We head to the future to take an alternative, imagined look at inflation. What if today’s markets, central bankers and economists are wrong in their assumptions?

Looking back, it was clear that the seeds of higher inflation were sown before the Covid pandemic ended. What started as a “transitory” rise in prices in 2021, turned into something far more persistent. With the benefit of a 2030 vantage point, it was clear that easy monetary and fiscal policy and a desire to avoid the mistakes of the past fuelled what is now known as the roaring inflation of the 2020s.

The initial recovery from the pandemic in 2021 caused a surge in inflation as the world economy re-opened. The strong unbalanced recovery led by the industrial sector put intense pressure on supply chains leading to bottlenecks and shortages of key goods.

Ships queued outside ports and delivery times stretched to record levels. 2021 and 2022 were known for shortages of everything from semi-conductor chips, petrol, carbon dioxide and truck drivers, to name but a few.

Meanwhile, energy prices rose sharply as demand soared and OPEC+ maintained discipline on supply. At the same time Europe was hit by a shortage of gas as renewables failed to keep up with the recovery in demand, primarily due to a lack of wind. Panic buying added a further twist as buyers tried to stockpile supplies in case of further shocks.

Inflation rose to its highest levels for more than a decade, but the expectation at central banks and of the majority of investors was that such a rise would prove to be temporary. In particular, commodity prices were expected to peak and unwind the powerful base effects which had pushed inflation higher.

However, this took longer than expected as the cold winter of 2021-22 spurred another frenzy of panic buying, which took oil prices over $100 per barrel. Meanwhile, in Europe the effect of higher gas prices was still being felt in 2022. This occurred as regulatory price caps prevented higher wholesale prices feeding through to the consumer until many months after the initial shock.

Nevertheless, although the impact of energy proved to be more persistent, it did not alter the transitory narrative amongst central bankers, politicians and economists.

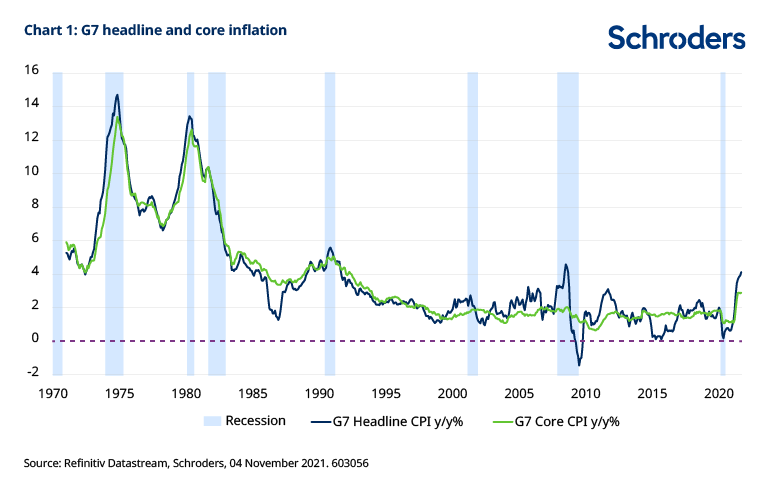

Periods of elevated energy prices were not unusual. For example, CPI inflation in the G7 hit 4.5% in 2008 after oil prices touched $150 per barrel. Earlier oil price spikes in the 1990s also told a similar story of transitory inflation.

In each case CPI inflation subsided once oil prices had peaked (chart 1).

Inflation doves also took encouragement from the signs of moderation in areas such as hotels, air fares, car rental and used car prices. These sectors had initially raised prices sharply as they re-opened, but having done so did not alter prices until later in 2022 as they resumed normal business.

As the world entered the second quarter of 2022, it looked as though the doves had prevailed as inflation moderated. Commodity prices had peaked and supply chain bottlenecks were easing.

The return of labour bargaining power

However, there were nagging doubts as to whether inflation was beaten. The core rate of inflation remained elevated, particularly in the US where shelter costs continued to rise in a tight housing market.

This cyclical component of inflation continued to rise as people returned to work in cities and looked for somewhere to rent. Meanwhile, house prices remained buoyant and a place to own was unaffordable for many.

