In case you missed it, a $5 trillion tax hike looms over American households and businesses in President Joe Biden’s latest budget proposal, which would include a 25% annual minimum tax on unrealized capital gains for individuals with incomes and assets exceeding $100 million.

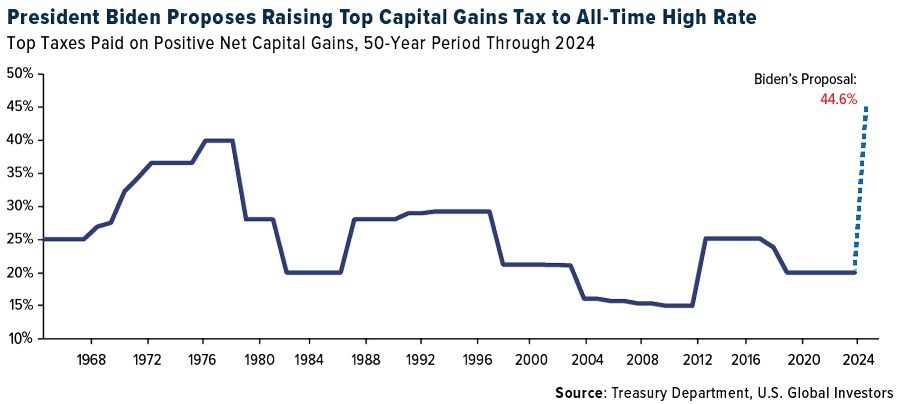

If signed into law, this would increase the top marginal rate on long-term gains and dividends to a jaw-dropping 44.6%, marking the highest such rate in U.S. history.

Biden’s plan proposes other changes to the tax code, but I want to focus on the part involving unrealized gains since it could have sweeping unintended consequences for the U.S. economy, personal liberty and the very fabric of American innovation.

To be clear, I don’t believe a deeply divided Congress would be able to find the votes necessary to approve this policy, but it’s crucial that people are at least aware of the potential ramifications.

When Gains Aren’t Gains

The idea of taxing unrealized capital gains—increases in the value of an asset like property or stocks that haven’t been sold yet—is not only unprecedented but fundamentally flawed.

Imagine purchasing shares in a company for $1 million, and next year, those shares appreciate to $1.5 million. Under Biden’s plan, you would owe taxes on this $500,000 gain, despite not having sold the shares or realized any actual profit.

Now imagine that the stock’s value drops back to $1 million the following year. You’ve already paid 25% on a gain that existed only on paper, and now you’re also left shouldering a financial burden without any actual economic benefit.

You can see how this policy might not go over well with the investment community. As influential entrepreneur Anthony Pompliano tweeted last week, “If they want to collect unrealized gains, we’re going to need refunds on unrealized losses.”

Scott Melker, host of the popular Wolf of All Streets podcast, commented that wealthy investors would simply employ a special strategy to minimize the impact of this additional tax burden. Rich people, he says, “will just take more loans against their portfolios,” knowing that the interest they pay on those loans can often be deducted.

Impact On Small Caps And Startups

This policy could dramatically distort investment behavior, especially when it comes to small caps, startups and early-stage companies. These businesses are often the engines of growth and innovation within the economy, but they rely on investments from those willing to take risks for the promise of future returns.

Knowing that their unrealized gains will be taxed, investors would be less inclined to invest in growth-oriented businesses, which tend to see greater swings in valuation year-over-year than larger, more established companies.

The consequence? A slower rate of innovation and a reduced growth in productivity.

Broad Opposition To New Tax Measures

You probably won’t be surprised to learn that Americans overwhelmingly oppose the taxation of unrealized gains. A 2021 study found that Americans reject this policy by a three-to-one margin, including a significant 76% of independent voters. This sentiment stems from a fundamental belief in economic liberty and the principle that a gain is not truly a gain until it is realized (sold).

The resistance to such tax policies is not merely financial but deeply psychological, rooted in the American ideals of fairness and the right to enjoy the fruits of one’s labor without government interference.

