US-listed China ADR Recap From Yesterday

We had a triple whammy starting at 10 am when the FCC announced China Telecom would be banned from operating in the US. I doubt the move has any financial impact on the company, but the timing post-Janet Yellen’s conversation with Vice Premier Liu He the night before was interesting.

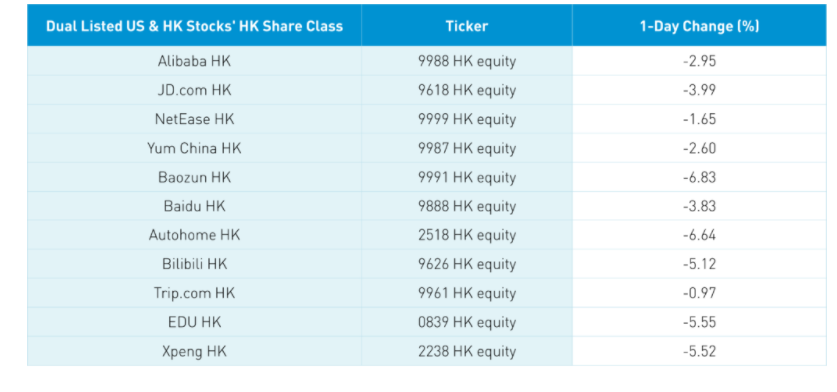

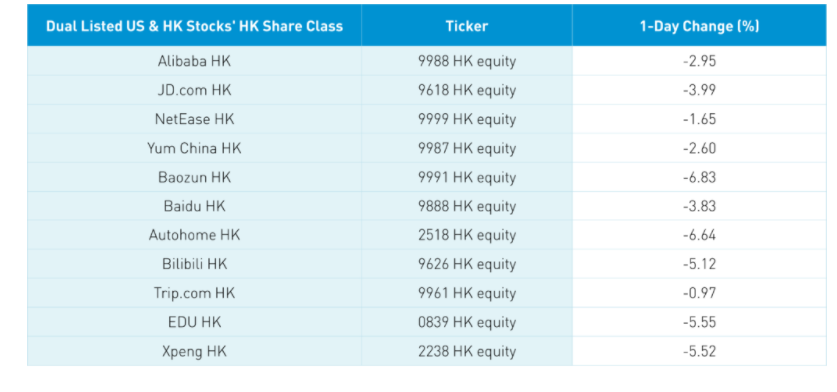

Also starting at 10 am, the US House Finance Subcommittee on Investor Protection, Entrepreneurship, and Capital Markets held a session titled “Taking Stock of China, Inc: Examining Risks to Investors and the U.S. Posed by Foreign Issuers in U.S. Markets”. The four “expert” witnesses were mega-China bears so it is hardly surprising that the tone was negative. The emphasis was all on risks with no examination of the rewards. There were multiple inaccurate statements that left me somewhat dismayed. Ultimately, institutional investors such as ourselves will simply convert out of the US ADRs into the Hong Kong share classes.

Last but not least, we had Secretary of State Anthony Blinken implicitly recommend Taiwan’s inclusion in the UN. It is worth noting that CNH, China’s currency that trades during US trading hours, did not move on the news. As we have stated in the past, CNH is usually a good barometer for the actual economic implications of a given news story. Several trading desks felt that the sharp sell-off was exacerbated by the recent strength of the sector, which led to some short-term profit-taking. We are still above the 50-day moving average, which should act as a support level.

Coincidentally, we mentioned yesterday’s 14th Five Year Plan for E-Commerce Development. My colleague Derek did a great job translating the plan for me. According to the report, by 2025, E-Commerce transactions are expected to reach RMB 46 trillion ($7.2 trillion) versus RMB 37.2 trillion in 2020. E-Commerce-related employment is expected to rise to 70 million by 2025 from 60.15 million in 2020.