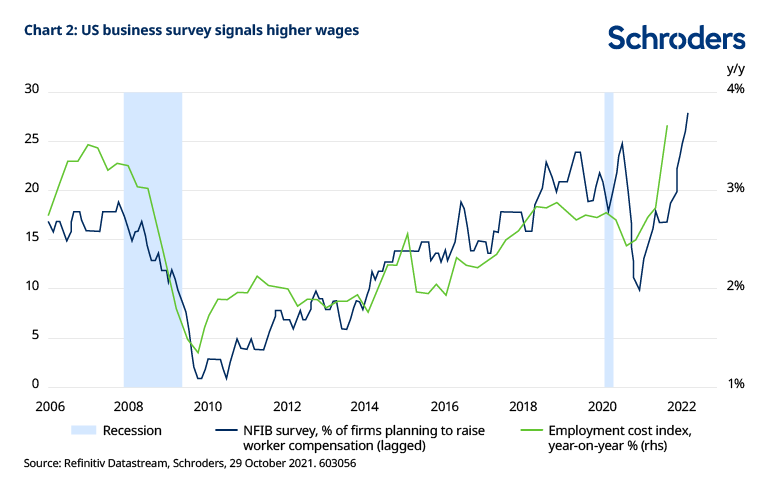

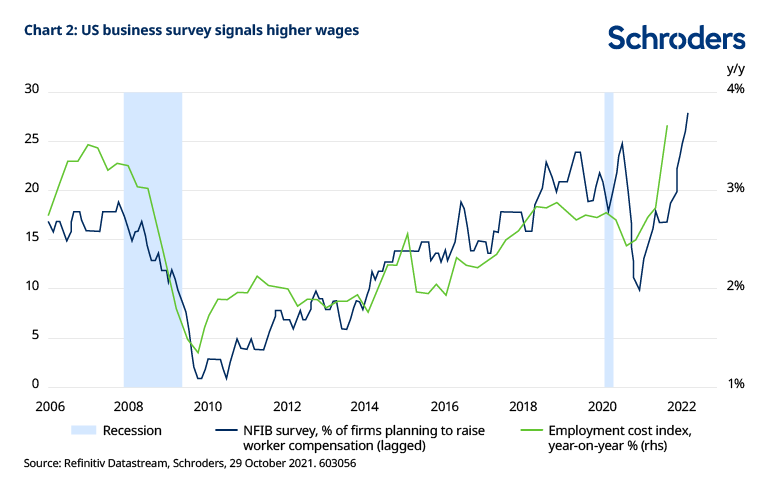

More fundamentally, labour markets around the world were tight and there were signs of rising wages. Despite the widespread assumption that there was spare capacity in the world economy (as suggested by the level of unemployment) labour shortages persisted and wages began to accelerate.

In the US the Employment Cost Index (ECI), which had been running between 2% and 3% for the past decade, picked up to its highest rate for more than 20 years. The move had been foreshadowed by business surveys, such as the one conducted by the National Federation of Independent Business (NFIB) (chart 2).

UK wage growth also accelerated and in the eurozone workers pushed for higher pay, particularly in Germany where it was said that unions were at their strongest for 30 years.

Underlying these developments was a structural shock in the labour market.

