Study Notes:

The IBKR ATS is a routing destination that allows the trader to discreetly execute trades without showing their size or price to the broad market. Orders directed to the IBKR ATS interact with SmartRouted orders in NMS stocks from other IBKR clients. The IBKR ATS employs anti-gaming logic to prevent predatory contra-side trading against the resting orders in the ATS.

The ATS venue is ideal for clients willing to be patient by leaving resting orders. Market orders, where investors typically seek an immediate fill, are not permitted in IBKRATS.

In this video we will go over some of the order types allowed on the IBKR ATS and how to direct an order to the ATS. We will also look at which TWS Algos are supported in the ATS and where to look in Trader Workstation to verify that the orders are placed and filled on the ATS.

The IBKR ATS is currently only available for U.S stocks trading above $1 and only non-marketable orders that add liquidity, will be accepted. IBKR clients can place several order types in the ATS such as: Limit, Relative, Pegged-to-Market, and Pegged-to-Midpoint.

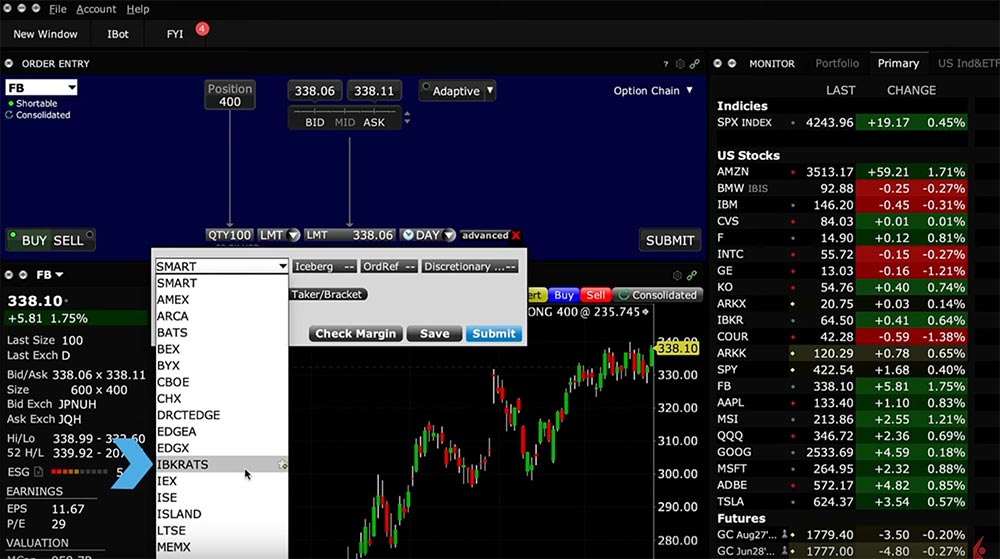

IBKR clients can access the ATS in several ways. In Mosaic you can direct an order to the IBKR ATS thought the Order Entry Window. After selecting a symbol click on the plus sign next to the “Advanced” button. Once the dialogue box appears go to the top left and click on the arrow in the “Destination” button and scroll down to the directed area until you see “IBKRATS”.

Complete the remaining aspects of your order. Clicking on the order type dropdown menu reveals the available order types to you. Since you cannot submit orders intended to execute immediately, available order types are used to peg the price of your order either to a limit or to continuously adjust somewhere between the spread, where it has a better chance of filling.

Once the order is placed you can verify that it has been sent to IBKR ATS by looking at the Destination column in the Activity Panel. Once the order is filled Mosaic users can confirm the destination by looking at the “Exchange” column in either the “Trades” tab or the “Exchange List” column in the “Summary” tab of the Activity Panel.

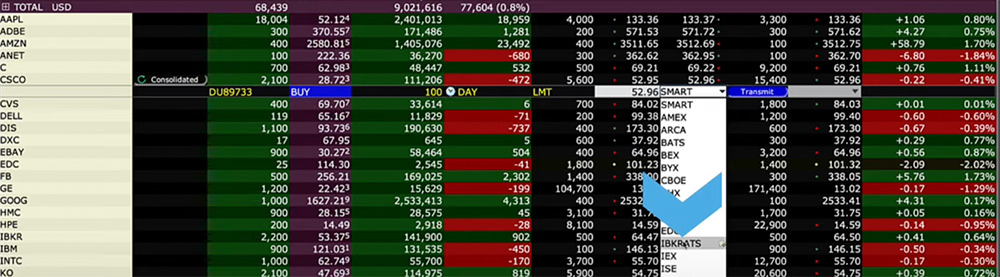

Clients using Classic TWS can direct orders to the IBKR ATS through the Order Row. Once an order is created, left click on the dropdown in the Destination column and select IBKRATS. The destination column can be added by going into the Configure area and selecting “Destination” from the available columns. Classic TWS users can verify that their order was filled on IBKR ATS by looking in the “Exchange” Column in the Trade Log.

