Today is the last trading day of the second quarter. We came into the week noting that there were few catalysts in the early part but several over the final two days. Now those catalysts are behind us, and those too provided little impetus to sway market trends dramatically.

Yesterday’s GDP report failed to sway markets, as did today’s Core PCE Deflator. The Fed’s preferred inflation measure came in exactly as expected. The deflationary trends continue, but at the same pace that we had already anticipated. University of Michigan Sentiment rose, and Inflationary Expectations fell, but those only caused a relatively minor blip higher in stocks. We’ve previously noted that inflation expectations generally follow gasoline prices. Pump prices fell recently, and so did expectations

University of Michigan 1-Year Inflation Expectations (yellow) vs. AAA National Gasoline Prices (green), since December 2016

Source: Bloomberg

It should be obvious by now that I’ve thus far avoided the elephant in the room (and the donkey, for that matter) – last night’s Presidential debate. There’s no way to spin that as a positive for President Biden, but it’s not clear that markets are particularly banking on a Trump victory right now. I have a very active text group with a bunch of college friends (one of whom was running a focus group at the time), and, noting that US equity futures were modestly higher afterwards, they inevitably asked what I thought the market’s reaction would be. I told them, as I often tell people, that stock traders are notably bad at interpreting geopolitical events that don’t directly affect corporate top and bottom lines in the near term. My comment was to watch the Treasury bond market, since they offer a clearer picture about concerns for inflation and the economy. At that time, rates were modestly higher by about 1 basis point. Now we see a bit more of a rise in rates and a slightly steeper curve. That may be attributable to bond market concerns about the former President’s preference for a set tariff hikes and tax cuts that could expand the government deficit. But the bond market has clearly not called the election one way or another.

If today’s gains hold, and since the expiring weekly options have a way of metastasizing Friday gains into something more substantial, they probably will, that will give us five straight days of gains for the S&P 500 (SPX) and four for the Nasdaq 100 (NDX). The Russell 2000 (RTY), which rebalances tonight, had a mixed week though. Interestingly, Nvidia (NVDA), the key stock of the moment, is slightly down for the week right now. Although it quickly recovered its Monday swoon, it has mostly muddled around for the rest of the sessions.

1-Week, NVDA (candles), SPX (yellow), NDX (blue), RTY (purple)

