For the five trading sessions that spanned Sep 30 to Oct 6, the Straits Times Index (“STI”) gained 1.2 per cent, with the Hang Seng Index gaining 4.3 per cent and the FTSE Bursa Malaysia KLCI gaining 1.0 per cent.

Overall, institutions were net buyers of Singapore stocks for the five sessions ending Oct 6, with more than S$110 million of net inflows, following the S$200 million of net inflows for the preceding five sessions. DBS Group Holdings, CapitaLand Integrated Commercial Trust, Sembcorp Marine, Oversea-Chinese Banking Corporation, and Genting Singapore led the net institutional inflows for the five sessions.

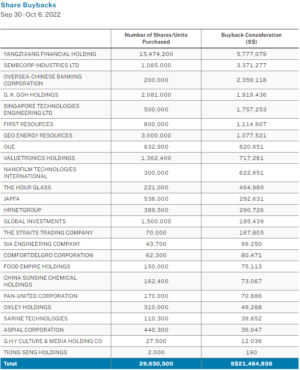

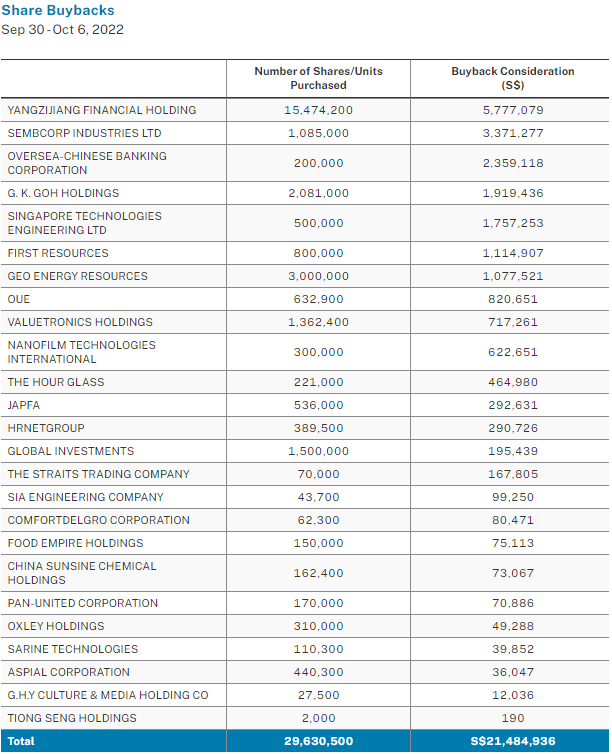

Share Buybacks

There were 25 primary-listed stocks conducting share buybacks over the five sessions ending Oct 6, with a total consideration of S$21.5 million, down from the preceding week’s S$48 million. Yangzijiang Financial Holding led the five-session buyback consideration tally, buying back 15.47 million shares at an average price of 37.3 cents per share. Yangzijiang Financial Holding has bought back 5.51 per cent of its issued shares (excluding treasury shares) on the current mandate, as of Oct 6.

There were more than 40 primary-listed companies that bought back shares with a total consideration of S$586 million in 3Q22, which was down from the S$657 million in consideration filed for 2Q22, but up from the S$241 million in consideration filed for 3Q21.

Director and Substantial Shareholder Transactions

The five trading sessions saw more than 70 changes to director interests and substantial shareholdings filed for more than 40 primary-listed stocks. This included 25 company director acquisitions with one disposals filed, while substantial shareholders filed seven acquisitions and three disposals.

Yanlord Land Group

On Sep 28, Yanlord Land Group Independent Non-Executive Director Hong Pian Tee acquired 100,000 shares at 97.0 cents per share. This increased his total interest in the real estate developer from 0.04 per cent to 0.05 per cent. Mr Hong Pian Tee was a Partner of PricewaterhouseCoopers from 1985 to 1999 prior to his retirement on December 31, 1999. His experience and expertise are in corporate advisory, financial reconstruction, and corporate insolvencies since 1977. He has been a Corporate/Financial Advisor to clients with businesses in Singapore and Indonesia and in addition was engaged to restructure companies with operations in Taiwan, Indonesia and Malaysia and serves on the boards of other companies listed in Singapore. Yanlord Land Group focuses on developing high-end integrated commercial and residential property projects in strategically selected high-growth cities in the People’s Republic of China (“PRC”) and Singapore. Currently, the Group has an established presence in 20 key high-growth cities within the six major economic regions of the PRC.

Mapletree Pan Asia Commercial Trust

On Sep 30, MPACT Management Ltd Independent Non-Executive Director Lilian Chiang Sui Fook acquired 30,000 units of Mapletree Pan Asia Commercial Trust (MPACT) at S$1.70 per unit. As the Senior Partner of Deacons and the Head of its Property Department, she has extensive experience in all types of real estate related transactions. MPACT will report its financials for its 1H23 (ended 30 Sep) after the close of trading hours on Oct 27.

