For the five trading sessions that spanned Feb 24 to Mar 2, the Straits Times Index (STI) declined 0.9 per cent with the Hang Seng Index gaining 1.0 per cent and the FTSE Bursa Malaysia KLCI slipping 0.3 per cent.

Institutions were net sellers of Singapore stocks over the five sessions with S$225 million of net outflow.

DBS, UOB, OCBC, Keppel Corporation and Venture Corporation led the net institutional outflow for the five sessions.

Meanwhile, Genting Singapore, Sembcorp Marine, Mapletree Pan Asia Commercial Trust, Jardine Cycle & Carriage and Yangzijiang Shipbuilding led the net institutional inflow for the five sessions.

Share buybacks

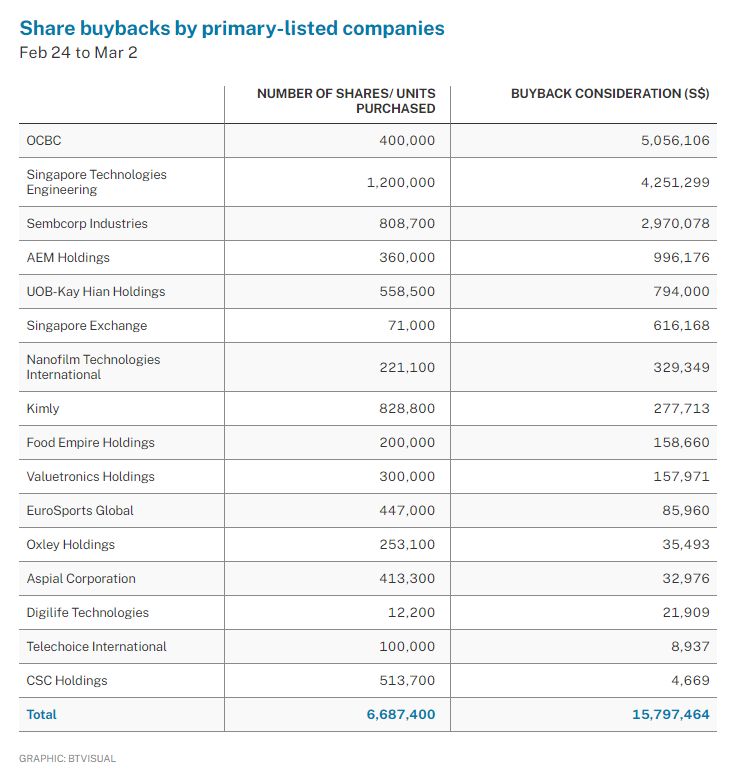

There were 16 primary-listed companies conducting share buybacks over the five trading sessions through to Mar 2, with a total consideration of S$15.8 million.

OCBC, Singapore Technologies Engineering and Sembcorp Industries led the consideration tally, buying back shares at respective average prices of S$12.64, S$3.54 and S$3.67 per share.

Director and substantial shareholder transactions

The five trading sessions saw close to 80 changes to director interests and substantial shareholdings filed for 40 primary-listed stocks.

This included 12 company director acquisitions with one disposal filed, while substantial shareholders filed 11 acquisition and five disposals.

ABR Holdings

Between Mar 1 and 2, ABR Holdings managing director Ang Yee Lim acquired 199,500 shares of the company for a consideration of S$91,770 at an average price of S$0.46 per share.

This took his interest in the restaurant operator from 52.02 per cent to 52.12 per cent. Ang has over 10 years of experience in the food and beverage business and more than 30 years of experience in property development and investment in Singapore, Malaysia, Indonesia, and Thailand.

On Feb 25, ABR Holdings reported that its FY22 (ended Dec 31) group revenue increased 36 per cent to S$101.7 million compared with S$74.6 million in FY21, attributed to the lifting of Covid-19 related restrictions in April 2022.

The group’s Malaysian F&B operations also benefited from the reopening of the land border between Singapore and Malaysia.

Baker Technology

On Mar 1, Baker Technology executive director Benety Chang acquired 3,115,164 shares at an average price of S$0.61 per share.

With a consideration of S$1,900,250, this increased his total interest in the company from 54.12 per cent to 55.65 per cent.

On Feb 27, Baker Technology reported net profit attributable to shareholders of S$13.4 million for FY22 (ended Dec 31), compared with a net profit attributable to shareholders of S$5.9 million for FY21.

The principal activities of the company are investment holding and the provision of specialised marine offshore equipment and services for the oil and gas industry.

UOB

On Feb 23, UOB deputy chairman and CEO Wee Ee Cheong acquired 100,000 shares at S$29.57 per share. With a consideration of S$2.96 million, this increased his total interest in UOB from 10.56 per cent to 10.57 per cent.

His preceding acquisition on the open market was on Aug 19, with 25,000 shares acquired at S$26.80 per share.