Source: Interactive Brokers

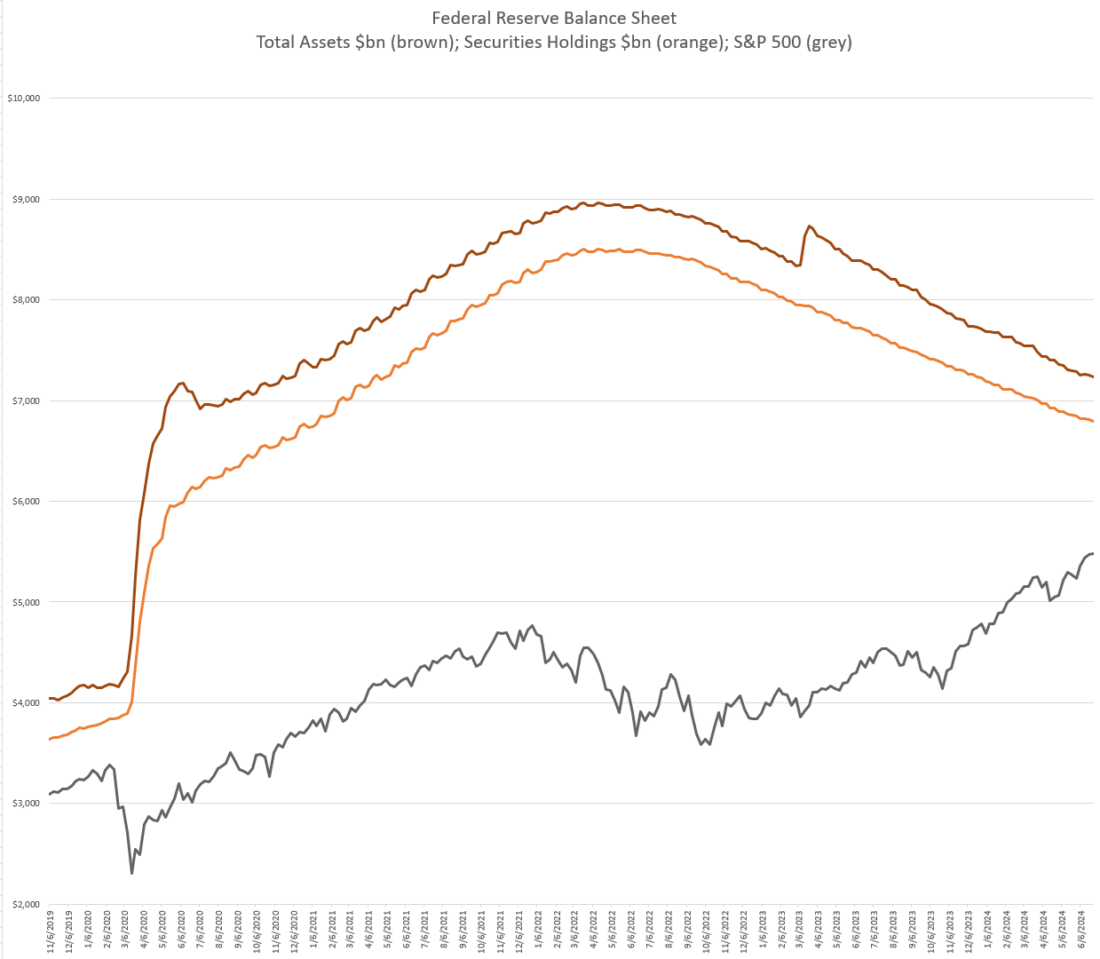

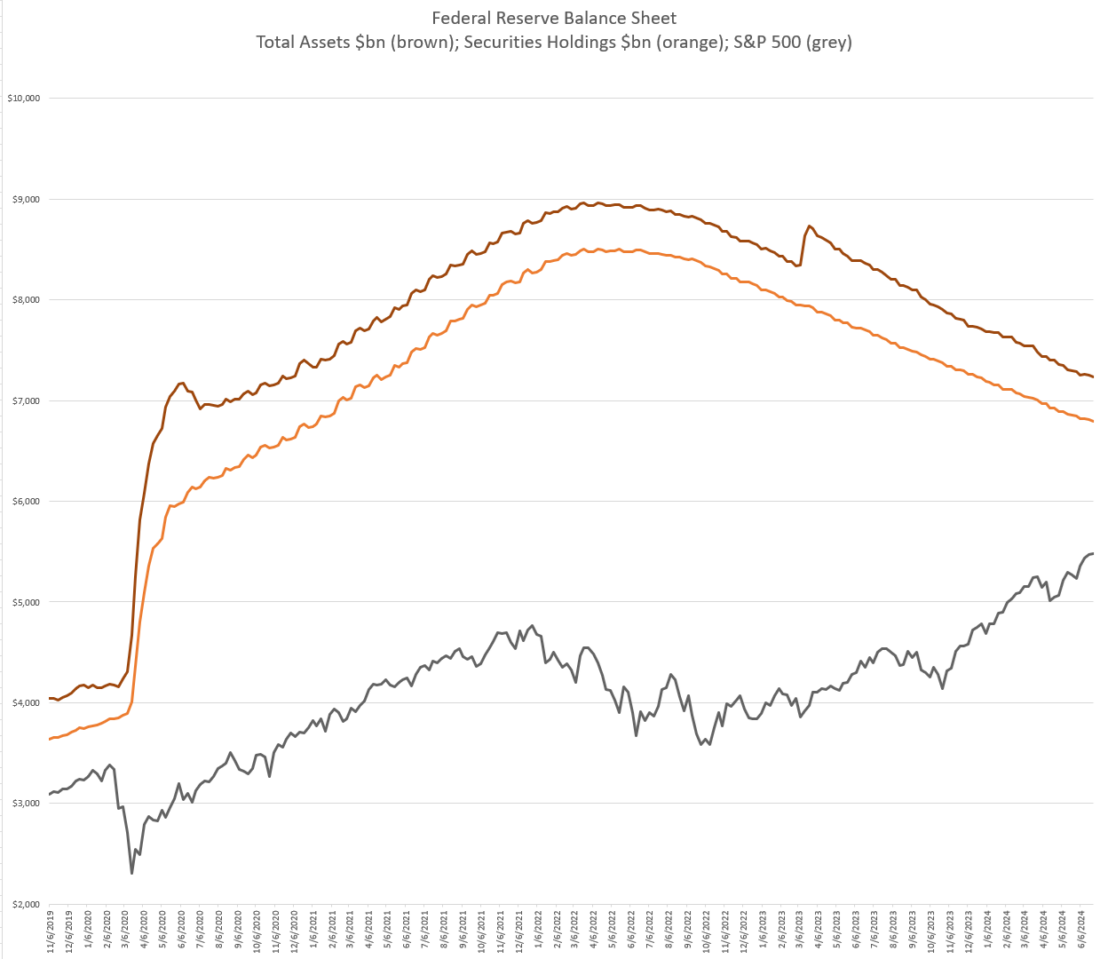

Finally, this seems like a good time to check in with a couple of our old favorite charts. The first compares the size of the Federal Reserve’s securities holdings and balance sheet with SPX. For a while, that relationship really mattered. Now it’s quite evident that equity investors haven’t cared at all about quantitative tightening for over a year. It will be interesting to see if the slower pace of QT will matter:

