Will 2023 be the year that gold hits a new record?

Ole Hansen, respected commodity strategist at Denmark’s Saxo Bank, says it’s possible once markets realize that global inflation will remain hot despite monetary tightening. I believe, as I’ve said before, that gold price could increase.

Hansen notes three other factors that could help push the metal to new record highs next year. One, an increasing “war economy mentality” could discourage central banks from holding foreign exchange reserves in the name of self-reliance, which would favor gold. Two, governments will continue to drive up deficit spending on ambitious projects such as the energy transition. And three, a potential global recession in 2023 would prompt central banks to open the liquidity spouts.

The analyst has already said that his comments are less of a forecast and more of a thought experiment, but I don’t think investors should brush him aside so easily. I believe it’s very possible that we could see an increase in the next 12 to 18 months, for all the reasons he mentioned.

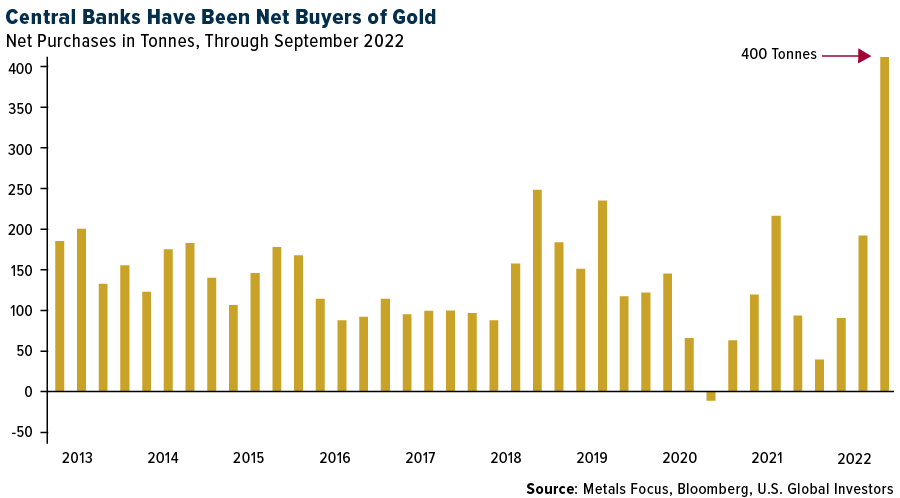

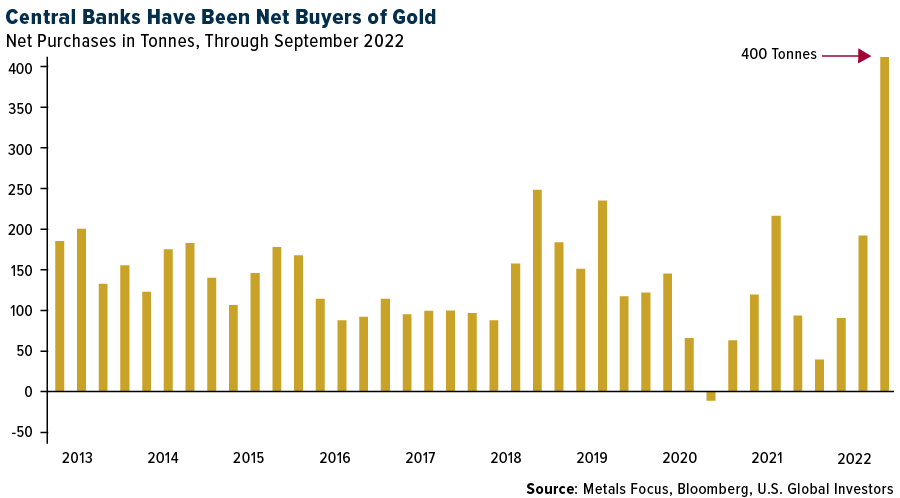

Central Banks On A Gold Buying Spree

Hansen is correct in bringing up central banks’ increasing appetite for gold as a reserve asset. Central bankers and finance ministers may be all about fiat currency, but behind the scenes, they’re gobbling up the yellow metal at the fastest pace in living memory. In the third quarter, official net gold purchases were approximately 400 tonnes, around $20 billion, the most in over a half-century.

Turkey was the biggest gold buyer in the third quarter, followed by Uzbekistan and India.

Last week, China’s central bank disclosed it purchased gold for the first time since 2019. The Asian country said it recently added 32 tonnes, or $1.8 billion, bringing its total to 1,980 tonnes.

Despite being the sixth largest holder of gold, not counting the International Monetary Fund (IMF), China still has a long way to go if it wants to diversify away from the U.S. dollar in a meaningful way. The metal represents only 3.2% of its total reserves, according to World Gold Council (WGC) data. Compare that to 65.9% of reserves in the U.S., the world’s largest holder with more than 8,133 tonnes.

This is very bullish, and I predict we’ll be seeing a lot more buying from China in the coming months.