Prior to the open of the Feb 23 session, UOB reported a record high core net profit of S$4.8 billion, up 18 per cent, for its FY22 (ended Dec 31). Including one-off expenses relating to the acquisition of Citigroup’s Malaysia and Thailand consumer businesses, net profit was also a record high at S$4.6 billion.

Subsequent to the financial results, UOB announced the completion of the acquisition of Citigroup’s consumer banking business in Vietnam on Mar 1, which included the transfer of approximately 575 Citigroup related staff to UOB Vietnam.

The consumer business comprises Citigroup’s unsecured and secured lending portfolios, wealth management and retail deposit businesses.

Wee noted that once completed, the Asean acquisitions, first announced in January 2022, are expected to double UOB’s existing retail customer base in the four markets and add 5,000 people to its team strength.

UOB chief financial officer Lee Wai Fai noted the well-timed acquisition complements UOB’s Asean strategy.

This involves intensified focus and investment in the region to develop and help realise the potential of the people in Asean, reinforcing UOB’s commitment to facilitate economic flows within and with Asean to support businesses across generations.

Wee joined UOB in 1979 and was appointed its deputy chairman in March 2000.

In April 2007, he assumed the position of CEO. He also sits on the boards of several UOB subsidiaries including United Overseas Insurance, UOB (China), Bank UOB Indonesia, UOB (Malaysia) and UOB (Thai). Wee was also formerly a director of Far Eastern Bank.

In September 2022, Wee was awarded Businessman of the Year at the 37th Singapore Business Awards.

He attributed the award to the generations who had worked hard to build UOB, particularly his late grandfather, who founded the bank, as well as his father, Wee Cho Yaw, and his colleagues for their perseverance and faith working alongside him to grow the business over the last four decades, with many unsung heroes across the bank, giving their best every day, so that UOB can give its best to its customers.

UOB currently maintains a global network of around 500 offices in 19 countries and territories in Asia-Pacific, Europe and North America.

In FY22, the group’s core operating profit rose 20 per cent to S$6.6 billion, mainly driven by robust margin expansion across customer segments and geographies amid rising interest rates.

Net interest income jumped 31 per cent to S$8.3 billion on the back of 3 per cent loan growth and a 30-basis-point net interest margin improvement.

Non-interest income totalled S$3.2 billion, with UOB noting that net fee income remained soft as weak market sentiment weighed on wealth management and loan-related activities.

However, strong double-digit growth in credit card fees partially offset the decline.

In a recent investor presentation, UOB maintained there is room for further tightening of Singapore’s monetary policy in 2023. With the Monetary Authority of Singapore pulling only one lever in October 2022, and with core inflation expected to remain high in H1 2023, another re-centring of the policy mid-point appears likely in April.

The outlook also highlighted macroeconomic resilience across key South-east Asian markets, with significantly higher reserves compared with 1998, in addition to improved current account balances, lower debt-to-equity ratios and a mix of lower foreign currency loans.

In addition, UOB sees Singapore mortgages remaining a low-risk asset class with a low risk of a housing bubble due to cooling measures, a high national savings rate, with low unemployment underscoring housing affordability and support for mortgage servicing, while Singapore private residential housing stays affordable as the median price-to-income ratio remains low.

UOB’s asset quality remained benign in FY22 with its non-performing loan ratio stable at 1.6 per cent as at Dec 31.

The group’s capital, liquidity and funding positions strengthened in Q4 2022. And post the Citigroup acquisition, its common equity tier 1 capital adequacy ratio improved to 13.3 per cent for the quarter.

Strategy consultant, EY-Parthenon, sees three themes for investment banks across Asia-Pacific in 2023.

These are, first, the pursuit of customised and experience-led operating models that enhance client and colleague experiences; second, technology adoption; and third, gaining headway in sustainability.

In parallel with these themes, UOB TMRW was designed to create a simple, engaging, transparent and hyper-personalised digital banking experience for retail consumers.

The digital platform enables the bank to acquire and serve the huge base of digital-first customers across South-east Asia. This complements its omni-channel approach, offering its customers the option of physical touchpoints to serve their more advisory and complex financial needs.

Technology adoption has also helped to embed UOB’s products within an expanding ecosystem of strategic partners, while the bank has also broadened its digital payment and trade capabilities for its corporate clients.

The group has also continued to make headway on its sustainability strategy in 2022 announcing its net-zero commitments by 2050.

Last year, UOB committed to exit financing for the thermal coal sector by 2039 and to cease new project financing for upstream oil & gas projects approved for development after 2022.

The bank also partnered with a leading global consultancy to develop an improved climate risk assessment methodology, with detailed methodology and assessment results to be disclosed in the UOB Sustainability Report 2022.

Inside Insights is a weekly column on The Business Times, read the original version.

—

Originally Posted March 6, 2023 – Wee Ee Cheong acquires UOB shares post FY22 results

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Singapore Exchange and is being posted with its permission. The views expressed in this material are solely those of the author and/or Singapore Exchange and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.