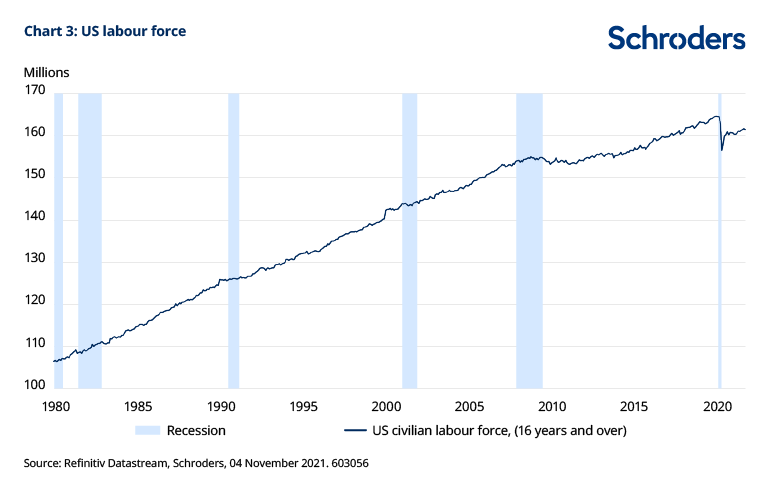

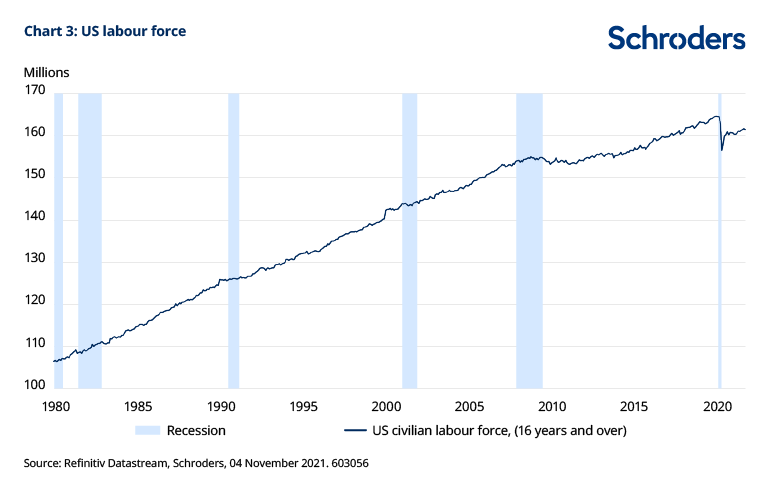

Around the world, the participation rate fell sharply during the pandemic and, although it initially bounced as the economy recovered, in many economies it remained well below pre-pandemic levels. In the US, for example, the labour force contracted by three million workers (chart 3) and took five years to return to pre-pandemic participation rates.

It was a similar story elsewhere, with the situation in the UK exacerbated by Brexit which meant the absence of immigration from the EU cut off one of the mechanisms for relieving inflationary pressure. In previous cycles an inflow of EU workers had helped cool an overheating labour market, increasing supply to meet demand.

History shows that the aftermath of past pandemics saw labour shortages and higher wages as many had passed away, but this time, thankfully, it was not deaths that created a shortage of labour.

Much of the contraction in the labour force reflected an increase in retirement as older workers decided the trade-off between leisure and the risk of contracting Covid at work was no longer worthwhile. Meanwhile, the experience of lockdown meant many made the lifestyle choice to spend more time with their family and less at work.

The participation rate for US workers aged 65 and over fell and did not recover as retirement rates rose. Industry evidence in the UK found that along with changes to immigration following Brexit, much of the shortage of lorry drivers could be traced back to early retirement.

Amongst younger age groups a reluctance to pursue occupations with face-to-face contact led to shortages in the service sector as many retrained or shifted careers. Scarcity started to shift the balance of power in the labour market toward workers so pushing up pay rates.

Higher wages alone do not cause inflation. They add to operating costs, but their overall impact on a firm depends on whether they can be offset by higher productivity, or passed on to consumers.

Optimism that the pandemic would have created new ways of working and so improve productivity faded as many firms struggled with the added costs of doing business. The service sector was most affected where social distancing reduced capacity and hit productivity, resulting in permanently higher costs. Productivity did improve in other sectors, but overall could not keep pace with wage gains.

Wages and costs had risen and were being passed on to the consumer, thus pushing up core and headline inflation even as commodity prices eased back. Loose fiscal and monetary policy played a role by keeping demand buoyant, allowing firms to pass on costs and hence accommodating inflation.

2022-25: Central banks respond, but the playbook changed

As inflation and wages rose the doves appeared to be beaten. However, they countered robustly with the view that although inflation had picked up again, central banks would respond by tightening policy to cool price rises. This was certainly the expectation of markets, which priced in a period of interest rate increases from 2022 to counter higher inflation.

Long dated bonds remained relatively unperturbed with the inflation-linked markets signalling a near term rise in inflation followed by a return back toward the 2% inflation target over the medium term.

