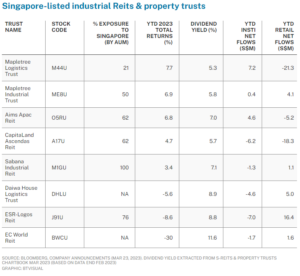

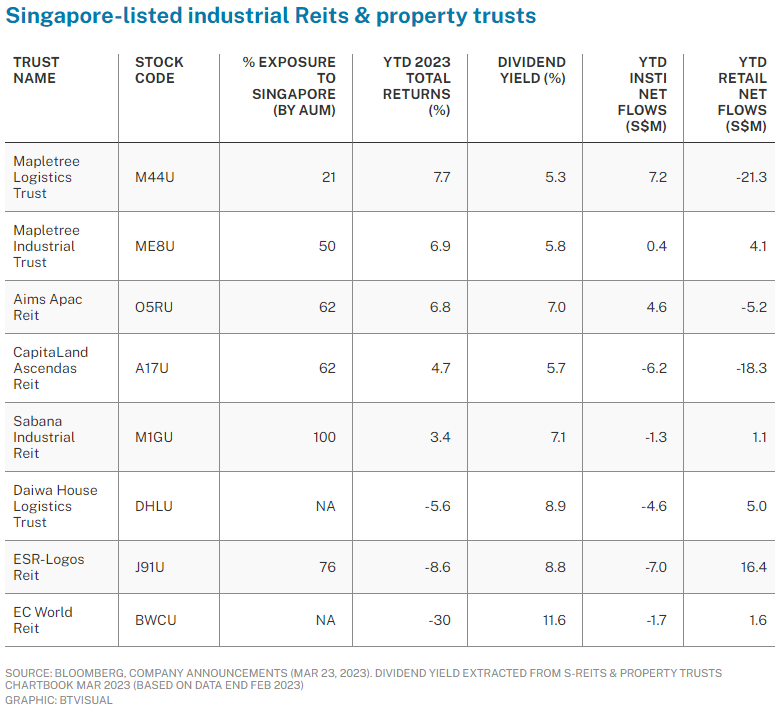

SINGAPORE’S February 2023 industrial production fell 8.9 per cent year on year (yoy), down from 3.1 per cent in January marking the fifth month of contraction. Six out of the eight industrial S-Reits have exposure to Singapore industrial properties and averaged 3.5 per cent total returns in the year-to-date till Mar 23, following an 8.3 per cent decline in 2022.

Mapletree Logistics Trust (MLT), Aims Apac Reit (AAReit) and Mapletree Industrial Trust (MIT) received the most institutional net inflows this year-to-date totalling S$12 million, while ESR-Logos Reit (E-Log), MIT and Sabana Industrial Reit received the most net retail inflows totalling S$22 million.

MIT was the only S-Reit which garnered both net institutional and net retail inflows during the period.

Most of them acknowledged macro headwinds such as rising energy prices and interest rates which are adding cost pressures to operations. Some Reits have taken cost-saving measures such as hedging borrowings to fixed rates, as well as initiatives to reduce overall utility consumption.

Mapletree Logistics Trust has 20.7 per cent of its assets under management (AUM) located in Singapore. Its latest Q3 FY22/23 gross revenue rose by 8 per cent yoy to S$180.2 million, mainly due to accretive acquisitions completed in Q1 FY22/23 and FY21/22. This resulted in a 7.3 per cent yoy increase in net property income (NPI).

It achieved positive rental reversion in Q3 FY22/23 of 2.9 per cent, with positive rental reversions registered in most markets across MLT’s portfolio.

Aims Apac Reit has a diversified portfolio of assets of which 62.4 per cent (by value) is located in Singapore. Q3 FY23 gross revenue and NPI increased 14.1 per cent and 14.0 per cent yoy respectively. This was mainly driven by higher rental income from Singapore and Australia properties and full quarter revenue contribution from the acquisition of Woolworths Headquarters. AAReit noted positive rental reversion for the quarter at 21.2 per cent, contributed mainly from the logistics and warehouse segment which represented 81.6 per cent of leases renewed.

MIT has half of its AUM located in Singapore and in its latest results release, reported that gross revenue and NPI for Q3 FY22/23 rose 5.0 per cent and 4.9 per cent yoy to S$170.4 million and S$128.8 million respectively, mainly driven by the contributions from new leases across various clusters in its Singapore portfolio.

ESR-Logos Reit, which has 76.3 per cent exposure to Singapore by AUM, reported full year FY22 results of which gross revenue increased 42.3 per cent yoy to S$343.2 million, primarily due to incremental contributions from ARA Logos Logistics Trust following the completion of the merger in April 2022. On the back of higher gross revenue, NPI increased 41.0 per cent to S$244.2 million. E-Log also recorded a positive rental reversion of 11.8 per cent.

Sabana Industrial Reit, the only industrial S-Reit with all of its assets in Singapore, saw FY22 gross revenue rise by 15.9 per cent yoy, while NPI rose 2.6 per cent yoy.

Over the year, it recorded positive rental reversions of 12.9 per cent and has strengthened tenant mix, which now includes a higher proportion of tenants from more resilient sectors such as electronics, logistics, food & beverage, retail and healthcare.

REIT Watch is a weekly column on The Business Times, read the original version

—

Originally Posted March 27, 2023 – REIT Watch – Industrial S-Reits record positive rental reversions

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Alternative Investments

Alternative investments can be highly illiquid, are speculative and may not be suitable for all investors. Investing in Alternative investments is only intended for experienced and sophisticated investors who have a high risk tolerance. Investors should carefully review and consider potential risks before investing. Significant risks may include but are not limited to the loss of all or a portion of an investment due to leverage; lack of liquidity; volatility of returns; restrictions on transferring of interests in a fund; lower diversification; complex tax structures; reduced regulation and higher fees.