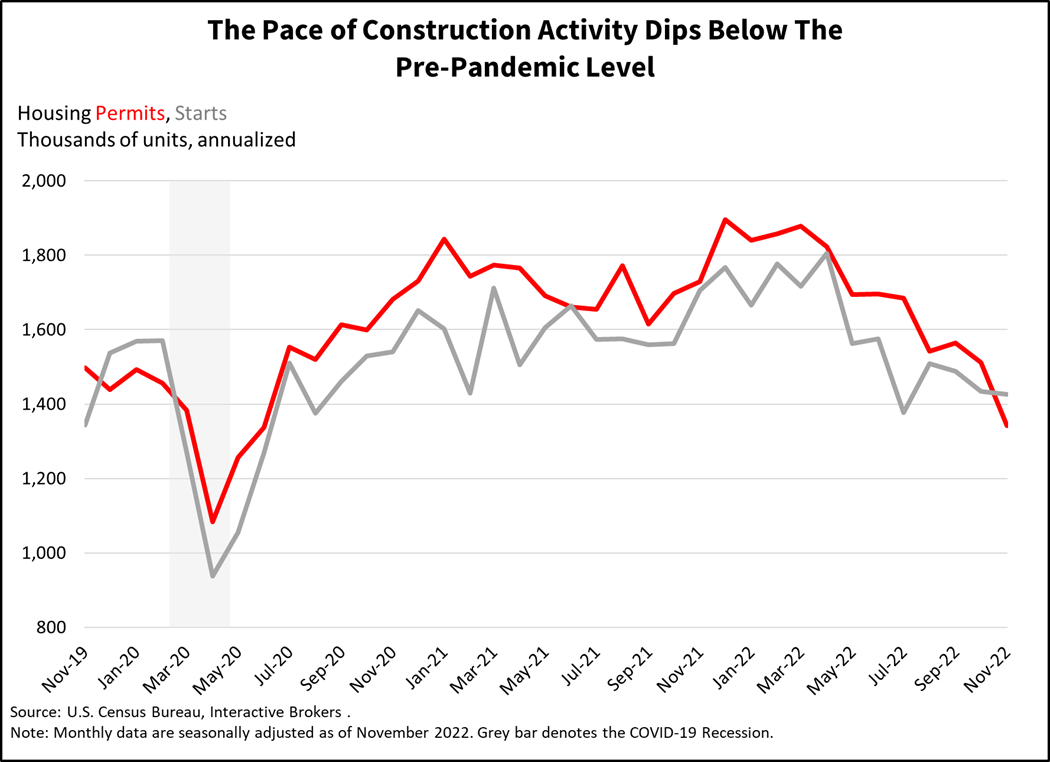

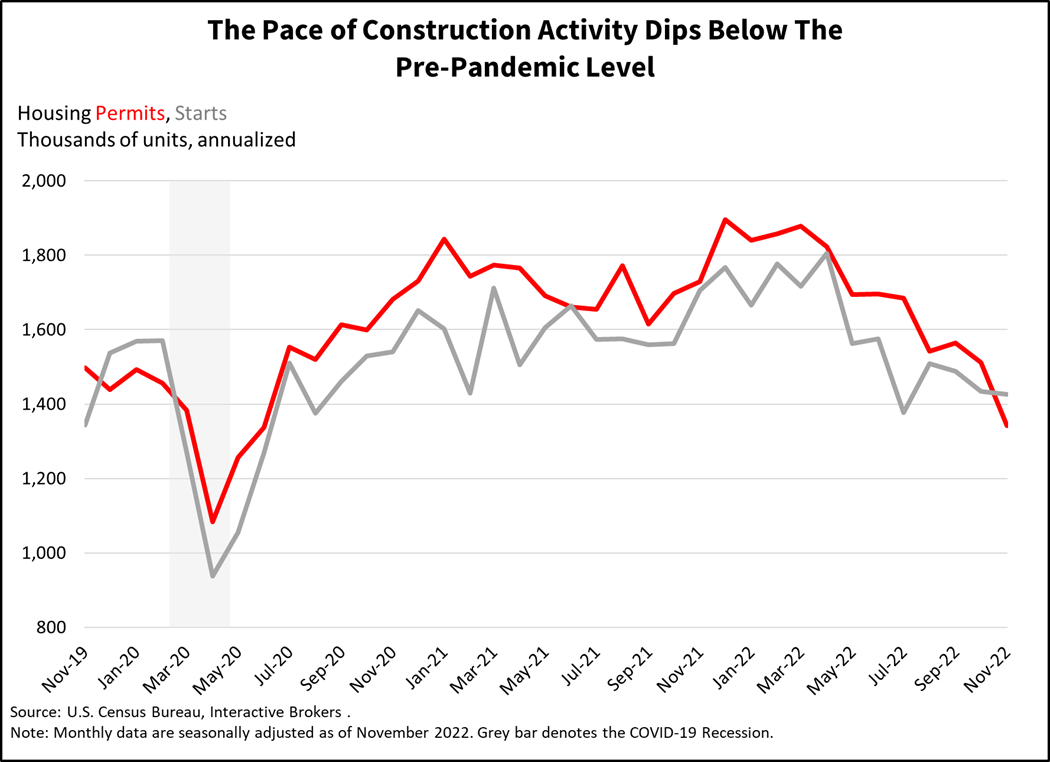

Residential construction and applications for new homes are weakening significantly as higher interest rates, tighter credit availability, rising property inventories and home affordability continue to cause homebuilders to curtail their operations in the face of weakening earnings prospects. November building permits fell a sharp 11.2% from a month earlier, dwarfing consensus expectations for a more modest 1.8% decline. The seasonally adjusted annual rate of 1.342 million was the lowest level since March 2019 with the exception of the dramatic fall due to the COVID-19 pandemic.

