Stocks – ROKU, PYPL, BABA

Macro – SPY, HYG, LQD

If you were only watching the stock market today, then you missed the carnage that continues in the bond market and is now spilling into the corporate and high yield markets. The HYG and LQD ETFs fell again today, and both ETFs saw considerable damage.

The LQD today fell below $131 and may now be very well heading towards $130, a sign that rates on corporate bonds are now on the rise.

All of this tells us that financial conditions are now tightening in anticipation of a Fed that will be more hawkish in 2022. Tomorrow may prove to be the nail in the coffin for the doves, with the Fed minutes coming out at 2 PM. Fed governors Clarida and Bostic may have provided a message when they recently said a faster taper may be warranted or something to that effect. Tomorrow, I expect the Fed minutes to indicate that a faster taper will be discussed at the next FOMC meeting. Given the Fed left the optionality for a faster taper in the FOMC statement from the November meeting, it seems highly likely the language in the minutes will be decisive. That will give the market until December 15 at 2 PM to break Powell into submission and not taper faster. Especially when today’s flash PMI data was weaker than expected and indicated the US economy slowed in November.

It may not seem evident when looking at the broader averages, but in the bond ETFs, the dollar index, and the Treasury market, you see massive shifts taking place. All of this is pointing to tightening financial conditions, which are not favorable for stocks.

S&P 500 (SPY)

As I noted in today’s midday write-up for readers of Reading The Markets, the S&P 500 has now seen its RSI, MACD turn lower, a sign of declining momentum. Additionally, the advance/decline line continues to plunge. Not exactly indicators that suggest the market is ready to race higher.

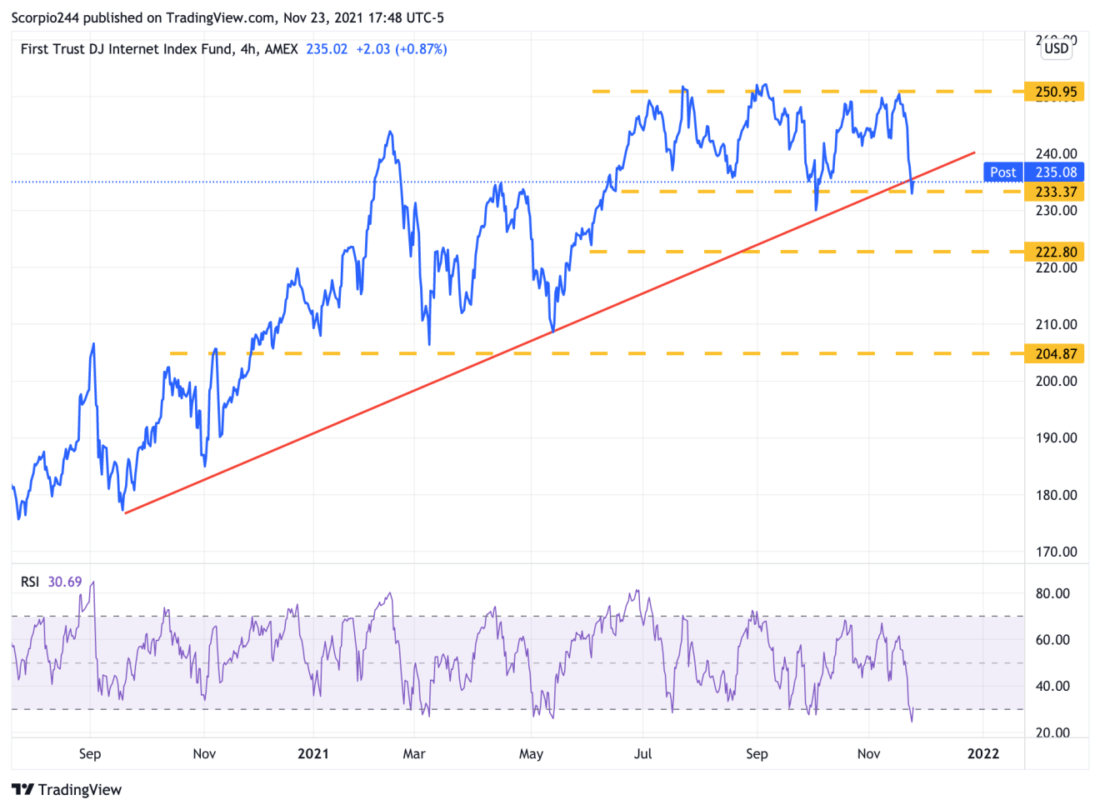

DJ Internet (FDN)

More importantly, look at the DJ Internet Index (FDN); today is closed on support at $233, and more importantly, right on an uptrend that dates back to September 2020.

PayPal (PYPL)

PayPal is hanging for dear life around this $190 region. It needs to hold here, or this thing is toast. Last week, I noted some bullish option buying in this stock, but I don’t know. I’m getting concerned about it.

