Excerpt

We would like to present our newest own-research about factor allocation and passive versus active strategies clash. However, respecting our blog format, this version is largely shortened and we invite you to read the full version.

Introduction

In the equity market, there are two types of investing: active and passive. The aim of passive investors is to track the market with all the “ups” and “downs”. The passive investing is simple; after all, the strategy consists of tracking the market by a buy-and-hold. Nowadays, it is easy to implement with the numerous ETFs, for example, by buying SPY ETF and getting exposure to the S&P500 index. Proponents state that in the long run, the equity market is going up. They do not try to beat the market, they bet on the market in the long run.

On the other hand, there is active management. The main aim of active investing should be to beat the market. Therefore, active investors aim to achieve better returns or risk-adjusted returns since the equity markets tend to be volatile. The passive investors should aim for a long horizon, and therefore, they should not panic when they experience the first drawdown. However, for many, it is desired that their investment would be more stable or safe. A major part of active investment management consists of factor (or smart beta) strategies. Equity factors include, for example, value, size, volatility, momentum or quality. With the numerous ETFs, it is also easy to get exposure to these factors through smart beta ETFs.

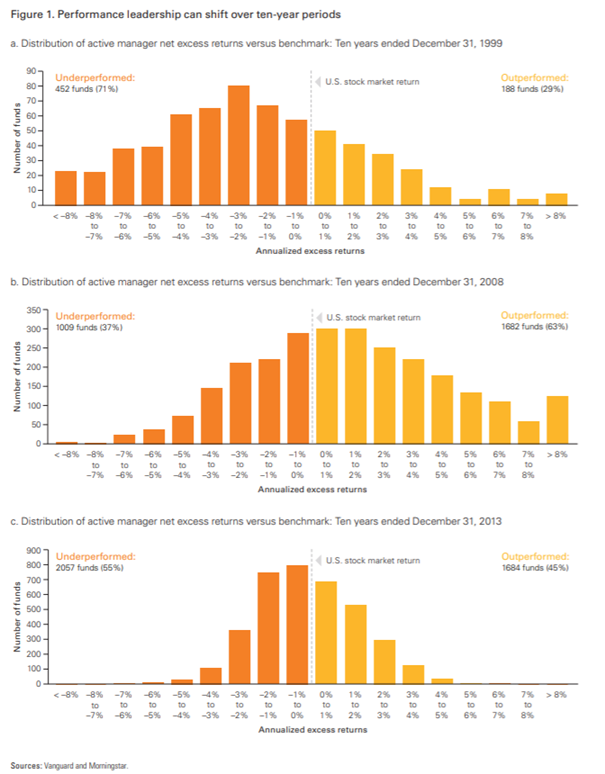

Having established that there are two major management styles and many factors, numerous questions arise. Firstly, there is a debate that is as old as investing itself, is active or passive investing better? There seems to be an unreasonable debate, many investing “experts” shame active investing stating that active managers often cannot beat the market. Indeed, the active management requires skill and knowledge, which can bring success, and outperform the market (either in total or risk-adjusted returns). On the other hand, passive management does not require much of the skill or knowledge and with low-cost brokers, and ETFs, it is widely accessible to retail investors. The truth lies somewhere in the middle. The performance of active and passive investing is cyclical. The periods of active (passive) outperformance rotate (see the following figure). Therefore, the answer to the question of which investing is better, changes in time. We should find a solution to a different problem, in which state of the market is it better to invest passively and in which state of the market is it better to invest actively? Another question that arises is whether we can use our active investing strategy to outperform the market consistently.

Active vs Passive investing leadership. Source: [4]