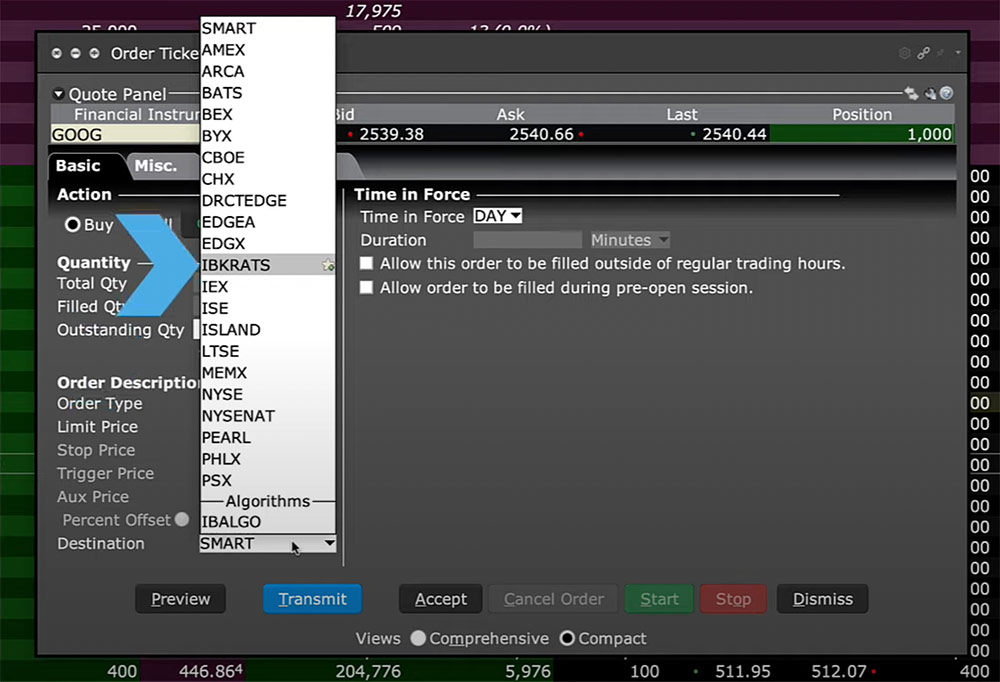

The IBKR ATS can also be selected from the order ticket for both Mosaic and Classic users. Once you access the Order ticket look for the “Destination” drop down box in the lower left-hand corner. Click on the arrow and select IBKRATS, then transmit.

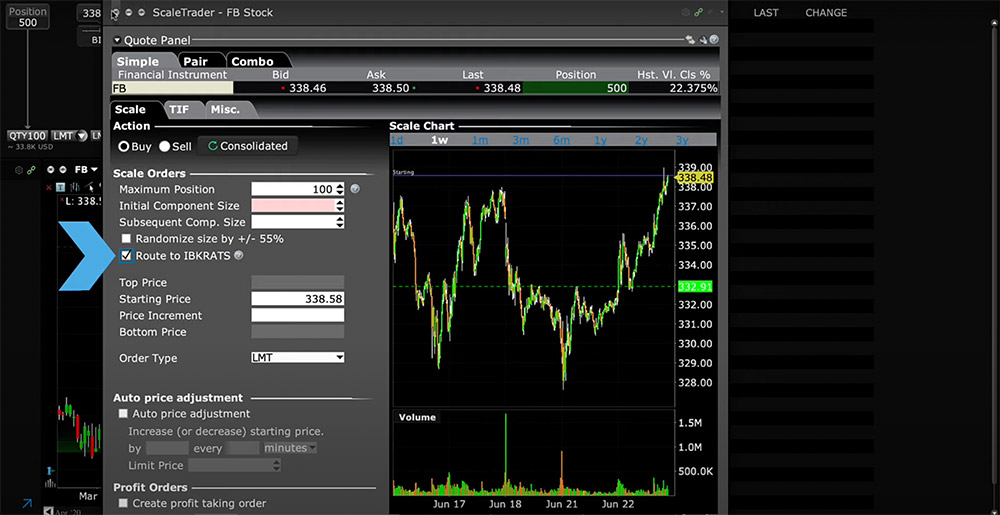

IBKR ATS is also supported by some of our most popular algos including ScaleTrader and Accumulate Distribute. To route to IBKRATS instead of SMART from either of these look for the “Route to IBKRATS” check box in the upper left of the information window when you access the algorithms.

Directing a basket of orders to the IBKRATS is no problem using the BasketTrader tool in TWS. All or some of the orders can be directed to the ATS by selecting IBKRATS in the dropdown menu in the Destination column. Alternatively, when using an uploadable CSV file locate the Exchange column and enter “IBKRATS” before uploading to the BasketTrader software.

IBKR clients can also connect directly to the IBKR ATS via FIX CTCI and integrate their existing applications and front end.

If you are looking to trade a block of stock against other IBKR customers without wanting to expose your interests, the IBKR ATS may be the right destination for you. Several order types and algorithms are supported, and you can route to the IBKR ATS from powerful tools such as BasketTrader.

Is this Interactive Brokers’ Automated Trading System or Interactive Brokers’ Alternative Trading System (Automated vs Alternative – you indicated both)?

Thank you for asking, Tesfaye. IBKRATS stands for IBKR Alternative Trading System.