Digital asset networks are like railway lines1. An essential feature that makes an efficient and ultimately useful railway network is interoperability. This is not immediately obvious to people in 2021 as most are accustomed to railway networks that are interoperable. Anyone who has had to change trains at a national border does not take this feature for granted – nor did people in the 1850s. The same need for interoperability has become apparent across the digital asset ecosystem – and developers are working on solutions. The networks that are able to create ‘bridges’ and ‘speak’ to one another will ultimately deliver greater utility to their users – and thus create greater value.

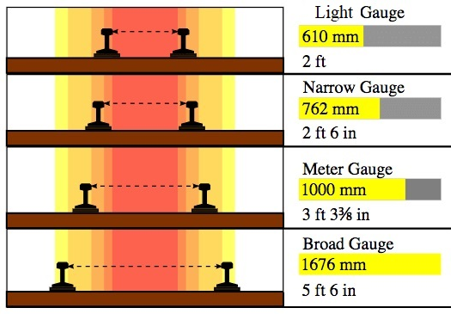

Many people take various forms of rail transport without thinking for a second about the interoperability between the lines that they take. It was not always so. For decades the first train lines were just that: lines. Each one was built according to the standards that the engineers deemed appropriate given the needs of the line. This led to a situation where different rail gauges were used across different lines. Unfortunately, this meant that train carriages could not easily move from one line to another – so time consuming and ultimately costly transfers of people and/or cargo had to occur to transfer from one line to another. Once these transaction costs became apparent solutions were developed, which included standardised gauges in some (not all2) countries.

Standardised gauges… important. (source3)

One can observe a similar phenomenon with digital asset networks. Each network’s code is written in a certain language to accomplish a certain purpose. The end result is that many of these networks cannot ‘speak’ to the other ones. This adds friction and cost to people who wish to do multiple things across these networks.

The space is evolving though. For a number of years a series of ‘bridges’ between different networks have been developed. Put simply, “a bridge in the crypto world is like a bridge in the physical world. They connect two distinct locations or communities so that traffic and resources can go back and forth freely4.” These bridges make it so that one can make transactions on one network that are recognised on another network. In more technical terms, people ‘wrap’ coins or tokens in a way that allows said coins or tokens to be used on different networks. WBTC (wrapped bitcoin), which is bitcoin in an Ethereum compatible wrapper, is one such example. This solution has largely worked out well – there is around USD$13bn5 in wrapped bitcoin at present – and that is just WBTC.

Another area where greater connectivity can be seen is the emergence of interoperable protocols. Think of this like variable gauge lines6. Instead of trying to build an exclusive space that constrains users some of the fastest growing projects have decided to write their software in a way that makes their service usable across different networks. The largest decentralised exchanges realised that interoperability was necessary well ahead of time. Curve, the largest decentralised exchange presently with USD$17bn7 in total value locked, is interoperable with seven different protocols. Sushi swap is best in class – it is interoperable with thirteen protocols8. This goes beyond exchanges though. Aave, which provides borrowing/lending pools and thus requires as much liquidity as possible, has made it so that their lending/borrowing protocol can be used across the Ethereum, Polygon and Avalanche networks.

The digital asset ecosystem continues to grow and evolve – just as train lines were built separately then evolved into the networks that exist today. The good news is that it is much less capital intensive to retroactively implement interoperability, whether via bridges or directly via protocol updates, in digital asset networks than it is to rip up rails and replace them with rails of a different gauge. This is part of the beauty that is software. Expect interoperability to play a role in the parts of the ecosystem that reach and maintain critical mass – then ultimately deliver greater utility and value to their user base.

Sources

1 https://medium.com/hackernoon/bitcoin-analogies-7066c58df9ec

2 https://en.wikipedia.org/wiki/Rail_gauge_in_Australia

3 https://civilcrews.com/gauges/

4 https://medium.com/chainsafe-systems/bridges-in-crypto-space-12e158f5fd1e

5 https://www.coingecko.com/en

6 https://en.wikipedia.org/wiki/Variable_gauge

7 https://defillama.com/protocols

8 https://defillama.com/protocols

—

Originally Posted on November 10, 2021 – Digital Asset Networks Are Like Train Lines

Disclosure: WisdomTree Europe

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Please click here for our full disclaimer.

Jurisdictions in the European Economic Area (“EEA”): This content has been provided by WisdomTree Ireland Limited, which is authorised and regulated by the Central Bank of Ireland.

Jurisdictions outside of the EEA: This content has been provided by WisdomTree UK Limited, which is authorised and regulated by the United Kingdom Financial Conduct Authority.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from WisdomTree Europe and is being posted with its permission. The views expressed in this material are solely those of the author and/or WisdomTree Europe and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Bitcoin Futures

TRADING IN BITCOIN FUTURES IS ESPECIALLY RISKY AND IS ONLY FOR CLIENTS WITH A HIGH RISK TOLERANCE AND THE FINANCIAL ABILITY TO SUSTAIN LOSSES. More information about the risk of trading Bitcoin products can be found on the IBKR website. If you're new to bitcoin, or futures in general, see Introduction to Bitcoin Futures.