Yesterday, a friend asked me a question about options that perplexed him. I’ll paraphrase for the sake of clarity and anonymity:

“On October 19th, when Zoom (ZM) was trading at $580, I thought that price was nuts. I bought the $300 puts expiring on Jan 15th, 2021 for $4.91. Yesterday the stock closed at $351, down about $230, but the puts closed at $3.10. I was right that the stock would plunge, but with the stock down ~40% my puts are down ~37%. How did I lose money on this trade?”

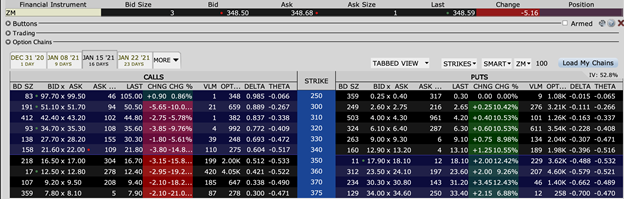

Allow me to add for background that my friend is hardly a neophyte or uninformed investor. He’s a successful entrepreneur with a Wharton undergraduate degree. Unfortunately, he made an all-too-common misunderstanding for options traders. He focused on one “Greek” – delta – at the expense of another – theta. Let’s use the following snapshot of ZM options taken today using the “OptionTrader” function of my IB Trader Workstation. Please pay particular attention to the at money, $350 options as well as the out of the money $300 puts that my friend mentioned. For the sake of simplicity, I removed most of the available columns aside from basic pricing data, delta and theta.

Delta is the most straightforward options pricing variable to understand. It is the price change of an option for a given change in the underlying instrument, all things being equal. With In the case of US equity options, that is expressed in dollar increments. If a call option has a delta of .5, we can expect that the price of the option will increase by 50 cents if the underlying stock rises by $1. The reverse is true for puts. This is a fairly easy concept for investors to understand.

Stock investors typically think in terms of delta whether they realize it or not. Stocks go up and down, and investors know that options tend to follow those stock moves. Much of the recent popularity of options is attributable to the understanding that options can provide an inexpensive, risk-controlled method for tracking the moves of a given stock or ETF. During the relentless rise of the market and many popular stocks, many savvy speculators realized that they could supercharge their returns by buying call options on those stocks instead of the stocks themselves. Their potential loss was limited to the initial options premium paid (and any associated commissions), while their gain was theoretically unlimited. That structure was especially appealing to gamblers who gravitated to markets when spectator sports were largely shut. A relatively small outlay could have a high return, there was a multitude of potential outcomes on which to wager, and best yet, the sheer number of speculators on one side of the market could actually influence the outcome of the contest – something that is impossible for bettors in other fair contests. (I wrote about this distinction at length here: https://ibkrcampus.com/traders-insight/securities/macro/the-key-difference-between-speculation-and-gambling/).

Unfortunately for many speculators, delta is not the only variable that matters for options pricing. In the example above, we see the ZM 350 calls have a delta of .512 and the puts have a delta of -.488 (the absolute values typically sum to 1). With ZM falling $5.16, we would expect to see the $350 puts rise by $2.52 (-.488 x -5.16). Yet those puts are only $2 higher. Similarly, we would expect to see the $350 calls fall by $2.64 (.512 x -5.16), but they are down by $3.15. What gives?

Remember the phrase “all things being equal” in the delta definition above. In reality, all things are rarely equal. In this case, the bulk of the underperformance can be explained by the variable displayed in the rightmost column, theta. We can see that the theta for the ZM 350 put is -.532. Subtracting the day’s theta of -.532 from the theoretical delta gain of 2.52, we are left with $1.99, which is awfully close to the $2 change seen today. The same is true for the call, where the 3.15 actual decline is 51 cents greater than the decline implied strictly by the option’s delta. That option’s theta is .533, which again explains almost all of the underperformance.

Options are a decaying asset. They lose value with the passage of time, and that decay is measured by theta. Theta is the amount that a given option would be expected to decline in one day. Theta, or decay, is relentless. Stocks may move up or down, but time simply passes. That is why theta is typically displayed as a negative number. If you hold a long option, it will decay. The buyer has to hope that the delta move (or other factors) will exceed the option’s decay over their holding period.

Another nasty feature of decay is that it is non-linear. It accelerates as an option approaches expiration. When I was a novice, a senior options trader constantly reminded me that an option’s value “falls off a cliff” as it approaches expiration. For some perspective, the ZM $350 calls that expire tomorrow (12/31) are trading at $3.90 with a theta of -1.66. That is over 3 times the theta of the options that expire in just over 2 weeks. If ZM stock is unchanged for the rest of the day, someone who purchases that call could expect to lose about 42% simply with the passage of time.

This of course is another crucial difference between options trading and sports gambling. Sports betting odds do not decrease simply because the end of the contest approaches. Sports odds remain roughly unchanged in the days leading up to the event unless there is a change in the money flowing to one side of the bet or another. Options odds decline at an accelerating rate the closer one gets to the outcome on expiration.

Yet we are seeing an explosion in volume in short-dated options, particularly those with a week or less to expiration. This is a sign of the lack of understanding of options fundamentals by so many who trade them. These buyers are fighting the most expensive theta available to them. This is a mistake that can be rectified – or even thoroughly reversed – in an environment where stocks can rise exponentially for the flimsiest of reasons. It also exposes a risk to the sustainability of options speculation. If stocks were to simply move sideways for a period of time, those speculators who have become enamored with short-term call options could find themselves consumed by decay. They may not be exposed to catastrophic losses, but instead lose relatively small amounts of money repeatedly. That would benefit the options writers who benefit from decay, but the buyers would likely run out of patience after a series of unprofitable wagers. We’re not at that point yet, though. As for my friend, all is not bleak. He also bought some ZM June $250 puts that are up by 55%. Those options only have a theta of -.111, so he has some time before decay really becomes painful. But I think he might be a bit quicker to take a profit on this and future trades now that he better understands options decay.

Read Steve’s Referenced Post Here:

The Key Difference Between Speculation and Gambling: https://ibkrcampus.com/traders-insight/securities/macro/the-key-difference-between-speculation-and-gambling/

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