S-REITs have been in the spotlight over the past week due to recent banking news and ahead of the Federal Open Market Committee (FOMC) meeting on Mar 21-22.

The majority of traders in the market are expecting another 0.25 percentage point interest rate increase.

A key metric for Reits is the gearing ratio, also known as aggregated leverage, which is a metric closely monitored by investors and often used to access a Reit’s financial leverage.

It is the ratio of a Reit’s total debt to total assets. A lower gearing ratio could point to more capacity to take on more debt when needed, while a higher ratio could lead to credit concerns, especially during an economic downturn.

As of end-February this year, the 40 actively traded S-Reits and Property Trusts had an average gearing ratio of 37.7 per cent, below the regulatory limit of 50 per cent if the minimum interest coverage ratio (ICR) is at least 2.5 times, imposed by the Monetary Authority of Singapore (MAS).

If the ICR is below 2.5 times, the maximum allowable limit is at 45 per cent. This limit was last increased in April 2020, to provide the sector with more flexibility to manage their capital structure during the pandemic.

Among the 40 trusts, all of them have gearing ratios within regulatory limits and half of them, or 20 trusts, have ratios at or below the sector’s average.

In the first two months of this year, these 20 have generated average total returns of 6.6 per cent, outperforming the sector’s average total returns at 4.0 per cent.

In a recent SGX Research market update in January, which looked at comparative performances and fund flows within the sector since the end of 2021, debt-to-asset ratios have anecdotally held some level of investor influence.

Also, ahead of the US FOMC commencing its Fed Funds Rate tightening on Mar 17, 2022, on average, close to 75 per cent of S-Reits and Property Trusts’ current debts were entered directly in fixed rates or hedged through floating-to-fixed interest rate swaps.

Taking a look at the ICRs available and reported in latest filings, average ICR for the sector stands at around 4.7 times. ICR is used to determine how easily a company can pay interest on its outstanding debt.

It is typically calculated as earnings before interest, tax, depreciation and amortisation (Ebitda) divided by interest expense.

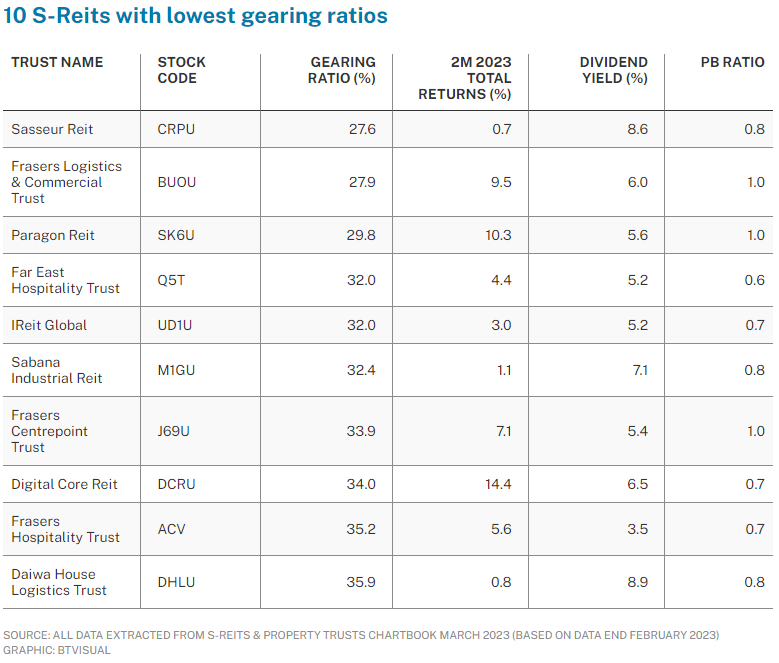

The 10 trusts with the lowest gearing ratios reported are Sasseur Reit, Frasers Logistics & Commercial Trust, Paragon Reit, Far East Hospitality Trust, IReit Global, Sabana Industrial Reit, Frasers Centrepoint Trust, Digital Core Reit, Frasers Hospitality Trust, and Daiwa House Logistics Trust.

On average, these 10 have an average aggregated gearing ratio of 32.1 per cent.

According to the MAS Code on Collective Investment Schemes (latest revised Mar 9, 2023) on its website for property funds, the aggregate leverage limit is not considered to be breached if due to circumstances beyond the control of the manager such as a depreciation in the asset value of the property fund or any redemption of units or payments made from the property fund – if the aggregate leverage limit is exceeded as a result of these examples, the manager should not incur additional borrowings or enter into further deferred payment arrangements.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted March 20, 2023 – REIT Watch – 10 S-REITs with lowest gearing ratios average 32% gearing

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.