After discussing Nvidia’s (NVDA) outsized role in the market’s psyche in the lead-up to its earnings report, it seems prudent to offer a final follow-up amidst the stock’s latest post-earnings rally. Quite frankly, if you told me that NVDA would be up over 10% by midday while the S&P 500 (SPX) is up only slightly, I would have thought that impossible. Like the mythical Titan, NVDA is the Atlas holding up the broader market.

The results from NVDA offered the usual – raising guidance after beating last quarter’s raised guidance. This is becoming habit for them, but it is important to remember just how wild of a run that they are on. Revenues are up over 2.5X on a year-over-year basis, causing EPS to be up over fourfold in that time. The rises are less eye-popping on a quarter-over-quarter basis, but let’s keep in mind that 18% growth in a quarter is still quite, quite impressive. Management confirmed that there is no apparent slowdown in the demand for the chips that power artificial intelligence. Throw in the magic phrase “stock split”, and we have the rally that we see this morning.

(A quick digression about stock splits. It is the stock market’s way of making change, in NVDA’s case ten $1 bills for a $10. There may be additional utility for having small bills, but how much? Splits do make expensive stocks more affordable, increasing access for small investors. But in an era where fractional shares are readily available and traders large and small utilize options for exposure – and when NVDA is already the perennially most active stock and option on the IBKR platform – it seems more cosmetic than a measure that creates demand.)

NVDA’s rally is helping lead other AI-related stocks higher. We see the PHLX Semiconductor Index (SOX) up over 1%, for example. But the rally is hardly uniform. More components of SOX are down than up as I write this, which coincides with decliners outpacing advancers in the broad market by a wide margin. I need to wonder whether NVDA was a “buy the rumor, sell the news” event for the market as a whole. I also shudder to think what might have transpired if NVDA was a disappointment – or even just “in-line.”

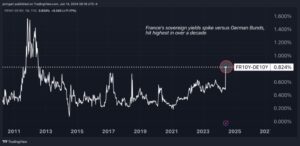

The bond market set the dour mood that we see across much of the market. Yields are about 6-7 basis points higher across the curve, pushing 2-year yields toward 4.94% and 10-years to 4.48%. The key 5% and 4.5% levels are now in play. The proximate cause was a series of PMI reports from S&P Global. The Manufacturing, Services, and Composite results were all well above expectations. Coming on the back of yesterday’s “higher for longer” Fed Minutes, bond traders were in no mood to hear about a strengthening economy. In theory, a stronger economy should be good for companies, and thus stocks, but because we are all so obsessed with the Federal Reserve and other central bank policy makers, we see most stocks trending lower as bond prices fall. Volatility measures, as is their recent wont, seem unperturbed, however.

Our conclusion to yesterday’s piece now seems overblown:

If today’s report from NVDA brings good news, then we might be off to the races once again. If not, buckle up. No pressure Mr. Huang…

NVDA’s stock is off the races, even if my implication was that it would extend to the markets as a whole. But, Atlas-like, NVDA is indeed holding up major market indices. Good thing that Atlas didn’t shrug yesterday.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.

NVDA slams the market UP as it increases Revenues by 50% for its new AI based Chip…and now makes up 5% of SPY !

Ridiculous…but real in its revenue. BUT the companies that are buying NVDA chips, head over heels, are spending Billions…BUT are they going to make that much more Revenues themselves$ ? MSFT, AMZN, META, CRWD, CRM, AAPL, GOOGL…all of these huge Tech companies are spending a lot of $$ BUT will it increase their Revenues..?

Answer is probably none in the immediate term, maybe a bit in the near term, and MAYBE a lot in the Long term. BUt in the immediate term its costing a lot more in expenses….Sooo…the big Tech companies may NOT report huge Revenue increases for a while….

Add to this…when or IF, is the FEd Res going to cut int rates OR are they going to stay firm at 5%….also…will Fed have to raise rates because of increase in inflation??

If NVDA is Atlas, could TSLA be Taggart Transcontinental ?