The year 2023 was a challenging one for real estate investment trusts (Reits). The key drivers of the sector’s performance continued to be elevated interest rates and expectations of higher and for longer rates.

Higher interest rates would lead to higher borrowing costs, lower property valuation and potentially lower distributions for Reits.

It would also make Reits a less attractive asset class compared to other assets with higher yields such as fixed income securities or cash deposits.

As a result, the iEdge S-Reit Index declined 9.0 per cent in total returns in the first 10 months of the year.

However, along with expectations that interest rates have peaked, the S-Reits sector saw one of its best months in three years in November, gaining 7.4 per cent in total returns.

This momentum continued into December.

The US Federal Reserve held interest rates steady for the third consecutive time during its last meeting of the year on Dec 13, and investors are now looking towards potential rate cuts in the coming year.

Following the meeting, the iEdge S-Reit Index gained 3.8 per cent across the Dec 14 trading session.

This brought its December month-to-date total returns to 7.1 per cent and finally turned green for the year, with year-to-date total returns at 4.7 per cent.

S-Reits with office properties in the US continue to see double digit rebounds in December so far.

The top three performers in December month-to-date are Prime US Reit, Manulife US Reit and Keppel Pacific Oak US Reit, averaging 45.2 per cent total returns.

On a year-to-date basis till Dec 14, data centre S-Reits outperformed the broad market with Digital Core Reit (23.7 per cent total returns) and Keppel DC Reit (23.3 per cent) emerging as the top performers.

Beside these two pure-play data centre S-Reits, the three trusts with significant data centre exposure all saw double digit gains this year.

They are Mapletree Industrial Trust (16.6 per cent year-to-date total returns), CapitaLand Ascendas Reit (15.4 per cent) and CapitaLand India Trust (10.4 per cent).

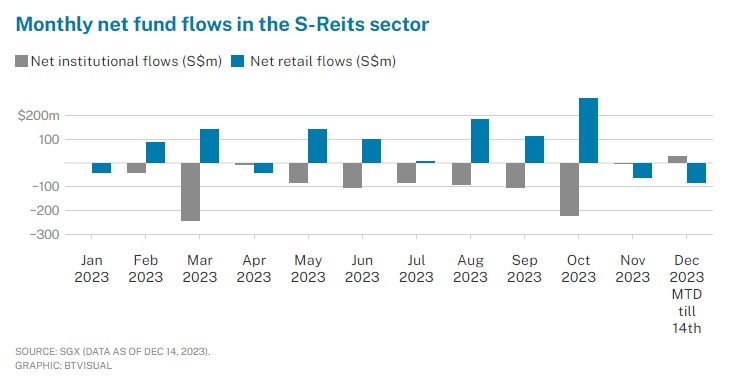

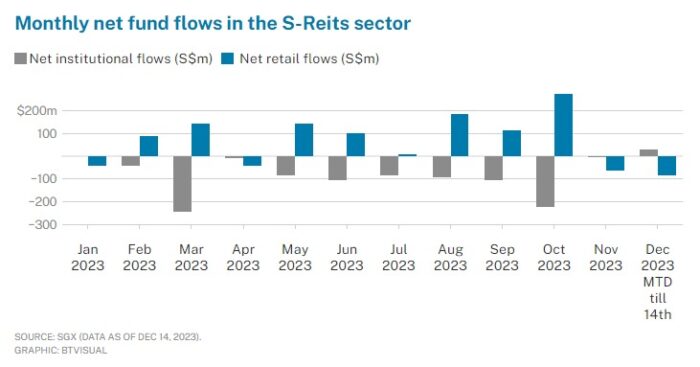

In terms of fund flows, institutional investors net bought about S$12 million worth of S-Reits on Dec 14, a day after the December Federal Reserve meeting.

On a December month-to-date basis, institutional investors net bought more than S$29 million of the sector. The sector had been seeing monthly net institutional outflows since February this year.

The argest net institutional inflows in December thus far were seen in CapitaLand Integrated Commercial Trust, Mapletree Industrial Trust and Suntec Reit, totalling S$39 million.

There were two S-Reits which saw net inflows from both institutional and retail investors – Paragon Reit and Sabana Industrial Trust.

From a fundamental perspective, while rising interest rates put pressure on Reits’ gearing ratios, S-Reits managers have been actively managing balance sheet exposures.

Seventeen S-Reits have seen a drop in gearing ratio since the end of 2021, averaging a three-percentage point drop.

Among those that saw higher gearing ratios, they averaged a four percentage-point increase. Currently, 26 S-Reits maintain gearing ratios below 40 per cent.

—

Originally Posted December 18, 2023 – REIT Watch – 2024: Inflection point for S-Reits?

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.