Quantpedia’s team reviews the academic paper “What Moves Markets?” by Mark Kerssenfischer and Maik Schmeling. Read an excerpt below.

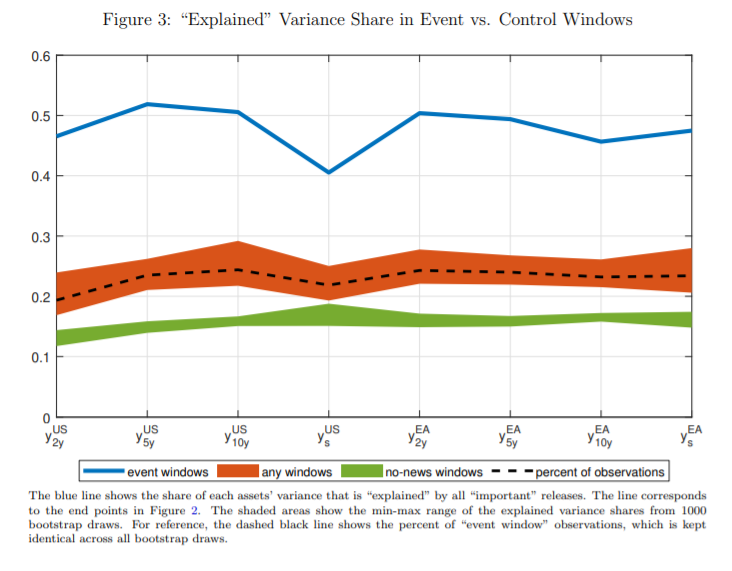

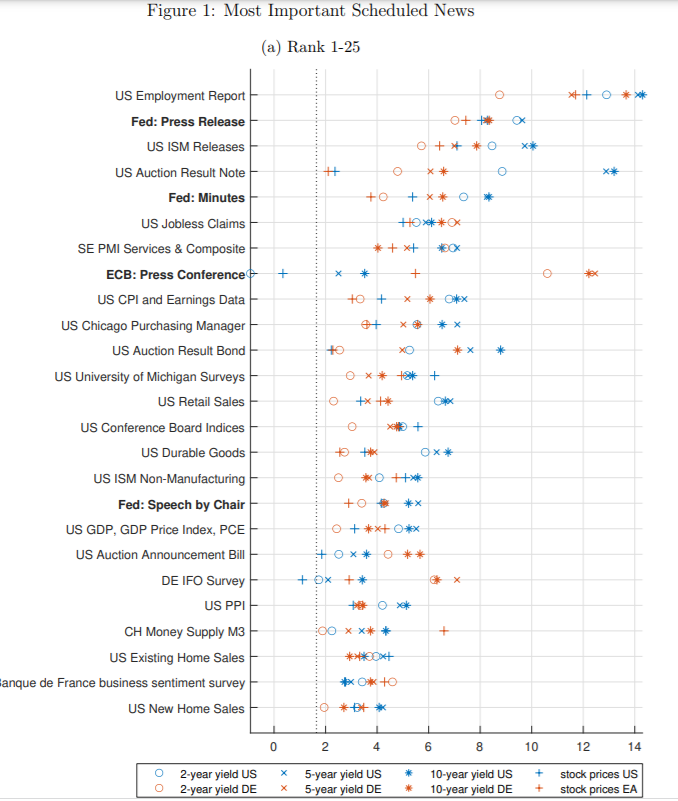

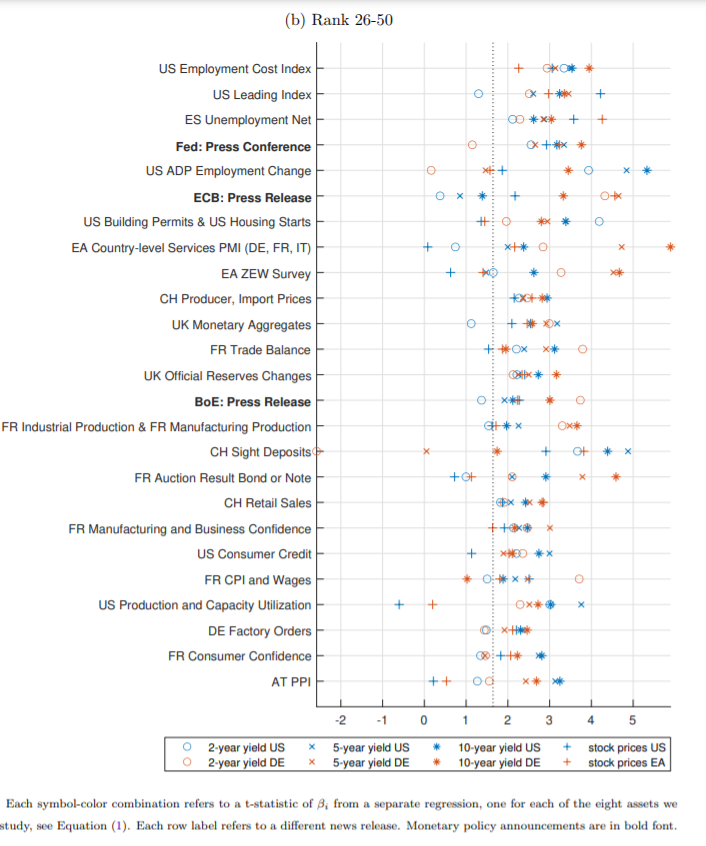

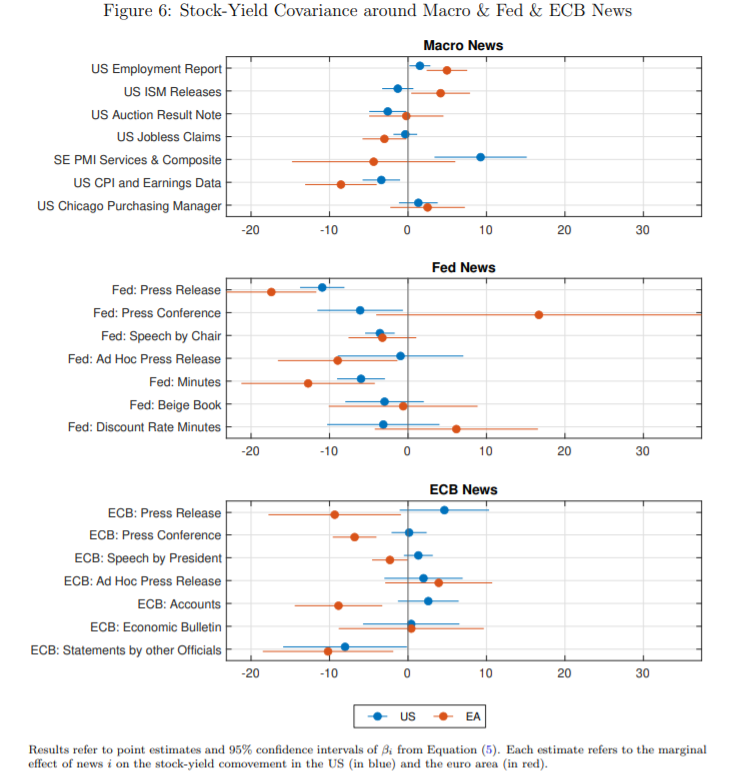

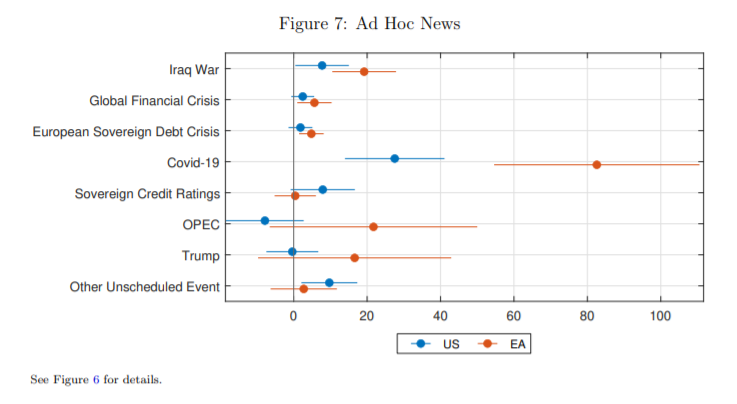

Nobody would argue that nowadays, we live in an information-rich society – the amount of available information (data) is constantly rising, and news is becoming more accessible and frequent. It is indisputable that this evolvement has also affected financial markets. Machine learning algorithms can chew up big chunks of data. We can analyze the sentiment (which is frequently related to the news). Big data does not seem to be a problem anymore, and high-frequent trading algorithms can react almost instantly. But how important is the news? Kerssenfischer and Schmeling (2021) provide several answers by studying the impact of scheduled and unscheduled news (frequently omitted in other news-related studies) in connection with high-frequency changes in bond yields and stock prices in the EU and US as well. The research points out that the effect is tremendous and significant. According to the researchers, roughly half of all stock and bond movements in the US and EU happen around identifiable unscheduled (such as Covid spread or Lehman Brothers bankruptcy) or scheduled (FOMC meetings, macro announcements, etc.) news. Furthermore, most central bank announcements cause a lower comovement in stocks and bonds. Overall, the research provides an excellent piece of information for both practitioners and academics and helps us better understand the impact and magnitude of news.

Authors: Mark Kerssenfischer and Maik Schmeling

Title: What Moves Markets?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3933777

Abstract: What share of asset price movements is driven by news? We attempt to answer this question by building a large, time-stamped event database covering scheduled macroeconomic data releases, central bank announcements, bond auctions, as well as unscheduled news such as election results, sovereign rating downgrades, and natural catastrophes. We combine this news database with high-frequency stock price and bond yield changes, both for the United States and the euro area, going back to 2002. We find that news events account for about 50% of all market movements, suggesting that a much larger amount of return variation than previously thought can be traced back to observable news. Finally, we use our news database to quantify the share of asset price variation due to different types of news, to study the predictability of monetary policy surprises, and to dissect changes in the stock-bond correlation.

As always we present some interesting figures:

Visit Quantpedia for additional insight on this topic and to read notable quotations from the academic research paper: https://quantpedia.com/how-news-move-markets/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.