Today is Fed day! At 2pm EDT, we will learn the results of the current meeting of the Federal Open Market Committee (FOMC), and a half hour later, Federal Reserve Chair Powell will take to the mic for his customary press conference. By now you’ve likely heard that markets are widely expecting an announcement that the Fed will taper its $120 billion of monthly bond purchases by $15 billion each month for the next 8 months. Investors will also be looking for clues about inflation and the timing for potential rate hikes. Accommodative monetary policy from a market-friendly Fed has been a key driver of rising asset prices for the better part of a decade and certainly since the Covid crisis hit early last year. Now comes the trickier part – unwinding some of that accommodation while neither stoking inflation or spooking markets.

Although I concur with the general expectation for the pace of tapering, I am concerned that the language about inflation and interest hikes could be more strident than many investors expect. I’ll leave the nuanced punditry to the economists who are better versed in Fed-speak, but I will note that the equity options market seems to be in broad agreement with my opinion.

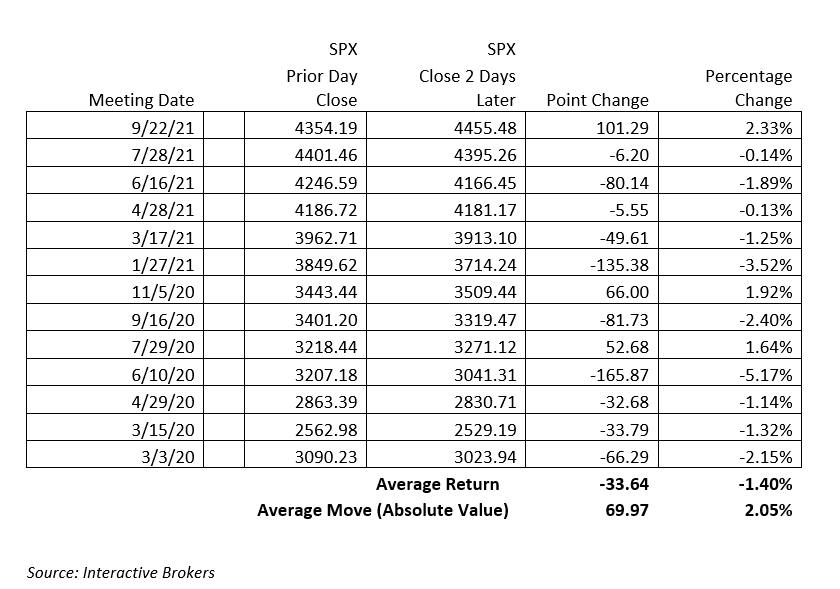

Equity markets have tended to react poorly after recent FOMC meetings. As the table below indicates, the S&P 500 Index (SPX) has traded lower 10 of the last 13 times in the three-day period that includes and immediately follows an FOMC meeting:

Three-Day Changes After Prior FOMC Meetings & Close of Prior Day Through 2 Days After the Announcement

The average return over those 3-day periods was -1.40%. Bear in mind first that those negative periods occurred during the midst of a raging bull market when over 63% of 3-day moves were higher. Also notice that the return was improved by the 2.33% bounce after the last meeting, though that added to the size of the average move. Although the sample size of periods around an FOMC meeting is relatively small, it is not incorrect for traders to be risk averse ahead of these events.

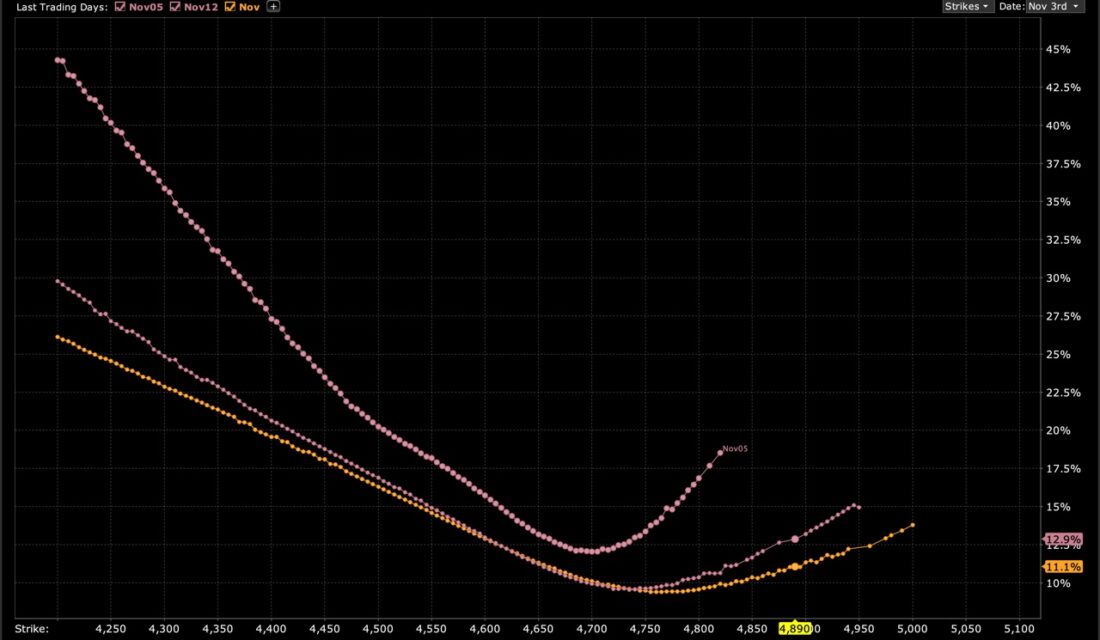

The skew in SPX options, particularly for those expiring this Friday show that risk aversion quite clearly.

Multi-Expiry Skew for SPX With Sequential Three-Week Expirations

Source: Interactive Brokers

The top line shows this Friday’s expiration. Bear in mind that this period includes not only today’s FOMC meeting, but also Friday’s payrolls report. We see that the at-money options are elevated, but only somewhat, with implied volatilities below 15. Remember, that indicates an expectation that volatility will average less than 1% per day during the remaining life of the option. But notice how quickly the implied volatilities for options that hedge downside risk accelerate. Options that are struck at 95% of the current 4625 index level are trading with a nearly 30% implied volatility. That is indeed some risk aversion. And those implied volatilities continue to soar as we approach strikes 10% below the current level.

The takeaway here is that most options traders appear reluctant to expect too great of a post-FOMC move, since at-money volatility remains only slightly elevated. But it is clear that there are persistent bids for downside protection, with at least some traders nervous ahead of an important news cycle.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