Key News

Asian equities were lower overnight. China’s September industrial profits rose by +16.3% to RMB 738 billion versus August’s 10.1% rise driven by higher input prices. Higher commodity prices are being baked into the prices of manufactured goods, another sign of increasing inflation. Year-to-date, industrial profits are up 44.7% year-over-year.

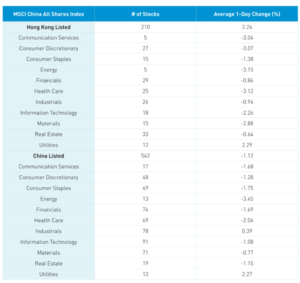

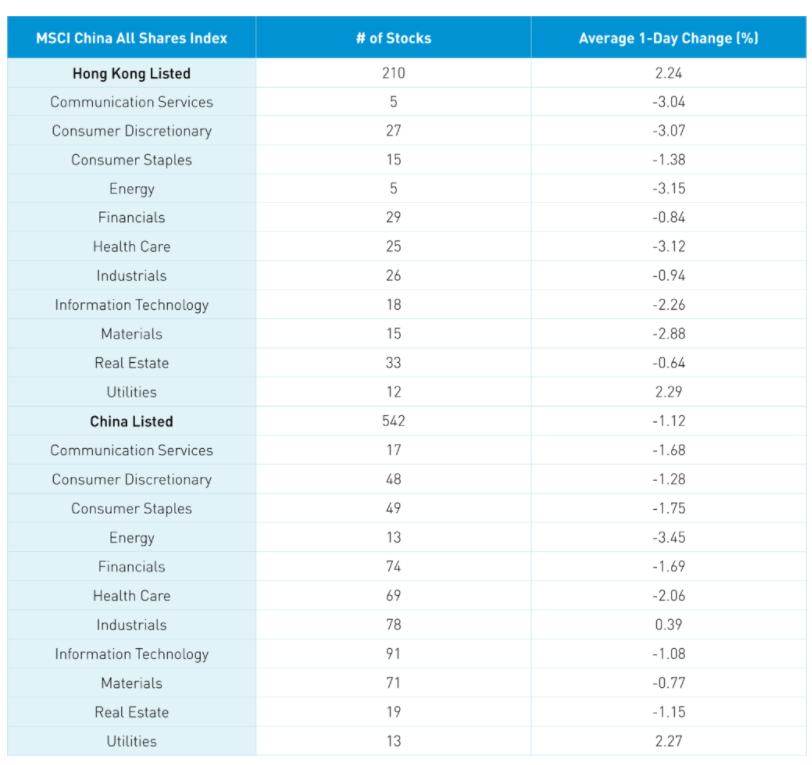

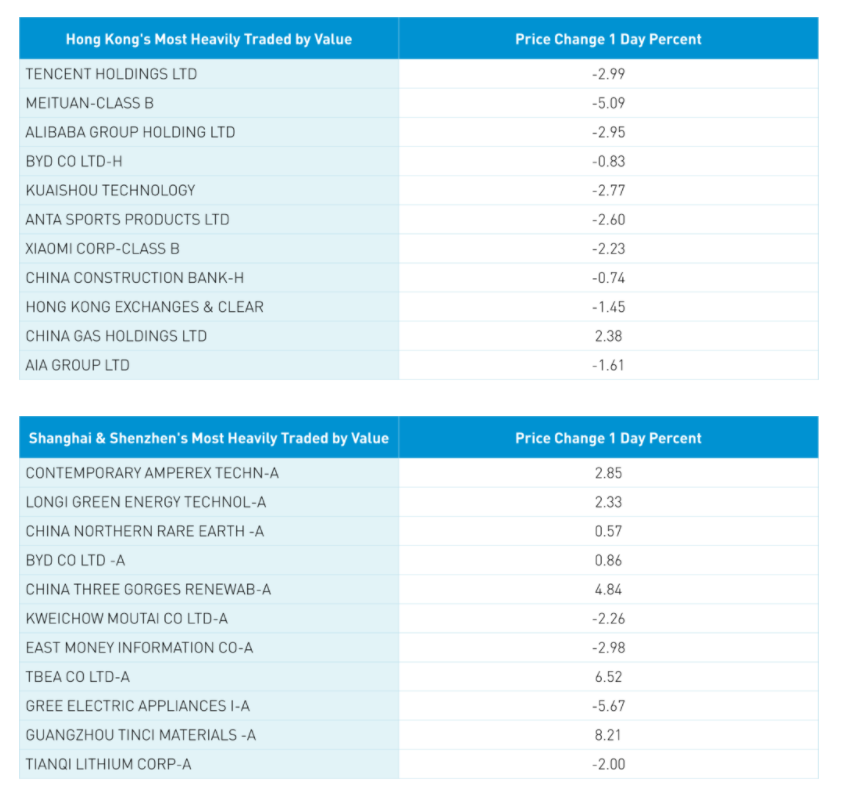

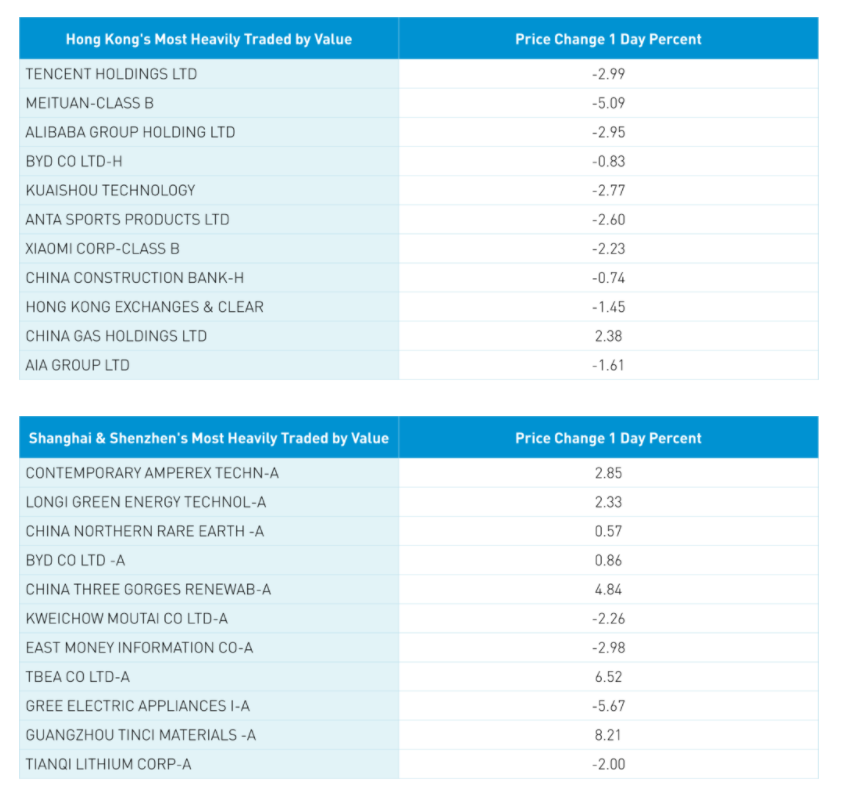

The positive economic release was a non-event as the Hang Seng was off -1.57%, led lower by internet stocks following yesterday’s sell-off in the US. Volumes were off though breadth was nearly 4 to 1 decliners to advancers as utilities was the only positive sector. Southbound Stock Connect volumes were light as Mainland investors were small net sellers of Hong Kong stocks including Tencent, which fell -2.99%, and Meituan, which fell -5.09%. Kuaishou Technology was off -2.77% though saw net buying via Southbound Stock Connect.