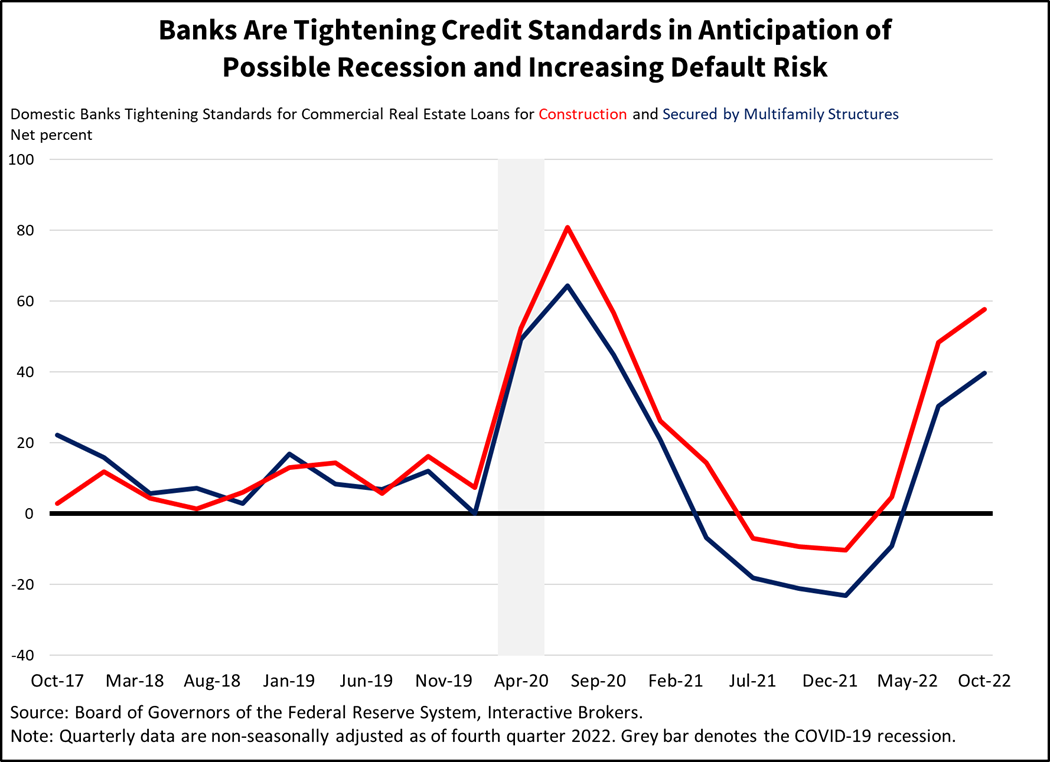

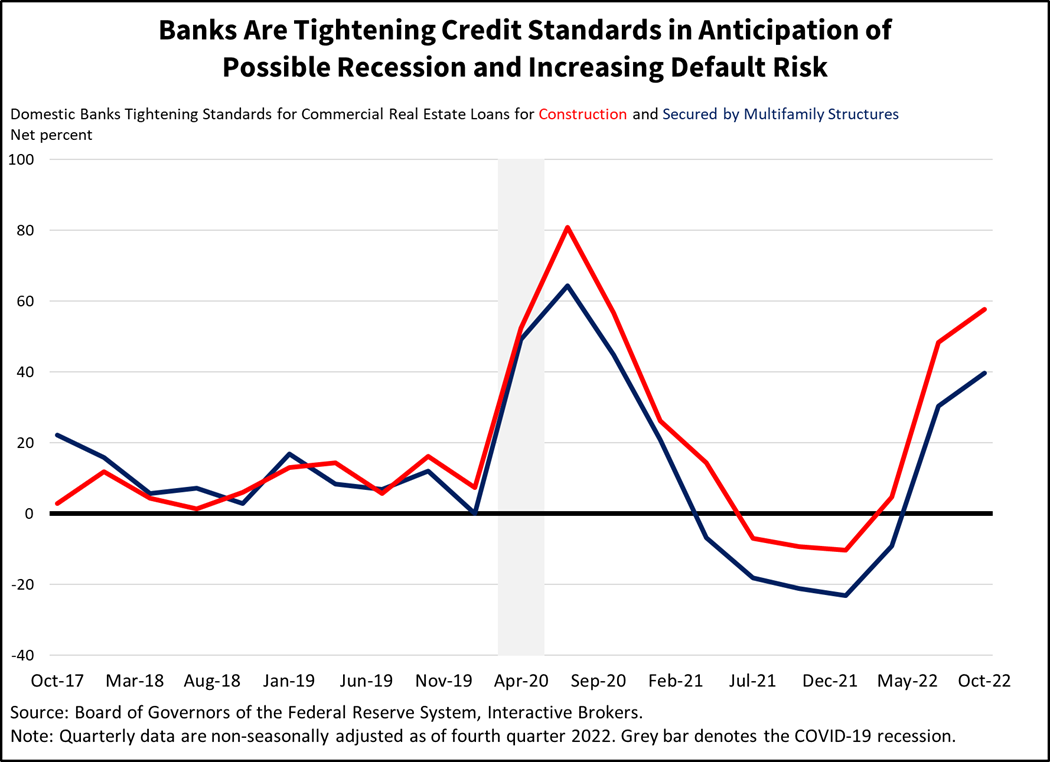

With historically low home affordability driven by real estate price increases and higher mortgage rates, many Americans have been priced out of homeownership and builders have responded by cutting construction and slowing permitting requests for new projects. Builders are also hard pressed to acquire financing with banks tightening their loan standards and seeking to protect themselves from a potential recession. This issue has even crimped construction of rental properties even though Americans who can’t afford homes are increasingly relying on apartments.

Permits for apartment buildings underperformed single-family homes in November, declining a notable 17.9% month-over-month (m/m), the worst decline all year. Single-family permits fell 7.1% m/m, the sharpest monthly fall since June of this year. On a year-over-year (y/y) basis however, single-family continues to lead the longer-term decline, down 29.7% y/y and much worse than apartment buildings which are down 10.7% y/y. When looking at the different regions, today’s data shows that overall building permit contractions were driven by the West, South and Midwest with declines of 16.4%, 12.2% and 6.2% during the period. The Northeast served as an outlier in this morning’s report, notching a 1.8% rise in permits driven by apartment building construction while single-family remained unchanged during the period.

Banks have become reluctant to extend credit because of growing recession fears as the Federal Reserve (the Fed) continues to raise interest rates and wind down its balance sheet. This financing reluctance extends to businesses and consumers, which is slowing down virtually everything in the economy, including real estate, manufacturing and