Sources: Federal Reserve, Interactive Brokers

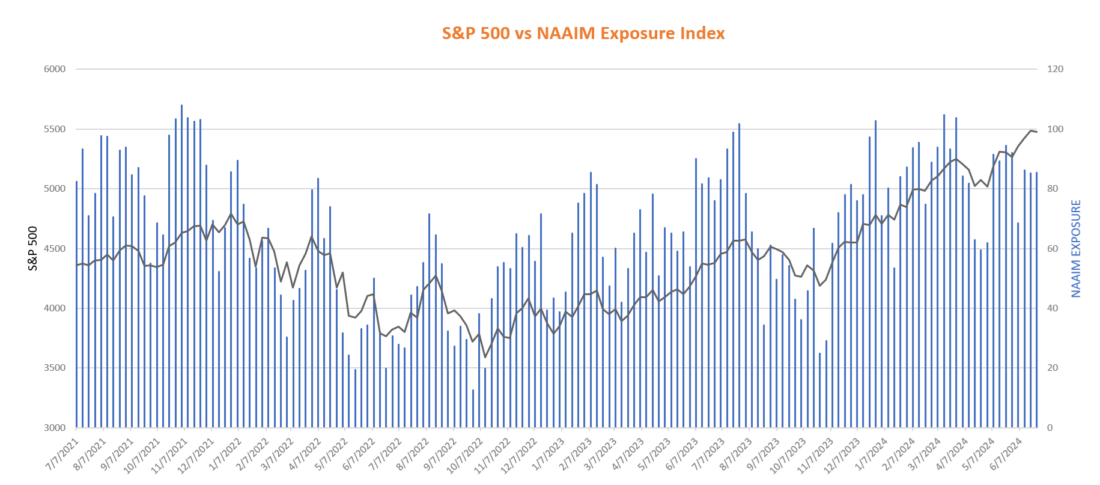

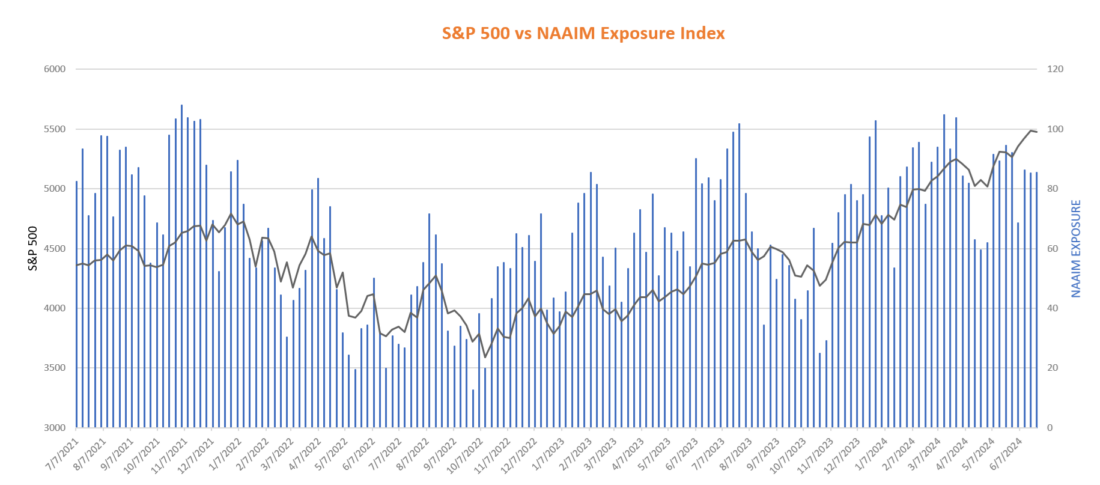

Another favorite chart of mine compares the sentiment readings from the National Association of Active Investment Managers (NAAIM) against SPX. Typically we see sentiment follow the market higher and lower. Of course it does. When surveyed, investors’ answers tend to reflect what they have already done rather than how they intend to invest. Interestingly, NAAIM sentiment has declined in recent weeks even as SPX ground higher:

Sources: NAAIM, Interactive Brokers

There are some important questions that require answers on the political, monetary and sentiment fronts. But don’t expect too many answers during the holiday-shortened coming week. Instead, the adage “don’t short a dull tape” is more likely to be relevant in the coming days.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

Disclosure: Options Trading

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more information read the "Characteristics and Risks of Standardized Options" also known as the options disclosure document (ODD) or visit ibkr.com/occ

THIS is first time I’ve seen/noticed that this writer gave such credit, as I have extolled on this space repeatedly, that inflation follows oil prices; for OIL is really the only quick reference point needs to see to guage inflation affecting the consumer. Also, though it seems the big election has started it seems too quick to take a ‘bad’ shoot at THE TRUMP by referring to ‘his preference for tarriff hikes.’ Of course, there’s no mention of HIS (proper grammar) history of holding China in check while after his ‘passing’ from office the cries against China continually rose. Not being particularly pro TRUMP nor against, this is just an example as in the past the media jumped on the man before he even took office. As I have constantly said, this man could find a cure for cancer and the media would not give him any credit.