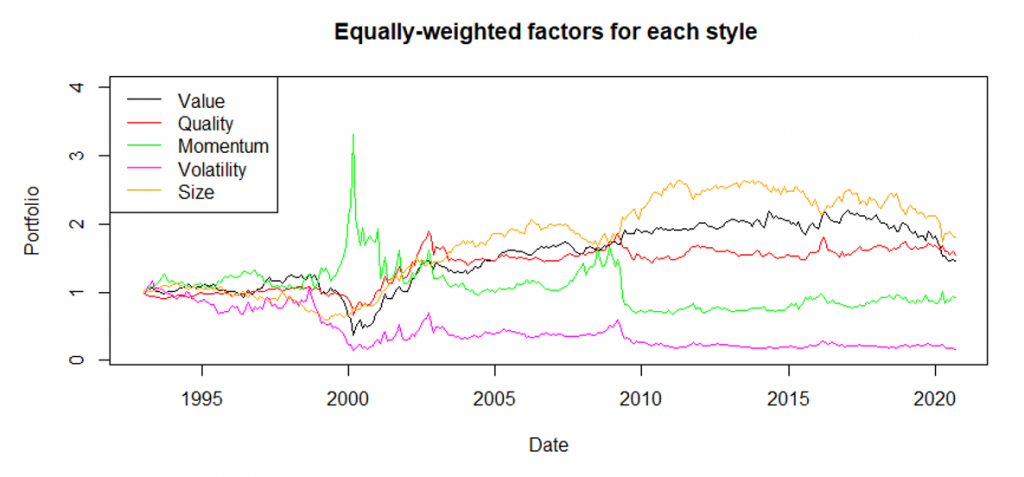

Considering active investing, if we get back to the factor investing, we have a similar ongoing debate. It is widely recognized that equity factors also have cyclical performance. Many argue that value is dead (which has already happened in the past), yet Blitz and Hanauer (2020) claim that value can be resurrected. Momentum is notoriously known for its crashes (Hanauer and Windmüller, 2020). Also, the size factor seems to have its problems (Blitz and Hanauer, 2020). On the other hand, quality appears to be emerging as a popular investment style, and it has even enjoyed outperformance compared to the other factor during the recent first Covid wave (Quantpedia, 2020).

Establishing that factor investing is not that straightforward and has cyclical performance, the aim of this paper is to find a profitable way how to invest in plenty of equity factors. Factors are obtained from the Alpha Architect’s Factor Investing Data Library. The factor library includes all the major styles: Value, Momentum, Volatility, Quality and Size. We are interested in two markets: the US market that is represented by the top 1500 stocks and developed market (EAFE). Through the paper, the analysis is made for both markets.

Since the performance of the factors is cyclical, the hypothesis of the paper is that each factor could be a vital part of the final portfolio. However, the weight of each factor in the portfolio should be changing in time. A possible way is to react to the actual market situation. Garg et al. (2019) examined the time-series momentum strategies and the momentum turning points. According to the research, turning points are the Achilles’ heel of time-series momentum portfolios. The reason is straightforward, slow signals tend to be unreactive to changes in trend, and fast signals are often false alarms. The authors examine fast and slow momentum signals and different blending approaches to construct more profitable momentum strategies. The weight of the long (short) position depends on both fast and slow signals, and whether they agree or disagree. We follow a similar approach for the construction of the factor momentum strategies, but there are major differences. For the active factor strategy, we first examine two signals: fast, which is 1-month momentum and slow, which is 12-month momentum. Moreover, we examine the strategy which is traded only if both signals agree and blended strategy similar to the Garg et al. (2019).

Nextly, separately for each type of signal and for each factor, we cross-sectionally rank the absolute value of the signal to obtain the strength of the signal. The ranks act like weights – stronger the signal greater the weight. After establishing cross-sectional strength, the factor strategies that utilize the slow and fast signals can be further enhanced. The detailed strategies and results can be found in the sections 3, 4 and 5 in the paper.

The dynamic weighting outperforms the baseline strategies. The outperformance of dynamical weighting compared to all other strategies is present on each market and each type of portfolio sort (quintiles, deciles and ventiles). Moreover, the results of the dynamic weighting of signals outperform other strategies in two distinct approaches. Firstly, when we consider the relative strength of the signals for all factors together or in the other case, when we firstly, break all the factors into individual investment styles separately. The results are almost exactly the same (since the breaking the factors into individual styles does not alter the results, for the simplicity, results for such variant are unpublished).

It is worth mentioning that by the construction, all of the strategies are “immune” to problems like value versus growth or short-term momentum/short-term reversal. For example, if the value tends to be profitable, the strategy would tilt its exposition to the value factors. If the value tends to be unprofitable (growth is profitable), the strategy shorts the value factors (in other words, it reverses deciles, quintiles or any other sorted portfolios).

Having established that it is possible to utilize the factors better in a relative-strength dynamically weighted factor momentum strategies, it is time to get back to the active versus passive investing debate. In the recent period, it is well-known that many factors have underperformed.

Therefore, it seems that in the past, proponents of passive investing were right. However, that conclusion would not be correct. Later, we show that active investing, using the relative-strength dynamically blended factor momentum strategy could be a great addition to the market portfolio. The combined strategy looks back on the past twelve months, and twelve moving averages (MA) of the returns: one month, two months, three months and so on. Suppose the MA for active investing (factor momentum) is larger than MA for market portfolio, then the active investing scores one point. Otherwise, the market portfolio gets one point. Therefore, each month, the weight of the factor momentum and market portfolio is determined by the number of “winning” (loosing) moving averages. Combining active and passive investing largely outperforms passive investing only. Moreover, if we have a rule that we follow for investing into factors and market, it is definitely an active investing strategy.

Although the relative-strength dynamically blended factor momentum strategy and its combination with the market portfolio might seem to be tangled, the rules are straightforward and transparent. It is possible to ex-post choose the best lookback periods for fast and slow indicators, or the best blending rule, however, such overfitting is not in the interest of this paper. Strategies should be transparent, and the aim of this paper is to show a set of transparent rules to find answers to two questions. Firstly, which factor to invest in (factor allocation problem), and secondly, to have a rule-based solution to the active versus passive clash.

Visit Quantpedia to learn more about the dataset they used, and to read the rest of the article: https://quantpedia.com/the-active-vs-passive-smart-factors-market-portfolio-or-both/

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from Quantpedia and is being posted with its permission. The views expressed in this material are solely those of the author and/or Quantpedia and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.