EXECUTIVE SUMMARY

- The stock of this global supplier of gaming equipment, lottery, digital betting systems and technology solutions stock popped 9% on 3Q21 results, We are raising guidance.

- Strong quarter featured gains in all business units including newly formed digital.

- Dividend restored, cash flow and debt reduction goals continue ahead of targets.

DETAILS

Investors in global gambling shares now approaching year end decisions about portfolio adjustments face a challenge of separating current headwinds from tailwinds associated with the pandemic. In the three most dominant global regions for gaming, i.e, Asia, US and the EU we see conflicting signals.

In Asia, we see real evidence of pent up demand bursting at the seams yet suppressed due to continuing travel bans and protocols, none more damaging at the moment, than Beijing’s zero tolerance policy toward Covid. This is despite China’s claim of expecting near 90% of its population to be vaccinated by year’s end. They persist in the zero tolerance policy. This keeps travel bans in place that severely reduces footfall in all casino jurisdictions, most dramatically to Macau.

We have noted that even the most isolated, relatively small outbreaks of new cases in China, brings down the hammer of lockdowns on travel to Macau, the Philippines, South Korean and other jurisdictions all of which had a powerful growth surges going pre-pandemic.

So the potential prolongation of a recovery cycle previously believed to have by now, shown robust growth, has stalled. This has kept many investors wary of being long now on these shares in the face of what are still considered to be headwinds out of China. Yet these companies have all posted revenue gains against pandemic lows, most maintain more than adequate cash reserves and those committed to major capex expansions have continued those programs.

In the UK and the EU we see a mixed picture. While the brick and mortar casino business there is relatively modest, the digital side of the business in both online casino and sports betting has fared better. Better yet has been the performance of lotteries where clearly the ability to buy either scratch and play cards or lottery tickets from terminals is not materially hampered by the lingering threats of the pandemic.

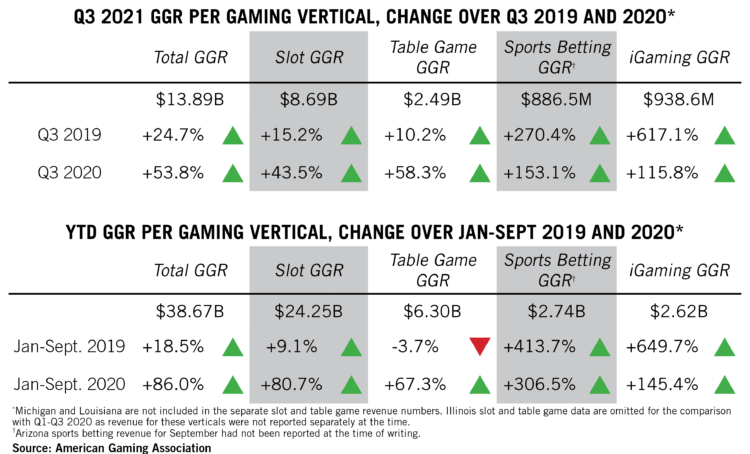

In the US, we see a far brighter picture. With an estimated 63% of the US population vaccinated to date, states are opening at a steady rate. We see record revenues both in core markets like Las Vegas as well as regions in the 40 states where casino gambling is legal. According to figures from the American Gaming Association, 3Q21 gaming revenues hit an all- time record US$13.89B. The Las Vegas Strip alone hit an all-time high for the town in the quarter, posting US$2b in revenue. Online casino and sports betting revenue for the nine months reached US$5.3b up 200% y/y led by sports betting.

Click here to read the full article

—

Originally Posted on November 12, 2021 – International Game Technology: Strong 3Q21 Performance Shows Recovery in All Gaming Segments

Disclosure: Smartkarma

Smartkarma posts and insights are provided for informational purposes only and shall not be construed as or relied upon in any circumstances as professional, targeted financial or investment advice or be considered to form part of any offer for sale, subscription, solicitation or invitation to buy or subscribe for any securities or financial products. Views expressed in third-party articles are those of the authors and do not necessarily represent the views or opinion of Smartkarma.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Smartkarma and is being posted with its permission. The views expressed in this material are solely those of the author and/or Smartkarma and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.