What’s going on?

Tencent posted mixed results on Wednesday, as the Chinese government forces the emotionally distant tech giant to finally take on its fair share of child care.

What does this mean?

Like Whitney, China believes that children are our future. So in order to teach them well and let them lead the way, the country’s government banned for-profit after-school tutoring last quarter, as well as introduced stricter limits on how long they can play video games – both of which, it argued, were having detrimental effects on kids’ wellbeing.

Tencent knows how they feel: the company – which sells advertising space in its apps and online games – saw its ad revenue grow just 5% compared to the same time last year, as education companies collapsed and kids’ laser-like focus faded. And while its fintech and business services segment – which includes instant messaging app WeChat – posted strong growth, the damage was already done: Tencent’s overall revenue climbed by a weaker-than-expected 13% – the slowest quarterly growth since the company hit the stock market in 2004.

Why should I care?

For markets: China’s still on the agenda.

Most Chinese tech giants’ stocks are listed in the US or Hong Kong, so investors – nervous about government crackdowns on foreign-listed domestic companies – have been steering well clear lately. They’ve not sworn off the country altogether, mind you: data out this week showed international investors were holding around $560 billion worth of Chinese-listed stocks at the end of last quarter – 30% more than the same time last year.

Zooming out: There are bigger fish to fry.

The Chinese government’s mood probably isn’t about to improve: new data has shown that the prices manufacturers pay for materials accelerated by its fastest pace in 26 years last month, as the country continues to be rocked by power and commodity shortages. Those higher costs will probably be passed onto consumers, put a dent in consumer spending, and, ultimately, hamper the country’s economic growth.

—

Originally Posted on November 10, 2021 – Time Out

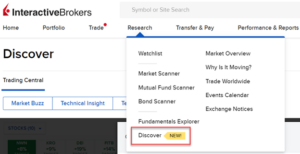

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Finimize and is being posted with its permission. The views expressed in this material are solely those of the author and/or Finimize and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: OTC Securities

An investment in an OTC security is speculative and involves a high degree of risk. Many OTC securities are relatively illiquid, or "thinly traded," which tends to increase price volatility. Illiquid securities are often difficult for investors to buy or sell without dramatically affecting the quoted price. In some cases, the liquidation of a position in an OTC security may not be possible within a reasonable period of time.

Disclosure: Forex

There is a substantial risk of loss in foreign exchange trading. The settlement date of foreign exchange trades can vary due to time zone differences and bank holidays. When trading across foreign exchange markets, this may necessitate borrowing funds to settle foreign exchange trades. The interest rate on borrowed funds must be considered when computing the cost of trades across multiple markets.