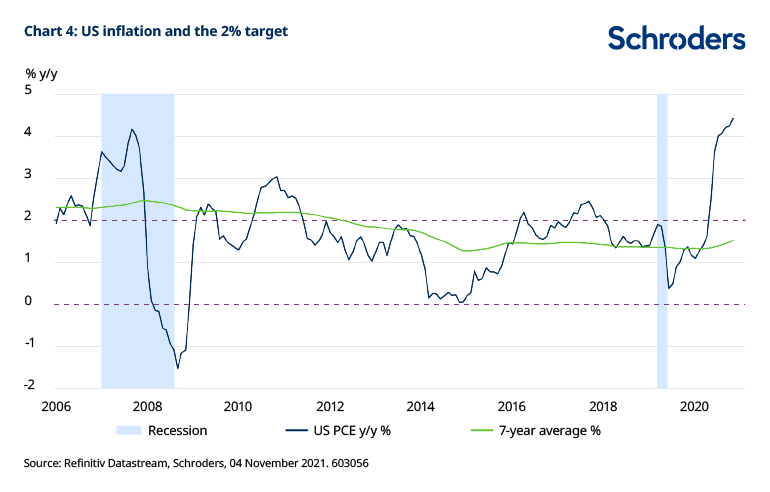

Central bankers did react, but not as forcefully as expected. In the US, changes in the Federal Reserve’s (Fed) policy framework meant that the central bank was prepared to tolerate a situation where inflation ran above 2% for a period so as to offset earlier periods where inflation had run persistently below target.

In implementing Average Inflation Targeting (AIT) the Fed was careful not to specify how long the overshoot should last. Yet it soon became clear that it was thinking in terms of years not months.

Some members of the bank’s Federal Open Market Committee (FOMC) were citing the seven year average as a reference point for correcting the extended undershoot from the last cycle (see chart 4).

For the US this approach was reinforced by the desire to achieve maximum employment and thereby reduce inequality. The social agenda had been having an increasing bearing on their decisions and greater weight was now being given to reducing unemployment as low as possible across as many social groups as possible.

As a consequence after an initial spell of rate rises in 2022 and 2023 the Fed went on hold at 1% even though inflation was then running at 3%.

Inflation undershoots were not uncommon in the decade before the pandemic and other central banks adopted similar approaches to AIT. For example in the eurozone where deflation had been a significant threat after the global financial crisis the European Central Bank positively welcomed the overshoot of inflation, despite objections from the Bundesbank.

Consequently, although interest rates rose they did not match market expectations and monetary policy remained loose by past standards with real interest rates running well below zero.

These changes in central bank strategy helped sustain inflation above 2% until the middle of the decade and at the time were seen as a great success. Unemployment and inequality fell and the spectre of deflation was banished in Japan and the eurozone.

In Japan there were nationwide celebrations as the Bank of Japan declared deflation dead.

Inflation of 3%, or 4% in some economies such as the UK, was seen as a price worth paying. One hundred years on and the roaring twenties were back.

2025-29: Tensions as economic and political cycles diverge

The real problems began when political pressure was brought to bear on central bank decision making.

Populism may have retreated during the pandemic, but returned by the middle of the decade as many had not seen the improvement in living standards expected. As a consequence, few political parties were prepared to countenance fiscal austerity and most ran on a platform of continuing fiscal expansion.

Meanwhile, high public debt levels had increased the sensitivity of government expenses to interest rates and, as general elections approached, there was intense political pressure to keep rates low to facilitate tax cuts and increase public spending.

Unfortunately it was at this point that the economic and political cycles began to diverge. Genuine capacity constraints were emerging in the world economy.

Although the bottlenecks of 2021 and 2022 had been overcome and many people brought back into the labour force, there were limits. Demographics meant that work force growth slowed as the boomers retired.

Further increases in the state pension age were seen as off limits given the political importance of the elderly. Populists also ensured that a resumption of immigration was off the agenda, cutting off access to overseas workers.

Meanwhile, productivity gains had run their course whilst the threat of off-shoring workers rang hollow as the world became increasingly regionalised. China saw an increasing outflow of foreign investment as firms on-shored production back home in an increasingly hostile geo-political environment.

