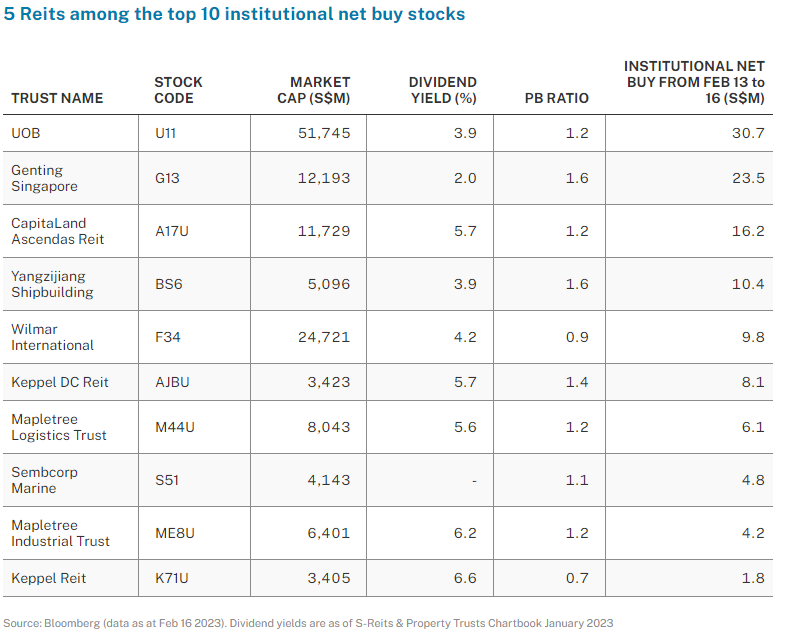

Five Singapore Reits took up spots among the 10 stocks which recorded the largest institutional net inflows for most of last week. The five S-Reits were CapitaLand Ascendas Reit, Keppel DC Reit, Mapletree Logistics Trust, Mapletree Industrial Trust, and Keppel Reit.

Keppel DC Reit and Mapletree Industrial Trust were also among the three best performing STI stocks in the week with total returns of 1.5 per cent and 1.3 per cent respectively, just after Yangzijiang Shipbuilding at 4 per cent total returns.

CapitaLand Ascendas Reit (CLAR) in its full year FY2022 results reported 10.3 per cent year-on-year (yoy) growth in gross revenue to S$1.35 billion, mainly attributed to contributions from a built-to-suit development in Singapore and newly acquired properties during FY2021 and FY2022. In 2022, CLAR completed S$223.4 million worth of acquisitions, and funds were deployed into the logistics sector in the US and Australia.

In Singapore, the redevelopment of UBIX, a premium B1 industrial property in the Ubi industrial hub obtained TOP in January 2022 and the Reit has managed to secure a higher base rent compared to the original two light industrial properties prior to redevelopment.

The Reit’s distribution per unit (DPU) for FY2022 rose 3.5 per cent yoy to 15.798 cents. Its portfolio occupancy has crossed a 10-year high of 94.6 per cent and the Reit managed to achieve rental reversions of 8 per cent for leases renewed.

Keppel DC Reit in its full year FY2022 update announced 2.3 per cent higher gross revenue and 7.7 per cent increase in distributable income on a yoy basis. The Reit attributed its resilient performance to accretive acquisitions and active asset management initiatives. In 2022, it expanded its presence in London, one of the top global data centre hubs and in Guangdong, one of China’s most established data centre markets. In 2022, Keppel DC Reit had grown its assets under management to S$3.7 billion, from S$3.4 billion a year earlier. The Reit’s FY2022 DPU stood at 10.214 cents, representing a 3.7 per cent growth yoy.

Keppel DC Reit was among the two S-Reits, aside from Frasers Logistics & Commercial Trust, to lead the STI in early 2023 through to Feb 9, despite being among the three least performing STI constituents in 2022.

Mapletree Logistics Trust in its latest Q3FY22/23 results reported that its gross revenue for the quarter rose by 8 per cent yoy to S$180.2 million, mainly due to accretive acquisitions completed in Q1FY22/23 and FY21/22. Portfolio occupancy increased to 96.9 per cent, driven by properties in Singapore, China and Japan, and average rental reversion achieved for the period was 2.9 per cent. The amount distributable to unitholders was S$107.1 million, 10.8 per cent higher yoy while DPU grew 1.9 per cent to 2.227 cents on an enlarged basis. SGX RESEARCH

The writer is a research analyst at SGX. For more research and information on Singapore’s Reit sector, visit sgx.com/research-education/sectors for the monthly S-Reits & Property Trusts Chartbook.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted February 20, 2023 – REIT Watch – 5 S-Reits among top 10 institutional net buy stocks for the week

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.