The post “Cross-Asset Signals and Time-Series Momentum” first appeared on Alpha Architect Blog.

In their paper “Time Series Momentum,” published in the May 2012 issue of the Journal of Financial Economics, Tobias Moskowitz, Yao Hua Ooi and Lasse Pedersen documented significant time-series momentum (trend) in equity index, currency, commodity and bond futures—delivering substantial abnormal returns with little exposure to standard asset pricing factors and performing best during extreme markets. AQR Capital Management’s Brian Hurst, Yao Hua Ooi and Lasse Pedersen updated that earlier work in their June 2017 paper “A Century of Evidence on Trend-Following Investing.” Their evidence documented that time-series momentum had not only been persistent across time and economic regimes, as well as pervasive around the globe and across asset classes, but also robust to various definitions.

Aleksi Pitkäjärvi, Matti Suominen, and Lauri Vaittinen contribute to the literature on time-series momentum with the February 2019 study “Cross-Asset Signals and Time Series Momentum.” Building on the work from the aforementioned papers, the authors documented a related cross-asset phenomenon in bond and equity markets they called “cross-asset time-series momentum.” For a strategy buying an equity index, they required positive excess returns from both stock and bond markets. If not, the strategy moved to cash. For a strategy trading a bond index, they required a positive excess return from the bond market and a negative excess return from the equity market. If the excess returns of the asset and the cross-asset predictor disagreed, they held the risk-free asset. Their data sample covered bond and equity market indices from 20 leading developed countries. The earliest return series started in January 1980, and it all ended in December 2016. All local currency index returns were converted into U.S. dollar indexes.

The following is a summary of their findings:

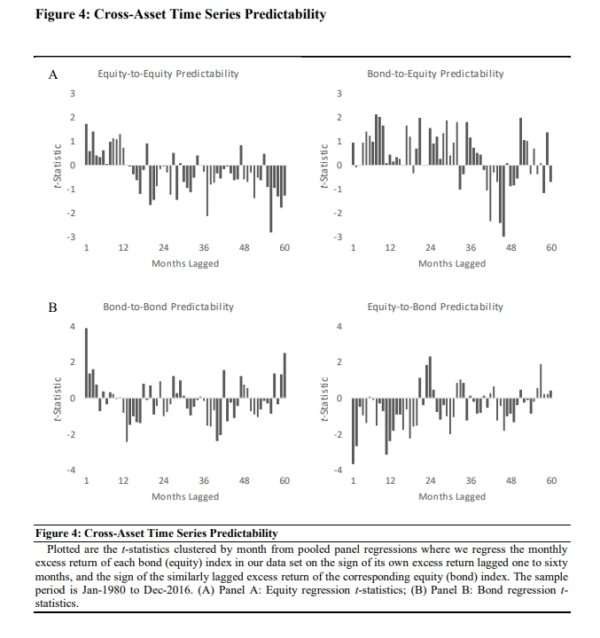

- Past positive (negative) bond market returns predict positive (negative) future equity market returns. Past equity market returns are negative predictors of future bond market returns.

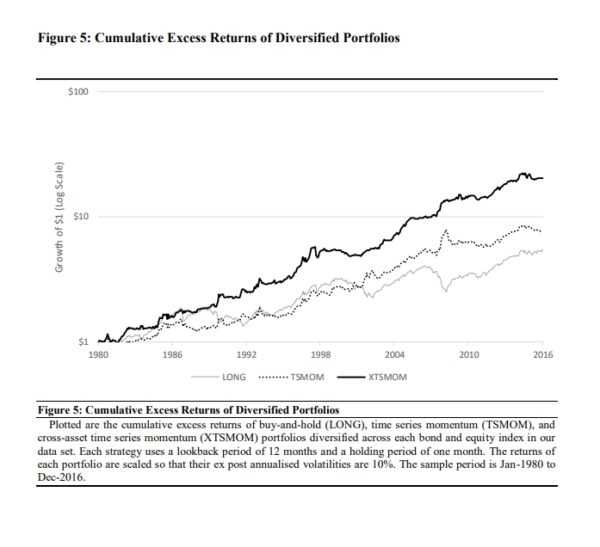

- A diversified portfolio of the cross-asset time-series momentum strategies yields a Sharpe ratio 45 percent higher than a similarly diversified time-series momentum portfolio, and almost 70 percent higher than a similarly diversified buy-and-hold portfolio.

- Controlling for the returns of the cross-asset time-series momentum portfolio, the alpha of the time-series momentum portfolio is insignificant.

- Cross-asset time-series momentum portfolios outperform time-series momentum portfolios across a wide range of time horizons and in all but one of the 20 countries.

- Equity return is highest during positive bond and equity momentum regimes—while the equity return is 0.81 percent per month during positive equity momentum regimes, the return increases to 1.04 percent per month when the bond regime is also positive.

- The lowest bond return occurs during periods where the bond momentum regime is negative and the equity momentum regime is positive, while the highest bond returns occur in those regimes where the past equity returns are negative.

- Positive past returns in bond and equity markets attract fund flows to equity funds for a prolonged period of time, supporting cross-asset time-series momentum. Similarly, positive bond returns and negative equity returns predict fund flows to bond funds for several months ahead.

- Simultaneously positive momentum regimes in bond and equity markets predict better outcomes for the economy, with high industrial production growth, high investment, and decreasing unemployment over the next 12 months. In contrast, simultaneously negative momentum regimes predict negative industrial production growth, low investment, and increasing unemployment. Thus, time-series momentum and cross-asset time-series momentum are not just financial market phenomena; they also contain information about fundamental changes in economic activity.

- In a test of robustness, the results were qualitatively similar when they scaled momentum for volatility.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Visit Alpha Architect Blog to read the full article: https://alphaarchitect.com/2020/08/06/cross-asset-signals-and-time-series-momentum/

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.