How Tax Policies Drive Demographic Shifts

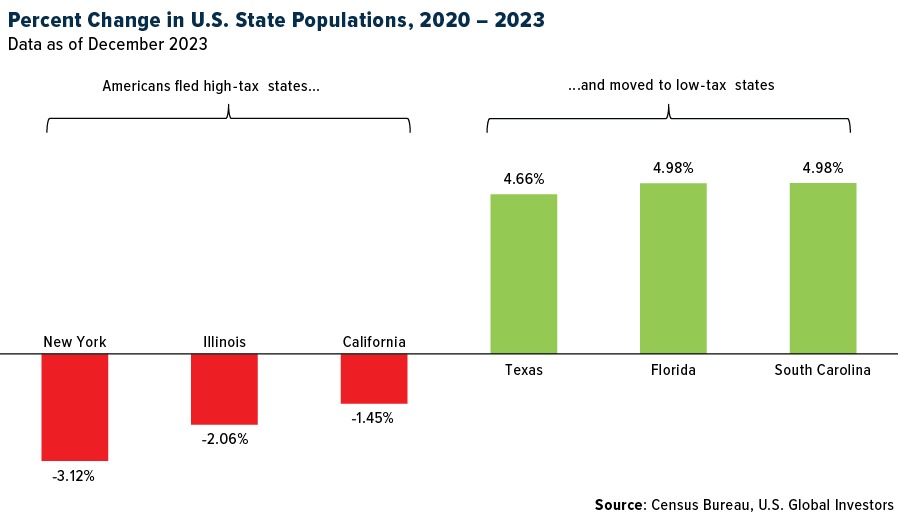

Higher taxes also influence shifts in demographics. As some of you may know from first-hand experience, high-tax environments drive individuals—and capital—to more hospitable fiscal climates.

Data from the Census Bureau vividly illustrates this, with significant net migration to states where tax burdens are below the national average. Take a look below. New York, Illinois and California, which impose heavy tax burdens on their residents, had the largest percentages of people leaving between 2020 and 2023, while Texas, Florida and South Carolina saw their populations grow the fastest.

I often say that money tends to flow where it’s respected the most, and this trend underscores that sentiment.

Small Caps Feeling The Pressure

This is all set against a backdrop of rising Treasury yields as inflation concerns persist and doubts grow that the Federal Reserve will be able to lower rates this year. High borrowing costs have impacted us all, but they’ve been especially challenging to small-cap stocks, which are generally more sensitive to economic shifts due to their higher debt loads and smaller financial cushions.

The chart below illustrates the inverse relationship between the 10-year yield and the Russell 2000. When the bond yield traded above its 50-day moving average, the selloff in small-cap stocks accelerated.

Small-cap stocks may continue to encounter significant obstacles, especially if rates remain inflated and Biden succeeds in taxing unrealized gains. Relative to the S&P 500, small caps are trading at their lowest levels since the dotcom bubble, making this a potentially interesting buying opportunity.

—

Originally Posted April 29, 2024 – Americans Overwhelmingly Reject Biden’s Plan To Tax Unsold Assets

Past performance does not guarantee future results. All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

The Russell 2000 Index is comprised of the smallest 2000 companies in the Russell 3000 Index, representing approximately 8% of the Russell 3000 total market capitalization.

Join The Conversation

If you have a general question, it may already be covered in our FAQs. If you have an account-specific question or concern, please reach out to Client Services.

Leave a Reply

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: IBKR Tax Disclosure

Interactive Brokers does not provide tax advice, does not make representations regarding the particular tax consequences of any investments, and cannot assist clients with tax filings. Investors should consult with their tax professional about the tax implications of any investment.

This would easily fail a court challenge. The 16th Amendment to the constitution authorizing the taxation of income is very simple:

“ARTICLE XVI. The Congress shall have the power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

An increase in the value of an asset is not income, so the federal government’s income taxation authority does not apply. No proceeds were received. These phantom paper gains could disappear after taxes were paid with no actual profits ever in the taxpayer’s possession. They are not real.

“…for individuals with incomes and assets exceeding $100 million”

I think I’ll be okay.

…I imagine even the folks impacted by this will find a way to survive.

This articles is incorrect and misleading. You must imagine to buy 100 million of stock to be subject to new tax, 1 million is not enough. I am sure you would then change your basis for next year tax and record loss if your stock price drops.

Most Americans would like billionaires to pay same % of income taxes like regular people. They now transfer it by inheritance without paying any taxes on gains. This is a great proposal.

By the way, everybody has to already pay those taxes on unrealized gains today, when you leave US and give up US citizenship. I guess Article XVI is not what you think.