JB Foods

Between Sep 29 and 30, JB Foods CEO Tey How Keong acquired 113,400 shares at an average price of 49.6 cents per share. With a consideration of S$56,265, this increased his total interest in the global cocoa ingredient producer from 46.84 per cent to 46.88 per cent. Mr Tey was appointed to the Board in January 2012 and is responsible for the overall strategic, management and business development of the Group. Mr Tey has over 25 years of experience in the cocoa business. He started his career in the cocoa business in November 1988 as sales manager of JB Cocoa Group Sdn Bhd. In August 1989, he was appointed as a director of Guan Chong Cocoa Manufacturer Sdn Bhd, a position which he remained in until October 2003 and played an active role in setting up its cocoa processing plant in Pasir Gudang.

Keppel DC REIT

On Oct 4, Keppel DC Reit Management Pte Ltd non-executive director Thomas Pang Thieng Hwi acquired 13,000 units of Keppel DC REIT at an average price of S$1.64 per unit. With a consideration of S$21,320, the acquisition increased Mr Pang’s direct interest in the REIT to 97,188 units, which represents 0.01 per cent of the total number of issued units. This followed his acquisition of 13,800 units at S$2.15 per unit between Feb 4 and 7. Mr Pang is currently Executive Director and the CEO of Keppel Telecommunications & Transportation Ltd (Keppel T&T), a position he has held since July 2014. Prior to that, from June 2010 to June 2014, he was CEO of Keppel Infrastructure Fund Management Pte Ltd, the trustee-manager of Keppel Infrastructure Trust.

As of June 30, Keppel DC REIT maintained S$3.5 billion of Assets Under Management (AUM), through 21 data centres across nine countries, with 70 per cent of the AUM based in Asia Pacific and 30 per cent of the AUM based in Europe. In August, the Manager maintained there was more than S$2 billion of potential data centre assets for acquisitions that were under development and management through Keppel T&T hand Keppel’s private data centre funds. Keppel T&T has granted the Rights of First Refusal (ROFR) to Keppel DC REIT for future acquisition opportunities of its data centre assets.

Samudera Shipping Line

On Sep 30, Samudera Shipping Line executive director and CEO Bani Maulana Mulia acquired 25,800 shares at 81.5 cents per share. This followed his acquisitions of 25,800 shares at 81.5 cents per share on Sep 19 and 97,600 shares at S$1.02 per share between Aug 25 and Aug 26, and 49,100 shares at S$1.02 per share between Aug 18 and Aug 19. He maintains a 0.65 per cent direct interest in Samudera Shipping Line, which is primarily engaged in container shipping transportation of cargo in the Asian region. Mr Bani was appointed group CEO in September 2020 and is responsible for the group’s strategic direction, growth and day-to-day operations. He is also the president director of Samudera Indonesia.

Sasseur REIT

On Sep 30, Sasseur Asset Management Pte Ltd Lead Independent Director Gu Qingyang acquired 30,000 units of Sasseur REIT at 70.0 cents per unit. This took his direct interest in the first outlet mall REIT to be listed in Asia to 342,500 units, which represents a 0.03 per cent direct interest. Dr Gu has been an Associate Professor of the Lee Kuan Yew School of Public Policy of the National University of Singapore since August 2009, where he conducts lectures on the Chinese economy, economics of the public sector and urban development. He has been an economic adviser to some provincial and municipal governments in China. As economic adviser, he provides advice to the Chinese governments for economic development of new zones. Sasseur REIT’s initial portfolio of four quality retail outlet mall assets strategically located in fast-growing cities in China such as Chongqing, Kunming and Hefei, with a combined net lettable area of 310,242 square meters.

A-Sonic Aerospace

On Oct 3, A-Sonic Aerospace CEO Janet LC Tan acquired 15,952 shares for a consideration of S$8,546, at an average price of 53.6 cents per share. This took her direct interest in the company from 60.58 per cent to 60.60 per cent. She has gradually increased her total interest in A-Sonic Aerospace from 53.35 per cent at the end of 2018.

LHT Holdings

On Sep 29, LHT Holdings managing director, Yap Mui Kee, acquired 12,300 shares for a consideration of S$8,364. At an average price of 68.0 cents per share, this took her direct interest in the manufacturer of high-quality wooden pallets, boxes, and crates from 15.15 per cent to 15.17 per cent. Ms Yap has gradually increased her direct interest in LHT Holdings from 14.12 per cent in August 2021.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted October 9, 2022 – Increasing Number of Real Estate Plays Among Director Acquisitions

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.