Shanghai, Shenzhen, and the STAR Board were off -0.98%, -1.11%, and -1.04%, respectively, on volumes that were just above the 1-year average. It was a risk-off day as decliners outpaced advancers by nearly 4 to 1. The only bright spot was the clean energy technology space as the electric vehicle (EV) ecosystem, solar, wind, and hydrogen stocks were strong performers following Monday’s release of clean energy targets. The State Council reiterated carbon targets overnight. A separate piece stated that EVs should account for 25% of all auto sales by 2025, which would be up from 5% in 2020, with a target of 40% by 2030. Ambitious!

Northbound Stock Connect volumes were light as foreign investors sold $475 million worth of Mainland stocks today. The PBOC was active again in injecting liquidity into the financial system. CNY was off a touch versus the US dollar overnight along with bonds and copper.

S&P and MSCI have proposed another update to the Global Industry Classification System (GICS), a long-winded way of saying sectors. The most notable changes include the elimination of the internet retailing subsector, which is a pure-play E-Commerce sub-sector, and breaking out renewable versus non-renewable energy providers. The former change could have an effect on thematic ETFs as they may lose out on companies solely focused on E-Commerce, as the index providers believe many brick and mortar companies now sell online. That is true, though pure plays still exist. Our approach has always been bottom-up, so it is a non-event for us, though I suspect others might not be so lucky.

If Helen of Troy launched a thousand ships, Luckin Coffee launched a thousand pessimists. The company announced having paid a $175 million class-action settlement following its fraud debacle last year. It is worth noting that the fraud was discovered by its auditor at the time, Ernst & Young. Ironically, the company’s stock is trading at $15 versus $25 in March 2020, which was just prior to the fraud news.

Last Night’s Exchange Rates, Prices, & Yields

- CNY/USD 6.39 versus 6.38 Yesterday

- CNY/EUR 7.42 versus 7.41 Yesterday

- Yield on 10-Year Government Bond 2.98% versus 2.98% Yesterday

- Yield on 10-Year China Development Bank Bond 3.32% versus 3.32% Yesterday

- Copper Price -0.78% overnight

—

Originally Posted on October 27, 2021 – US-China Rhetoric Weighs on Stocks

Author Positions as of 10/27/21 are KBA, KALL, KCNY, KFYP, KCNY, KEMQ, BZUN, HSBC, KWEB

Disclosure: KraneShares

Content on China Last Night is for informational purposes only and should not be construed as investment advice. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events or a guarantee of future results; material is as of the dates noted and is subject to change without notice. This information should not be relied upon by the reader as research or investment advice regarding the funds or any security in particular.

This material may not be suitable for all investors and is not intended to be an offer, or the solicitation of any offer, to buy or sell any securities. Investing involves risk, including possible loss of principal.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial advisor before making an investment decision.

Forward-looking statements (including Krane’s opinions, expectations, beliefs, plans, objectives, assumptions, or projections regarding future events or future results) contained in this presentation are based on a variety of estimates and assumptions by Krane. These statements generally are identified by words such as “believes,” “expects,” “predicts,” “intends,” “projects,” “plans,” “estimates,” “aims,” “foresees,” “anticipates,” “targets,” “should,” “likely,” and similar expressions. These also include statements about the future, including what “will” happen, which reflect Krane’s current beliefs. These estimates and assumptions are inherently uncertain and are subject to numerous business, industry, market, regulatory, geo-political, competitive, and financial risks that are outside of Krane’s control. The inclusion of forward-looking statements herein should not be regarded as an indication that Krane considers forward-looking statements to be a reliable prediction of future events and forward-looking statements should not be relied upon as such. Neither Krane nor any of its representatives has made or makes any representation to any person regarding forward-looking statements and neither of them intends to update or otherwise revise such forward-looking statements to reflect circumstances existing after the date when made or to reflect the occurrence of future events, even in the event that any or all of the assumptions underlying such forward-looking statements are later shown to be in error. Any investment strategies discussed herein are as of the date of the writing of this presentation and may be changed, modified, or exited at any time without notice.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from KraneShares and is being posted with its permission. The views expressed in this material are solely those of the author and/or KraneShares and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.