Those are the enthusiastic opening remarks of Carsten Spohr, CEO of Deutsche Lufthansa, in the European airline’s earnings report for 2022, released last Friday.

“Lufthansa is back.”

Those are the enthusiastic opening remarks of Carsten Spohr, CEO of Deutsche Lufthansa, in the European airline’s earnings report for 2022, released last Friday.

I think it would be just as accurate to say that commercial aviation in general is back, with attractive investment opportunities.

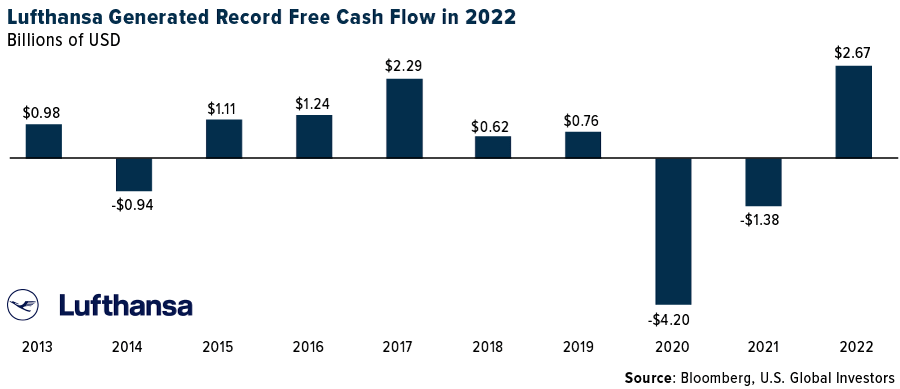

Spohr reported that Lufthansa, Europe’s largest carrier group by revenue, achieved an “unprecedented turnaround” in 2022 on the back of increasing demand for air travel. Revenue of USD$34.5 billion was almost double what it collected in 2021, while free cash flow came in at $2.6 billion, the highest annual amount in the German company’s history. Shares were up approximately 5.3% in intraday trading on the news.

Lufthansa went on to announce that it ordered 22 new long-haul aircraft from Airbus and Boeing, the company’s largest order since 2013.

As I’ve said before, as an investor, I like to see when a company invests in itself. It tells me that management is optimistic about the future and is positioning the company for growth.

That’s exactly what airlines are doing around the globe right now. According to Airlines for America (A4A), U.S. carriers are investing a record amount in new aircraft, equipment, information technology and more. Capital expenditures are forecast to hit $27.0 billion this year, which would be significantly higher than the $21.2 billion airlines are estimated to have spent in 2022.

More Bang For The Buck

Lufthansa’s blockbuster report is just the latest signal that commercial aviation, one of the hardest-hit industries during the pandemic, may be ready to make a landing again in investors’ portfolios.

Travel demand is surging as Europe, China and other key markets have dropped travel restrictions, and in the interim, carriers have adapted by streamlining operations, eliminating unprofitable routes and more.

The actions appear to be working. Even though total passenger volume hasn’t fully recovered to pre-pandemic levels, operating revenues are soaring to new record highs, according to Bureau of Transportation Statistics (BTS) data.

Domestic airlines have managed this without having to cut jobs at the same pace as the tech industry. In fact, passenger airlines in the U.S. currently have the largest workforce in 20 years, according to A4A.

Staff members are also producing more bang for their buck. In the chart below, you can see that sales-per-employee for select carriers were higher in the past 12 months than in 2019, before the pandemic. This indicates that the decision not to sacrifice customer service in the name of cost-cutting has been financially rewarding for airlines.

To me, that’s a win-win-win-win: a win for airlines, win for employees, win for customers and a win for investors.

“Aviation Is Investible Again”

“Aviation is investible again,” says Jun Bei Liu, a portfolio manager at Sydney, Australia-based advisory firm Tribeca Investment Partners. Speaking to Bloomberg last month, Jun Bei said she believes Asian airlines “are going to go through the roof.”

I’ve highlighted Asian airlines in recent weeks, particularly after the Chinese government announced it was lifting pandemic-era quarantine requirements for travelers entering the country. I still agree with Jun Bei and others in forecasting a dramatic travel rebound in Asia this year, even though Chinese demand so far hasn’t been as strong as unexpected.

Perhaps surprisingly, shares of European carriers are leading those in Asia and the U.S. I say “surprisingly” because there are so many negative headlines about airlines right now, but often these headlines don’t accurately reflect what’s really happening. European airlines rose over 41% in the six months through the end of February, compared to Asian airlines, up 7%, and U.S. airlines, down slightly at negative 1%, over the same period.

Record-High Premiums On American Eagle Silver Coins

Switching gears, I want to briefly address something that came to my attention in the past couple of days. Kitco News’ Neils Christensen wrote a thought-provoking piece on American Eagle silver coins, sales of which slumped last year compared to sales in 2021. The U.S. Mint sold less than 16 million one-ounce silver coins in 2022, or 43.5% less than it did in the previous year.

As Neil points out, this decrease can’t be due to a lack of investor demand since silver bullion sales were solid elsewhere around the world in 2022. Australia’s Perth Mint, for instance, sold a record number of ounces.

Instead, the sales slump can be attributed to the 70% premium for the American Eagle coins. According to Neil, that’s a record-high premium. At today’s prices, then, a one-ounce American Eagle coin that contains $21 worth of silver is really priced at $35.

Neil explains why this is happening. To make its coins, the U.S. Mint buys silver “blanks” from private mints, and supply can be limited. Some people have suggested that the Mint should make its own silver blanks.

I’ll go a step further and suggest that precious metal miners should get in on this business. Imagine if they began pressing blanks and selling them to the U.S. Mint at a 70% premium. Would their share prices go up 70% as a result? I can’t say, but what I do know is that producers, particularly the juniors, are extremely undervalued right now.

Join me and portfolio manager Ralph Aldis on Wednesday, March 29, as we discuss investing in gold. Email me at info@usfunds.com to register!

—

Originally Posted March 6, 2023 – Is Commercial Aviation Ready To Make A Landing In Investors’ Portfolios?

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Holdings may change daily. Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of (12/30/22): Deutsche Luftsansa AG, Frontier Group Holdings Inc., United Airlines Holdings Inc., Allegiant Travel Co., Alaska Air Group Inc., American Airlines Group Inc., Southwest Airlines Co.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.