For some time, it has been my contention that Tesla (TSLA) is a “faith-based” stock. By conventional measures such as P/E ratios, the stock’s valuation borders on insane. But investors who focused on the company’s technology and future prospects have been richly rewarded. They have seemingly unshakeable faith in Elon Musk and his ability to deliver groundbreaking technology. Why change tactics when faith is working so well, they might ask?

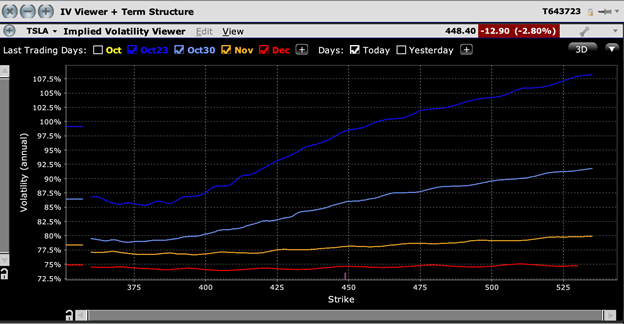

The time seems right to check out whether options traders in TSLA share that faith. The short answer is “yes”, at least according the chart below:

Source: Trader Workstation

What we see here is the skew for options +/- 20% of today’s price for upcoming expirations in TSLA options. I have eliminated those expiring tomorrow, since skews for imminently expiring options can lack pricing consistency, and instead focused upon those with expiries on October 23rd (dark blue), October 30th (light blue), November 20th (orange), and December 18th (red).

Experienced observers will note that these curves appear to be unusual. For typical stocks we see below market strikes with higher implied volatilities than above market strikes. That is because there tend to be writers of upside calls and buyers of downside puts. Here we see the opposite. Traders are paying higher prices for speculative calls than they are for protective puts.

Perhaps that shouldn’t be a surprise, considering how almost everything about TSLA is unusual. There is a logical reason for the demand differential, though. Considering both, the mostly one-way upward trajectory of TSLA and the devotion of its holders, there is a relative paucity of holders willing to cap their upside by writing calls. Covered call writing is primarily an income strategy, and TSLA holders are much more focused upon stock return than income. If it were the other way around, the valuations would not be nearly this extreme. Furthermore, protective put buying has been largely a waste of money for most of the company’s existence. True faith is not something one hedges.

Yet is important to bear in mind that TSLA is expected to announce its earnings on October 21st, meaning that the options that expire on the 23rd are essentially a pure play on the earnings period. Again, this is a clear expression of the faith shown by TSLA options traders. The options show higher implied volatility around the earnings date, but that is completely normal. Options traders track earnings carefully because they bring the potential for large moves around predictable dates, so they adjust their prices accordingly. But it is normal to see even steeper skew around earnings, since markets tend to punish companies that miss their number more harshly than they reward those that beat. This is clearly not the case for TSLA right now. Options traders are bidding up speculative calls more aggressively than protective puts or at-money options.

It is rare to see that sort of enthusiasm, or faith, ahead of a company’s earnings release. While I can’t express an opinion about the likelihood of TSLA beating the published consensus of an approximately $0.53 quarterly profit, I can say that there are few precedents for traders to express such a bullish view ahead of a quarterly number. Those who don’t share the faith might find this an opportune time to consider vertical or calendar spreads that offer a risk-controlled method of cashing in on the high implied volatility of the near-term, out-of-money calls. But remember, it is difficult to question the faith of those who have been rewarded repeatedly.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