consumer spending. Banks are generally tightening credit standards across the board in credit cards, auto loans, commercial real estate loans, business loans, etc. The tightness in credit standards is a newer development that began to emerge in the third quarter of this year as a 2023 recession became more probable, while the first half of 2022 featured much looser credit conditions.

Yesterday’s NAHB/Wells Fargo Housing Market Index release didn’t offer any reason for optimism either, dropping for the twelfth consecutive month to a low reading of 31. Excluding the April 2020 low of 30 during the height of the COVID-19 pandemic, you have to go back over a decade to June 2012’s reading of 29 to spot a lower point.

The Fed’s battle against inflation featuring tightening liquidity conditions is in stark contrast to the Fed’s efforts to reverse economic weakness associated with COVID-19 just two short years ago which involved loosening liquidity conditions. Caught in the middle is the economically cyclical and interest rate sensitive real estate sector, which has experienced a fire to ice dynamic in such a short period. It wasn’t long ago when folks were purchasing houses without conducting home inspections and sometimes paying all cash for nosebleed prices. Many buyers who toured homes for sale had to wait in long-lines at open houses. Today’s frozen market is much different, as home sellers and new home builders offer discounts and concessions while they pray for a short supply of prospective buyers to visit their open houses.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from IBKR Macroeconomics and is being posted with its permission. The views expressed in this material are solely those of the author and/or IBKR Macroeconomics and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.