Robot Wealth Blog recently explored the concept of Frechet Distance. See below for an overview.

Excerpt

Frechet Distance

The Frechet distance between two curves is a measure of their similarity — it’s often described like so:

Suppose a man is walking his dog and that he is forced to walk on a particular path and his dog on another path. Both the man and the dog are allowed to control their speed independently but are not allowed to go backwards. Then, the Fréchet distance of the two paths is the minimal length of a leash that is necessary to keep man and dog joined throughout their walk.

If the Frechet distance between two curves is small, it follows that the curves are similar. Conversely, a large Frechet distance implies that the curves are not similar.

Describing Chart Patterns as Arrays

If we want to detect chart patterns, the first thing we need to define is the shape of that pattern. Note that in describing our pattern in an array, we only need to be concerned with its shape. We can deal with its size (both horizontally and vertically) using other frechet() arguments. Therefore don’t focus too much on the absolute values of the numbers that describe the pattern – their relative values are much more important here.

To define a pattern in an array, think of an x,y coordinate plane. The array indexes are the x values; the numbers stored in each index are the corresponding y values. We then map our pattern as a series of x,y pairs.

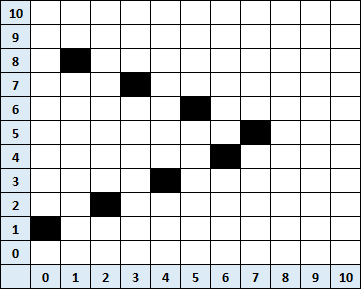

Here’s an example for a triangle pattern:

Remembering that zero terminates the pattern, the corresponding array would consist of the numbers 1, 8, 2, 7, 3, 6, 4, 5, 0. We would define such an array as

var Triangle[9] = {1, 8, 2, 7, 3, 6, 4, 5, 0};

The obvious question that arises from this approach is how well does the algorithm detect patterns that we would consider a triangle, but which deviate from the idealized triangle shown above?

For example, what about asymmetry in the legs of the triangle? That is, what if the early legs take longer to complete than later legs? In the example above, all the legs take the same amount of time. What about triangles that don’t terminate at the apex?

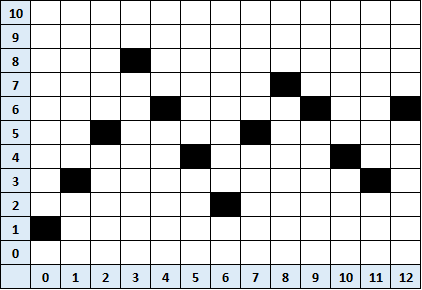

By way of example, the following would probably fit the definition of a triangle:

But now our array would be given by 1, 3, 5, 8, 6, 4, 2, 5, 7, 6, 4, 3, 6, 0. That is,

var Triangle[14] = {1,3,5,8,6,4,2,5,7,6,4,3,6,0};

Would these two patterns return different Frechet similarities when applied to the same price curve?

The answer is yes. But, bear in mind that a pattern corresponding to the first triangle will still be somewhat similar to the second triangle. In practice, this means that in order to use this approach effectively, we would need to cover our bases and check for multiple variants of the intended pattern, perhaps using some sort of confirmation between different variations of the pattern.

Visit Robot Wealth Blog to download the sample code used to detect patterns and analyze their usefulness as trading signals.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Robot Wealth and is being posted with its permission. The views expressed in this material are solely those of the author and/or Robot Wealth and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.