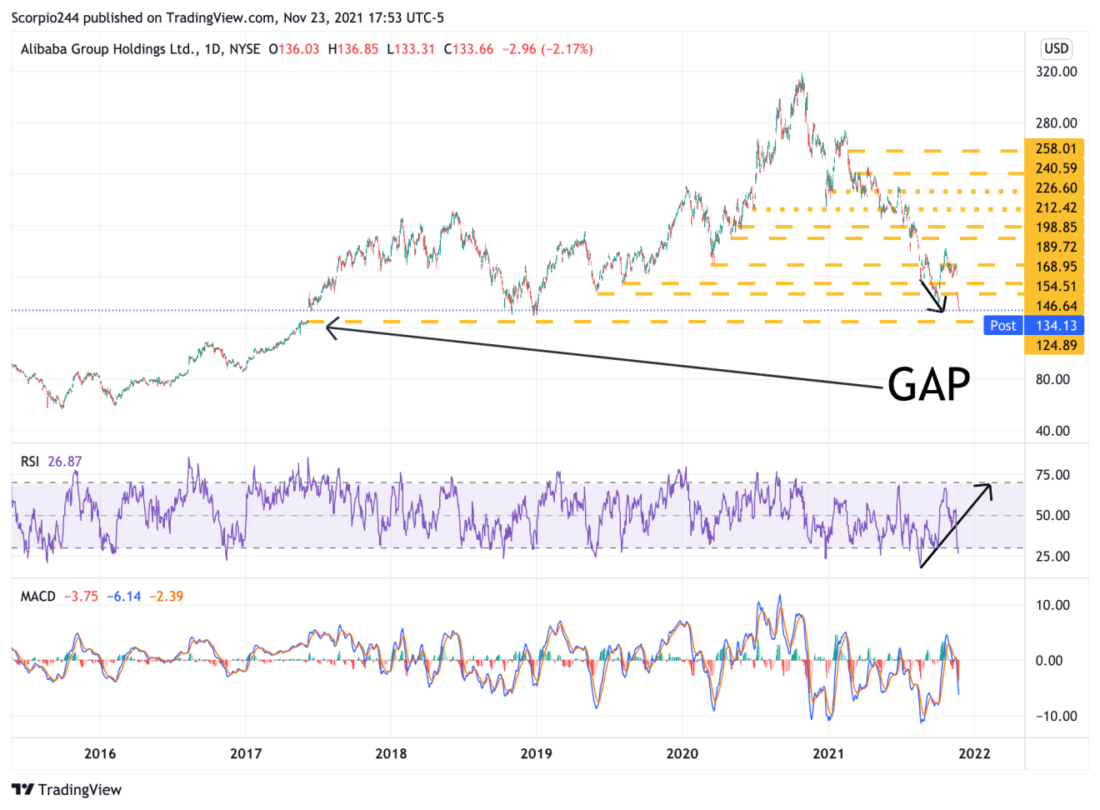

Alibaba (BABA)

Today, I noted that Alibaba looks like it wanted to fill the gap back in 2017. That’s just brutal.

Roku (ROKU)

Well, Roku is now at the point where it is $228. It could be a do or die moment for the stock as it sinks into oblivion on its way to $193 and then $151. The RSI doesn’t tell me this stock is close to a bottom yet. It may get a dead cat bounce, but not the bottom.

Originally Posted on November 23, 2021 – Stock Market Volatility Picks Up On November 23 As Financial Conditions Tighten

Disclosure: Mott Capital Management

Mott Capital Management is the portfolio manager for one portfolio offered by Interactive Advisors. Interactive Advisors clients do not invest directly with the Portfolio Managers like Mott Capital Management, and the Managers do not have discretionary trading authority over Interactive Advisors client accounts. The Portfolio Managers on the Interactive Advisors platform simply license their trade data to Interactive Advisors, which then allows its clients to have the same strategy and trading decisions mirrored in their accounts if the Portfolio is in line with their risk score. Portfolio Managers like Mott Capital Management implement their trading philosophy and strategy without knowing the identity of Interactive Advisors’ clients or taking into account these clients’ individualized circumstances.

Mott Capital Management has entered into a Portfolio Manager License Agreement with Interactive Advisors pursuant to which it provides trading data IA uses to offer a portfolio to its investment advisory clients. Mott Capital Management is not affiliated with any entities in the Interactive Brokers Group.

Interactive Advisors is an affiliate of Interactive Brokers LLC.

Pursuant to the Investment Management Agreement between Interactive Advisors and its clients, all brokerage transactions occur through Interactive Brokers LLC, an affiliate of Interactive Advisors. The use of an affiliate for brokerage services represents a potential conflict of interest as Interactive Brokers LLC is paid a commission on trades executed on behalf of Interactive Advisors. Interactive Brokers LLC does not consider this conflict material as it does not sell, solicit, recommend, trade against or otherwise attempt to induce Interactive Advisors to place any orders in any products. Interactive Advisors does not offer services through any other broker-dealer. All trading by Interactive Advisors is self-directed. Interactive Advisors clients acknowledge this potential conflict of interest and authorize Interactive Advisors to execute transactions through Interactive Brokers LLC when they open an Interactive Advisors account. Clients should consider the commissions and other expenses, execution, clearance, and settlement capabilities of Interactive Brokers LLC as a factor in their decision to invest in an Interactive Advisors Portfolio. Interactive Advisors believes it satisfies its best execution obligation by trading its clients’ trades through Interactive Brokers LLC. While there can be no assurance that it will in fact achieve best execution, Interactive Advisors does periodically monitor the execution quality of transactions to ensure that clients receive the best overall trade execution pursuant to regulatory requirements.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Mott Capital Management and is being posted with its permission. The views expressed in this material are solely those of the author and/or Mott Capital Management and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.