One of the great deflationary forces of earlier decades was weakened as the global labour market became fragmented.

Additional pressure on prices came as the green agenda picked up pace. Following the surprising success of COP26, countries adopted taxes on carbon, raising duties on fossil fuels and pushing up energy bills.

The rolling nature of these tax hikes created a continuous process of price increases, otherwise known as persistent inflation. Measures to force firms to decarbonise exacerbated shortages of oil as the majors cut capital spending on exploration and production and rebranded as renewable producers.

The energy transition was inflationary as the world economy switched from burning cheap fossil fuels to the more expensive clean alternatives.

The politicisation of the central banks

Tensions rose as central bankers recognised the threat to price inflation and tried to end to the party by raising rates and tightening policy. Fearful of an electoral backlash, populist leaders turned on these “unelected” officials. Taking their cue from earlier events in Turkey, governments removed the more hawkish governors from their posts.

So began the great central bank reshuffle. Many subsequently joined forces with Jens Weidmann who had resigned from the Bundesbank in 2021 in what was subsequently seen as a harbinger of the politicisation of central banks.

However, the effect was to undermine inflation expectations. Seeing the independence of central banks undercut, public confidence in a return to stable inflation evaporated. When combined with the weakening of structural factors, pay soared as the expansion was allowed to continue unabated.

In this way inflation ratcheted up from the 3% seen in the first half of the decade to over 6% in the second half. In inflation-prone economies such as the UK it averaged 10% in some years.

Workers then pushed even harder for higher wages to counter these rises, but in the absence of productivity growth, costs and prices only rose further creating a classic wage-price spiral.

The roaring 2020s ended in stagflation as capacity constrained economies had little option but to absorb the excess demand created by loose fiscal and monetary policy in higher inflation.

What had started as a transitory rise in inflation in 2021 had turned out to be more permanent. This was initially welcomed as strong activity combined with moderate inflation to deliver more equitable growth. But it soon turned out that structural shifts and a regime change in central banking led the world economy into one of the most inflationary decades since the 1970s.

—

Originally Posted on November 9, 2021 – The View From 2030: How Transitory Inflation Became Permanent in The “Roaring 2020s”

The views and opinions contained herein are those of Schroders’ investment teams and/or Economics Group, and do not necessarily represent Schroder Investment Management North America Inc.’s house views. These views are subject to change. This information is intended to be for information purposes only and it is not intended as promotional material in any respect.

Disclosure: Schroders

Important Information: This communication is marketing material. The views and opinions contained herein are those of the author(s) on this page, and may not necessarily represent views expressed or reflected in other Schroders communications, strategies or funds. This material is intended to be for information purposes only and is not intended as promotional material in any respect. The material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. It is not intended to provide and should not be relied on for accounting, legal or tax advice, or investment recommendations. Reliance should not be placed on the views and information in this document when taking individual investment and/or strategic decisions. Past performance is not a reliable indicator of future results. The value of an investment can go down as well as up and is not guaranteed. All investments involve risks including the risk of possible loss of principal. Information herein is believed to be reliable but Schroders does not warrant its completeness or accuracy. Some information quoted was obtained from external sources we consider to be reliable. No responsibility can be accepted for errors of fact obtained from third parties, and this data may change with market conditions. This does not exclude any duty or liability that Schroders has to its customers under any regulatory system. Regions/ sectors shown for illustrative purposes only and should not be viewed as a recommendation to buy/sell. The opinions in this material include some forecasted views. We believe we are basing our expectations and beliefs on reasonable assumptions within the bounds of what we currently know. However, there is no guarantee than any forecasts or opinions will be realized. These views and opinions may change. Schroder Investment Management North America Inc. is a SEC registered adviser and indirect wholly owned subsidiary of Schroders plc providing asset management products and services to clients in the US and Canada. Interactive Brokers and Schroders are not affiliated entities. Further information about Schroders can be found at www.schroders.com/us. Schroder Investment Management North America Inc. 7 Bryant Park, New York, NY, 10018-3706, (212) 641-3800.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Schroders and is being posted with its permission. The views expressed in this material are solely those of the author and/or Schroders and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.