In the U.S., generally, quant professionals are offered salaries of around $130,000 (according to Indeed). Although, the experience of the quant, the job role and the expertise matter in determining the exact salary, a quant usually earns well. This blog will give you a deeper insight into the salary of a quant in general as well as where the quants are employed.

To give you an example of the impact of quant trading, Man Group’s AHL Dimension programme is a $5.1 billion dollar hedge fund with the help of quants.

Let us find out more about the quantitative analyst and the salary aspect of the same with this blog that covers:

- What is a quant?

- All about the quant salary

- Skills for becoming a quant trader

- The job responsibility of a quant

- Where do quants get employed?

- Future of quants

- A candid conversation with an algorithmic trader

What is a quant?

Simply speaking, a quant or a quantitative analyst holds knowledge of the three fields, namely:

- Finance

- Mathematics

- Programming language (Python, C++ etc.)

Hence, a quant applies the knowledge of mathematical and statistical methods (such as numerical or quantitative techniques), to financial and risk management problems. A quant applies the knowledge of above mentioned fields to fulfil any trade related requirement.

For instance, in order to identify and evade the risk of trading a particular stock, the quant will calculate the probability of risk occurrence as well as the possibility of the amount of risk involved. The quant will then create a computer algorithm of the solution to execute the solution in an automated manner.

All about the quant salary

Let us now find out the average salary of a quant or a quantitative analyst in different regions/countries.

| Country | Average Base Salary/year |

| U.S | $137,475 |

| India | ₹16,00,000 |

| U.K | £82,298 |

| Canada | C$74,766 |

| Singapore | S$122,500 |

| Hong Kong | HK$407,920 |

| Australia | AU$115,498 |

Please note that this is the average base salary computed from leading portals such as Indeed, LinkedIn, Payscale and Glassdoor.

Also, it is important to mention here that, since a majority start as freshers, they get the benefits of a joining bonus and profit-sharing which are not included in the base salary. Hence, the actual salaries are higher.

Also, the better and more relevant your skill sets are, the more are chances that a prospective company will hire you. Becoming a quant requires effort from your end, but the results are much more rewarding from a career point of view.

Hence, even as amateur traders, you can surely climb the ladder up to become a professional quant someday!

Note: The salary figures may vary across companies, roles, experiences and other factors.

Skills for becoming a quant trader

We just mentioned the relevant skill sets for increasing your chances of being hired by a firm as a quantitative analyst. But, what are those relevant skills?

Let us take a look at each skill briefly here:

- Programming – For becoming a quant, you must have a good hold of programming skills. Python being the most favoured computer language is used the most by quants.

- Probability and statistics – A key part of trading is a good knowledge of probability and statistics. Basic statistics, time series, multivariate analysis etc. are used for formulating strategies, and risk-management.

- Markets and the economy – Good knowledge of how markets and the economy work helps the quant sustain in the industry.

- Analytical thinking – A big role is played by an individual’s analytical thinking and the capability to work out the problem with strong reasoning.

Hence, these were some of the most integral skills for becoming a quant. According to the job responsibility of each role in the quant domain, the skills come into use.

The job responsibility of a quant

As a fresher, a quant will be working in a team with other quants for creating trade related models or strategies.

Usually, the job responsibility of a quant requires the individual to perform the following tasks:

- Trading a vast portfolio.

- Analysing hundreds of gigabytes of data to ascertain micro behavioural patterns (at the microsecond time frame) to trade at such signals.

- Simultaneously, while trading, analysing information across time and assets to build macro signals.

- Creating automated trading signals with the help of algorithms.

- Performing risk management while trading.

- Discovering and imitating the logic and, thereby, automating the process of setting the hundreds of parameters or conditions of trading that traders do on a daily basis.

But as you move up the ladder, you will be able to handle much more. Take a look at the various job roles of a quant, which are as follows:

- Junior analyst

- Quant analyst

- Quantitative research analyst

- Senior quantitative analyst

Note: The job responsibilities may vary across companies, roles, experiences and other factors.

Where do quants get employed?

The simple answer to this question is, Quant Funds!

Before we begin with what a quant fund is, it is a must to mention that aspiring individuals need to crack the quant interview in order to get started as a quant.

At first glance, you might think – What is the big deal about a quant fund?

It must be just another one in the plethora of options we have today, like index funds, mutual funds etc. But drill down and you will find that quant funds are slowly but surely getting a foothold in the industry.

If you look at the US market, the two big names are Renaissance Technologies and Two Sigma. While Renaissance Technologies has AUM of US $130 billion ⁽¹⁾ (April 2021), Two Sigma is reportedly managing $58 billion ⁽²⁾ (January 2020) of AUM.

In the era of diversification, quant funds have, thus, created demand from investors who are seeking a relatively structured fund. This has also spiked up the demand for quants who are already fewer in number.

While most of the fund houses would definitely have profit-sharing as a part of the compensation package, there are countless examples of quants who have set up their own algorithmic trading desks.

Future of quants

There is a reason Quants have become sought after in the world of finance, especially trading.

Back in the day, manual traders used to apply technical analysis tools as well as fundamental analysis to gauge whether the stock is worth investing in or not. Over time, complex mathematical models were built to assess the profitability of a trade.

In the quest to develop a sound trading strategy which avoided human emotions, these models became increasingly complex and difficult to put into practice. Here is where the role of programmers came in, who developed the algorithms for the models.

Over time, it was realised that we didn’t need three different people to perform the task when one trained professional could easily perform them alone.

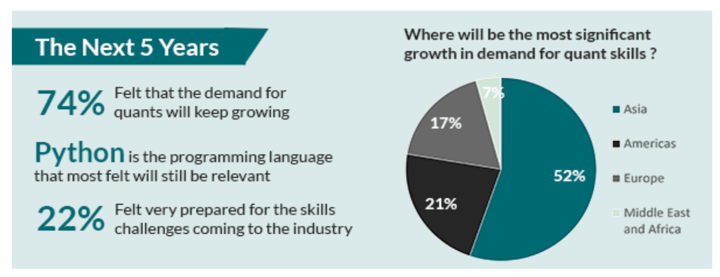

Going forward, in the next five years, it has been predicted that the demand for quants will grow significantly. This can be seen in the image below.

Source: FitchLearning

Visit QuantInsti for additional insight on this topic: https://blog.quantinsti.com/salary-quants-really-earn/.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from QuantInsti and is being posted with its permission. The views expressed in this material are solely those of the author and/or QuantInsti and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.