The post “Factor Investing in Sovereign Bond Markets: 221 Years of Evidence!” first appeared on Alpha Architect Blog.

Factor Investing in Sovereign Bond Markets: Deep Sample Evidence

- Baltussen, Martens and Penninga

- working paper, 2021

- A version of this paper can be found here

- Want to read our summaries of academic finance papers? Check out our Academic Research Insight category

What are the Research Questions?

Despite government bonds being one of the major asset classes invested in global portfolios, 30% of overall market capitalization according to Doeswijk, et al. (2020), little work has been done to investigate whether factors are present in the sovereign bond market. (Here is a deep dive into fixed income factors by Ward). If factors are indeed present in the sovereign bond market do they add value and are they are persistent? This paper attempts at answering these research questions.

What are the Academic Insights?

One of the key features of this study is the extensive length of the sample: from January 1800 to December 2020: 221 years, a time frame with yields rising (wait, they can do that?) and falling cycles (different from other studies which covered a time frame dominated by falling yields). The research covers 16 developed government bond markets.

Several of the key results of the paper are as follows:

- Value and Momentum across bond markets (country allocations), and Low-Risk on the bond curve (maturity selection) offer attractive factor premiums, with Sharpe ratios of 0.51, 0.24, and 0.40 over the full sample.

- These factor premiums are consistent over time, being positive in 72% (Momentum) to 92% (Value) of 10-year rolling periods.

- Combining the factors into a simple multi-factor portfolio gives a highly significant Sharpe ratio of 0.56 (t-statistic of 8.22) from 1800 to 2020 and is positive in 89% of the 10-year rolling periods.

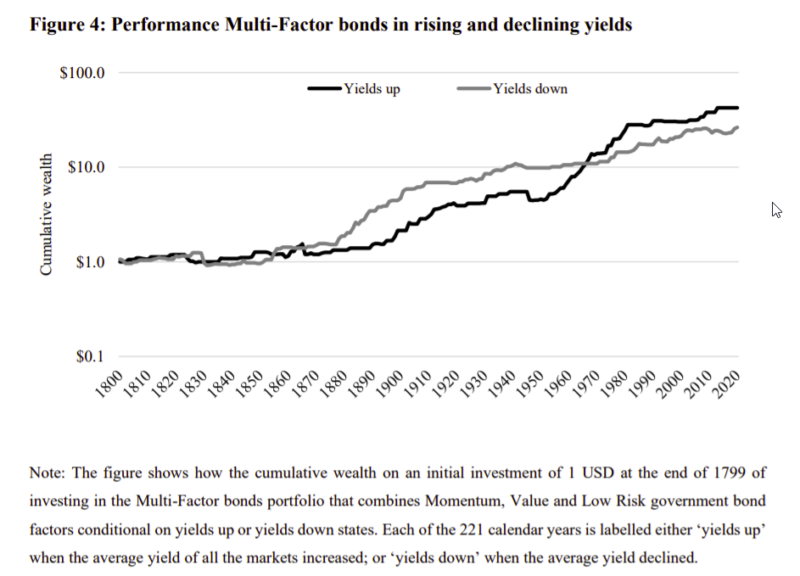

- A multi-factor bonds portfolio gives robust performance over various macroeconomic states like recessions and expansions, crisis and non-crisis periods, years with either rising or declining yields, years with above or below median inflation, and years with positive or negative equity returns.

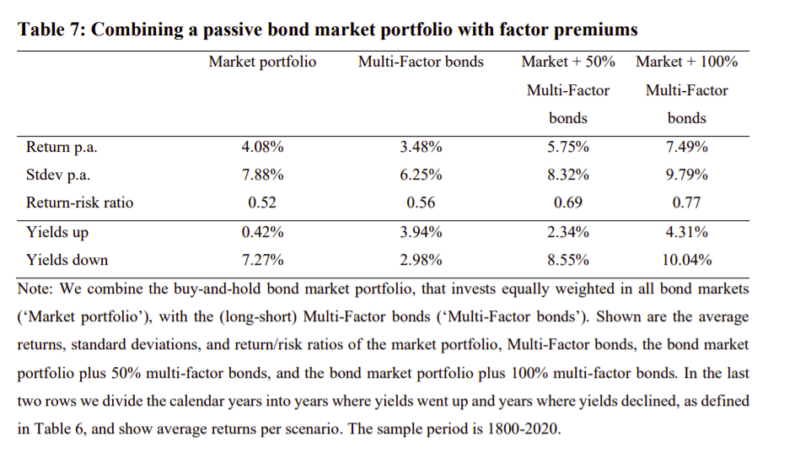

- There is a strong value add of a multi-factor bonds portfolio to an existing allocation: a multi-factor bonds portfolio has an average return of 3.48% a year at a correlation of –0.05 with the bond market and adding a multi-factor bonds strategy to a passive global government bond portfolio increases returns substantially with little impact on risk.

Why does it matter?

This paper is an important addition to the academic debate on factor investing. In particular, it adds important and robust evidence to the fact that factor strategies in government bonds offer attractive returns and diversify each other. They do so in both a long-short and long-only constrained setting.

The Most Important Chart from the Paper:

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index.

Abstract

We examine government bond factor premiums in a deep global sample from 1800 to 2020 spanning the major markets and maturities. Bond factors (Value, Momentum, Low-risk) offer attractive premiums that do not decay across samples, are persistent over time, and consistent across various market and macroeconomic scenarios. The factor premiums diversify to each other, as well as to bond or equity market risks. A combined multi-factor bond strategy provides the strongest risk-adjusted returns. These results strongly show a consistent added value of

government bond factor premiums over a passive bond portfolio.

Past performance is not indicative of future results.

Any stock, options or futures symbols displayed are for illustrative purposes only and are not intended to portray recommendations.

Disclosure: Alpha Architect

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Alpha Architect, its affiliates or its employees. Our full disclosures are available here. Definitions of common statistics used in our analysis are available here (towards the bottom).

This site provides NO information on our value ETFs or our momentum ETFs. Please refer to this site.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Alpha Architect and is being posted with its permission. The views expressed in this material are solely those of the author and/or Alpha Architect and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Margin Trading

Trading on margin is only for experienced investors with high risk tolerance. You may lose more than your initial investment. For additional information regarding margin loan rates, see ibkr.com/interest