Growth at a Reasonable Price, or GARP, has been a popular investment strategy. The term was popularized by Peter Lynch, the manager of Fidelity’s Magellan Fund during the 1980’s. His highly successful strategy was to seek companies that were capable of high future growth at low valuations. His preferred metric was PEG – a company’s Price/Earnings (P/E) ratio divided by its projected growth rate over a reasonable period of time. Lynch had a phenomenal track record, averaging 29% returns during the 13 years that he ran Magellan, leading a wide range of investors to emulate his techniques ever since.

Sharp-eyed readers will realize that GARP and PEG sit at the crossroads of growth and value investing. When we use PEG to identify good GARP candidates, we are seeking stocks with low P/E’s and/or high growth. A low P/E stock is pretty much the definition of a value stock, while a high growth rate is obviously the definition of a growth stock. The challenge is to find a growth stock that is priced like a value stock. A logical place to start would be to look at the universe of value stocks and search for companies that should be able to support higher growth rates than the market is currently anticipating. That is much harder to do in practice than in theory, however. It would be much more efficient to find investments that are working and join the fray. That is the definition of momentum investing.

I suspect that most investors are now simply focusing on growth and momentum above all else. Or more specifically, it seems that growth is being used to justify the momentum that we have seen in growth stocks. I would assert that Growth at a Reasonable Price (GARP) has morphed into Growth at Any Price (GAAP).[i]

For evidence of that theory, consider the following chart:

3 Year Normalized Daily S&P 500 Growth Index (SGX, blue) and S&P 500 Value Index (SVX, white)

Source: Bloomberg

It is quite clear that growth and value stocks moved roughly in tandem for much of the period prior to the Covid crisis. Just before the crisis hit in early 2020, we saw growth begin to outpace value, a phenomenon that continued even as stocks plunged. Since then, the outperformance of growth is stark. Much of the monetary and fiscal stimulus that arose in response to the Covid crisis found its way into equities. It is apparent that much of that money gravitated to growth stocks rather than value shares. In fact, the pace of appreciation of SGX over the past two months is similar to that of last summer, when markets were digesting unprecedented stimuli. Investors clearly want to own growth stocks, and seem to be willing to chase them higher. That leads me to the idea that GARP has been superseded by GAAP.

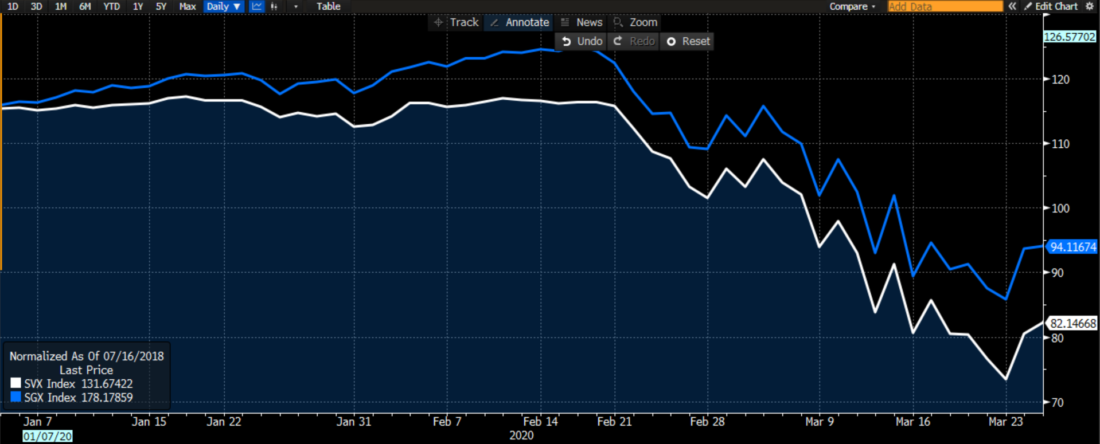

Again, the path of least resistance is to continue to follow the momentum that is benefitting growth stocks. But I see a potential warning signal in the chart. I have enlarged the early 2020 section of the chart above:

Early 2020 Normalized Daily S&P 500 Growth Index (SGX, blue) and S&P 500 Value Index (SVX, white)

Source: Bloomberg

We see a divergence in February 2020, as the Covid crisis was beginning to take root. We see that value stocks moved sideways even as growth stocks pushed on to new highs. In hindsight, it appears that value investors were more concerned about the trouble that was on the horizon than their growth counterparts. Or alternatively, growth stock investors remained enamored with their positive momentum even as warning signs were on the horizon.

Let’s now compare that chart to the present day:

3 Month Normalized Daily S&P 500 Growth Index (SGX, blue) and S&P 500 Value Index (SVX, white)

Source: Bloomberg

The current divergence is quite similar to that of January-February 2020. Since May 2021, when SGX and other growth indices (like NDX, which is dominated by megacap tech stocks) began a sharp advance, we see that SVX has moved sideways and failed to confirm recent highs. Some might find that similarity to be curious, if not eerily familiar.

To be fair, the similarity of the current divergence hardly signals catastrophe ahead. The scope of events of March 2020 were largely unforeseen and certainly unprecedented. But it is quite clear in hindsight that the failure of value stocks to confirm the new highs in growth stocks portended trouble ahead. It is not unreasonable to worry that the current failure of value stocks to confirm new highs in growth could portend concerns among equity investors.

I acknowledge that Growth at Any Price has been a simple and lucrative strategy for well over a year, and I never want to begrudge a successful investment approach. But investors who are engaging in that strategy should consider whether their dedication to GAAP instead of GARP has obscured signals from other important parts of the investment universe.

[i] My use of GAAP in this sense is not to be confused with the more common use of GAAP as Generally Accepted Accounting Principles. Ironically, many of the most popular growth stocks prefer that investors focus on non-GAAP earnings measures.

Disclosure: Interactive Brokers

The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the extent that this material discusses general market activity, industry or sector trends or other broad-based economic or political conditions, it should not be construed as research or investment advice. To the extent that it includes references to specific securities, commodities, currencies, or other instruments, those references do not constitute a recommendation by IBKR to buy, sell or hold such investments. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Interactive Brokers, its affiliates, or its employees.