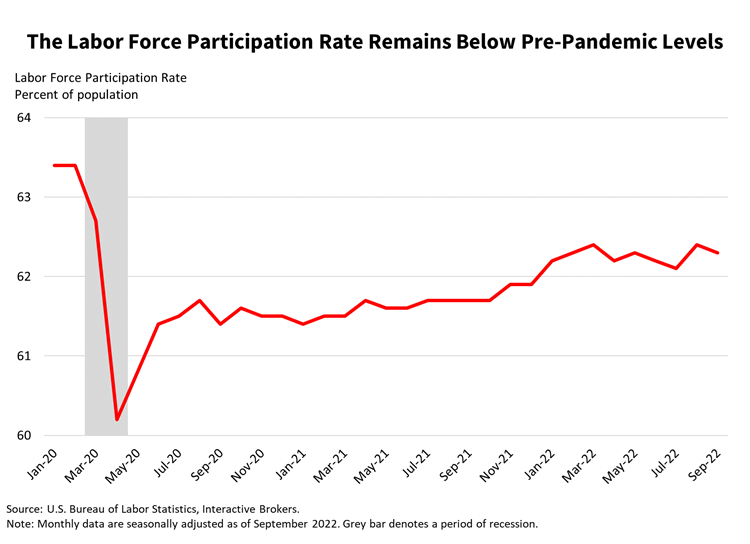

In other signs of a hot labor market, the unemployment rate dipped from 3.7% in August to 3.5%, which was lower than expectations by 20 basis points. Additionally, average hourly earnings for private sector employees grew 0.3% in September, as expected, while the labor force participation rate declined to 62.3 from 62.4 and remained 1.1% below the pre-pandemic level (February 2020). The data underscores that the tight labor market is allowing workers to find jobs trouble-free and grow their earnings on a nominal basis.

The continued labor market strength reinforced investors’ ongoing inflation fears. Additionally, West Texas Intermediate crude oil climbed to $91 a barrel this morning after OPEC leaders supported the largest production cut since the pandemic earlier this week. Oil is a huge contributor to inflation because it’s needed in many facets of life and business and may propel inflation higher in coming months as we approach the winter season.

Having already become terrified of the potential for additional Fed tightening to stymie inflation, investors sold off equities and bonds in early trading following the jobs data release with the S&P 500 Index dropping approximately 2% and the NASDAQ Composite Index falling approximately 3%. Yields climbed 4 to 6 basis points across the duration curve with the 2-year Treasury returning back above 4.3% and the 10-year Treasury reaching 3.9%. I believe we are poised to see new lows on the S&P 500 Index and new highs for yields on 2-year and 10-year Treasuries as investors’ fears about inflation and Fed tightening continue.

September’s job gains were led by the education and health services, leisure and hospitality, professional business services and manufacturing sectors, with each adding 90,000, 83,000, 46,000, and 22,000 jobs, respectively. Gains in the mining, construction, wholesale trade, utilities, information and other services sectors also contributed to a strong headline number. Offsetting some of the payroll gains were declines of 25,000, 8,000 and 8,000 in the government, financial activities, and transportation and warehousing sectors. Retail trade also offset some gains at the margin.

Within the jobs data report, the labor force participation rate reflects less people participating in the labor force, leading to businesses having a smaller pool of workers to choose from. A sky high 10 million job openings, near the record set in March 2022, also reflects a worker shortage. Overall business costs or inflation have been rising faster than wages and that’s built an incentive to hoard labor. Companies don’t want to relive the challenging experiences of hiring during the pandemic and are keeping their workers close even as general economic conditions weaken. On the other hand, there has been substantial anecdotal evidence of hiring freezes and layoffs, and at this point in time, it’s safe to assume that those laid off workers are having an easy time finding work elsewhere.

Weaker labor force participation is inflationary, because fewer workers make it harder to produce things, leading to less goods and services to sell and bid on. Simultaneously, fewer workers means businesses have to compete for employees via higher wages, propping up prices further. Lower unemployment and strong job gains also support higher prices, because people have money and incrementally demand more goods and services. This supports higher GDP but inflation cooling is of the greatest importance in the times we’re living in. The Fed has forecasted a higher unemployment rate in their dot-plot in 2023, as they expect tighter monetary policy and higher interest rates to eventually cool the labor market and inflation. They’ve tightened aggressively since March, with roughly 3% in hikes and $206 billion in balance sheet reduction and so far, inflation and the labor market have barely come off the boil.

Investors believe that the Fed may need to take further action, with the rate hike path currently priced with expectations for a 75 basis point hike in November, 50 in December and a 25 in February to leave the terminal rate at 4.63%. Fed officials have expressed that they’d like to get rates to a restrictive area and keep them there until inflation gets back down to 2%. Time will tell if 4.63% will be enough; if inflation and the labor market remain on fire, they may have to shoot to 4.88% or 5.13%.

Meanwhile, north of the border in Canada, the employment gain was 21,100 in September, above expectations of 20,000 and a recovery from 3 consecutive months of employment declines totaling -113,500 thousand jobs.

Learn more about what goes into the Payroll Employment report? Watch here at Traders’ Academy.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.