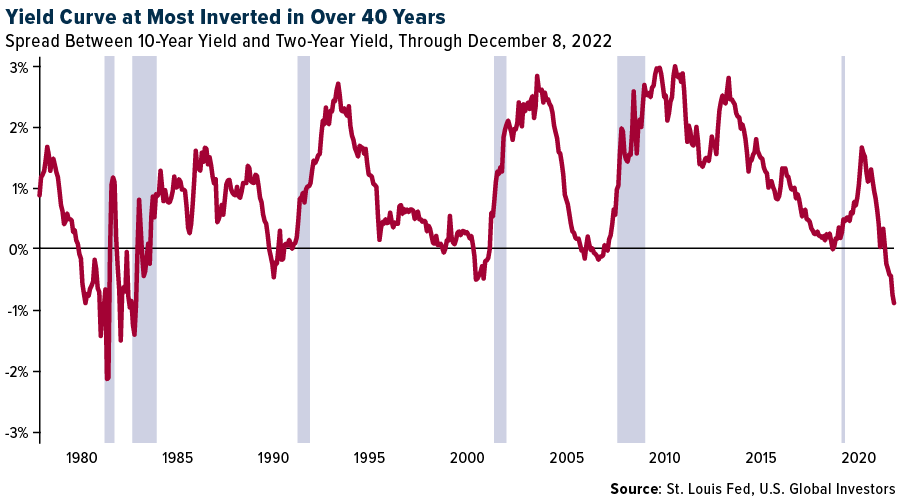

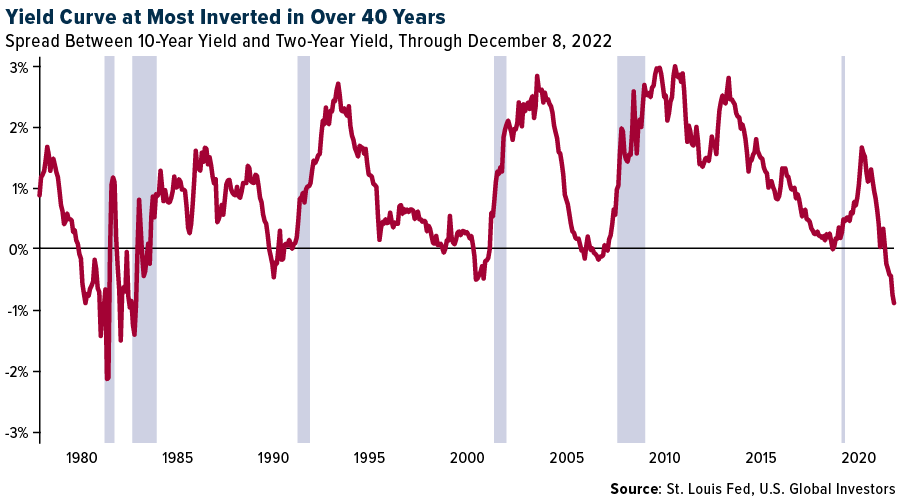

Over-Tightening Risk And Recession Watch

With inflation looking to persist into next year, a small to moderate recession appears more and more likely. There’s the risk that the Federal Reserve will overtighten, and this has strong macroeconomic implications for gold.

An indicator we keep our eyes on is the spread between the 10-year Treasury yield and two-year Treasury yield. Over the past 40 years (at least), every recession has been preceded by a yield curve inversion. As of today, the yield curve is at its most inverted in over 40 years, suggesting a recession is all but guaranteed. The question is not if, but when.

In recent days, most banks and ratings agencies have slashed their global growth estimates for 2023 on expectations of persistently high consumer prices and rapid monetary tightening. Buying gold now could prove itself to be a wise investment choice. In five out of the last seven recessions, gold delivered positive returns, according to the WGC, providing some protection to investors.

Gold Setting Up For A Rally?

Technically, gold is starting to look attractive right now, the metal having broken above its 50-day and 200-day moving averages. After breaching the key $1,800-an-ounce level the week before last, gold is again testing the psychologically important price point.

If 2022 ended today, this would mark the second straight year that gold has declined. And yet, at negative 1.75%, the yellow metal has remained one of the best assets to hold this year.

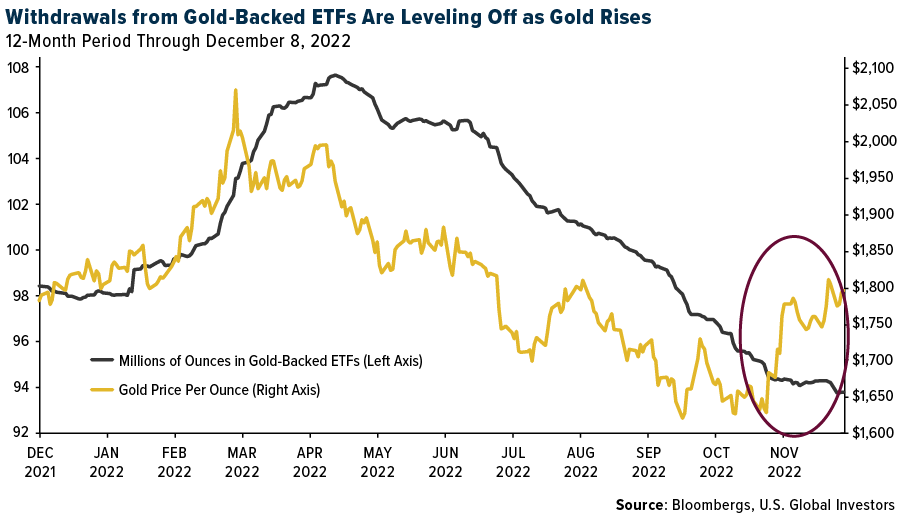

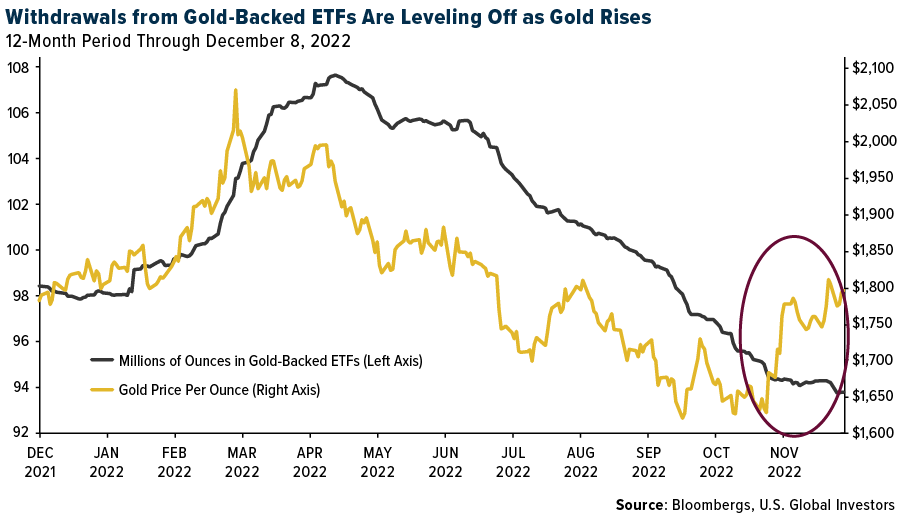

It hasn’t always been easy. Holdings in all known gold-backed gold ETFs have declined for seven months straight as of November 2022. However, we’re starting to see these declines level off as gold begins to push higher.

A gold rally—possibly to $3,000, as Ole Hansen forecasts—would also be highly constructive for gold mining stocks. These companies are much more volatile than the price of the underlying metal. As you can see below, when gold has jumped, gold mining stocks have historically jumped higher. (The reverse has also been true.)

—

Originally Posted December 12, 2022 – Gold Has The Potential To Hit $3,000 Or $4,000 An Ounce In 2023

The Philadelphia Stock Exchange Gold and Silver Index is a capitalization-weighted index which includes the leading companies involved in the mining of gold and silver.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

Disclosure: US Global Investors

All opinions expressed and data provided are subject to change without notice. Holdings may change daily.

Some of these opinions may not be appropriate to every investor. By clicking the link(s) above, you will be directed to a third-party website(s). U.S. Global Investors does not endorse all information supplied by this/these website(s) and is not responsible for its/their content.

About U.S. Global Investors, Inc. – U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

Please consider carefully a fund’s investment objectives, risks, charges and expenses. For this and other important information, obtain a fund prospectus by clicking here or by calling 1-800-US-FUNDS (1-800-873-8637). Read it carefully before investing. Foreside Fund Services, LLC, Distributor. U.S. Global Investors is the investment adviser.

Disclosure: Interactive Brokers

Information posted on IBKR Campus that is provided by third-parties does NOT constitute a recommendation that you should contract for the services of that third party. Third-party participants who contribute to IBKR Campus are independent of Interactive Brokers and Interactive Brokers does not make any representations or warranties concerning the services offered, their past or future performance, or the accuracy of the information provided by the third party. Past performance is no guarantee of future results.

This material is from US Global Investors and is being posted with its permission. The views expressed in this material are solely those of the author and/or US Global Investors and Interactive Brokers is not endorsing or recommending any investment or trading discussed in the material. This material is not and should not be construed as an offer to buy or sell any security. It should not be construed as research or investment advice or a recommendation to buy, sell or hold any security or commodity. This material does not and is not intended to take into account the particular financial conditions, investment objectives or requirements of individual customers. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: ETFs

Any discussion or mention of an ETF is not to be construed as recommendation, promotion or solicitation. All investors should review and consider associated investment risks, charges and expenses of the investment company or fund prior to investing. Before acting on this material, you should consider whether it is suitable for your particular circumstances and, as necessary, seek professional advice.

Disclosure: Futures Trading

Futures are not suitable for all investors. The amount you may lose may be greater than your initial investment. Before trading futures, please read the CFTC Risk Disclosure. A copy and additional information are available at ibkr.com.